Obtaining a mortgage and purchasing a house are frequently tasks that require assistance from others. In case you’re intending to purchase a house and require assistance, a co-borrower or cosigner might be of use. A loan officer can assist you in determining which one best suits your needs regarding finances and a mortgage.

A co-borrower or cosigner can be helpful if you’re looking for someone to share financial responsibilities with, someone to support you in your mortgage application, or someone to fall back on in case of financial difficulties.

Remember: Prior to starting your mortgage application process, you should coordinate with the other party and gather all required documentation if you decide a co-borrower or cosigner is someone you would like to work with.

Co-Borrower Meaning

Your Credit Profile Excellent 720+ Good 660-719 Avg. 620-659 Below Avg. 580-619 Poor ≤ 579.

When do you intend to buy your house? Found a house; signed a purchase agreement; offer pending; will you buy in 30 days, 2 to 3 months, 4 to 5 months, or 6 months from now?

Consent:

You accept our Terms of Use and Privacy Policy, which include the use of arbitration to settle disputes pertaining to the Telephone Consumer Protection Act, by providing your contact information. ! NMLS #3030.

Congratulations! Rocket Mortgage can proceed with your online home loan application based on the information you have submitted.

If a sign-in page does not automatically pop up in a new tab, click here

How Can I Qualify?

Kevin Graham is a Senior Blog Writer for Rocket Companies. He specializes in economics, mortgage qualification and personal finance topics. Being a wheelchair-dependent person with cerebral palsy spastic quadriplegia, he also writes about smart home technology and adapting your house for physical challenges. Kevin has a BA in Journalism from Oakland University. He worked as a freelancer for a number of Metro Detroit newspapers before joining Rocket Mortgage.

FAQ

Who owns the house borrower or co-borrower?

As co-credit applicants, the two of them share the mortgage’s financial risk. This implies that, whether or not they reside in the home, the co-borrower also effectively owns it.

Is it better to have a co-borrower on a mortgage?

Having more purchasing power is one advantage of having a co-borrower on a mortgage. In the event that you need to raise your debt-to-income ratio or credit score, a co-borrower can also assist you in purchasing a property with a better interest rate.

What is the difference between a cosigner and a co-borrower?

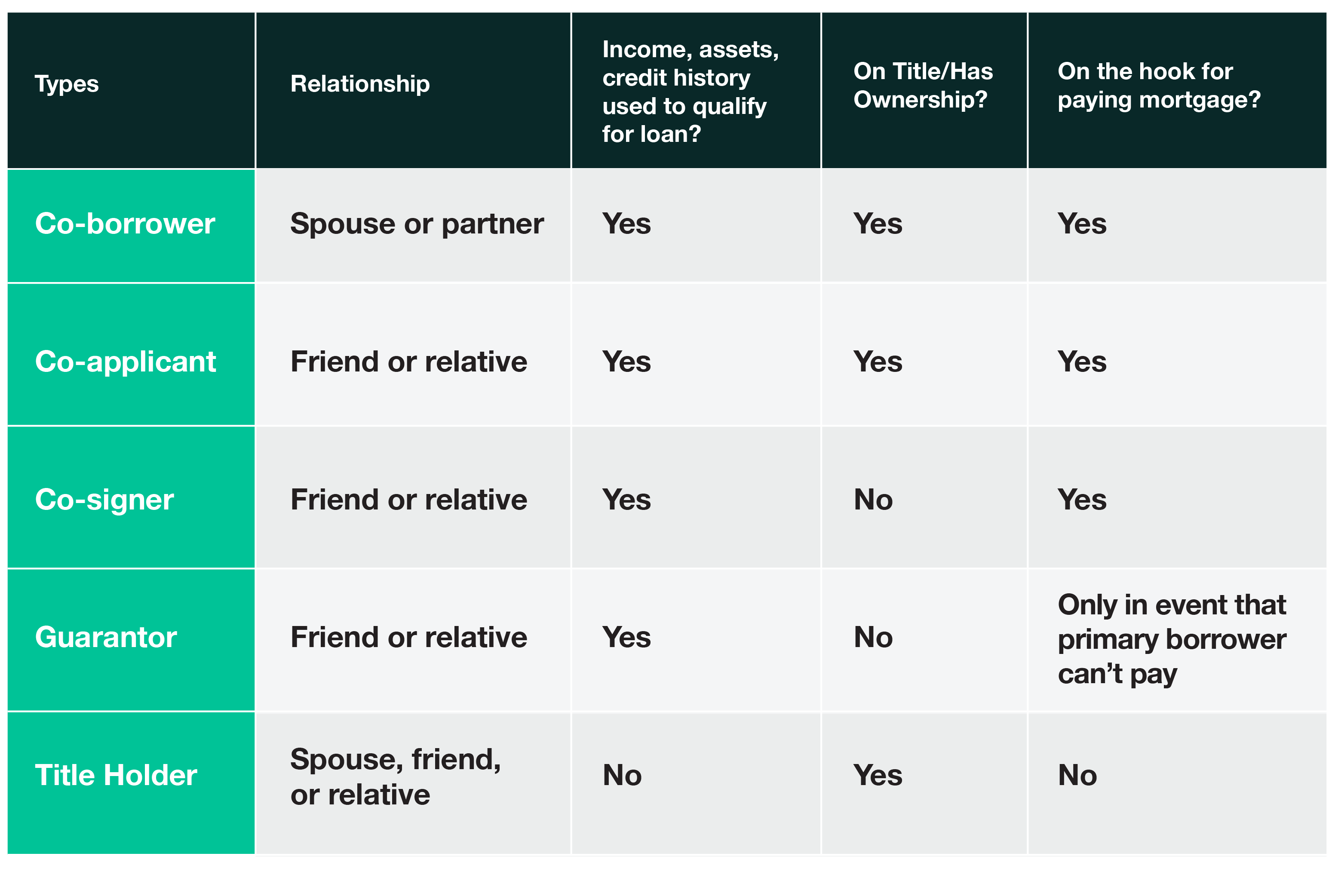

Furthermore, even though the conditions are the same, a co-borrower, also known as a joint applicant, co-owns the loan and is initially responsible for payments. Conversely, a co-signer bears responsibility for the loan only in the event that the principal borrower defaults.

Does a co-borrower have the same rights as the borrower?

Generally, co-borrowers share the title of the home. However, because the loan and the title are distinct, this isn’t always the case. You will not be able to use the home if you are a co-borrower and your name is not on the title, but you will still be responsible for paying off the mortgage.

Read More :

https://www.rocketmortgage.com/learn/co-borrower

https://www.chase.com/personal/mortgage/education/financing-a-home/coborrower-vs-cosigner