Any remaining financial gaps not filled by your child’s financial aid package can be filled with a parent PLUS loan. Parent PLUS loans with fixed interest rates, flexible repayment plans, and chances for student loan forgiveness are provided by the government.

But before applying, it’s crucial to consider the advantages and disadvantages of a parent PLUS loan. In certain cases, a private parent loan might even be a better option.

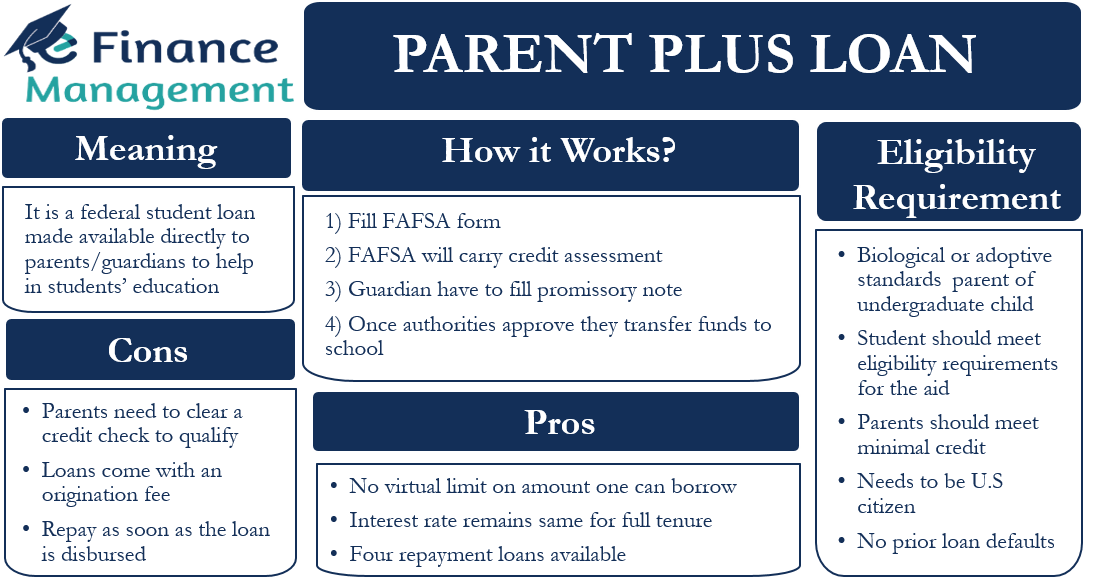

What Is a Parent PLUS Loan?

Federal loans known as Parent PLUS Loans are available to parents of dependent undergraduates. Why was it that they threw the 20%E2%80%9CPLUS%E2%80%9D%20into the name? That’s just marketing to make you feel better about getting deeply into debt, which is akin to calling a credit card that charges you 20% interest on 20%E2%80%9Clatinum. However, PLUS stands for Parent Loan for Undergraduate Students as well.

All set for some fundamental information regarding the Parent PLUS Loan?

- The interest rate is fixed. For the 2020–21 school year, it’s set at 5. 30%.

- The idea is to “assist” students who were previously turned down for a private loan by making a parent like you responsible for the debt, as private loans typically have lower interest rates.

- Do you like to pay fees for the luxury of having debt? PLUS Loans offer them! The origination fee for a PLUS Loan that will be disbursed in the fall of 2020 is $4. 236% of the debt. Taking out a loan for your daughter’s first year of school, which typically costs $25,000, will set you back $1,000 immediately—or more frequently, throw money at the principal before her first chemistry lab.

- Compared to other student loan options, the PLUS Loan has a substantially larger maximum loan amount. You have the ability to borrow funds up to the entire cost of your child’s preferred school, less any financial aid that they may have already received.

The biggest financial myth that most people hold is that taking out loans to pay for college is considered “good debt.” False! Here’s why we never advise taking on debt: It keeps you from pursuing your goals. Whether you’re a parent of a college-bound student or a student yourself, nobody benefits from taking on debt. While it may expedite the completion of a degree, it also delays the majority of the main adult aspirations, such as home ownership, marriage, and retirement planning.

Parent PLUS Loans are no different. Because they are dependent on a parent’s income, they might appear more prudent or less risky than other types of student loans. That’s not a safe assumption, though, because you can’t really justify jeopardizing your financial stability in order to support your child’s college education. (We’ll also discuss prudent ways to pursue a degree debt-free later!)

