Federal Direct Student Loans are low-interest, long-term loans that SUNY ESF grants to students directly from the federal government. The student loans provided by this program are guaranteed, so income or credit history are not factors in determining eligibility. Direct Loan consideration is available to all students who satisfy the general eligibility requirements for federal student aid and who have not yet reached the aggregate loan limit, defaulted on a prior loan, or owed money on a federal grant.

Interest Rate and Fees

Interest is money paid to the lender in exchange for borrowing money. Interest is calculated as a percentage of the unpaid principal amount (loan amount) borrowed. The interest rate varies depending on the loan type and (for most types of federal student loans) the first disbursement date of the loan. Please click here to view the current interest rates, or click here to view historical Federal Direct Loan interest rate information.

Loan fees on the majority of federal student loans are expressed as a percentage of the total loan amount. You will receive a proportionate deduction for the loan fee with each loan disbursement. This implies that the amount you get will be less than what you really borrow. Not just the amount you received back, but the total amount you borrowed must be returned.

Please click here to view the current loan fees for Federal Direct Subsidized Loans, Federal Direct Unsubsidized Loans and Federal Direct PLUS Loans.

The College Cost Reduction and Access Act and the Subsidized Stafford Loan Interest Rate

The Bipartisan Student Loan Certainty Act of 2013, which links federal student loan interest rates to financial markets, was passed by Congress and signed by the President. In accordance with this Act, interest rates for new loans made for the forthcoming award year—which runs from July 1 to the following June 30—will be decided in June. For the duration of the loan, the interest rate on each loan will be fixed.

These rates will apply to all new Federal Direct Loans made during indicated timeframe. Please click here to view the current interest rates, or click here to view historical Federal Direct Loan interest rate information.

Consolidated Appropriations Act of 2012: Subsidized Stafford Loan Grace Period Interest Subsidy

Both subsidized and unsubsidized Stafford loans have a grace period during which the borrower is not required to repay the loan until six months following graduation, withdrawal, or enrollment in less than half-time classes. In the past, the interest subsidy for Federally Sponsored Stafford Loans was preserved during the grace period. During the grace period for first disbursements made on or after July 1, 2012, but before July 1, 2014, there will be no interest subsidy.

Public Law 112–141: New Cap on Eligibility for Subsidized Stafford Loans

If a borrower has taken out Federal Direct Subsidized Loans for a period longer than 150 percent of the stated duration of their educational program, they will not be eligible for new loans on or after July 1, 2013. A borrower who has reached the 150 percent threshold is also prohibited by law from receiving interest subsidy benefits on any Federal Direct Subsidized Loans that were first disbursed to them on or after July 1, 2013.

- Federally subsidized direct loans are available to borrowers for a maximum of 150% of the duration of their current academic program (i e. , six years for a four-year degree).

- Following the completion of 150 percent of the program, a borrower’s eligibility for further Federal Subsidized Direct Loans will terminate.

- If a student continues to enroll after having received federally subsidized direct loans for 150 percent of the program duration, they will forfeit all of their prior subsidies for those loans. Additionally, the student must pay all accrued interest.

Budget Control Act of 2011 for the Stafford and PLUS Loan Program Rebate

In Aug. 2, 2011, Congress passed the Budget Control Act of 2011, which put into place automatic federal budget cuts, known as a “sequester.” While the sequester does not otherwise change the amount, terms or conditions of Federal Direct Loans, the terms of the sequester affect the loan fees charged to Federal Direct Loan borrowers for Federal Direct Subsidized, Federal Direct Unsubsidized and Federal Direct PLUS loans. The amount of the loan origination fee for a loan is determined by the date of the first disbursement of the loan. Any subsequent disbursements, even if made on or after the relevant Oct. 1, have the same loan fee percentage that applied to the first disbursement of that loan. Please click here for more information about loan fees.

For latest announcements regarding the federal student aid programs, please visit the Federal Student Aid website.

