VA streamline refinance

A VA IRRRL may be a solid choice if you:

- Already have a VA mortgage.

- Do you want to switch from an adjustable-rate mortgage to a fixed-rate mortgage in order to save money or to a lower interest rate?

- Dont want to take out any cash from home equity.

Chris Birk, director of education at Veterans United Home Loans in Columbia, Missouri, states that the Interest Rate Reduction Refinance Loan “is envisioned as a low-impact, no-frills refinance that exists to get veterans into a lower interest rate.”

In order to refinance into an IRRRL, your VA mortgage must already be current. Additionally, unless you’re refinancing out of a VA loan with an adjustable rate, the rate on your new loan must be lower.

Your home need not be your primary residence, unlike with the majority of other refinances. All that’s required is prior occupancy. You can refinance your mortgage without having to move out of your first house, for example, if you’re stationed in a new area and want to keep it.

You can also choose to include the closing costs in the new loan when you apply for a VA streamline loan.

According to Birk, certain VA lenders might have requirements for a streamline refinance, such as a minimum income, credit score, or appraisal. They may also demand that you haven’t missed any mortgage payments in the previous 12 months.

VA cash-out refinance loan

You might be a good candidate for a VA cash-out refinance loan if you:

- Have a VA loan or conventional loan.

- Want to extract cash from your home equity.

- able to pay all closing costs in full up front or with money you withdraw

- can negotiate a rate so that your monthly payments on a home equity loan or HELOC would be less than your current mortgage payments plus those from the loan.

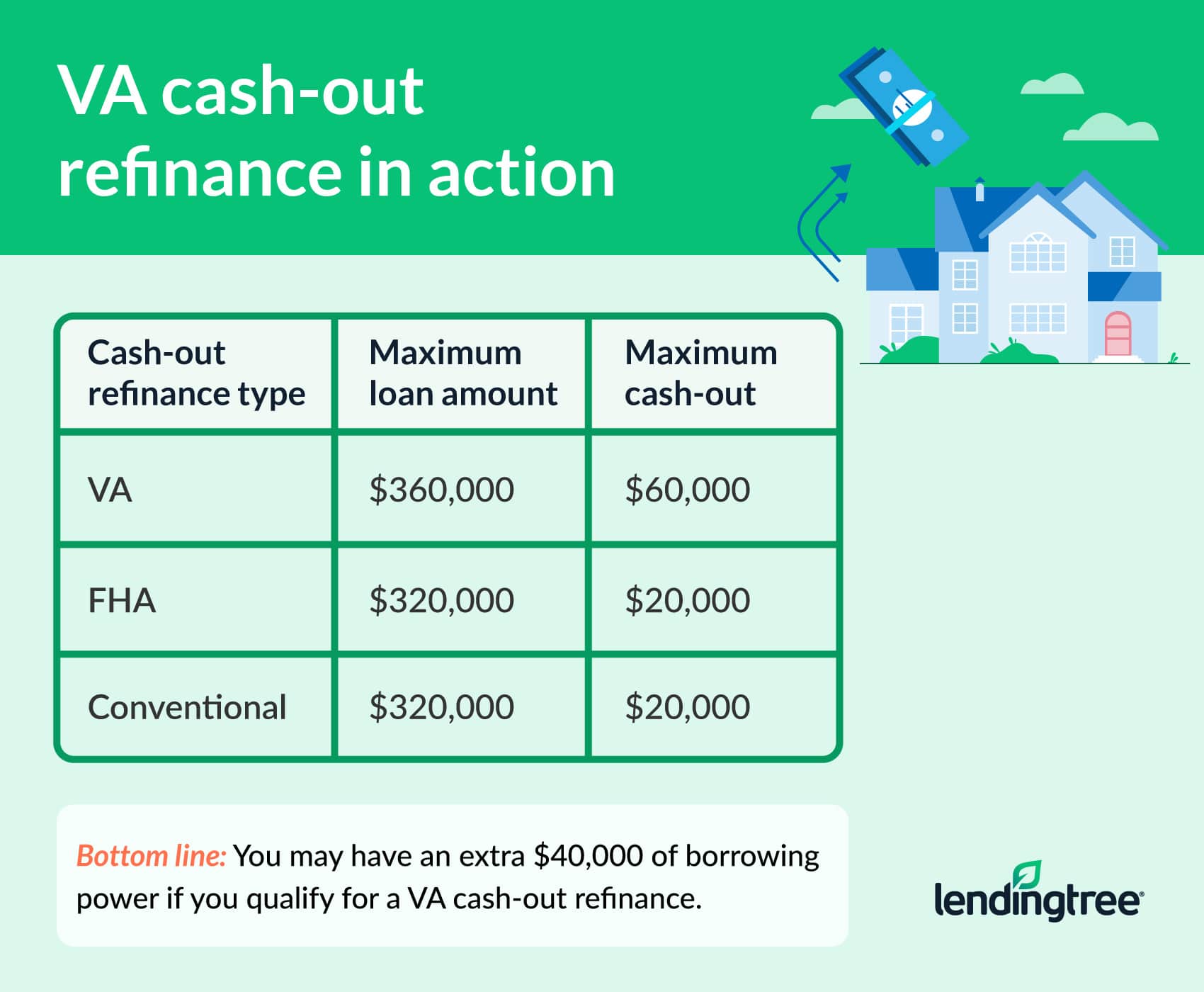

You can refinance your current mortgage into a VA cash-out refinance loan if you wish to access the equity in your house, regardless of whether it is a conventional or VA mortgage.

