How to Refinance Your Car Loan in Six Steps

Before refinancing your car, consider whether it makes financial sense. You may find that the best deal you can get is the one you already have if your credit score has dropped since you took out your loan.

Although it’s not too complicated, refinancing does require some paperwork. There also are some important steps to take afterward. The most crucial things are to make sure you pay off your old car loan and your new one on time, and to find out how your credit score has been impacted by the new loan.

Here is how to refinance if you’re interested in doing so:

Review Your Current Loan

First, sign into your current auto lender’s online account. Gather information about your existing loan, such as the amount you have left to pay, the interest rate, the number of payments left, and the amount you pay each month.

Assess Your Car’s Value

Check how much your car is worth using a website such as Kelley Blue Book or J.D. Power. This will give you an idea of how much you’ll be able to borrow with your refinance loan.

Understand Your Credit Score

Next, check your credit score and examine the details in your credit report by using a free credit monitoring service from a company like Credit Sesame, Experian, or Credit Karma.

The better the refinancing deal you can get, the higher your credit score If your credit score is less than 700, you may need to raise it before you can get the best possible rate.

Get Quotes

You can apply online for auto loan refinancing with many auto lenders, and some even provide pre-qualification for this kind of loan.

To ensure you receive the best deal, take the time to gather a few quotes.

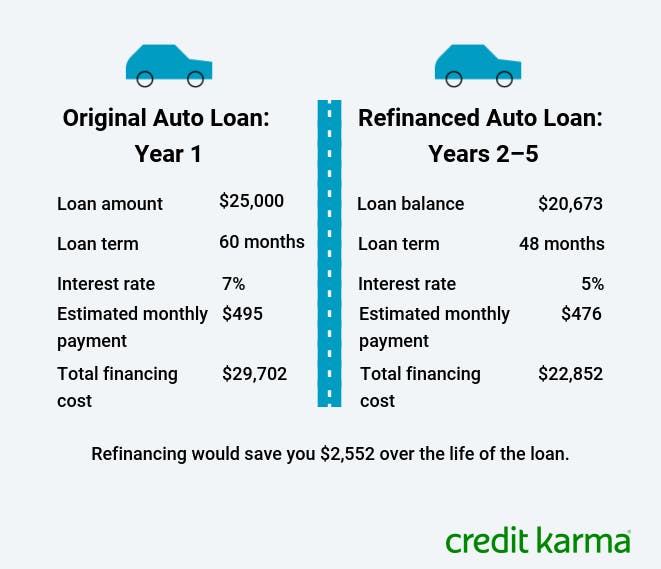

Determine Your Savings

After obtaining your quotes, you can evaluate whether refinancing makes financial sense by comparing them to your current loan. In other words, are you making a significant monthly savings that will add up to significant savings over the course of the loan?

Apply for Refinancing

To move forward with refinancing, submit an application straight to the lender of your choice. You’ll need to give some lenders a call; with others, you can complete this process online. You ought to be prepared to provide details regarding your car and financial situation.

Your credit score may suffer if you refinance, at least initially. The lender will run a credit check when you apply for a car loan. In a short amount of time, multiple hard inquiry credit checks can temporarily lower your credit score because it appears that you are taking on more debt.

Your credit score won’t be impacted by being pre-qualified, and if you submit all of your inquiries in a 14-day window, they will all be combined into one check for credit scoring purposes.

What to Do After Refinancing Your Car Loan

There are a few crucial tasks to finish after obtaining your new loan in order to ensure a seamless refinancing process.

Keep Paying Your Existing Loan

First things first, it’s crucial to continue paying off your previous auto loan. A late payment could lower your credit score.

You can call the lender and request a credit back if you overpaid for your previous loan. Overpaying is preferable to taking the chance of not making a payment and suffering a seven-year credit score damage.

Receive Your New Loan

You will receive information about your terms and payments from your new lender as soon as they process your loan. They might also get in touch with your previous lender to let them know you refinanced your vehicle.