These ceilings apply to Federal Direct Unsubsidized and Federal Direct Subsidized Loans.

|

Dependent Undergraduates |

||||

|

Annual Limit |

Aggregate Limit |

|||

|

Total |

Subsidized Maximum |

Total |

Subsidized Maximum |

|

|

Freshmen |

$5,500 |

$3,500 |

$31,000 |

$23,000 |

|

Sophomores |

$6,500 |

$4,500 |

||

|

Juniors and Seniors |

$7,500 |

$5,500 |

||

|

Independent Students |

|||||

|

Annual Limit |

Aggregate Limit |

||||

|

Total |

Subsidized Maximum |

Total |

Subsidized Maximum |

||

|

Freshmen |

$9,500 |

$3,500 |

$57,500 |

$23,000 |

|

|

Sophomores |

$10,500 |

$4,500 |

|||

|

Juniors and Seniors |

$12,500 |

$5,500 |

|||

|

Graduate and Law Students |

$20,500 |

$0 |

$138,500 |

$65,500 |

|

|

HEAL (Pharmacy/Optometry/Medical) |

$33,000 Pharmacy $40,500 Optometry $40,500-$47,167* Medical |

$0 |

$224,000 |

$65,500 |

|

*Medical student annual loan limits dependent upon medical year level.

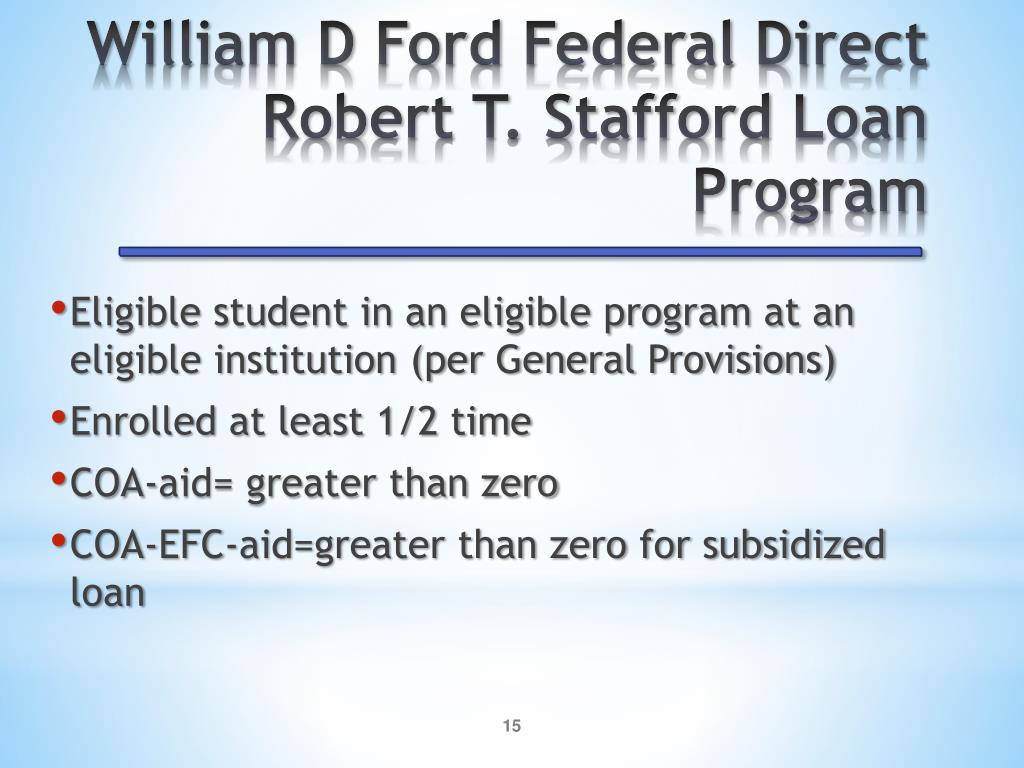

– Federal Subsidized loans: Applicants must,

- be an undergraduate student;

- be enrolled at least half-time with demonstrated financial need;

- be enrolled in an undergraduate degree program (financial aid is not available for certificate programs);

- possess filed an FAFSA and be qualified for government funding

– Federal Unsubsidized loans: Applicants must,

- be undergraduate or graduate student;

- be enrolled at least half-time, regardless of financial need;

- be enrolled in an undergraduate or graduate program (financial aid is not available for certificate programs);

- possess filed an FAFSA and be qualified for government funding

All students planning to receive a Federal Direct Loan will need to complete a Master Promissory Note and Entrance Counseling at StudentAid.gov. To complete these requirements, the following information will need to be provided: social security number, date of birth, Department of Education FSA ID (the same FSA ID used for the FAFSA), driver’s license number (if applicable) and two personal references (full name, address and telephone numbers). The University of Houston will electronically verify with the Department of Education that these steps have been completed before funds are released.

