What Is an Amortized Loan?

A loan that has scheduled, recurring payments applied to both the principal amount and the interest is known as an amortized loan. The relevant interest expense for the period is paid off first by an amortized loan payment, with the remaining amount going toward lowering the principal amount. Bank personal loans for debt consolidation or small projects are frequently amortized loans, as are home and auto loans.

- When a borrower takes out an amortized loan, they must make regular, scheduled payments that cover both the principal and interest.

- Any amount left over after the interest expense for the period is paid off by an amortized loan payment goes toward lowering the principal amount.

- With an amortization loan, the principal amount of payments rises as the interest component falls.

How an Amortized Loan Works

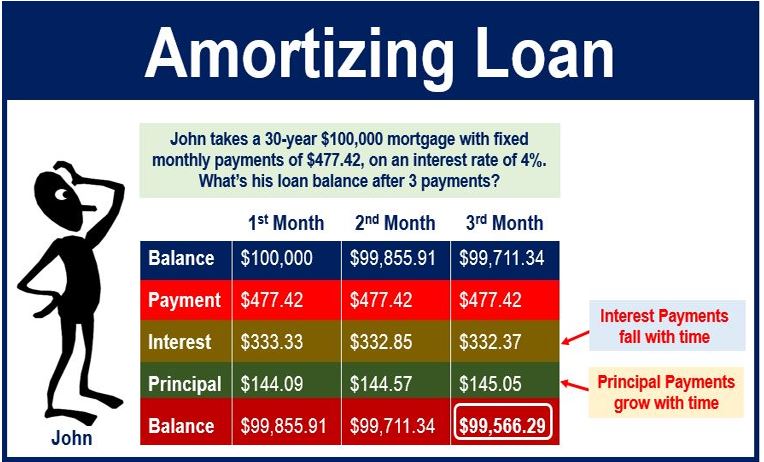

An amortized loan’s interest is computed using the loan’s most recent ending balance; as payments are made, the amount of interest due drops. This is due to the fact that any payment made above the interest amount lowers the principal, which lowers the balance used to compute interest. In an amortized loan, the principal amount of the payment rises as the interest component falls. Consequently, over the course of the amortized loan, interest and principal have an inverse relationship within the payments.

A set of computations results in an amortized loan. To determine the interest owed for the period, first multiply the loan’s current balance by the interest rate applicable to the current period. (Monthly rates can be calculated by dividing annual rates by twelve.) The dollar amount of principal paid during the period is calculated by deducting the interest due for the period from the total monthly payment.

The principal paid during the period is applied to the loan’s remaining balance. As a result, the new outstanding balance of the loan is equal to the current balance of the loan less the principal paid during the period. The interest for the upcoming period is computed using this new outstanding balance.

Amortized Loans vs. Balloon Loans vs. Revolving Debt (Credit Cards)

Even though balloon loans, revolving debt, and especially credit cards are similar, there are some key differences that buyers should understand before committing to any of them.

Amortized Loans

Generally speaking, amortized loans are paid off over a long period of time, with equal payments made at each payment period. But, you can always choose to make a larger payment to lower the principal amount even further.

Balloon Loans

Generally speaking, balloon loans have a short term and only amortize a portion of the principal balance. The remaining amount is due as a final repayment at the end of the term, and it is typically large (at least twice the amount of previous payments).

Revolving Debt (Credit Cards)

Credit cards are the most well-known type of revolving debt. With revolving debt, you borrow against an established credit limit. You can continue borrowing as long as you haven’t reached your credit limit. Since credit cards don’t have fixed loan amounts or payment schedules, they differ from amortized loans.

With amortized loans, interest and principal are deducted from each payment; initially, interest is paid at a higher rate than principal until the ratio is eventually reversed.

Example of an Amortization Loan Table

An amortization table may show the results of the calculations for an amortized loan. Relevant balances and dollar amounts for each period are listed in the table. In the example below, a row in the table represents each period. The columns show the date of payment, the principal and interest portions of the payment, the total amount of interest paid thus far, and the final outstanding balance. The first year of a $165,000 30-year mortgage with an annual interest rate of 4 is shown in the following table excerpt. 5%.

:max_bytes(150000):strip_icc()/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

Can I Pay Off an Amortized Loan Early?

Yes. You can choose to make principal-only payments or more frequent payments to pay off an amortized loan sooner. Making additional payments on the principal reduces the amount that can accrue interest because interest is charged on the principal. Before trying this, make sure you are aware of any early payoff penalty fees by consulting your loan agreement.

How Can I See How Much of my Payment Is Interest?

The majority of lenders will offer amortization tables that display the percentage of interest versus principle for each payment. You can also request this information from your lender.

Do I Pay More Interest in the Beginning of my Loan or the End?

Usually, amortized loans begin with payments that are primarily allocated to interest.

The Bottom Line

An amortized loan addresses your principal and the anticipated interest you will pay at the same time. If your loan permits it, you can reduce the total amount owed by making additional principal payments. To determine how much interest you would pay on a potential loan compared to the principal, try using an amortization calculator. Article Sources: Investopedia mandates that authors cite original sources to bolster their claims. These consist of government data, original reporting, white papers, and conversations with professionals in the field. When appropriate, we also cite original research from other respectable publishers. You can read more about the guidelines we adhere to when creating impartial, truthful content in our

You consent to the use of cookies on your device to improve site navigation, track user activity, and support our marketing initiatives by selecting the option to “Accept All Cookies.”

FAQ

What is the meaning of amortizing loan?

Fixed, recurring payments are made on an amortizing loan toward principal and interest until the loan balance is paid in full. Most, if not all, of your payment at the start of your repayment term goes toward paying interest.

What does it mean when a loan is fully amortizing?

A fully amortized payment is one in which your loan will be entirely paid off at the end of the term if all payments are made in accordance with the original schedule on your term loan. The amount of principal and interest paid each month for the duration of your loan is all that is meant to be understood by the term amortization.

What is the difference between a regular loan and an amortized loan?

The main difference between amortizing loans vs. Simple interest loans have an amortizing loan structure, meaning that the amount of interest paid drops with each payment. When you take out a loan with simple interest, the amount of interest you pay each month stays the same.

What is loan amortization with example?

Spreading out a loan’s repayment over time is referred to as amortization in the lending industry. In the first stage of repayment of an amortized loan, a fixed portion of your fixed equated monthly installment (EMI) covers the monthly interest, and the remaining portion covers your principal.

Read More :

https://www.investopedia.com/terms/a/amortized_loan.asp

https://www.rocketmortgage.com/learn/fully-amortized-loan