What Is a Parent PLUS Loan?

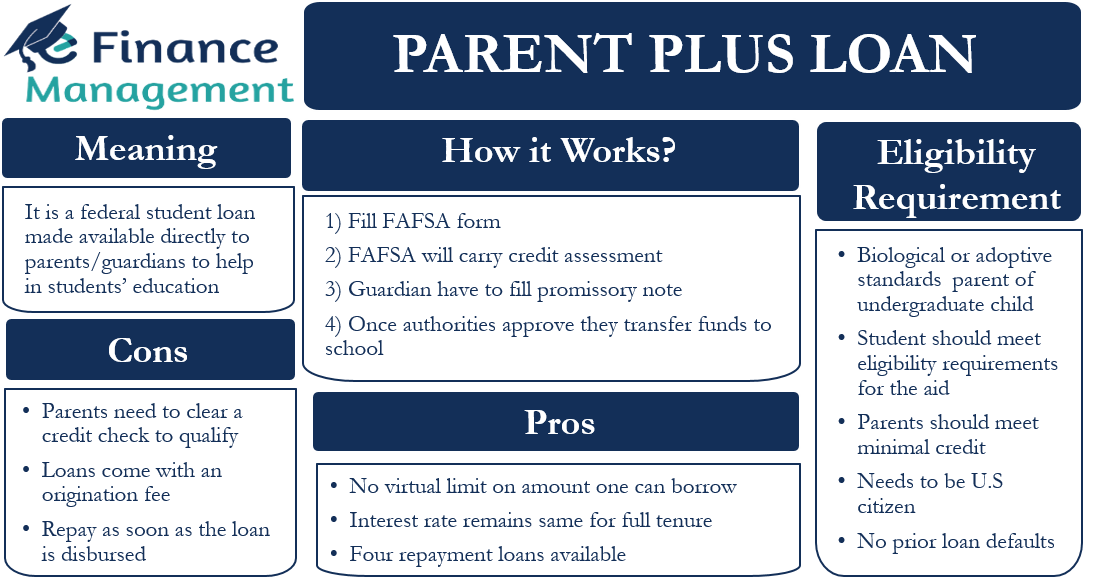

The only federal student loan designed specifically for parents is the PLUS Loan. They have a standard ten-year repayment term and a fixed interest rate. Up to the cost of attendance, less any additional financial aid the student receives, can be borrowed by parents. Funds are disbursed directly to the school.

According to the Department of Education, a parent eligible for a Parent PLUS student loan must be the biological or adopted parent of a dependent undergraduate student. Grandparents and legal guardians do not qualify to take out parent loans unless they have lawfully adopted the student.

Parent PLUS loans differ significantly from other federal student loans, despite having many of the same features.

Payments for federal parent PLUS loans are due as soon as money is sent to the school because there is no automatic grace period. Additionally, they are not qualified for the well-liked income-based repayment scheme (IBR).

Additionally, parents requesting a PLUS loan must submit to a credit review, in contrast to other federal student loans.

How Do I Apply for a Federal Parent Plus Loan?

The first step is for parents to fill out the FAFSA (Free Application for Federal Student Aid) with their child.

Then, there is a separate application for Direct PLUS Parent Loans, which must be submitted. Most schools use an online application form, but some have their own process, so be sure to ask the financial aid office.

What Credit Score Do You Need for a Parent PLUS Loan?

Parent PLUS loans do not have a minimum credit score requirement; however, a credit review is necessary to look for any negative credit history, such as foreclosures, bankruptcies, and repossessions. Check the Federal Student Aid website for specifics.

What Is a Private Parent Loan?

A private parent loan is given to a qualified parent or guardian of an undergraduate college student by a non-governmental organization such as a bank or credit union in order to assist with the cost of education.

Every private lender has different terms, requirements for eligibility, forms to fill out, and interest rates that can range from fixed to variable. Usually, a credit history and an income review are used to determine these.

Benefits and Drawbacks of Parent Loans

Parent student loans can be used for a variety of purposes, but as with any loan, it’s crucial to read the terms completely.

Parents want the best for their child academically, and many want to assist by covering all or part of the cost of college. Reducing a student’s debt after graduation through a parent loan can assist them in concentrating on their studies, launching their careers, and getting ready to make their next major purchase, like a house or car.

While parents are fully liable for repaying the parent loan, they are free to request contributions from their kids without having to take on the same obligations as they would if the loan were in the student’s name. This allows them to practice borrowing money and making bill payments without having to assume any risk.

An additional advantage is that tax deductions are available for interest on all student loans, including parent loans. Borrowers may be eligible to write off all or a portion of the interest paid on their parent student loans.

The financial responsibility the parent takes on is one of the main drawbacks of a parent loan. While timely payments can raise your credit score, missed or late payments can lower it as well.

Cosigning as a Borrowing Option for Parents

In contrast to a parent loan, which imposes complete repayment obligations on the parent, a cosigner loan places equal obligations on both the borrower and the cosigner. Both borrowers’ credit reports will show the loan, and both borrowers’ good and bad payment histories will be impacted. The majority of undergraduate students probably require a cosigner because they lack the credit history necessary to be eligible for private student loans on their own.

Where Do Parent Loans Fit into the Financial Aid Picture?

To make the best financial decisions for you and your family, it’s critical to consider all of your options, speak with loan providers, and confer with financial aid officers at universities.

Parent loans are just one kind of financing available for higher education. Before taking out a loan of any kind, parents ought to urge their children to look for non-repayable financial aid, like grants and scholarships. After that, they may think about using any income or savings to pay for the expenses. If money is still tight, taking out a parent loan could make sense if you have the means and feel comfortable repaying the entire amount.

Find out more about the ways that families pay for college with loans.

Our initial goal was to assist students in becoming ready for a bright future. We love providing an altogether different (and uncomplicated!) experience. Our goal is to provide young adults with a head start on their journey to financial success by offering them personalized and realistic solutions.

By giving College Ave your email address, you consent to our privacy policy and grant us permission to contact you. College Ave will only send you emails on occasion because we value your inbox.

My Student Card Account

Check, arrange, move money around, or pay for your Ambition Card.

Interested in building your credit?

With Ambition Card, you can quickly and safely build a positive credit history and aim for a better financial future. ‡.

FAQ

What is the meaning of parent loan?

A parent loan is a sum of money borrowed by a student’s guardian or parent to assist with educational expenses. The parent or guardian is fully responsible for repaying the loan, and the loan is fully registered in their name.

What is a parent student loan?

January 20, 2023 • 5 min read. By Ben Luthi. Quick Answer. Parent student loans enable parents to contribute to their child’s college expenses. Usually, they need to be paid back right away, but depending on the lender, there may be different conditions.

Do you have to pay back a parent loan?

You as a parent cannot transfer a Direct PLUS Loan to your child. You are responsible for repaying the loan. Is it possible for me to receive a deferment or forbearance under certain circumstances, allowing me to temporarily stop or lower my loan payments?

Who is financially responsible for a parent loan?

It is legally your responsibility as the parent borrower to repay the loan.

Read More :

https://studentaid.gov/understand-aid/types/loans/plus/parent

https://finaid.org/loans/parentloan/