What Fannie Mae Does

Fannie Mae is a participant in the secondary mortgage market; it does not originate mortgage loans. Rather, by buying or guaranteeing mortgages issued by credit unions, banks, thrifts, and other financial institutions, it maintains cash flow to lenders. Fannie Mae provides lenders with liquidity through its mortgage market investments, enabling them to approve or fund more mortgages. In 2022, the mortgage market received $684 billion in liquidity from Fannie Mae.

It is one of the two major buyers of secondary market mortgages. The other is its sibling, Freddie Mac, also a GSE chartered by Congress and also known as the Federal Home Loan Mortgage Corporation. Fannie Mae pools mortgages it has acquired from the secondary market to create a mortgage-backed security (MBS). A mortgage or a group of mortgages serves as the security for an asset-backed security, or MBS.

Institutions including investment banks, insurance companies, and pension funds buy Fannie Mae’s mortgage-backed securities. It guarantees payments of principal and interest on its MBSs. Moreover, Fannie Mae has a retained portfolio where it makes investments in mortgage-backed securities from other institutions as well as its own. Agency debt is the type of debt that Fannie Mae issues to finance its retained portfolio.

History of Fannie Mae Stock

Fannie Mae has been publicly traded since 1968. It was traded on the New York Stock Exchange (NYSE) until 2010. Fannie Mae had to delist its shares after the Great Recession and its effects on the housing market because it didn’t meet the NYSE’s minimum closing price requirement. Fannie Mae now trades over the counter.

The Federal Housing Finance Agency (FHFA) assumed conservatorship over Fannie Mae and Freddie Mac in 2008. In an effort to move Fannie Mae and Freddie Mac out of conservatorship, the Treasury and FHFA permitted the two to retain their earnings in September 2019 in order to strengthen their capital reserves.

Fannie Mae Loan Requirements

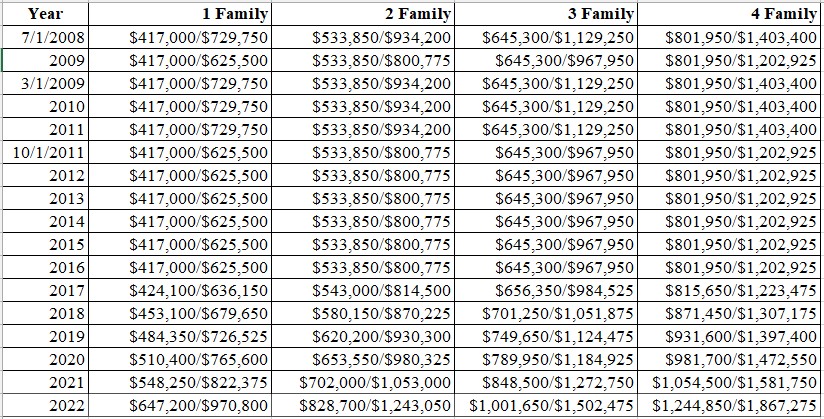

Strict requirements must be met for the mortgages that Fannie Mae purchases and guarantees. In 2023, the FHFA will set a limit of $726,200 for most areas and $1,089,300 for high-cost areas, such as Hawaii and Alaska, for conventional loans for single-family homes.

The federal government’s Statement on Subprime Lending, which addresses risks associated with subprime loans, such as variable rates, limits on interest rate increases, borrower income documentation, and product features that make frequent refinancing of the loan likely, must be complied with by approved lenders in order to ensure the credit quality of the financing.

Conforming loans are mortgages that Fannie Mae has purchased and guaranteed. When compared to non-conforming or jumbo loans that are not backed by Fannie Mae, conforming loans frequently have lower interest rates.

How to Apply for a Fannie Mae-Backed Mortgage

In addition to filling out a Uniform Residential Loan Application, borrowers must also collect and submit supporting financial records. Employment, gross income, and statements like a W-2 or 1099 are included in this. The applicants submit monthly debt obligations, including credit card balances, auto payments, child support, and alimony.

Lenders typically prefer to follow the 28/36% Rule, which states that a household should not spend more than 2028% of its monthly income on housing expenses and no more than 2036% on debt servicing for car loans and mortgages. Fannie Mae will accept a maximum debt-to-income (DTI) ratio of 2036 percent, but if the borrower satisfies credit score and reserve requirements, the ratio can go as high as 45 percent.

Borrowers can lower monthly expenses by making a larger down payment if the DTI ratio is too high. Even though a 20% down payment is preferred, some borrowers might be able to contribute as little as 3% of the total. In order to qualify for a mortgage backed by Fannie Mae, buyers must also fulfill minimum credit requirements. A minimum FICO score of 620 for fixed-rate loans and 640 for adjustable-rate mortgages (ARMs) is needed for a single-family home used as a primary residence.

Upfront fees on Fannie Mae and Freddie Mac home loans changed in May 2023. Fees were increased for homebuyers with higher credit scores, such as 740 or higher, while they were decreased for homebuyers with lower credit scores, such as those below 640. Another change: Your down payment will influence what your fee is. The higher your down payment, the lower your fees, though it will still depend on your credit score. Fannie Mae provides Loan-Level Price Adjustments on its website.