Students must use their myUH self-service account to accept any loan awards after receiving email notification. The student may reduce or reject any loans they are given if they are not needed.

In the event that all of your classes have started, payment will start the first week of the semester. For Federal Direct Loans to be disbursed, a minimum of half-time enrollment is required (five credit hours for graduate students, and six credit hours for undergraduate, law, optometry, pharmacy, and medical students). Disbursement also requires the completion of entrance counseling and a valid Master Promissory Note (MPN).

The money from the loan will be applied to the student’s account to pay for fees once it has been disbursed. If a credit balance is generated, money will be returned in accordance with the refund preferences that the student has specified. For more information on refunds, please click here.

Students must meet all requirements for Satisfactory Academic Progress and be enrolled at least half-time (five hours for graduate students, and six hours for undergraduate, law, optometry, pharmacy, and medical students) at the time of disbursement in order to remain eligible.

Repayment of Federal Direct and FFELP loans starts six months after the loan recipient graduates, leaves school, or otherwise ceases to be enrolled full-time. Loan Exit Counseling is required when these situations occur. Kindly visit StudentAid and click on this link to obtain the Federal Direct Loan Exit Counseling Guide. gov to complete this requirement. While you’re considering whether to apply for Federal Student Loans, we also invite you to look over our estimated Sample Loan Repayment Schedules.

Standard Repayment Plan:

- Federal Direct Subsidized and Unsubsidized Loans, Federal Stafford Subsidized and Unsubsidized Loans, and All Federal PLUS Loans are eligible loans.

- Payments are a fixed amount of at least $50. 00 per month.

- Youll have 10 years to repay your loans.

- Under this plan, you will eventually pay less interest on your loan than you would under other plans.

Graduated Repayment Plan:

- Federal Direct Subsidized and Unsubsidized Loans; Subsidized and Unsubsidized Federal Stafford Loans; and All Federal PLUS Loans are among the loans that qualify.

- Payments start out lower and rise every two years on average.

- Youll have up to 10 years to repay your loans.

- Over time, you will repay your loan more than you would have under the 10-year standard plan.

Extended Repayment Plan:

- Federal Direct Subsidized and Unsubsidized Loans; Subsidized and Unsubsidized Federal Stafford Loans; and All Federal PLUS Loans are among the eligible loans.

- In order to qualify for the extended plan, your debt must exceed $30,000.

- Payments may be fixed or graduated.

- Youll have up to 25 years to repay your loans.

- Your monthly payments will be less than the monthly payments of the standard 10-year plan.

- Over time, you will repay your loan more than you would have under the 10-year standard plan.

Income-based Loan Repayment Program:

- Federal Direct Subsidized and Unsubsidized Loans; Subsidized and Unsubsidized Federal Stafford Loans; All Federal PLUS Loans to Students; and Direct or FFEL Consolidation Loans, excluding Direct or FFEL PLUS Loans to Parents, are all eligible loans.

- The maximum monthly payment you can receive is 15% of the discretionary income that falls between your adjusted gross income and 150 percent of the poverty threshold based on the size of your family and the state in which you live (other restrictions apply).

- Your payment changes as your income changes.

- Youll have up to 25 years to repay your loans.

- You must have a partial financial hardship.

- Your monthly payments will be less than the monthly payments of the standard 10-year plan.

- Over time, you will repay your loan more than you would have under the 10-year standard plan.

- Any remaining balance on your loan will be forgiven if, after making qualifying monthly payments for the equivalent of 25 years, you have not paid off your loan in full.

- Income tax may be due on any amount that is forgiven.

