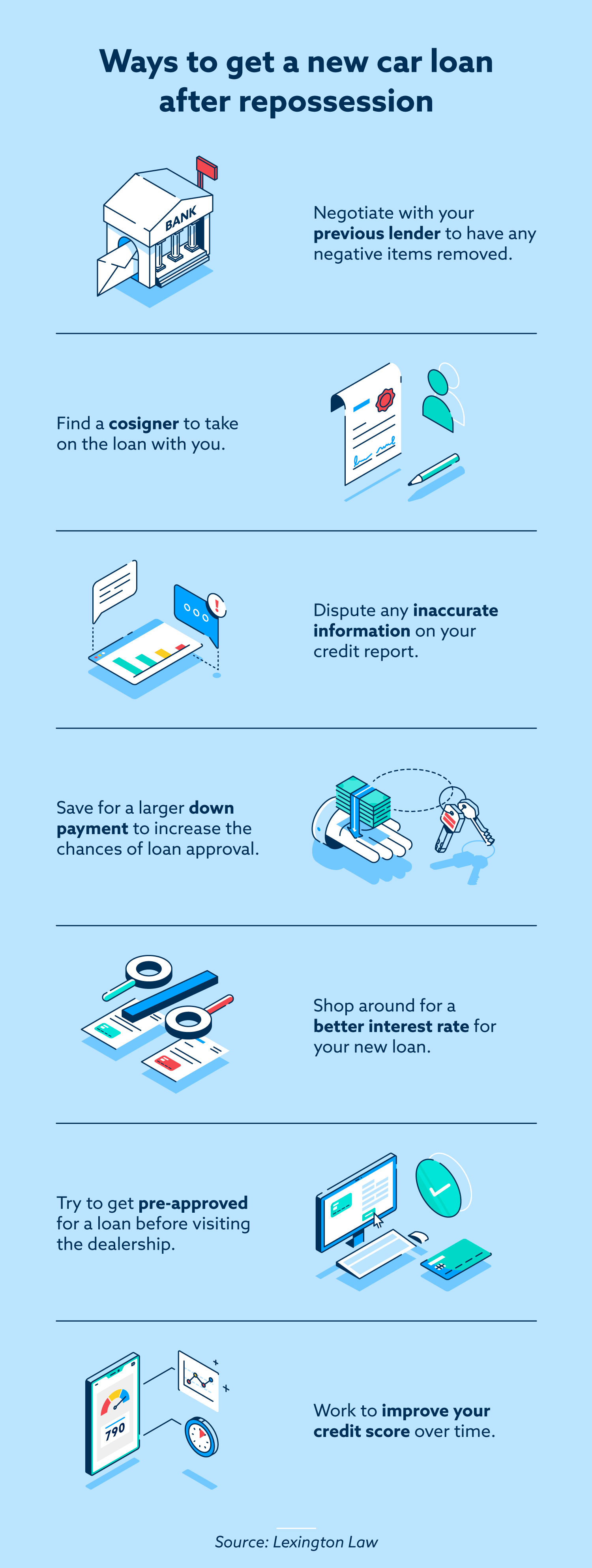

You can get a new car loan after repossession by finding a cosigner, negotiating with your previous lender, disputing inaccurate items on your report, saving for a larger down payment, shopping around for better rates, trying to get preapproved for a loan or improving your credit.

Once your vehicle is repossessed, the repossession will appear as a negative item on your credit report. Consequently, getting a new car loan may be considerably more challenging because lenders consider your payment history when reviewing your application. Nevertheless, you can improve your chances of getting a new auto loan by repairing errors on your credit report, establishing your credit, or locating a cosigner.

You might require a new car if yours has been repossessed in order to carry out necessary transportation. Regrettably, the adverse entry resulting from a repossession on your credit record makes it more challenging to obtain a new loan.

It’s possible that a lot of lenders won’t give you a new loan, or they might give you one with a high interest rate that would make it difficult for you to repay.

After your car has been repossessed, consider some of the following options to obtain a new auto loan rather than accepting terms that might not be suitable for you.

Find a cosigner

Getting a better interest rate on a new car loan can be achieved by having a creditworthy person cosign. If you take out a favorable loan and make your monthly payments on time, you will have the chance to rebuild your credit.

Signing with a reliable friend or family member is usually preferable because cosigners bear equal responsibility for the loan.

Negotiate with your previous lender

Sending a goodwill letter to your former lender may result in a deal wherein the item of negative credit is eliminated in return for a predetermined sum of money. Before paying off the loan, make sure to obtain any agreements in writing.

You might have to pay off both the original loan and the collection account separately if your debt has already been sent to collections. In any event, obtaining a new auto loan will be simpler if you work to have unfavorable information removed from your credit report.

