Key loan terminology

Four main components are typically present in loans: principal, interest, installment payments, and term. Understanding each of these will help you determine whether a loan fits within your budget by letting you know how much and how long you’ll have to pay.

Principal: The sum of money you take out from a lender is this. $500 for auto repairs or $500,000 for a new home The principal is the amount owed on your loan after interest and fees are deducted.

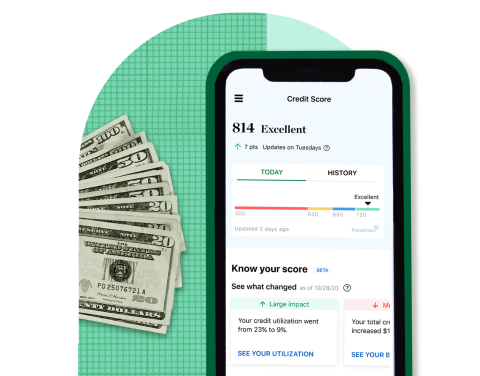

Interest: The amount you must repay on top of the principal amount of a loan is known as the interest rate. Your interest rate is set by the lender based on a number of variables, such as the kind of loan you take out, how long you have to pay it back, and your credit score.

The annual percentage rate, or APR, which is the interest rate plus additional expenses like upfront fees, can vary from the interest rate.

Installment payments: Loans are normally returned to lenders on a regular basis, usually once a month. Your monthly payment is commonly a fixed amount.

Term: The length of time you have to make all loan repayments is known as the loan term. The length of the loan can vary from a few weeks to several years, depending on the type.

Credit cards and credit lines are examples of revolving credit, whereas loans are normally installment credit, meaning you borrow a large amount and pay it back over time. Revolving credit, as opposed to loans, allows you to take out loans as needed, pay them back, and then take out new loans. You only pay interest on the money you borrow.

Types of loans

This is a summary of various loan kinds, along with their conditions and interest rates.

|

Type of loan |

Typical interest rate |

Typical terms |

|---|---|---|

|

Mortgage |

5% to 7%. |

15 or 30 years. |

|

Auto loan |

5% to 22%. |

3 to 5 years. |

|

Student loan |

4% to 15%. |

10 years. |

|

Personal loan |

6% to 36%. |

2 to 7 years. |

|

Payday loan |

400%. |

2 to 4 weeks. |

Loans fall into two broad categories: secured and unsecured.

Secured loans

Examples: A mortgage or an auto loan.

In the event that you are unable to repay the loan as per the terms of the agreement, the lender will usually use a tangible asset, such as your house or car, to secure its funds. Your interest rate is determined by the lender based on the asset, credit history, and credit score. Secured loans typically have lower interest rates than unsecured loans.

Unsecured loans

Payday loans, personal loans, and student loans are a few examples.

Your interest rate is determined by unsecured loan lenders based on your income, credit history, credit score, and amount of outstanding debt. The lender cannot seize any of your assets if you fail to repay the loan as agreed, but it can report the default to the three major credit bureaus, which will lower your credit score and potentially make it more difficult for you to get credit in the future.

Unsecured loans typically have higher interest rates than secured loans.

How do loans work?

Depending on the kind of loan you’re looking for, different procedures must be followed. Typically, a lender will consider your income, current debts, and credit score when determining whether to approve your loan application. The lender will assess the collateral if the loan is secured.

Before you go house or car shopping, you can usually get pre-approved for a mortgage and auto loan. This procedure gives you an idea of how much you’ll be approved for and what your interest rate will be, and it may require a hard credit check.

You can often prequalify for personal loans to see an estimate of the possible loan amount and interest rate. Since a hard credit check is not necessary for prequalification, you can compare offers from various personal loan lenders without worrying about how they will affect your credit score.

Lenders who don’t verify your creditworthiness or loan repayment capacity frequently tack on exorbitant interest rates. As an illustration, the average payday lender charges a 15% fee for each $100 you borrow, as reported by the Consumer Financial Protection Bureau. This works out to an annual percentage rate (APR) of almost 400%. Customers advocate that loans with annual percentage rates (APRs) higher than 3.6 percent are typically unaffordable.

After you sign a loan agreement and the lender releases the funds, you will begin making regular loan repayments, typically on a monthly basis.

Your lender may impose a late payment fee if you fail to make a payment. The majority of respectable lenders notify the credit bureaus of loan payments; thus, late payments will lower your score while timely payments can raise it.

FAQ

What loan means?

A loan is a form of credit arrangement wherein a certain amount of money is extended to a third party with the expectation that the principal amount will be repaid in the future. Frequently, in addition to the principal amount that the borrower must repay, the lender also adds interest or finance charges to the principal value.

What is the term loan meaning?

A term loan is a financial loan that is typically paid back over a predetermined length of time in equal installments. Term loans typically have a duration of one to ten years, but they occasionally have a 30-year duration. A term loan usually involves an unfixed (a. k. a. interest rate that is variable and will increase the amount owed

What is personal loan in simple words?

Financial institutions grant unsecured personal loans based on a variety of factors, including employment history, ability to repay debt, income level, occupation, and credit history. A personal loan, sometimes referred to as a consumer loan, is a type of loan with several uses that you can use to cover any emergency needs.

What is a loan and borrow?

More precisely, “borrow” refers to using someone else’s property with the goal of giving it back. “Loan” can refer to both the act of lending something to someone or a noun, such as an amount of money that you have to repay with interest. This implies that you cannot claim to be “borrowing” something from someone.

Read More :

https://www.nerdwallet.com/article/loans/personal-loans/what-is-a-loan

https://www.law.cornell.edu/wex/loan