Student loan payments restart this fall!

Get a plan to ditch your loans for good. Watch our student loan livestream replay.

Parent PLUS Loan Eligibility

Because of the way that the law defines that relationship, Parent PLUS Loans are actually only available to the student’s parents. Here are a few edge cases.

Nope. Just parents. No other relatives can take one out for a student. This disqualifies Uncle Hank from being eligible for a Parent PLUS Loan, unless he has adopted his niece and is simply seeking to incur debt.

Good for you both, if your college-bound son is already living independently. If so, you’ll be relieved to hear that you are not eligible for a PLUS Loan as an independent student. We assure you that having less reliance on parents and no debt will make you both happy!

When parents get divorced, each parent is eligible to apply for a separate Parent PLUS Loan. Still, the student’s total cost of attendance less financial aid determines the total borrowed.

Parent PLUS loans are also available to stepparents, but only while they continue to be married to the student’s parent.

Parents who meet the Federal Student Aid office’s definition of “adverse credit” are exempt from applying. Here are a few disqualifiers:

- being behind on more than $2,085 in total debt, or more than 90 days past due

- having debts worth more than $2,085 written off in the two years before the PLUS Loan

- having any of the following occur during the previous five years: wage garnishments; tax liens; bankruptcies; foreclosures; repossessions; write-offs of federal student aid debt; or a combination of these.

We always appreciate it when debt is prevented before it begins, but don’t think that these regulations will prevent the government from coming up with innovative ways to give you a loan in the first place; they will overlook anything if you can just get a friend who has better credit to recommend you! We are discussing contacting a coworker to ask him to cosign your son’s student loan debt. We don’t think there’s anything more foolish than jeopardizing both your money and a friendship in one move.

How to Apply for a Parent PLUS Loan

Hopefully not, but are you still considering applying for one of these monsters? But maybe you enjoy horror stories . or rubbernecking mortgage brokers! If so, let’s review how to submit an application for a Parent PLUS Loan.

Step 1. Have your student complete a FAFSA. That’s the Free Application for Federal Student Aid, if you’re unaware. It’s found on the Federal Student Aid website. Even if you and your child aren’t applying for loans, this is a wise move because it’s required in order to be eligible for any kind of financial assistance, such as grants and scholarships.

Step 2. Complete the Application. The Direct PLUS Loan Application for Parents is the precise title. (Can you guess who fills it out? Yes, you. ) That’s also found on the Federal Student Aid site. You also choose how much you wish to borrow at this point, which is obviously zero. In order to proceed—please don’t do this—you would have to give permission for a credit check to be conducted.

If you have adverse credit at that point, the Department of Education will contact you. This is due to their sincere desire for you to be approved for the loan; they will explain your options for appealing a negative credit report or finding a cosigner. But we know you’re too smart for that.

Step 3. Sign the Master Promissory Note. That’s the terms and conditions for paying back your loan. It is available on the same official website as the application. We sincerely hope you are not at this stage because once you sign, you (or your child if you’re splitting the repayment) will be committed to making loan payments for a minimum of ten years, at least, and who knows how much interest there will be.

What Does Parent PLUS Loan Repayment Look Like?

Millions of people enroll in college each year, unaware that there is a high cost because there are no bills to be paid right away. This is the part that is left out of college tours and glossy catalogs: you have to pay back whatever you borrow, and then some!

Additionally, while students with private loans are able to remain in that bubble as long as they attend school, those who have Parent PLUS Loans are not eligible to do so. The repayment plan starts as soon as the funds are received by the college. It arrives on time and is roughly as welcome as a credit card bill.

A Parent PLUS Loan should be repaid as quickly as possible, just like any other debt. And the best way to do that is to prioritize paying off the smallest amount first, even if it isn’t your PLUS Loan, by listing it alongside all of your other debts. Everything else receives the minimum payment each month until the initial debt is paid off. The money you had been paying on that one is then rolled over to the next lowest. (We call it the debt snowball!).

Here are the options for PLUS payback:

- You can choose to defer repayment. Stated differently, you can adopt a college-style approach when you should already be an adult. But remember that you can only defer payments for the duration that your student is enrolled in classes and for six months after they graduate. Meanwhile, the interest you owe on your PLUS continues to accrue even in the event that it is deferred. Don’t stay in debt any longer than necessary. Start payments immediately. Big ones!.

