What Is Loan Syndication?

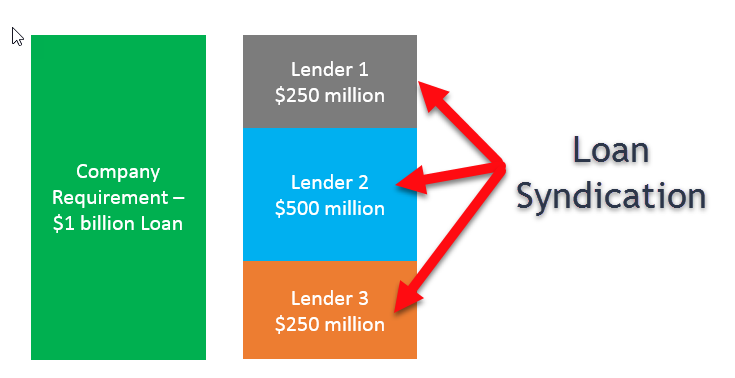

The practice of having multiple lenders fund different parts of a loan for a single borrower is known as “loan syndication.” Most frequently, loan syndication happens when a borrower needs a sum of money that is too big for a single lender or when the loan exceeds the risk tolerance of the lender. To give the borrower the required capital, a syndicate of lenders pools their resources.

- When two or more lenders pool their resources to fund a single loan for a single borrower, this is known as loan syndication.

- When a loan exceeds a bank’s risk tolerance or is too big for one bank, syndicates are formed.

- In a loan syndicate, the banks are only exposed to their share of the loan and share the risk.

- The lead bank that arranges the loan, its terms, and other pertinent details is known as the syndicate agent, and they are always present in a loan syndicate.

- Resources on loan syndications in the corporate loan market are available from the Loan Syndications and Trading Association.

Understanding Loan Syndications

Loan syndication is often used in corporate financing. Businesses look for corporate loans for a number of purposes, such as financing capital projects like buyouts, mergers, and acquisitions. Large sums of capital are frequently needed for these capital projects, often more than a single lender’s resource or underwriting capacity can provide.

There is only one loan agreement for the entire syndicate. However, the liability of each lender is capped at their respective portion of the loan interest. Most terms, with the exception of collateral requirements, are similar across lenders. Typically, collateral assignments are made to various borrower assets according to each lender. Because the associated risks are shared with other lenders, the syndicate does enable individual lenders to provide a large loan while maintaining a more cautious and manageable credit exposure.

A corporate risk manager frequently oversees the contracts between lenders and borrowers. This reduces any misunderstandings and helps enforce contractual obligations. The majority of the due diligence is carried out by the primary lender, but inadequate supervision can raise company expenses. Legal representation for a business may also be enlisted to uphold lender commitments and loan covenants.

Within the corporate loan market, the Loan Syndications and Trading Association is a well-established organization that aims to offer resources on loan syndications. In addition to offering market research and facilitating the gathering of loan market participants, it actively influences industry regulations and compliance protocols.

Top U.S. syndicators in the sector include Citi, JPMorgan, Wells Fargo, and Bank of America Securities. S. loan market, as of the first quarter of 2021.

Special Considerations

A lead financial institution coordinates the transaction for the majority of loan syndications. This institution is often known as the syndicate agent. Additionally, the initial transaction, fees, compliance reports, loan repayments over the course of the loan, loan monitoring, and overall reporting for all lending parties are frequently the responsibilities of this agent.

Throughout different stages of the loan syndication or repayment process, a third party or additional specialists may be used to help with various aspects of reporting and monitoring. Because of the extensive reporting and coordination needed to finish and maintain the loan processing, loan syndications frequently come with high fees.

Example of a Loan Syndication

Let’s take an example where Company ABC wishes to purchase an abandoned airport and turn it into a sizable development that includes a mall, several apartment buildings, and a sports stadium. To do this, it needs a $1 billion loan.

The company goes to JPMorgan. The bank approves the loan. However, since the sum is so big and exceeds the bank’s risk tolerance, it chooses to establish a loan syndicate.

Serving as the lead agent, JPMorgan coordinates the participation of other banks. It enters into agreements with Citi, Wells Fargo, Bank of America, and Credit Suisse to participate in the loan. JPMorgan makes a $300 million contribution to the loan, with the other syndicate members splitting the remaining $700 million. $200 million is lent by Bank of America, $100 million by Credit Suisse, $250 million by Citi, and $150 million by Wells Fargo.

JPMorgan arranges the loan’s terms, covenants, and other requirements in its capacity as the lead bank. After everything is finished, Company ABC uses the loan syndicate to get the $1 billion loan.

How Does Loan Syndication Work?

The process of loan syndication entails several banks and other financial organizations pooling their resources to finance a single loan for a single borrower. There is just one contract, and each bank is in charge of its own share of the debt. As the lead institution, it is in charge of enlisting the support of other banks, handling paperwork, assigning collateral, and distributing borrower payments.

Who Are the Parties Involved in Loan Syndication?

The process of loan syndication entails the borrower working with two or more banks. As the lead bank or syndicate agent, one bank is in charge of managing the repayment and documentation. This bank then filters payments to the remaining banks.

How Does a Loan Syndication Affect the Borrower?

Borrowers are not affected by loan syndication in any way that is distinct from other loan types. The borrower generally applies for a loan at one bank. If authorized, this organization contacts other people to create a syndicate so that they can all share the risk. Following the loan’s advancement, the borrower executes a single contract that lists each syndicate member’s name and loan contribution. The lead bank receives regular payments and distributes them among the syndicate members.

What Are the Disadvantages of the Loan Syndication Process?

The length of time it takes to get approved (or denied) is the primary disadvantage of the loan syndication process. This is due to the fact that obtaining approval and getting the syndicate together can take several days or even weeks. Article Sources: Investopedia mandates that authors cite original sources to bolster their claims. These consist of government data, original reporting, white papers, and conversations with professionals in the field. When appropriate, we also cite original research from other respectable publishers. You can read more about the guidelines we adhere to when creating impartial, truthful content in our

FAQ

What is meant by loan syndication?

When two or more lenders pool their resources to fund a single loan for a single borrower, this is known as loan syndication. When a loan exceeds a bank’s risk tolerance or is too big for one bank, syndicates are formed. In a loan syndicate, the banks are only exposed to their share of the loan and share the risk.

How does a syndicate loan work?

A syndicated loan is a type of lending arrangement wherein one or more lenders work together to jointly provide loans for one or more borrowers with identical terms, but distinct obligations, and under one single loan agreement. Typically, one bank is designated as the agency bank to oversee the syndicate members’ loan business.

Why would a bank want to syndicate a loan?

When working with large sums, lenders prefer syndicated loans because a group of bankers can provide access to more capital while sharing the risk.

Read More :

https://www.investopedia.com/terms/l/loansyndication.asp

https://www.investopedia.com/terms/s/syndicatedloan.asp