Dispute inaccurate items on your report

You can have negative items completely removed from your credit report by filing a credit dispute if you think there is inaccurate information on it. To aid in the official dispute procedure, think about employing credit repair services.

Save for a larger down payment

If you can afford it, offering a larger down payment on a new car will probably result in better terms because the lender will bear less of the risk and the loan amount will be lower overall.

The same down payment may have a greater effect on your car loan’s interest rate if you buy a used vehicle. A $5,000 down payment, for instance, is 20% of a $25,000 auto loan, but it is 50% of a $10,000 auto loan, indicating that the lender is taking on less risk with the loan.

Shop around for better rates

After a repossession, it’s a good idea to look at several lenders because the first one to offer you a loan might not have one that fits into your budget. Even a modest loan can feel more burdensome with a high interest rate.

Utilize internet comparison tools to evaluate credit rates offered by various financial institutions. If you are a member of a credit union, see if they can provide you with a loan that suits your needs.

Try to get preapproved for a loan

Try to get preapproved for a loan before heading to the dealership. When a lender uses a preapproval process, they will consider your income, credit history, and debts before deciding how much money to lend you.

When you have a strong loan offer in hand, you’ll be better equipped to look for a new car.

Improve your credit over time

Gaining better credit is the best way to get a new car loan with favorable terms, though it is not a quick fix. Better credit typically translates into lower interest rates for auto loans.

Continue reading for some tips on raising your credit score to obtain a loan at an exceptional rate.

How to improve your credit after a repossession

Even though a negative item can seriously harm your credit, the harm is not irreversible. By taking the following actions, you can start improving your credit:

- Pay your bills on time: To stay on top of payments, think about setting up autopay or reminders for your bills.

- Try to settle collection accounts: If at all possible, try to resolve outstanding balances and have negative information removed from your credit report by working with your original creditors.

- Reduce your utilization: Try to use no more than 30% of your available credit, or less than one-third of the total amount of credit.

In addition to the previously mentioned, spend some time annually, at the very least, reviewing your three credit reports—which you can obtain for free from each credit bureau.

Work with the credit repair consultants at Lexington Law Firm to begin addressing any inaccurate information on your credit report, keeping improved credit as your ultimate goal.

Note: The listed attorney has not written the articles; they have only reviewed them. The information on this website is only for general informational purposes and is not meant to be used as legal, financial, or credit advice. The reader, user, or browser does not establish an attorney-client or fiduciary relationship with the owner of the website, authors, reviewers, contributors, contributing firms, or their respective agents or employers by using this website or any of the links or resources it contains.

Before coming to Lexington, Brittany worked as a mixed-practice criminal and family lawyer. After working for the Maricopa County Public Defenders Office for a while, Brittany entered private practice. Brittany defended clients facing accusations of everything from drug sales to sexual offenses to murders. Brittany participated in several hundred criminal court proceedings, including evidentiary hearings, pretrial proceedings, and trials for felonies and misdemeanors. Apart from criminal cases, Brittany also represented individuals and families in a range of family court cases, such as divorce, legal separation, child support, paternity, parenting time, legal decision-making (previously known as “custody”), spousal maintenance, relocation, orders of protection, and modifications and enforcement of existing orders. As a result, Brittany has extensive courtroom experience. Brittany completed her undergraduate studies at the University of Colorado at Boulder and her legal education at Arizona Summit Law School. Brittany received a Summa Cum Laude degree from Arizona Summit Law School, placing her 11th in her graduating class. Related Articles.

FAQ

How bad will a voluntary repossession hurt my credit?

A voluntary repossession is likely to result in a 50–150 point drop in your credit score, though exact figures may differ. The amount of the decline will vary depending on a number of variables, including your past credit history and the number of payments you made prior to the repossession.

How long does it take to rebuild credit after voluntary repossession?

A repossession typically stays on credit reports for seven years. Nonetheless, before the seven years expire, you can take action to raise your credit score. Your credit can be positively impacted by making consistent, wise financial decisions over time, such as using credit cards sensibly.

Will paying off a repo help my credit?

When a derogatory account—one that indicates a status of chargeoff, repossession, or other negative activity—is settled, the debt associated with it is updated to appear as “paid” on your credit report. Will Paying Off a Derogatory Account Help My Credit?

Can you get a car loan with a credit score of 450?

What Credit Score Is Too Low for a Car Loan? Generally speaking, a credit score of less than 450 is deemed too low for a car loan. But, if you have a co-signer or make a sizable enough down payment, you might still be able to qualify.

Read More :

https://www.capitalone.com/cars/learn/finding-the-right-car/what-you-need-to-know-about-buying-a-car-after-a-repossession/1573