Loan Modifications and Fannie Mae HomePath

Loan modifications alter the terms of an existing mortgage to assist borrowers in avoiding default, foreclosure, and the eventual loss of their houses. Reductions in interest rates and longer loan terms can result in smaller monthly payments.

When properties are acquired by deeds rather than through foreclosure or forfeiture, or when foreclosures occur on mortgages in which Fannie Mae is the owner or investor, the company makes an effort to sell the properties as soon as possible to reduce any potential negative effects on the neighborhood. Investors and home buyers can find these properties on HomePath by Fannie Mae and submit offers there. HomePath provides creditworthy buyers with a means of financing new construction.

In some cases, special financing may be available. These consist of assistance with closing costs, 3% down payments, and improvement costs that are bundled into the loan. HomePath. com markets Fannie Mae-owned real estate, such as single-family homes, townhomes, and condominiums. Local real estate experts are hired by Fannie Mae to prepare, maintain, and list the properties for sale.

Fannie Mae’s RefiNow Program

Through a program called RefiNow, Fannie Mae provides low-income mortgage holders with the opportunity to refinance in order to lower monthly payments and interest rates. Homeowners must earn at least 10% less than the area median income (AMI) in order to be eligible.

“Lower-income borrowers typically refinance at a slower pace than higher-income borrowers, potentially missing an opportunity to save on housing costs,” says Malloy Evans, executive vice president of single-family business at Fannie Mae. If homeowners are unsure about whether or not Fannie Mae owns their mortgage, they can visit Fannie Mae’s Loan Lookup Tool.

The homeowner must save at least $50 on their monthly mortgage payment and have their interest rate reduced by at least 50 basis points in order to qualify for the RefiNow program. If an appraisal was obtained for the transaction, Fannie Mae provides a $500 credit to the lender at the time the loan is purchased; the homeowner must receive this credit from the lender.

To qualify for RefiNow, a homeowner must meet these qualifications:

- possess a mortgage backed by Fannie Mae that is secured by a single primary residence

- Possess an income that is currently at or below 10% of the AMI

- paid the mortgage on time every six months, with not more than one late payment in the previous twelve months.

- Have a mortgage with a loan-to-value ratio of up to 2097% and a debt-to-income ratio of 65% or less.

Why Does Fannie Mae Matter?

Banks, credit unions, and lenders can continue to offer credit to financial institutions because Fannie Mae purchases their mortgages.

What Is HomePath ReadyBuyer?

Through the HomePath ReadyBuyer program, Fannie Mae offers qualified buyers wishing to buy one of its foreclosure properties closing cost assistance, education on homebuying, and other benefits.

What Would Happen If Fannie Mae Didn’t Exist?

The majority of mortgages that lenders offer are tailored to Fannie Mae terms in order for them to be bought on the secondary mortgage market. Requirements for mortgages acquired by non-government entities on the secondary mortgage market might be loosened if Fannie Mae hadn’t existed. Lenders may experience problems with liquidity if their mortgage buyer leaves the business. If those lenders don’t have the capital to support the debt of more mortgages, they might make it more difficult for people to get mortgages.

The Bottom Line

A government-sponsored company called Fannie Mae purchases mortgages that fit certain requirements. Banks, credit unions, and thrifts can obtain liquidity by investing in mortgages through Fannie Mae. Fannie Mae provides the funding necessary for regional and national banks to keep issuing mortgages. Article Sources: Investopedia mandates that authors cite original sources to bolster their claims. These consist of government data, original reporting, white papers, and conversations with professionals in the field. When appropriate, we also cite original research from other respectable publishers. You can read more about the guidelines we adhere to when creating impartial, truthful content in our

FAQ

What does FNMA mean in mortgage?

Government-sponsored enterprise (GSE) Fannie Mae, also known as the Federal National Mortgage Association or FNMA, was founded in 1938 with the goal of developing a secondary mortgage market to increase the liquidity of home mortgages. Fannie Mae always ranks in the top 25 U. S. corporations by total revenue.

Is FNMA the same as conventional?

What distinguishes a conventional loan from a Fannie Mae loan when they are identical? The mortgages that the government-sponsored firms Fannie Mae and Freddie Mac purchase are known as conventional loans. What are the benefits of a Fannie Mae loan?.

What is FNMA requirements?

To be eligible for loans from Freddie Mac or Fannie Mae, you must have a qualifying FICO® Score of at least 620. The qualifying score for an individual borrower is determined by averaging the scores from the three major credit bureaus: ExperianTM, Equifax®, and TransUnion®.

Is a Fannie Mae loan a federal loan?

Fannie Mae is not a federal agency. It is a government-sponsored business that the Federal Housing Finance Agency (FHFA) is in charge of.

Read More :

https://www.rocketmortgage.com/learn/fannie-mae

https://www.investopedia.com/mortgage/fannie-mae-loans/