What is a Consumer Loan?

A consumer loan is one that is provided to customers to cover particular categories of expenses. Stated differently, a consumer loan refers to any form of loan extended by a creditor to a consumer. The loan may be unsecured (not backed by the borrower’s assets) or secured (backed by the borrower’s assets).

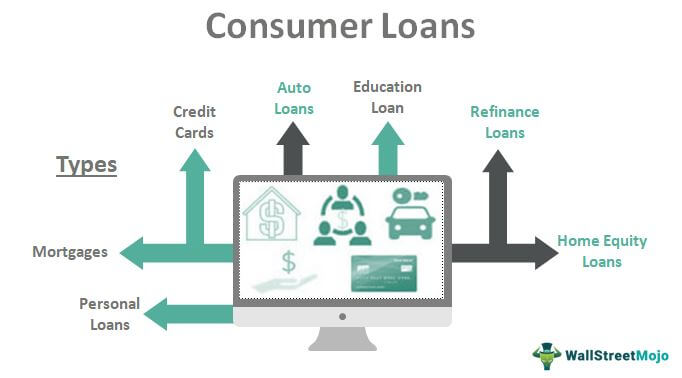

Types of Consumer Loans

- Mortgages: A type of financing used by buyers to fund the purchase of a home

- Credit cards: Used by consumers to finance everyday purchases

- Consumers use auto loans to finance the purchase of a car.

- Student loans: Used by consumers to finance education

- Personal loans: Used by consumers for personal purposes

Consumer loans are very helpful to qualified borrowers for a variety of reasons, including helping them finance their daily expenses.

Secured vs. Unsecured Consumer Loans

Consumer loans that are secured by collateral are those that will be paid back with assets in the event that the borrower defaults. Secured loans typically provide the borrower with larger loan amounts, longer loan terms, and lower interest rates. Because the loan is secured by assets, the lender bears less of the risk. For instance, the lender might be able to seize collateralized assets and sell them to cover the outstanding debt if the borrower defaulted.

Consumer loans that are not secured by collateral are known as unsecured loans. Unsecured loans typically have higher interest rates, shorter payback terms, and restricted financing amounts for the borrower. The lender is exposed to greater risk because the loan is not secured by any assets. For instance, if the borrower defaults, the lender might not be able to get the remaining loan balance back.

An open-end consumer loan, sometimes referred to as revolving credit, is one that the borrower can utilize for any kind of purchase as long as they repay the minimum amount owed, plus interest, by a deadline. Open-end loans are generally unsecured. Interest is assessed if a borrower is unable to repay the loan in full by the deadline.

An illustration of an open-ended consumer loan is a credit card. With a credit card, the customer can make purchases, but they also have to pay the balance due when it’s due. The customer will be assessed interest until the balance is paid off if they do not pay the outstanding balance on their credit card.

Installment credit, another name for a closed-end consumer loan, is used to finance particular purchases. With closed-end loans, the borrower pays back the loan in equal installments over time. Such loans are generally secured. The collateralized assets may be seized by the lender in the event that the debtor is unable to make the installment payments.

The Financial Modeling and Valuation Analyst (FMVA)TM certification program, which is intended to turn anyone into a top-tier financial analyst, is officially offered by CFI.

We strongly suggest using the extra CFI resources listed below to continue learning and expanding your financial analysis expertise:

Create a free account to unlock this Template

Access and save a variety of free templates to boost your output and effectiveness.

Supercharge your skills with Premium Templates

Use our Premium Templates to advance your learning and productivity.

If you upgrade to a paid membership, you’ll get access to CFI’s entire course catalog, accredited certification programs, and our vast library of ready-to-use Templates that will enhance your performance.

Get unlimited access to hundreds of resources, professional reviews and assistance, CFI’s entire course catalog, accredited certification programs, more than 250 productivity templates, the ability to use real-world finance and research tools, and more.

FAQ

What is an example of a consumer loan?

Consumer installment loans include loans for vehicles, education, and home mortgages, among other things. Certain revolving credit products, like consumer credit cards and personal lines of credit, are examples of additional consumer loans.

What is difference between consumer loan and personal loan?

A personal loan, sometimes referred to as a consumer loan, is any circumstance in which a person takes out a loan for their own needs, such as investing in a business. Three components are shared by all personal loans: the principal amount borrowed; a promissory note serving as proof of the debt.

What are the 2 most common types of consumer loans?

The Basics of Consumer Loans. There are two primary types of debt: secured and unsecured. When you provide security or collateral to back up your loan, it becomes secured. If you don’t pay back the loan, the lender may sell the collateral.

What is the difference between a mortgage loan and a consumer loan?

Key Takeaways. A personal loan is usually unsecured (i. e. , without the need to provide collateral). Mortgages are typically used to buy real estate, and the loan-secured property is what secures the mortgage. Mortgages can typically be funded more slowly than personal loans, but personal loans may have higher interest rates.

Read More :

https://corporatefinanceinstitute.com/resources/commercial-lending/consumer-loan/

https://mycreditunion.gov/life-events/consumer-loans