Current Car Loan Interest Rates

The average car loan interest rate currently is 9. 00%. The most prevalent rates you’ll see advertised on auto loan websites are auto loan annual percent rates, or APRs. Your interest rate, fees, and other associated costs are all included in your annual percentage rate (APR).

There are several variables that can affect the APRs you receive. The average auto loan rates by credit score, state, and kind of vehicle are shown below.

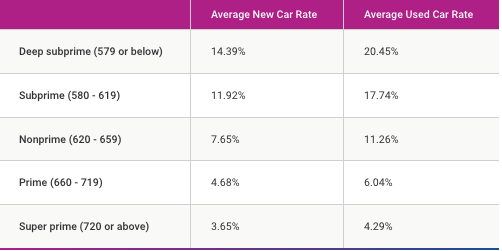

Average Car Loan Interest Rates by Credit Score

According to Experian’s most recent State of the Automotive Finance Market report, the average auto loan interest rates across all credit scores are 6.63% for new cars and 11.38% for used cars. Creditors group people into categories — sometimes called credit bands — based on credit-scoring models like FICO® and VantageScore. While other factors affect the auto loan interest rates you’re offered, the credit band your score falls into is among the most influential.

You can compare rates for new and used auto loans for every credit score range on the FICO score model in the table below:

| Credit Score Range | New Car Loan Rates | Used Car Loan Rates |

|---|---|---|

| 781 to 850 | 5.07% | 7.09% |

| 661 to 780 | 6.44% | 9.06% |

| 601 to 660 | 8.99% | 13.49% |

| 501 to 600 | 11.72% | 18.49% |

| 300 to 500 | 14.18% | 21.38% |

Average Car Loan Interest Rates by State

Interest rates for auto loans can be affected by the monetary policies in each state, which are mainly influenced by federal treasury rate changes. This causes market rates to fluctuate, influencing the interest lenders charge. Below you can compare the average rates for new and used cars within all U.S. states and the District of Columbia according to Edmunds.

| State | New Car Loan Interest Rates | Used Car Loan Interest Rates |

|---|---|---|

| Alabama | 7.37% | 11.68% |

| Alaska | 8.95% | 10.81% |

| Arizona | 7.40% | 10.80% |

| Arkansas | 7.22% | 11.15% |

| California | 6.99% | 10.14% |

| Colorado | 7.30% | 9.98% |

| Connecticut | 6.69% | 9.44% |

| Delaware | 6.58% | 10.98% |

| District of Columbia | 9.14% | 10.78% |

| Florida | 7.68% | 10.89% |

| Georgia | 7.91% | 12.15% |

| Hawaii | 7.70% | 11.99% |

| Idaho | 6.74% | 10.51% |

| Illinois | 6.85% | 10.34% |

| Indiana | 6.77% | 11.27% |

| Iowa | 6.31% | 9.02% |

| Kansas | 6.61% | 10.61% |

| Kentucky | 7.30% | 11.92% |

| Louisiana | 6.94% | 11.97% |

| Maine | 6.22% | 9.38% |

| Maryland | 6.96% | 10.52% |

| Massachusetts | 6.90% | 9.23% |

| Michigan | 6.96% | 9.81% |

| Minnesota | 5.80% | 10.31% |

| Mississippi | 7.34% | 13.31% |

| Missouri | 6.66% | 10.90% |

| Montana | 6.54% | 11.46% |

| Nebraska | 6.12% | 9.80% |

| Nevada | 7.67% | 11.94% |

| New Hampshire | 6.77% | 9.41% |

| New Jersey | 7.09% | 10.84% |

| New Mexico | 7.64% | 11.07% |

| New York | 7.18% | 10.17% |

| North Carolina | 7.00% | 10.87% |

| North Dakota | 6.76% | 11.48% |

| Ohio | 7.36% | 11.85% |

| Oklahoma | 6.98% | 10.90% |

| Oregon | 6.77% | 10.71% |

| Pennsylvania | 6.91% | 10.62% |

| Rhode Island | 7.36% | 10.00% |

| South Carolina | 7.52% | 11.61% |

| South Dakota | 4.90% | 10.62% |

| Tennessee | 7.15% | 10.63% |

| Texas | 7.35% | 11.42% |

| Utah | 7.05% | 9.27% |

| Vermont | 6.99% | 9.22% |

| Virginia | 6.95% | 10.41% |

| Washington | 6.68% | 9.48% |

| West Virginia | 7.70% | 11.06% |

| Wisconsin | 6.42% | 9.59% |

| Wyoming | 6.15% | 10.29% |

*State average auto loan rates were combined based on Edmunds’ computations. com in August 2023.

