Update: New legislation may terminate the employee retention tax credit as early as January 31, 2024, as Congress searches for methods to provide funds for additional tax bill initiatives, like benefits to the child tax credit and business tax breaks, to mention a couple. If this is approved, the IRS won’t accept any more ERTC submissions after the suggested deadline.

The IRS was in the middle of stopping its review of any filings received after September 14, 2023, as they looked for dishonest people and their false claims

If companies believe they are no longer eligible or that they received ERTC funds in error, the agency has been enabling them to withdraw any pending claims. This Voluntary Disclosure Program is available through March 22, 2024. Businesses that meet the program’s requirements must reimburse the IRS with only 80% of the funds they were given in exchange for information about the people who prepared the ERTC application.

In order to keep their staff members employed during the peak of the COVID-19 pandemic, qualifying businesses that paid qualified wages after March 12, 2020, through the program’s conclusion, may be eligible for a refundable credit known as the employee retention tax credit (ERTC) or employee retention credit (ERC).

The Coronavirus Aid, Relief, and Economic Security Act (CARES) established this tax credit in March 2020. It was later modified three times by the Consolidated Appropriations Act of 2021, the American Rescue Plan Act (ARPA), and the Infrastructure Investment and Jobs Act.

This article discusses qualifying wages, eligibility, credit operations, and other related topics. It also draws distinctions based on date and law since the terms of the legislation in effect at the time a company first paid wages to keep its employees define what the company is entitled to. The credit that can be claimed is impacted by additional factors, such as whether you took out a loan through the Paycheck Protection Program (PPP).

Just want to know if you qualify? Get started here.

What is the Employee Retention Credit?

During government shutdowns caused by the COVID-19 pandemic, businesses were encouraged to continue paying their employees with the help of the Employee Retention Credit, a refundable tax credit.

CARES Act – 2020

First introduced in 2020 as a component of the Coronavirus, Aid, Relief, and Economic Security Act (CARES Act), the Employee Retention Credit The Act authorized qualifying businesses to claim up to $10,000 in qualifying wages per employee paid between March 2013 and December of 2011. 31.

Consolidated Appropriations Act – 2021

In order to enable qualifying employers to claim up to $10,000 per quarter in qualifying wages, the Employee Retention Credit was updated in 202021.

American Rescue Plan Act – 2021

Recovery startup companies that launched their operations on or after February 1st were added by this act. 15, 2020, as qualified companies if they employed more than one W-2 employee (aside from family members) and their yearly gross receipts did not surpass $1 million in 2020 or 2021.

Infrastructure Investment And Jobs Act – 2021

With the exception of recovery startup businesses, this act terminated the ERC credit for the fourth quarter of 2021.

How the ERC works.

For qualifying employee wages, there is a refundable tax credit called the Employee Retention Credit. You can still be eligible for the credit even if you did not pay any income taxes in 2020 or 2021 because it is based on payroll taxes rather than income taxes.

The best part is that you may be able to get more money back than you initially paid in payroll taxes because it is refundable. Therefore, even if you only paid $10,000 in payroll taxes but are eligible for $50,000 under the ERC, you will still receive the full $50,000 refund from the IRS. Remember that the ERC has a small non-refundable portion that is only available up to the total amount of employee Social Security and Medicare taxes that you actually paid.

How much money will my small business get from the ERC?

During the 2020 tax year, small businesses that meet the eligibility requirements can claim a maximum of $10,000 in wages per employee through the Employee Retention Credit. The maximum amount per worker is $5,000, and you can apply for this credit now through 2023.

During the first three quarters of 2020–2021, qualifying small businesses can claim up to 10% of the first $10,000 in wages per quarter for each employee. This amounts to $21,000 per employee.

| Year | Maximum refund per employee | How the ERC is calculated |

| 2020 | up to $5,000 per employee | 50% of first $10,000 in wages per employee |

| 2021 | up to $21,000 per employee | 70% of first $10,000 in wages per employee (quarters 1, 2, 3) |

A small business may be able to obtain credits totaling $26,000 for each employee retained in 2020 and 2021. Remember that the IRS considers some medical costs to be part of an employee’s compensation.

Is my small business eligible for the ERC?

ERC benefits companies of all sizes, but it gives preference to smaller companies over larger employers. This is where you can determine whether you’re eligible for the ERC and how to get your credit the quickest.

Number of full-time employees

A small business is one that employed 100 full-time workers on average per month in 2019 for the tax year 2020. The definition is broadened to encompass companies with 500 or fewer full-time employees per month on average in 2019 for the tax year 2021.

Larger employers are eligible to receive the ERC, but only for wages and certain medical expenses paid to non-working employees.

For small businesses, all employees—whether or not they worked—are eligible to receive credit.

Government-mandated full or partial suspension

Now, in order to qualify for the ERC, your company has to have experienced a drop in revenue or a lockdown imposed by the government.

