What is a paycheck loan?

Paycheck loans, sometimes referred to as cash advances or payday loans, are small-term, short-term loans designed to help you pay for bills until your next payday. When financial hardship strikes due to an emergency, this kind of loan may be a good choice.

How paycheck loans work

From the comfort of your home, you can apply online for a cash advance at any time. If accepted, you’ll get your money the same day, the next business day, or within 24 hours. When you receive your next paycheck, which should be in two to four weeks, you will repay your loan plus interest.

How much can I borrow?

The maximum amount you can borrow with a paycheck advance is determined by the state in which you reside and your current income. Paycheck loans are small-dollar loans, so the typical loan amount is between $300 and $1,000. An installment loan might be a good choice if you require a larger loan amount or one that you can pay back over time.

Can I get a paycheck loan online?

The websites of numerous lenders who provide online paycheck advance loans have application forms. These applications take just minutes to complete. Be ready to divulge financial information, such as checking account details and proof of income, along with personal details like your name and birthdate.

How to apply for a paycheck loan online or in-store

To apply for a payday loan, follow these easy steps:

Compare paycheck lenders

These loans are provided by numerous lenders, so be sure to apply with one that you can trust. Do some research to find loans available to you. Compare the terms, fees, and interest rates provided by each lender after you’ve narrowed down your options for loans.

Gather the necessary information

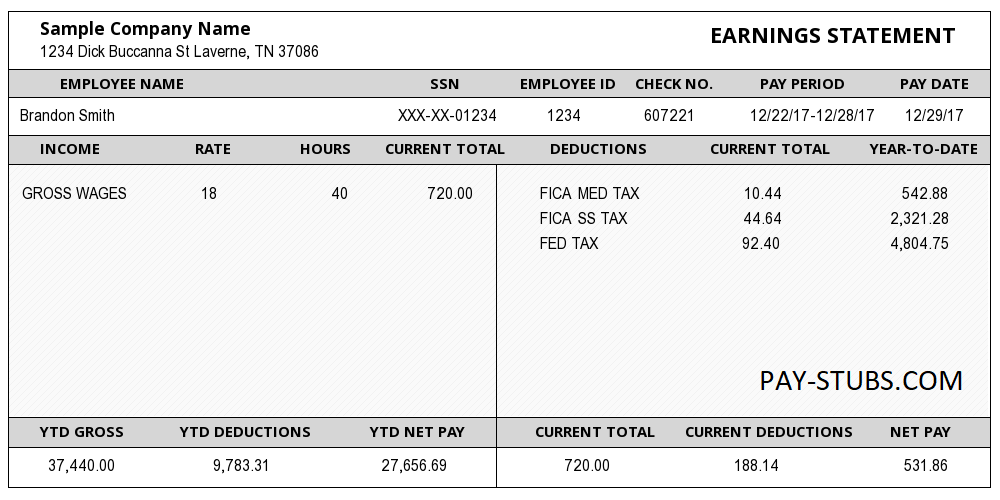

Gather the information and documents you’ll need for your application once you’ve decided which loan best suits your needs and budget. These will probably consist of a valid and active checking account number and routing information, pay stubs or other evidence of income, and a government-issued ID such as a passport or driver’s license.

Fill out and submit your application

Fill out the loan application online or in person. Make sure your application is accurate before submitting it to prevent delays in funding and approval.

Wait for the approval decision

Following the submission of your application, the lender will decide whether to approve your loan. Many payday lenders offer quick decisions. Usually, you’ll find out immediately or in a matter of minutes if you’ve been accepted.

Receive your funds

Many lenders for this kind of loan disburse your money by check, prepaid card, or direct deposit. The money you apply for may be disbursed the same day, the following banking business day, or a few business days later, depending on the lender.

Benefits of paycheck loans

There are advantages to paycheck or payday loans, such as:

- Easy application: Paycheck loan applications are simple to fill out. It might only take a few minutes for you to apply online.

- Quick loan approval decision: If your loan is approved, many lenders will notify you in a matter of minutes.

- Fast funding: The money from your loan could be in your account the same day you apply, depending on the lender you select.

- You don’t need excellent credit to be accepted: Payday lenders often have laxer credit score requirements, so you can be accepted with fair or bad credit.

- Numerous options: Choosing the best payday loan and lender for you might be simpler than you might think because there are so many different kinds of them available.

Is a paycheck loan right for me?

A paycheck loan can be an excellent financial solution for paying for unexpected costs if you only need a small loan amount and are certain that you can repay it in full by your next paycheck.

Get a paycheck loan today

Since we provide paycheck advances to all kinds of borrowers at Advance America, you might not need excellent credit to be accepted. You can apply online and receive a decision on approval in a matter of minutes. If accepted, your funds might be transferred to you the same day that you apply. Ready to get started?.

To discover more about payday loans and the other personal loan options we provide, visit Advance America right now.

The Advance America advantageSince 1997, Advance America has helped millions of hardworking people with a variety of financial solutions including Payday Loans, Online Loans, Installment Loans, Title Loans and Personal Lines of Credit.148+ millionloans issued900+ storesand online loans25+ yearsproviding loans

FAQ

How many check stubs do I need to get a personal loan?

It may be necessary for you to submit copies of your tax returns or pay stubs. Think about keeping the last two years’ worth of tax returns and the pay stubs for the previous three months on hand. Bank statements can help lenders determine your overall financial picture.

Can I get a loan if I don’t have direct deposit?

Yes, some lenders that specialize in payday loans offer quick loans without requiring direct deposit. Finding the best loan website for your needs requires investigation and review. In terms of repayment terms, how are installment loans different from conventional payday loans?

Can I get a loan if I have no income?

If you are willing to use property or other assets as collateral for a secured loan, or if you have a co-signer, you can often obtain a traditional personal loan without having to provide proof of income.

Can I borrow money from my paycheck?

If you have an unforeseen expense that comes up in between paychecks, a payroll loan might be exactly what you need. These loans, also referred to as cash advances, are made for brief periods of time and small sums of money up to $1,500 to help until the next payday.

Read More :

https://www.surepayroll.com/resources/terminology/payroll/payroll-loan

https://www.advanceamerica.net/loans/payday-loans/paycheck-loans