With this kind of refinance, lenders always demand a minimum credit score and a VA appraisal, and the property must be your primary residence.

Although the precise amount you can borrow will vary based on your lender, you may be able to finance up to 10% of the appraised value of your home.

A cash-out refinance is the only method to convert a conventional loan into the VA program.

|

VA streamline refinance |

VA cash-out refinance |

|---|---|

|

Refinance to get a lower interest rate or move from an adjustable-rate to a fixed-rate mortgage. |

Refinance to tap home equity. |

|

Can refinance only from a VA mortgage. |

Can refinance from a VA or conventional mortgage. |

|

Some lenders might require minimum credit score, minimum income or an appraisal, and no late mortgage payments within the past 12 months. |

Lenders require minimum credit score and appraisal. |

|

Home does not have to be your primary residence. |

Home must be your primary residence. |

|

Can roll refinance fees into the new loan. |

Can use money from the cash-out refinance to pay the fees, but you must pay them upfront. |

VA loan refinance eligibility

In order to be eligible for a VA refinance, you must fulfill certain requirements.

Service requirements

You must be an active-duty service member, a veteran with an honorable discharge, or the spouse of a current service member or veteran in order to be eligible for a VA refinance. In order to refinance a VA loan if you are a widow or widower of a veteran, you must be single at the time of the refinance and, unless you’re applying for an IRRRL, your spouse must have passed away in the line of duty or from a service-related injury. Then, it makes no difference how your spouse passed away; however, you must have applied for the VA loan before your spouse passed away.

Credit score for VA refinance

Generally speaking, lenders require a minimum credit score of 620. Similar to your initial mortgage, lower rate offers are typically obtained with a higher score.

Some lenders may still approve borrowers with lower scores, but you might need to have an exceptionally strong record in other areas.

Debt-to-income requirements

Generally, lenders prefer to see a debt-to-income ratio of 2041% or less, also known as a DTI. Nonetheless, some lenders will grant loans to borrowers whose DTI ratios are greater than 5%. Your financial profile may be subject to a closer examination by the lender if your DTI ratio is higher than 20%411%.

Other VA refinance requirements

The lender may impose additional conditions on VA loans in addition to those set by the government (the VA’s guarantee may only cover 25% of each loan). And just because one lender rejects your application doesn’t mean you won’t be eligible for a VA loan elsewhere.

Benefits of refinancing

Three advantages exist for borrowers who refinance with a VA loan.

Refinancing can reduce your monthly payment if you are eligible for a better rate now than when you first applied, such as if your credit score has increased. Your monthly payments may be reduced by extending your loan period, such as from 15 to 30 years. But because you’ll be paying more interest, you’ll end up paying more for the loan overall.

If you have equity in your house, a cash-out refinance could help you by turning some of that equity into a one-time cash payment. You can spend this money however you like, but it’s advisable to use it for things like home upgrades and other costs associated with increasing your wealth.

You can also convert from a conventional mortgage to a VA loan through refinancing; VA loans usually have lower interest rates.

VA refinance fees

The fees associated with VA refinance loans are generally the same as those associated with other mortgage refinancing; however, one fee is particular to the VA funding program. As of April 7, 2023, the following fees apply:

- The funding fee on an IRRRL is 0. 5% of the loan amount.

- On a VA cash-out refinance, it’s 2. 15% of the total amount borrowed, unless this isn’t your first VA loan.

- The funding fee is 3.3% on subsequent VA loans.

If you are the surviving spouse of a service member who died in the line of duty or from a service-related injury, or if you have a disability related to your military service, you are exempt from paying the VA funding fee. Active-duty military personnel who have been awarded a Purple Heart are likewise excused from paying the funding charge.

Mortgage insurance is not required for VA loans, unlike conventional and FHA loans that are backed by the Federal Housing Administration.

PNC: NMLS#446303

FAQ

How soon can you refinance with a VA loan?

When can you refinance a VA loan? You can’t do so until the later of two dates: (1) the day you’ve made six consecutive monthly payments on the loan you’re refinancing, or (2) the date that’s 210 days after the loan’s first payment due date. This is sometimes called “seasoning. “.

How much does it cost to refinance a VA loan?

How Much Does It Cost to Refinance a VA Loan? You will be required to pay the VA funding fee in addition to any other closing costs that your lender may impose. For an IRRRL, it’s 0. 5% of your loan amount. For cash-out refinancing, it’s 2. If this is your first loan, 3% of the total amount owed, or 6% after the first use.

Can you refinance a VA loan to a non VA loan?

Most of the time, if your primary residence is currently financed with a VA loan, you cannot use a VA loan to purchase a second property. But typically, what happens is that the veteran refinances his current VA loan into a conventional loan for his primary residence.

How much equity do you need to refinance a VA loan?

According to current VA guidelines, you must own a minimum of 2010% equity in your home; however, certain lenders may permit you to borrow up to 20100% of your home equity. VA funding fee. You may pay between 2. 3% and 3. There is a funding fee of 6%, which is charged to offset the tax payer cost of the VA loan program. Closing cost cap.

Read More :

https://www.va.gov/housing-assistance/home-loans/loan-types/cash-out-loan/

https://www.military.com/money/va-loans/3-ways-to-refinance-va-loan.html