How Does LendingTree Get Paid? LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site (such as the order). LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

You find out that your interest rate is higher than it should be after taking out a loan to purchase a new or used car. Or perhaps you discovered that your monthly payments are unaffordable. If you refinance at a lower interest rate, you might be able to save a significant amount of money.

In the first six months following the acquisition of a new loan, many lenders will not allow you to refinance. However, after that time has passed, you can shop around and find a better offer. This is the procedure and the timeframe for refinancing a car loan following a purchase.

On this page

When can you refinance an auto loan?

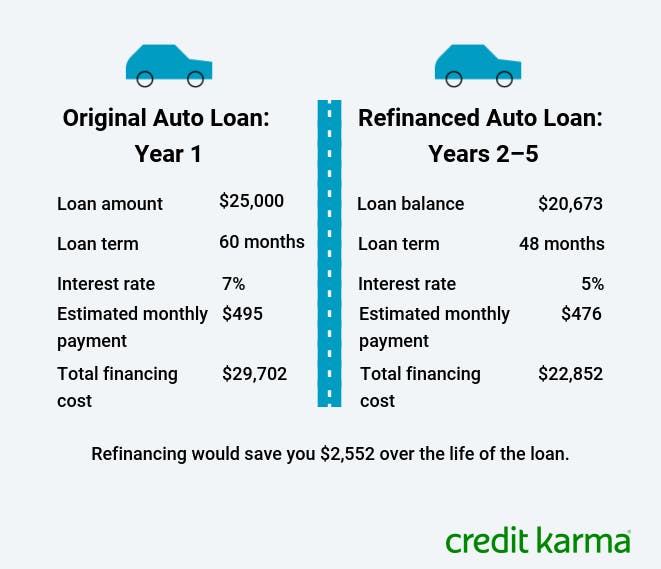

Refinancing an auto loan is just switching out one loan for another, with the second loan being used to pay back the first. The majority of borrowers who refinance do so in order to get a longer loan term or a lower interest rate. With careful execution, you may be able to avoid paying hundreds or even thousands of dollars in interest during the course of your loan. Here are the variations in refinancing based on the loan’s age.

Within the first 3 months

You are unable to refinance until your vehicle’s title has been processed and ownership has been transferred to your new lender, regardless of the formal terms of your loan. This process typically takes at least two or three months.

Another thing to think about is that applying for the new loan and accumulating a substantial amount of new debt on your credit report probably negatively impacted your credit score. Give your credit some time to improve if you’re hoping to refinance into a lower rate so you can be eligible for the best terms.

At least 6 months into the loan term

Usually, you can recover some of the credit score points you lost when applying for your auto loan in six months. Keep in mind that if you refinance, you’ll probably lose them again, if only temporarily. Your credit score may slightly decline, but if you can get a better deal and save money, it will be well worth it. Use an auto refinance calculator to estimate your savings.

It’s possible that the lending landscape has changed if you can wait at least six months before refinancing your auto loan. If interest rates have dropped since you obtained your initial loan, you might be able to take advantage of the lower rates and avoid paying interest. You can save even more money on interest over the course of the loan if you refinance your debt sooner rather than later.

Two years left on the loan

You probably won’t save much money by refinancing once your car loan has reached halfway. Every day that you keep the loan, the potential savings from refinancing diminishes because you pay the majority of the interest at the beginning of your repayment term. You can still refinance despite this, but your savings might not be sufficient to cover the costs.

Your car is aging along with your loan, meaning its value is decreasing. Some lenders won’t refinance a loan that is too near to its term’s end, and others have strict guidelines about the age and mileage of cars they will refinance. Lenders typically offer you a higher interest rate—if they offer refinancing at all—if your car is older or has a lot of miles on it.

When should you refinance an auto loan?

Refinancing an auto loan doesn’t make sense unless you are eligible for better terms. Increasing your credit score or waiting for the market rates to drop since you took out your first loan are the two main ways to be eligible for a reduced interest rate.