Average Car Loan Interest Rates by Vehicle Type

The kind of car you decide to finance will have an impact on the interest rates you pay. The cost and demand of various car models vary, which affects how much interest you pay for an auto loan over time. The average auto loan rates for each kind of vehicle are displayed in the chart below.

| Vehicle Type | New Car Loan Interest Rates | Used Car Loan Interest Rates |

|---|---|---|

| Sedans | 7.95% | 12.25% |

| SUVs | 7.10% | 10.78% |

| Trucks | 7.21% | 10.33% |

| Electric Cars | 5.75% | 9.33% |

*In August 2023, Edmunds stated that rates were determined using the combined state average car loan rates for each type of vehicle.

How Auto Loans Work

An auto loan is a kind of secured loan where the collateral is the vehicle being financed. When you finance a vehicle, the lender takes ownership of the title and becomes the lienholder until the loan is paid off.

This basically indicates that even though you are legally allowed to own and operate the vehicle, the lender is the real owner. The loan provider may take back the car if you don’t make the payments on time.

You’ll probably notice that auto loans are advertised using their annual percentage rate (APR) when you shop around. This amount includes the fees and other costs associated with the loan, as well as your interest rate.

Use an auto loan calculator to help you get an idea of how rates affect what you might pay before you start filling out loan applications. Numerous loan calculators let you input basic details like your preferred loan amount, interest rate, and term to determine how much your monthly auto payments would be and how much interest you would accrue over the course of the loan.

What Factors Affect Auto Loan Rates?

Interest rates on auto loans are determined in part by the likelihood of repayment. The interest rate a lender will likely charge on a loan will increase with its risk. A number of factors can impact the interest rate you receive on a loan by indicating risk to lenders.

The following are the most important variables that affect your rates:

- Credit score: The most important factor is your credit score. Your interest rate is likely to be higher the lower your score is.

- Credit history: Not all of your credit history is represented by your credit score. A comprehensive credit report that includes details about how much of your available credit you’re using and whether you’ve missed any payments this month is examined by lenders.

- Loan duration: Term lengths for auto loans typically range from 12 to 84 months. Longer terms usually result in lower monthly payments, but the interest rates associated with them are also typically higher.

- Market rates: A major determinant of the rates you receive is the average market rate. When the average interest rate rises, you’ll notice higher rates because lenders change their rates based on what they pay to borrow money.

- Loan-to-value (LTV) ratio: This ratio indicates how much of the value of an automobile is financed. In the event that you wish to borrow $20,000 for a car that is valued at $40,000, for instance, that represents an LTV ratio of 20% Your interest rate is likely to be lower the lower the LTV ratio is.

- Down payment: The LTV ratio is impacted by your down payment, whether it is made in cash or through a trade-in. Car loans with no money down are available, but a bigger down payment usually results in better interest rates.

- Debt-to-income (DTI) ratio: This is the ratio of your monthly income to the amount of debt you have to pay off each month. Lenders will consider your debt-to-income ratio (DTI ratio) in addition to your credit score to determine how much you can actually afford to pay off. Your chances of getting a lower auto loan rate increase with the ratio of your debt payments to income.

- Age and condition of the vehicle: For financed vehicles, lenders usually impose restrictions on age, mileage, and condition, and they modify rates accordingly. Higher interest rates apply to loans for older, more mileage vehicles or those in poorer condition.

What Goes Into Your Credit Score?

Since 1989, when FICO introduced its system—which is currently the most popular scoring model—credit scores have been used extensively. Lenders use credit scores to determine your likelihood of making required payments on time and in full. The five variables listed below, each with a different weight, determine your FICO credit score.

- Payment history (35%): Among the most important factors influencing your credit score is the possibility that you have missed payments. This includes whether you’ve had accounts that were delinquent.

- Amounts owed (30%): Although having debt does not always result in a low credit score, using too much of your available credit can lower your score.