In any quarter that a government COVID-19 order caused a full or partial suspension of operations for your business, you may be eligible. This includes restrictions on hours or capacity. Work with a vendor who is knowledgeable about government orders, their effects, and the timeliness of their enactment because this area of eligibility criteria is complicated.

A few examples of a qualifying business include:

- A business that was ordered to fully suspend operations

- a necessary business that continued to operate but had set hours or capacity restrictions set by the government, like a restaurant that could only have so many tables

- A company whose suppliers went offline and were unable to deliver goods

- A company that was forced to close down a section of its operations as a result of government regulations

Significant decline in gross receipts

If your company’s gross receipts saw a “significant decline,” as defined by the IRS, you may also be eligible. In the tax year 2020, a notable decline indicates that gross receipts for a quarter are lower than 2050 percent when compared to the corresponding period in 2019. In the first three quarters of 202021, it indicates that quarterly gross receipts are lower than 80% when compared to the same period in 2019.

Businesses can choose to use the immediately preceding quarter for comparison if they did not witness a decline in gross receipts in 2020 compared to 2019. This applies to the first three quarters of 2020-21. This implies that a company can use Q1 of 2021 and compare it to Q1 of 2019 to meet eligibility requirements if Q2 of 2021 isn’t eligible when compared to Q2 of 2019.

The American Rescue Plan changed the ERC in 2021 to even allow you access if your company is more recent. For Q3 and Q4 of 2021, so-called “recovery startup businesses” are eligible to apply for the credit. Businesses classified as recovery startups are those that opened for business after February 15, 2020, and generate less than $1 million in revenue annually. You do not need to fulfill the remaining qualifying requirements if you have one or more W2 employees and satisfy these two requirements. A recovering startup company is only eligible to receive a maximum of $50,000 in ERC per quarter.

Do you qualify for an Employee Retention Tax Credit?

2020 qualifications:

- Qualifying wages of up to 100 full-time employees

- A reduction in gross revenue of at least 20%50% when compared to the corresponding quarter in 2019

- Alternatively, a government mandate that results in a full or partial suspension of business operations

2021 qualifications:

- Qualifying wages of up to 500 full-time employees

- A reduction in the gross revenue percentage of at least 2020% in comparison to the corresponding quarter in 2019

- or a suspension, either complete or partial, of business activities brought about by a government order

Recovery startup business:

- Opened after February 15, 2020

- Annual gross receipts under $1 million

- Have one or more W-2 employees

How to apply for the Employee Retention Credit.

First, get advice from your accountant or tax expert before completing any forms. They will help guide your business through this process. It may be difficult to determine your eligibility, particularly if you applied for PPP loan forgiveness, so it will be well worth your money to consult with an ERC-specialized tax expert.

To amend your prior return, you can file Form 941-X, as you will need to claim the ERC retroactively. Start filing your claim here.

What is considered qualified wages?

The size of your company and the year you are hiring determine qualified wages.

All wages are eligible in the following circumstances, whether or not employees worked:

- In 2020: 100 or fewer full-time employees

- In 2021: Fewer than 500 full-time employees

Qualifying wages are compensation paid to employees who were unable to work because of operations being suspended or a significant decline in revenue if your company employed more than 100 full-time workers in 2020 or more than 500 full-time workers in 2021.

Any employee who worked an average of more than thirty hours per week is considered full-time. Generally speaking, the owner’s salary or that of their family members do not qualify

Cash tips exceeding $20 per month would be considered qualifying wages.

Can I still apply for the ERC during the moratorium?

In brief: During the IRS moratorium, small businesses are still eligible to apply for the ERC.

On September 14, 2023, the IRS announced a pause on processing new Employee Retention Credit claims. The moratorium will last at least through the end of 2023.

- Applications submitted before the moratorium will still be handled

- There may be an increase in processing times, possibly from 90 days to 180 days or longer.

- Payouts for previously filed claims will continue through the moratorium.

- The IRS is going to start a more thorough compliance review period in order to shield companies from false claims.

- You can still file new claims, but they won’t be examined until after January 1, 2024.

Note: If you haven’t received your refund yet and are worried about the validity of your claim, the IRS has also announced an ERC withdrawal procedure. Businesses also have the option to amend their ERC claim. Learn more about ERC scams to avoid here.

In order to apply for the ERTC, businesses must amend their 2020 tax filing by April 2024 and their 2021 tax filing by April 2025.

Businesses can qualify for the ERTC even if they received 100% PPP loan forgiveness. However, the credit cannot be used on wages that were claimed in an application for PPP forgiveness. Know that you can count up to 40% of qualified expenses that aren’t payroll, like rent, for PPP forgiveness.

Regretfully, LLC owners and independent contractors are not qualified for the ERC. In the event that your business is organized as an S-Corp or C-Corp, you might qualify if you work for the company and are paid.