Even though market rates have increased overall, you might be eligible for a better rate if your credit score has improved since you took out your initial loan. Borrowers with the best credit can score rates closer to 5%, while those with the worst credit can translate to auto loan rates of 10% or more. This can result in significant savings if you qualify.

Since interest rates fluctuate frequently, there’s a good chance that, after a year of loan payments, you’ll be able to find a lower rate. By comparing rates from different lenders, you might be able to refinance quickly if you were stuck with an above-market rate.

Consider twice before refinancing if you can’t afford your current loan and intend to extend the repayment period. Even though you can make smaller monthly payments on your auto loan, the total cost of the loan will increase.

What to consider before refinancing your auto loan

Ultimately, the numbers will determine if you should refinance. Refinancing your auto loan is generally a wise choice if it can help you save money. The following are the key elements you should take into account to prevent car refinancing errors:

- Total savings: You should consider if refinancing will result in higher costs or lower savings when determining if now is the right time to do so for your auto loan. It can make sense if the savings outweigh the work.

- Credit score: Your interest rate will be lower the higher your credit score is. If your credit has improved since you took out your first loan, you might be eligible for a lower rate. If you need to work on your credit, hold off on refinancing until you can raise your score.

- Repayment period: If your initial loan is almost up, refinancing might not be worth the trouble or the potential drop in your credit score. Refinancing your loan at a later date may not be advantageous because you have already paid off the majority of your interest and have a short repayment period remaining.

- Minimum loan amount: You might not be able to meet a lender’s minimum loan amount requirement if your car is older or its value has drastically decreased. Typically, this minimum is $10,000, but make sure to check with your lender to see if your vehicle qualifies for refinancing.

- Age of your car: Finding a lender ready to refinance your car, especially at favorable terms, becomes more difficult as it gets older. This is one more justification for trying to refinance in the first year of your car loan, while your age and mileage are still relatively low.

- Prepayment penalty: In exchange for financing your car purchase, lenders anticipate earning a specific amount of interest. Early repayment of your auto loan reduces the amount of profit the lender can make. Some lenders address this by including a prepayment penalty in their auto loans, which is an additional cost the borrower must pay if they pay off the loan in full before the repayment period expires. If there is a prepayment penalty associated with your loan, it could offset any possible savings from refinancing.

When you refinance your auto loan, you pay off your current loan and get a new one in its place. This decision could save you money or lower your payments.

Figuring out when to refinance a car can be tricky. When refinancing a car could result in lower payments, savings, or both, you should do it.

That could be feasible, particularly if you choose the appropriate refinance companies. Refinancing may enable you to obtain a loan with better terms and save money.

FAQ

How soon can I refinance my car loan?

It typically takes two to three months for your vehicle’s title to transfer from the manufacturer or previous owner to your current lender during the first sixty to ninety days of the auto loan. If the title hasn’t changed, most lenders won’t even take your application into consideration for a refinance.

Does refinancing a car hurt your credit?

Your credit score may drop a few points as a result of refinancing, but this effect will only last temporarily. Applying for a loan generates a hard inquiry. If interest rates have decreased since you obtained your loan, refinancing might be worthwhile.

Is it a good idea to refinance a car loan?

Refinancing your auto loan is usually a good idea if it can help you reduce your interest costs. However, given the rising interest rates, it’s not always a prudent financial decision, so consider your options carefully before applying.

How soon can you refinance a car loan with bad credit?

Usually, you can recover some of the credit score points you lost when applying for your auto loan in six months. Keep in mind that if you refinance, you’ll probably lose them again, if only temporarily. Your credit score may slightly decline, but if you can get a better deal and save money, it will be well worth it.

Read More :

https://www.lendingtree.com/auto/refinance/how-soon-can-you-refinance-a-car-loan/

https://www.nerdwallet.com/article/loans/auto-loans/when-can-you-refinance-a-car-loan