We are an independent, advertising-supported comparison service. Our objective is to empower you to make confident financial decisions by giving you access to interactive tools and financial calculators, publishing original and unbiased content, and allowing you to conduct free research and information comparisons.

Issuers that Bankrate has partnerships with include American Express, Bank of America, Capital One, Chase, Citi, and Discover, among others.

What Is PMI?

Your Credit Profile Excellent 720+ Good 660-719 Avg. 620-659 Below Avg. 580-619 Poor ≤ 579.

When do you intend to buy your house? Found a house; signed a purchase agreement; offer pending; will you buy in 30 days, 2 to 3 months, 4 to 5 months, or 6 months from now?

Consent:

You accept our Terms of Use and Privacy Policy, which include the use of arbitration to settle disputes pertaining to the Telephone Consumer Protection Act, by providing your contact information. ! NMLS #3030.

Congratulations! Rocket Mortgage can proceed with your online home loan application based on the information you have submitted.

If a sign-in page does not automatically pop up in a new tab, click here

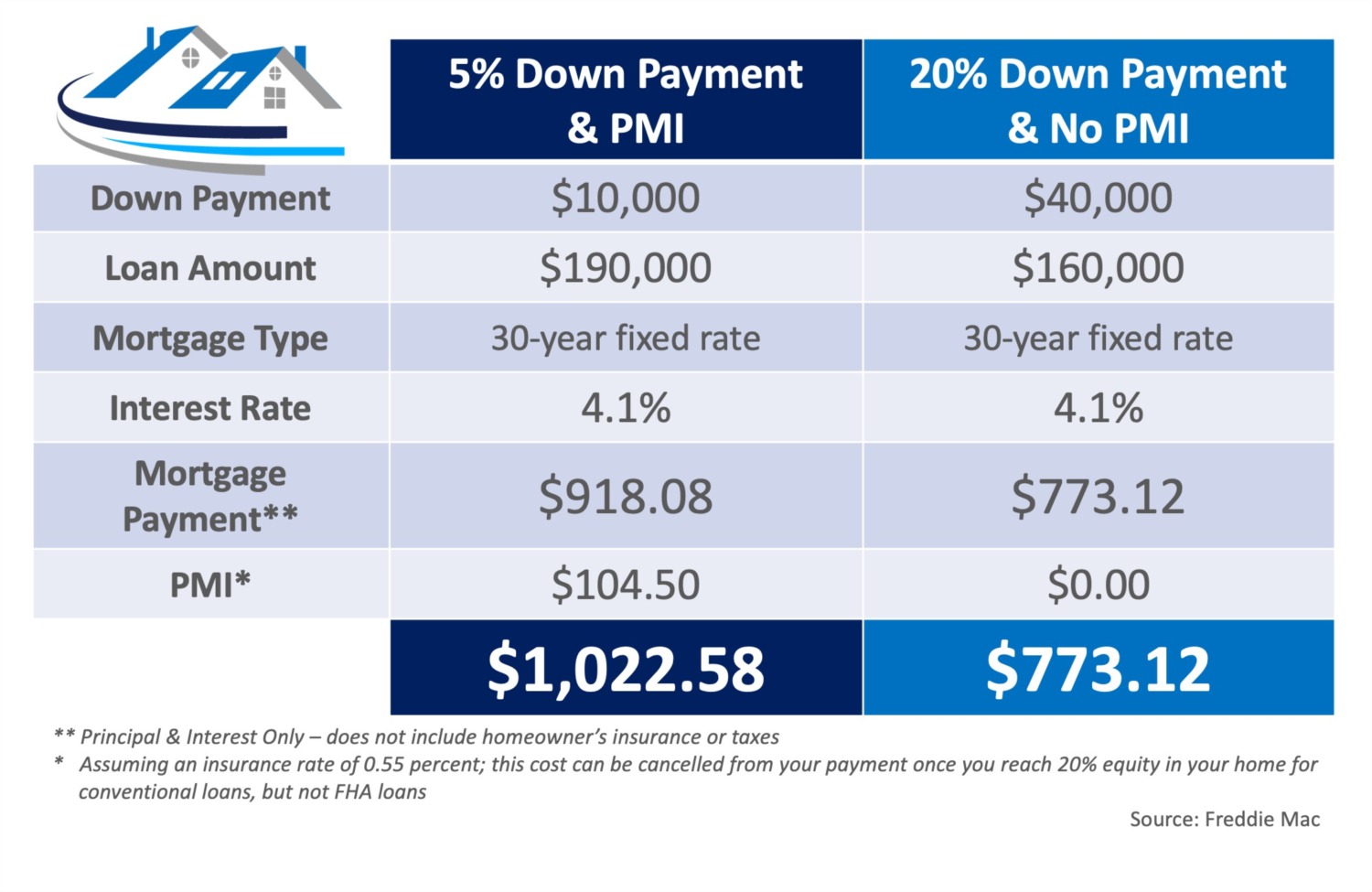

How Much Is PMI?

Professional writer Andrew Dehan writes about homeownership and real estate. He is also a published poet, musician and nature-lover. He and his wife, daughter, and dogs reside in the Detroit metropolitan area.

FAQ

How much is PMI on a $300 000 loan?

However, private mortgage insurance, or PMI, typically costs nothing. 5 to 1. 5% of the loan amount per year. The monthly installments of this annual premium are added to your monthly mortgage payment. Thus, the cost of a $300,000 loan would be between $1,500 and $4,500 a year, or $125 and $375 each month.

How long do you pay PMI?

After you have achieved equity in your home, you will be able to cancel your PMI and deduct that expense from your monthly payment. In the event that you make your mortgage payments on time, PMI will automatically terminate on the date that your principal balance is scheduled to reach 2078% of the original appraised value of your home.

What is PMI and why do I need it?

PMI is a kind of insurance that conventional mortgage loan borrowers may need to provide when they purchase a home and make a down payment that is less than 2020% of the purchase price of the property. In these cases, PMI may be included in your mortgage payment. It safeguards your lender in the event that you default on your loan.

How much is PMI on a $100 000 mortgage?

The amount of PMI on a $100,000 mortgage is determined by your loan-to-value (LTV) and credit score. Therefore, PMI on a $100,000 mortgage could be between $200 and $1,800 per year ($16 and $155). The lower your PMI costs, the more you save (or pay off) your loan and the higher your credit score.

Read More :

https://www.rocketmortgage.com/learn/what-is-pmi

https://www.bankrate.com/mortgages/basics-of-private-mortgage-insurance-pmi/