Ready to get your home loan?

We’re a Top VA Lender

Allow us to assist you in utilizing both our excellent loan rates and the benefits you have earned.

Being a Top VA lender, Navy Federal is aware of the special requirements that service members and their families have, and we can assist you in utilizing the benefits that come with having a VA loan. Our goal is to make the home-buying process easier for you by offering low VA home loan rates, resources, and membership benefits. Trustpilot.

| Term | Interest Rates As Low As | Discount Points | APR As Low As |

|---|---|---|---|

| 15 Year | 5.250% | 0.750 | 5.982% |

| 30 Year | 5.625% | 0.375 | 6.033% |

The interest rate above illustrates the possibility of reducing a loan’s interest rate and monthly payment by buying discount points. One point is equivalent to 1% of the loan amount and is settled at the closing. Points dont always have to be round numbers. Purchasing 1. 5 points would cost $4,500 on a $300,000 mortgage.

The rates shown are the “as low as” rates for refinancing and purchase loans.

Navy Federal VA Loans

VA loans offer many benefits. They’re a great choice if you meet the requirements and want to purchase a house.

- %20%20Options%20With%20No%20Down%20Payment%20Some lenders require a down payment of up to 2020%, but since Navy Federal VA Home Loans don’t require any down payment, you can purchase a home right away without having to wait years to save up. 3 .

- %20%20No%20Private%20Mortgage%20Insurance%20Required%20Unless%20the%20borrower%20is%20able%20to%20make%20a%20down%20payment%20of%2020%,%20most%20lenders%20require<the borrower%20to%20purchase%20PMI. Because PMI is not required for this loan, you will save money every month.

- The seller is permitted to contribute up to 4% of the home’s value toward your closing costs, which will save you money. %20Seller%20Contribution%20of%20Up%20to%204%%20

- Refinance Options Available: This loan might also be a good fit if you currently have a mortgage and want to refinance for a shorter term or a different interest rate.

Ready to apply? Sign in to get started.

Our U. S. -based member service reps are here for you 24/7. Reach us online, over the phone or at a branch. Contact us. Please give us a call at 1-888-842-6328 if you’re prepared to apply for a mortgage or would like to inquire about the status of your loan.

Visit Our Home Buying Center

All the things you need to simplify your next address are available at our Home Buying Center. Get a Verified Preapproval, the best loan option for you, connections to knowledgeable real estate agents, and lots of chances to save money.

Selecting the ideal real estate agent is the first step in locating the ideal house. Get in touch with a top-producing real estate agent in your area by using RealtyPlus®. Plus, you can earn cash back. Exclusively for Navy Federal members. 5.

- The Mortgage Loan Process in Ten Easy Steps: Preapproval is the first step, and your ideal home is the last To make the process simpler for you, we’ve broken it down. Learn More about The Mortgage Loan Process in 10 Steps .

- Mortgage Preapproval Having a preapproval increases your negotiating power and communicates to sellers that you are a serious buyer. Learn More about Mortgage Preapproval .

- Best Mortgage for You Watch our Mortgage Match video for assistance in selecting the best loan option for you. Learn More about Best Mortgage for You .

- Managing Your Equity Loan or Mortgage HomeSquad offers a one-stop shop for all of your mortgage management requirements. Learn More about Managing Your Mortgage or Equity Loan .

- How to Make Mortgage Payments Discover the components of your monthly mortgage payment as well as convenient ways to make payments. Learn More about How to Make Mortgage Payments .

- Discover how we determine your escrow payments and find the answers to the most common questions you have. What is an Escrow Account? Learn More about Whats an Escrow Account? .

These rate offers are effective 01/27/2024 and subject to change. The rates shown are the “as low as” rates for refinancing and purchase loans. Your rate and terms may vary because rates are determined by factors such as creditworthiness, loan-to-value (LTV), occupancy, and loan purpose. All loans subject to credit approval. Rates quoted require a loan origination fee of 1. 00%, which may be waived for a 0. 25% increase in the interest rate. Numerous of these initiatives have discount points, which could affect your rate.

A VA loan of $300,000 for 15 years at 5. 250% interest and 5. 982% APR will have a monthly payment of $2,411. A VA loan of $300,000 for 30 years at 5. 625% interest and 6. 033% APR will have a monthly payment of $1,726. Since taxes and insurance are not included, there will be a larger actual payment obligation. There may be restrictions on the amount you can borrow if you have less than your VA home loan entitlement.

Product features subject to approval. Available for purchase loans only. Additional funding fees apply to loans and can be financed up to the maximum loan amount.