Pay Off Your Old Loan

Next, you’ll need to pay off your old loan. Occasionally, your new lender will get in touch with your previous lender and settle your debt on your behalf. You will receive a check from other lenders to give to your previous lender. If so, you should send this check as soon as possible to your original lender to prevent incurring late fees.

Start Making Payments

Normally, 30 days after you formally accept the loan, the first payment is due on your new loan. To avoid fees or charges, make sure you are aware of when this payment is due and that you make it on time.

An autopay service that certain lenders provide can prevent you from missing payments. Enabling autopay may even result in a discount on the loan.

Check Your Credit Score

Once everything else is done, check your credit score again. You can use a free credit monitoring service from a provider like Credit Sesame or Experian to do this.

Because of the credit checks that were done when you applied for the loan, there’s a good chance that your score will slightly decline. This is normal and should be temporary.

In any event, your refinance will save you money over time if you timed it correctly because your car payment should be lower than it was previously.

What Happens to a Loan After Refinancing?

The new lender pays off the previous lender when you refinance a loan. The terms of the new loan may be significantly better than those of the previous one, which could result in lower monthly payments, longer-term interest savings, or both. You will still need to make repayments on the new loan.

Do You Get Money Back After Refinancing a Car Loan?

Depending on the amount of your loan balance, some lenders give you the option to receive a lump sum payment in cash.

This is tempting but risky. You are forfeiting the equity you have accrued in the car. Youre extending the amount of time youre paying it off. It’s possible that you’ll end up with negative equity in the car, which is a risky financial situation.

Can I Refinance My Car Loan with the Same Lender?

You can refinance your current auto loan with many lenders.

Your bank will be as eager to offer you a better deal as its rivals if your credit score has significantly increased since you took out the first loan.

Can I Refinance My Car Loan If I Have Bad Credit?

If your credit is not up to par, you can still refinance your auto loan, but you won’t likely get a great deal on the interest rate. Before you apply for any additional credit, think about working with a credit repair company to sort out your financial situation.

How Soon Can I Refinance My Car?

You must wait for the minimum of 60 to 90 days after buying your car in order to refinance it, as that is how long it takes to get the title transferred into your name.

The Bottom Line

You might be able to save money by refinancing your auto loan, particularly if you can get a significantly lower interest rate. Your credit score may drop a few points as a result of the application process, but this should only last temporarily.

It’s crucial to continue making payments on your previous loan until the refinancing process is finished after you obtain your new one. Following your refinancing, you should verify your credit score and make sure you are making your new loan payments on time. Article Sources: Investopedia mandates that authors cite original sources to bolster their claims. These consist of government data, original reporting, white papers, and conversations with professionals in the field. When appropriate, we also cite original research from other respectable publishers. You can read more about the guidelines we adhere to when creating impartial, truthful content in our

You consent to the use of cookies on your device to improve site navigation, track user activity, and support our marketing initiatives by selecting the option to “Accept All Cookies.”

FAQ

When you refinance a car loan do you get money back?

Is it possible to refinance a car and receive cash out? You can receive a cash-out auto refinance loan up to the current value of your car, which allows you to take equity out of it. More money than the total of your initial loan balance will be returned to you in one lump payment.

What is the disadvantage of refinancing a car loan?

Refinancing also comes with the risk of higher interest rates. You might find that interest rates are higher than they are now if your credit has declined or if interest rates have increased. In the current market, steep interest rates aren’t uncommon. Interest rates have reached all-time highs as a result of recent Fed rate hikes.

Does refinancing a car start your loan over?

Refinancing does start your auto loan over. Refinancing an auto loan allows you to select a new loan with a different interest rate and possibly a different term. The new loan replaces your current loan. Lenders typically offer refinance terms ranging from two to seven years.

Do you end up paying more when you refinance your car?

You can keep more money in your pocket each month by refinancing and extending the term of your loan, but you may end up paying more in interest over time. However, you will pay less overall if you refinance to a lower interest rate for the same or a shorter term than you currently have.

Read More :

https://www.investopedia.com/after-car-loan-refinance-7498894

https://www.onemainfinancial.com/resources/loan-basics/pros-and-cons-of-auto-refinancing