- Length of credit history (15%): Your score is influenced by how long you have had open accounts with creditors. Having more established accounts with a track record of timely payments will raise your credit score.

- 10% of credit is awarded for new accounts opened; this can temporarily lower your credit score.

- Credit mix (10%): Your score is affected by the variety of credit accounts you have, including credit cards, student loans, and mortgages.

You can find some steps to raise your credit score and lower your loan rates in the graphic below. Read more Read less.

Where Can You Get The Best Auto Loan Interest Rates?

Depending on your credit score, different lenders offer different auto loan interest rates. If you compare auto loan offers, you should be able to choose from a variety of rates. That’s why it’s good to shop around. There are several locations where you can obtain auto loans. Certain loan options may be more advantageous than others based on your specific situation.

Most traditional banks offer new and used car loans. Many also provide preapproved auto loans, which can help you in the car-buying process and facilitate financing, as well as refinance auto loans. It might be simpler for you to get approved for an auto loan with a particular bank if you already have a checking account, savings account, or credit card with them. You may even get a better rate.

Credit unions usually provide financing and refinancing for both new and used cars, just like banks do. Nevertheless, in order to use a credit union’s financial products, you must be a member. Membership requirements differ, but many credit unions have an easy process. Since credit unions frequently offer lower interest rates and are more likely to approve loans for borrowers with bad credit, joining may be worthwhile.

Online lenders occasionally have lower rates since they don’t have the overhead of physical branches like banks and credit unions. A large number of these lenders are subsidiaries or supported by commercial banks.

Lending marketplaces let you easily compare car financing offers. Upon submitting your details on any of these websites, multiple loan proposals from various lenders will be sent to you. To get the best rates for your credit profile, using these marketplaces can be beneficial.

Sometimes, auto dealerships have the best auto loan interest rates. Although financing is exclusively available to individuals with exceptional credit, you may encounter difficulties obtaining it from other sources. But when compared to other lenders, some dealerships have high interest rates. You can handle this circumstance by being aware of the rates to anticipate and by refusing to let yourself get tired at the dealership.

Prior to visiting the dealership, obtain a preapproval for a car loan from another financial institution. This will enable you to bargain for a better rate, as the dealership might attempt to outbid the other lender in order to get your business. Read more Read less.

How To Get Lower Interest Rates on Your Auto Loan

Consider the following advice if you’re trying to find the best rates on auto loans:

- Boost your down payment: A larger down payment lowers the loan-to-value ratio on your vehicle, potentially resulting in a better interest rate.

- Receive a discount: In the car finance sector, one of the most popular discounts is for setting up automatic payments, which can lower your interest rate by up to 0%. 5%.

- Obtain a co-signer: If your credit is poor, you may be able to obtain a lower interest rate by having a friend or relative with excellent credit co-sign a loan with you.

- Go for a newer vehicle: Most lenders base their interest rates on the age of the vehicle. You might be able to obtain better auto loan interest rates for your credit score if you can locate a newer vehicle in your price range.

- Select a shorter loan duration: Although longer loan terms typically have higher interest rates, they also have lower monthly payments. A shorter loan term will probably result in a lower interest rate and lower total interest paid over the course of the loan if you can afford the higher payments that accompany it.

- Boost your credit score: When you refinance your car, a higher credit score will enable you to receive the best deals. Later on, we’ll go over specific steps to take in order to achieve this.

- Refinance later: You might gain from refinancing your auto loan in the future if your bad credit has left you with a high interest rate. By taking advantage of the current interest rate and paying your bills on time, you can raise your credit score and eventually gain favor with lenders.

Source: Capital One

Average Car Loan Interest Rates: Conclusion

The majority of lenders partially base auto loan interest rates on credit scores. Your credit score usually has the biggest impact on the rates that are available to you, although there are other factors as well. You have many options for auto loans, including banks, credit unions, online lenders, loan marketplaces, and car dealerships. One might provide you with better rates than others, depending on your circumstances.