Customer satisfaction claims are based on 2021 Anywhere Leads Inc. customer surveys from clients who used an Anywhere Leads Network agent or a program to buy or sell a house

Except for Iowa and all employer-sponsored relocations, the program is only available for single-family home purchases or sales in the contiguous US, Alaska, and Hawaii. To benefit from this program, you are not required to obtain financing from Navy Federal Credit Union. With the exception of Iowa, Alaska, and Oklahoma, the cash back is only available when you buy or sell your home through the services of a program-approved and referred real estate agent. It is also not available in certain transactions that have restricted agent commissions, such as many new constructions, For Sale by Owner, or For Sale by iBuyer transactions. You can identify any transactions where the cash back would not be available with the assistance of your assigned agent. The value of the property you are buying or selling determines how much cash back you will receive. To receive the entire $9,000 cash back, the transaction must take place in a property valued at $3 million or more. Please use this link to the RealtyPlus website to determine your possible cash back amount: https://navyfederalrealtyplus com/. There is no cap on the number of times you can use the program, but the cash back offer is only good for one cash back per property. In certain states, the cash back may be substituted with a gift card or commission credit at closing. A MasterCard MAX gift card with preloaded points that can be used at specific retail locations after closing will be given out in Tennessee and Kansas. In Kansas, state laws restrict the types and dollar amounts of incentives. A commission reduction may be offered at closing in Mississippi, New Jersey, and Oregon instead of cash back. Please check with the program coordinator for details. All real estate commissions are negotiable. Contact RealtyPlus for terms and conditions. Seller listing fees apply. This program is offered, in part, by Anywhere Leads Inc. which, upon referral to any affiliated real estate firms, such as Corcoran, Coldwell Banker, Century 21, ERA, Better Homes and Gardens, and Real Estate, may earn a cooperative brokerage fee. The terms and conditions of the program are subject to change without prior notice at any time. Additional terms, conditions, and restrictions apply. If your property is already listed with an agent, this is an advertisement, not a request for representation by an agent. Anywhere Leads Inc. , 175 Park Avenue, Madison, NJ 07940. Licensed broker in the state of Texas. Broker license #9009191.

FAQ

What is the VA loan interest rate right now?

|

Loan term

|

Interest Rate

|

APR

|

|

30-Year Fixed

|

6.84%

|

7.08%

|

|

15-Year Fixed

|

6.48%

|

6.87%

|

|

30-Year Jumbo

|

6.98%

|

7.08%

|

|

5/1 ARM

|

7.15%

|

7.25%

|

Are VA loans cheaper interest rates?

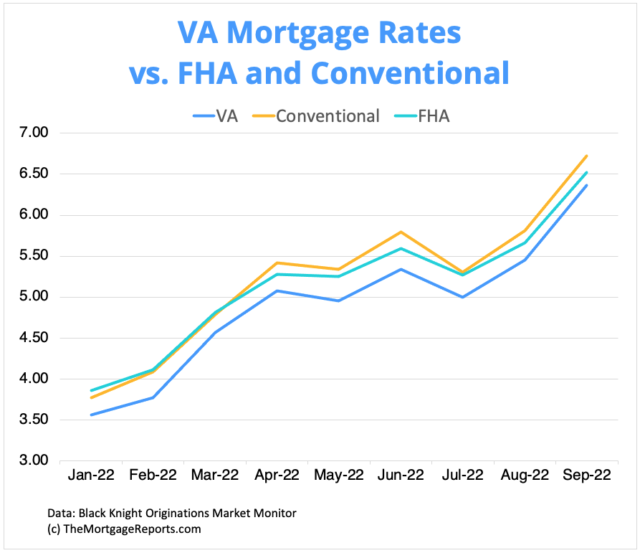

VA loans typically have lower interest rates from lenders than conventional loans, so over the course of the loan, especially if it’s a 30-year loan, you can save a significant amount of money on interest.

What is a VA 30-year fixed rate?

Government-backed 30-year fixed mortgages are available to veterans, surviving spouses, and active duty personnel. While most lenders have credit requirements, the VA does not. For VA loans, Rocket Mortgage® requires a minimum median credit score of 580.

Are VA interest rates lower than FHA?

A VA loan might be a better option if you don’t have much saved for a down payment or any money at all. When compared to FHA or other loan options, a VA loan can also be less expensive over time because it doesn’t require mortgage insurance and typically has lower closing costs and interest rates.

Read More :

https://www.navyfederal.org/loans-cards/mortgage/mortgage-rates/va-loans.html

https://www.veteransunited.com/va-loans/va-mortgage-rates/