- Standard repayment. Fixed monthly payments over a 10-year term. While having debt is never a good idea, this is the least bad—and thus, quickest—option available. To be clear, you are permitted to send more than the required amount each month. Run like a gazelle to escape the debt if you have already signed your name to it.

- Graduated repayment. It still takes ten years, but until the payoff date, the payments increase in size. This is illogical and contradicts the debt snowball strategy. We don’t recommend it. (But it’s way better than the next two turkeys. ).

- Extended repayment. This is your opportunity to pay off your child’s student loans over a 25-year period. For those who enjoy signing up for foolish schemes to ruin their financial futures, there are two options: fixed and graduated.

- Income-contingent repayment. Along with any other parent-only student loans, you must first consolidate your PLUS Loan into a Direct Consolidation Loan. (Parent PLUS Loans are separate entities with separate loan obligations; they cannot, repeat cannot, be consolidated with the student’s federal loans. If you follow through on that, the amount of your payment will be determined by either 2020% of your discretionary income or the specified payment for a 2012 year term, whichever is less. This sounds a lot like extended repayment, but it comes with a tenuous promise that you might have some of the debt forgiven years down the road. (This almost never happens. Once more, this is a 25-year term, so you’ll be grandparents for a very long time before it’s paid off. Pay it off as soon as possible; don’t worry about gimmicks or delays.

There is one sensible strategy we would suggest for those who already have a Parent PLUS Loan, and that is refinancing. However, it’s only a wise choice if your debt is impeding the achievement of other objectives (such as paying for retirement or the next child’s college). You can pay off your student loans more quickly by refinancing to get a better fixed-interest rate and a shorter term. Thus, you can concentrate on paying off your debt and pursuing your next set of financial objectives.

What Happens if You Don’t Pay a Parent PLUS Loan?

When a Parent PLUS loan is not repaid for 270 days, default occurs. At that point, the debt may be collected through wage garnishment, withholding of tax refunds or Social Security benefits, or all three.

The best defense against those issues is to abstain from all debt. The next best course of action is to pay it all off as quickly as you can.

Is a Parent PLUS Loan a Good Option?

Definitely not! I hope you’ve already witnessed that debt doesn’t pay Rather, your child and you should devote all of your time and energy to figuring out how to pay for college out of grants, scholarships, and your own savings. Naturally, you’re interested in a fantastic resource from a leading authority on how to pay for college. It’s titled Debt-Free Degree, and it contains a wealth of advice and answers to all of your inquiries regarding paying for college without taking out loans.

Did you find this article helpful? Share it! Link

Since 1992, Ramsey Solutions has dedicated itself to assisting individuals in taking back control of their finances, accumulating wealth, developing their leadership abilities, and improving their lives via personal growth. Through 22 books (including 12 national bestsellers) published by Ramsey Press, two syndicated radio shows, and ten podcasts with over 17 million weekly listeners, millions of people have benefited from our financial advice. Learn More.

Over the past three and a half years, a lot has happened with regard to student loans. The main changes to student loans since 2020 are summarized here, along with Biden’s most recent plan for forgiveness.

Have you fallen behind on your student loans? Learn what happens in default and how to get caught up.

Are you considering taking out student loans? Stop right there! Find out how much it would actually cost to take out a student loan before making a decision you’ll (definitely) regret.

FAQ

What is the point of a parent PLUS loan?

Enjoy paying fees for the privilege of debt? PLUS Loans have ’em! The goal is to “assist” students who were previously turned down for a private loan (which at least have lower interest rates) to borrow money in another way—by putting a parent like you on the hook for the debt!

Who is responsible for paying a parent PLUS loan?

It is legally your responsibility as the parent borrower to repay the loan.

What is the difference between parent PLUS and student loans?

Parent PLUS Loans are the most expensive federal student loans in terms of interest and fees, but you can borrow up to the full cost of attendance for your child’s program; just make sure you don’t take out more than you can afford to repay.

How are parent PLUS loans paid back?

Gradual Repayment Plan: In this plan, your payments will begin at a lower amount and increase over time, typically every two years. You must repay the loan in 10 years. Extended Repayment Plan: This plan allows you to pay back debt over a maximum of 25 years with either fixed or graduated monthly installments.

Read More :

https://studentaid.gov/help-center/answers/article/what-is-parent-plus-loan

https://www.ramseysolutions.com/debt/what-is-a-parent-plus-loan