Yes, you can still apply for the employee retention credit retroactively in 2023 if your company satisfies all requirements.

On average, within three to six months of filing. That period, however, can differ significantly based on when you submit your claim and the amount of credit you have.

In Notice 2021-49, the IRS reaffirmed that, provided all other conditions are met, cash tips that an employee receives in a calendar month totaling $20 or more are included in the definition of qualified wages for the ERC.

Yes, as long as additional requirements are satisfied, wages paid to part-time W2 employees are eligible under the ERC. The number of part-time employees who are eligible is unlimited, unlike full-time employees.

No, the ERC is not a loan; rather, it is a refundable tax credit granted by the IRS.

It is still possible for qualified companies to claim the employee retention credit by making changes to their prior payroll tax filing.

In order to claim the ERC tax credit, businesses will need to submit documentation proving their eligibility for each quarter. Only Q1, Q2, and Q3 will be qualified for the employee retention credit in 2021.

If you handle payroll taxes and issue W-2s to employees through a professional employer organization, your PEO will have the necessary payroll tax forms to update your tax return. In this case, Lendio will collaborate with your PEO to collect the required documentation.

See if you qualify for the ERC.

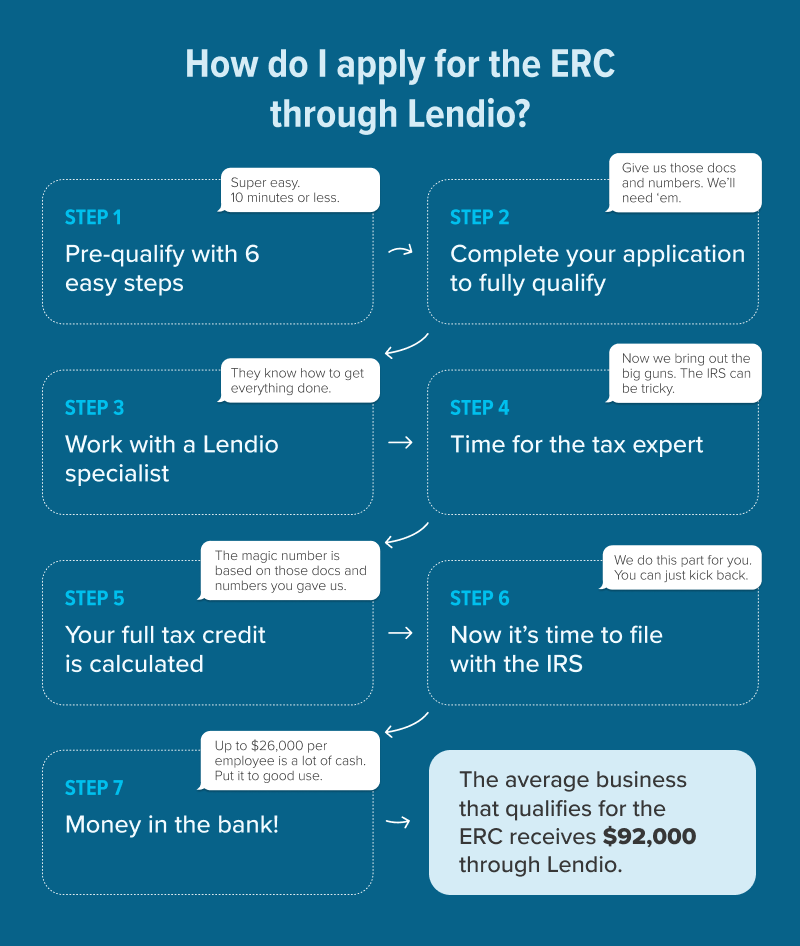

The goal of Lendio’s ERC application is to make the procedure simpler at every stage.

FAQ

Who is eligible for ERC loan?

You must have been subject to a qualifying COVID-19 government order that resulted in a complete or partial suspension of your trade or business operations in order to be eligible for ERC. There could be a municipal, state, or federal government order.

How does ERC work?

Employers that meet the requirements can deduct the Employee Retention Credit from specific employment taxes, and it is a fully refundable tax credit. It does not need to be repaid because it is not a loan. The refundable credit exceeds payroll taxes paid during a credit-generating period for the majority of taxpayers.

What is the difference between ERC and PPP?

Yes, the ERC is different from PPP. A refundable federal tax credit called the Employee Retention Credit is offered to some employers who see a sharp drop in gross receipts as a result of COVID-19. The PPP loan program offers businesses in particular industries impacted by the pandemic forgiven loans.

Do you have to pay back the ERC loan?

As long as your company qualifies, the Employee Retention Credit is not a loan and does not need to be repaid to the government. If you have any doubts about your company’s eligibility, you ought to think about completing your ERC application process in collaboration with a reliable tax advisor.

Read More :

https://www.irs.gov/coronavirus/frequently-asked-questions-about-the-employee-retention-credit