Recommended Auto Loan Providers

While no single lender has the best rates for everyone, some are more favorable than others when it comes to auto loan interest rates based on credit score. Finding and comparing loan offers from various lenders is the only way to find out if you’re receiving the best auto loan rates for your credit score. We suggest that you begin your search at Auto Credit Express and myAutoloan.

myAutoloan: Best Low-Rate Option

Using myAutoloan as a marketplace, you can find offers from lenders all in one location. Compared to contacting lenders directly, this can save you time and effort when determining the best auto loan interest rates based on your credit score. Rates for borrowers with excellent credit scores start at 5. 29% for new cars and 5. 54% for used cars, but individuals with credit scores of 575 percent or higher can find loan offers via the website

Auto Credit Express: Best Purchase Loan for Bad Credit

If your credit score is low, it might be difficult for you to get an auto loan from a traditional lender. Financing brokers like Auto Credit Express specialize in getting loans for customers with poor credit.

Even those who have struggled to obtain financing elsewhere can find loans through Auto Credit Express for borrowers with bad credit, no credit, or even bankruptcies. Due to Auto Credit Express’s affiliation with several lenders, interest rates and credit prerequisites differ.

Auto Loan Interest Rates: FAQ

The following are some commonly asked questions concerning average interest rates on auto loans:

Generally speaking, a good auto loan interest rate is less than 5. 18% for new cars and 6. 79% for used vehicles. To determine whether you’re getting a good deal, it’s best to look at the average interest rates for the credit score category you fall into as the best rate varies depending on the borrower.

A credit score of 700 places you in the “prime” lending category. Experian reports that the typical rates in this category are 6. 44% for new-car loans and 9. 06% for used-car loans.

If your credit score is 640, you fall into the “near prime” category of borrowers, which is typically sufficient to obtain a car loan. But even though your application for an auto loan is likely to be accepted, the rates won’t be the best.

In general, your chances of getting a loan approved and paying a lower interest rate increase with your FICO score. But some lenders provide loans to borrowers with poor credit, and some even focus on lending money for automobiles to borrowers with poor credit. A low FICO score will likely result in high interest rates.

You fall into the “near prime” category of borrowers if your credit score is 620. Experian reports that the typical interest rate for those in this group is 8. 99% for new-car loans and 13. 49% for used-car loans.

Since customers depend on us to deliver unbiased and precise information, we developed an extensive scoring system to develop our rankings of the top auto loan providers. In order to rank the loan providers according to a variety of criteria, we gathered information on dozens of them. Each provider received an overall rating at the end, and the top of the list went to the businesses that received the highest points.

Here are the factors our ratings take into account:

- Reputation: Our research team based this score on the number of years that each lender has been in operation as well as ratings from industry experts.

- Rates: In this category, auto lenders with the lowest APRs and largest loan amounts received the highest marks

- Availability: Businesses covering a range of situations have a higher chance of satisfying customer demands.

- Customer experience: Transparency and customer satisfaction ratings are the foundations of this score. Based on our shopper analysis, we also took into account how helpful, polite, and responsive each warranty company’s customer service staff was.

Our credentials:

Daniel is a team writer for MarketWatch Guides and has contributed to multiple automotive news websites and marketing companies in the United S. , U. K. , and Australia, with a focus on auto finance and maintenance subjects Daniel is an expert on auto insurance, loans, warranty options, auto services, and more for MarketWatch Guides.

Rashawn Mitchner has been writing about personal finance and insurance for MarketWatch Guides for over ten years.

FAQ

What is a good interest rate on a used car?

Range of Credit Score: 781 to 8505; New Car Loan Rates; Used Car Loan Rates 07%7. 09%661 to 7806. 44%9. 06%601 to 6608. 99%13. 49%501 to 60011. 72%18. 49%.

What is a good interest rate for a 72 month car loan?

What would be a good interest rate for a car loan that is due in two months? An interest rate that is less than five percent is a great rate for a car loan that is due in two months. But only those borrowers with the best credit scores and payment records qualify for the best loan offers.

What interest rate can I get with a 800 credit score car loan?

Average Credit Score for Auto Loan Interest Rates: Average Rate for New Cars; Average Rate for Used Cars; Nonprime (620-659)8 86%13. 28%Prime (660-719)6. 40%8. 75%Super prime (720 or above)5. 18%6. 79%.

Why is used car APR so high?

Used cars are no longer covered by warranties, and repairs can be costly. Higher rates on used auto loans help to reduce the risk that your vehicle may be totaled.

Read More :

https://www.marketwatch.com/guides/car-loans/auto-loan-interest-rates-by-credit-score/

https://cars.usnews.com/cars-trucks/advice/average-used-car-loan-interest-rates