quality auto coverage starts hereWhen you drive with quality coverage, you drive with peace of mind. Allstate auto insurance can help you stay protected for wherever the road takes you.

Many lenders require you to have collision and comprehensive coverage on your auto insurance policy until your car is paid off if you’re leasing or financing a new vehicle.

The purpose of gap insurance is to supplement comprehensive or collision coverage. Your comprehensive or collision insurance would assist in covering the full cost of your stolen or totaled car, up to its depreciated value, if you have a covered claim. According to Kelly Blue Book (KBB), a brand-new car loses approximately 20% of its value in the first year after being driven off the lot.

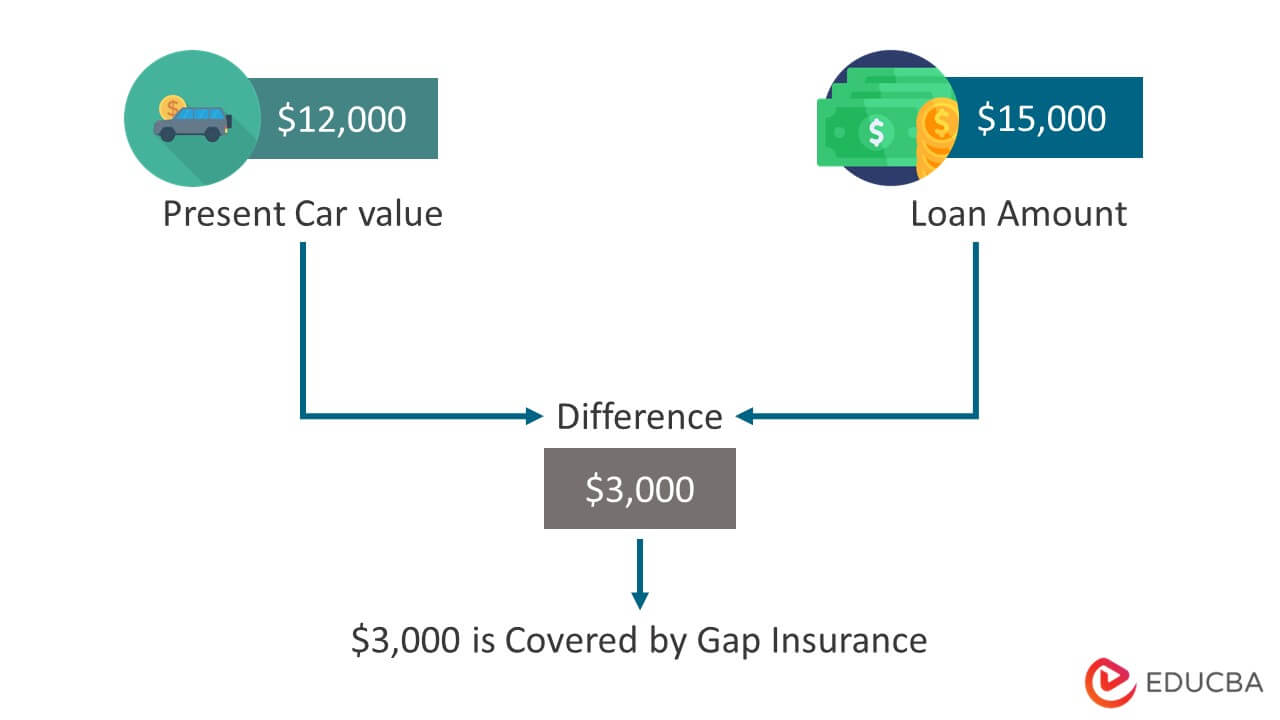

However, gap insurance might come in handy if you still owe more on your loan or lease than the car’s depreciated value.

When you might need gap insurance

If you are underwater on your auto loan—that is, you owe more than the car is worth—and your car is stolen or totaled, gap insurance coverage might be applicable. “Totaled” indicates that the vehicle’s value is less than the cost of repairs. The decision of your insurer and state regulations determine whether a car is declared totaled.

How does gap insurance work?

Here’s an illustration of how gap insurance might function: Let’s say you paid $25,000 for a brand-new car. In the event that the vehicle is totaled in a covered collision, you are still in debt $20,000. Your lender would receive payment from your collision coverage up to the depreciated value of the totaled car, let’s say $19,000. You would have to pay $1,000 out of pocket to settle your auto loan on the totaled car if you didn’t have gap insurance. In the event that you have gap insurance, your provider would contribute $1,000.

Remember that in the example above, the entire reimbursement from your auto insurance goes toward paying off your non-drivable car loan. You might want to think about getting new car replacement coverage if you believe you would require assistance in purchasing a new vehicle after yours was totaled. Some insurance companies offer new car replacement coverage and loan/lease gap coverage as a single add-on to a new car insurance policy.

Can you get gap insurance after you buy a car?

Depending on the car’s model year, gap insurance might be available to you after you purchase a vehicle. Not only is gap insurance provided by auto dealerships, but it is also a feature of many insurance policies. Furthermore, the III claims that purchasing gap insurance from an insurance provider is frequently less expensive than doing so from a car dealership.

To be eligible for gap insurance, your car must be brand-new according to certain insurers. That may mean:

- that you are the car’s original owner (you still have the original loan or lease on it)

- that the car isn’t more than two or three years old

Find out from your insurer what requirements must be met in order for you to purchase gap insurance.

Is gap insurance worth it?

If youre considering buying gap insurance, its important to remember that this type of coverage may only be available if youre leasing or financing a new vehicle. Then, think about how much you owe on your auto loan versus the value of your car. You can get an estimate of what your car is worth by checking a site like KBB. Do you owe more than your car is worth? Could you afford to pay the difference out of pocket if your car is totaled?

The III states that you should think about gap insurance in the following circumstances:

- If your vehicle’s down payment was less than twenty percent

- If your auto loan is 60 months or longer

- If youre leasing a vehicle. The III points out that if you’re leasing a new car, gap coverage is often included in the lease. Check yours to see whether you have coverage.

Speak with your insurance provider if you have any questions about gap insurance; they can help you understand your options.

FAQ

What are the cons of gap insurance?

Cons are as follows: You may pay interest if you purchase gap insurance from the dealership or financing company. The cost of the coverage will be added to your monthly loan or lease payments, so be aware that you may have to pay interest.

How does gap insurance work on a car loan?

Gap insurance covers the difference when your loan balance exceeds the value of your car. For instance, your gap coverage pays the $5,000 difference, less your deductible, if your car is only worth $20,000 and you owe $25,000 on your loan.

What does gap of insurance cover?

What Does Gap Insurance Cover? Gap insurance only pays out if you owe more on your loan than the car is worth at the time of the incident and your vehicle is totaled or damaged. If your vehicle was stolen or totaled in an accident, you may be able to make a gap insurance claim.

Is Gap Protection worth it?

For those who choose a long payback period and no down payment because they may owe more than the car’s current value, gap insurance makes sense. Assuming that you made a down payment of at least 2020% on the car when you bought it, or that you’re paying off the car loan in less than five years, you might be able to forego gap insurance.

Read More :

https://www.allstate.com/resources/car-insurance/gap-insurance-coverage

https://www.progressive.com/answers/gap-insurance/