Pay As You Earn Repayment Plan:

- Federal Direct Subsidized and Unsubsidized Loans; Subsidized and Unsubsidized Federal Stafford Loans; All Federal PLUS Loans to Students; and Direct or FFEL Consolidation Loans, excluding Direct or FFEL PLUS Loans to Parents, are among the loans that qualify.

- The maximum monthly payment you can receive is 15% of the discretionary income that falls between your adjusted gross income and 150 percent of the poverty threshold based on the size of your family and the state in which you live (other restrictions apply).

- Your payment changes as your income changes.

- Youll have up to 20 years to repay your loans.

- You must have a partial financial hardship.

- Your monthly payments will be less than the monthly payments of the standard 10-year plan.

- Over time, you will repay your loan more than you would have under the 10-year standard plan.

- Any remaining balance on your loan will be forgiven if, after making qualifying monthly payments for the equivalent of 20 years, you have not paid off your loan in full.

- Income tax may be due on any amount that is forgiven.

Income Contingent Repayment Plan:

- Federal Direct PLUS loans to students, Federal Direct Consolidation loans, and Federal Direct Subsidized and Unsubsidized Loans are all eligible.

- Annual payments are determined by taking into account your family size, adjusted gross income, and the total amount of your federal direct loans.

- Your payment changes as your income changes.

- Youll have up to 25 years to repay your loans.

- Your monthly payments will be less than the monthly payments of the standard 10-year plan.

- Under this plan, you will eventually pay more for your loan than you would under the standard 10-year plan.

- The unpaid amount of your loan will be forgiven if you default on it after making qualifying monthly payments for the equivalent of 25 years.

Income-Sensitive Repayment Plan:

- Loans that qualify include Federal Stafford Loans—both subsidized and unsubsidized—FFEL PLUS Loans, and FFEL Consolidation Loans.

- Your monthly payment is based on annual income. Your payments change as your income changes.

- Youll have up to 10 years to repay your loans.

- Over time, you will repay your loan more than you would have under the 10-year standard plan.

- The formula used by each lender to calculate the monthly payment under this plan may differ.

Public Service Loan Forgiveness Program:

- The remaining balance of principal and accrued interest on an eligible Federal Direct Loan is forgiven under this program.

- Borrower must not be in default.

- Borrower must make 120 monthly payments on the loan.

- Payments must be made after Oct. 1, 2007.

- At the time the cancellation is approved and during the time the qualifying payments are made, the borrower must be working full-time in a public service position.

Deferment:

A deferment is a period during which repayment of the principal and interest of your loan is temporarily delayed.

Forbearance:

If you cant make your scheduled loan payments, but dont qualify for a deferment, your loan servicer may be able to grant you a forbearance. With forbearance, you may be able to stop making payments or reduce your monthly payment for up to 12 months. Interest will continue to accrue on your Federal Direct Subsidized and Federal Direct Unsubsidized Loans (including all Federal PLUS Loans).

FAQ

How much is the William D Ford Direct loan?

|

Credits Completed

|

Undergrad Dependent

|

Graduate

|

|

|

Subsidized

|

Unsubsidized

|

|

0 – 27

|

$3,500

|

$20,500

|

|

28 – 55

|

$4,500

|

$20,500

|

|

56 – 85

|

$5,500

|

N/A

|

Do you have to pay back a direct loan?

Repayment of the loan must begin as soon as you graduate, stop attending, or enroll less than half-time. Repayment starts after your six-month grace period has ended.

How does the direct loan program work?

Undergraduate students who exhibit financial need are eligible to receive Direct Subsidized Loans. During the time you are enrolled in classes and the grace period that follows, you will not be required to pay or accrue interest. During that period, the Department of Education bears the cost of interest on your loan.

Is a direct loan good?

For students who must take out a loan in order to pay for college, federal direct student loans are the greatest choice. Federal direct student loans do not require a co-signer or credit history, in contrast to private student loans. They also provide borrowers with more adaptable options for repayment and default prevention measures.

Read More :

https://www.uh.edu/financial/undergraduate/types-aid/loans/William-D-Ford-Direct-Loan-Program/

https://www.tntech.edu/consumer-info/pdf/student-fed-loan.pdf