We are an independent, advertising-supported comparison service. Our objective is to empower you to make confident financial decisions by giving you access to interactive tools and financial calculators, publishing original and unbiased content, and allowing you to conduct free research and information comparisons.

Issuers that Bankrate has partnerships with include American Express, Bank of America, Capital One, Chase, Citi, and Discover, among others.

How Does LendingTree Get Paid? LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site (such as the order). LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

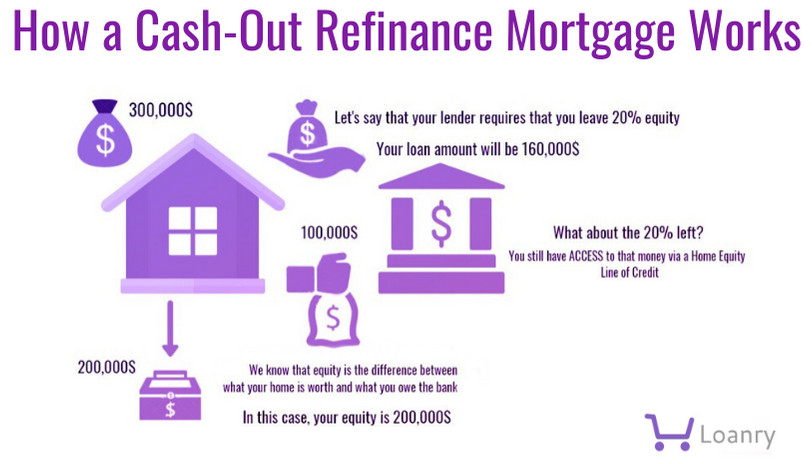

With a cash-out refinance, you can take advantage of your home equity by taking out a larger loan than you currently have, paying off the previous balance, and keeping the difference. You can pay off credit cards or renovate an old kitchen with the money however you choose.

Key takeaways about cash-out refinances>

Replacing your existing mortgage with a larger loan and receiving the difference in cash is known as a cash-out refinance. Two important things to remember:

- The amount of equity you have in your house determines how much you can borrow.

- You typically can’t borrow all of your home’s equity

Your home’s appraised value is subtracted from your loan balance by lenders to determine your equity. They also set loan-to-value (LTV) ratio requirements, which restrict how much of the value of your house can be cashed out. Most lenders set an LTV limit of 80%.

You have $150,000 in home equity if your house is worth $450,000 and your current mortgage balance is $300,000.

Due to the fact that the majority of cash-out refinance programs don’t allow you to borrow more than 80% of the value of your home, two additional calculations are needed to determine the amount of equity that can be converted to cash:

- First, multiply your home’s value by 80%: $450,000 x 0. 80 is $360,000. This is your maximum loan amount. After that, deduct the amount you currently owe on your mortgage: $360,000 – $300,000 = $60,000. This is the amount of money you will receive as payment for your mortgage.

In summary, the maximum amount of money you can borrow from your $150,000 in home equity is $60,000.

How to use a cash-out refinance calculator>

If the thought of mortgage math makes your eyes glaze over, use LendingTree’s cash-out refinance calculator and follow these three steps instead.

- To determine the approximate value of your house, start by using a home value estimator.

- To find out your current mortgage balance, consult your most recent mortgage statement.

- Enter the home equity amount you’d like to cash out.

You can find out if you can borrow the cash amount you entered with our cash-out refinance calculator. The calculator will advise you to lower your desired amount if you’re not.

How does a cash-out refinance work?

A cash-out refinance functions largely in the same way as any other type of home loan. You look for a mortgage lender, apply for a loan, and are approved based on your assets, income, and credit. However, there are a few extra steps involved:

Your lender will need to confirm that you can afford a larger loan amount and higher monthly payment because you are taking out a new loan for a larger amount than you currently owe.

The cash-out refi loan amount is an estimate until your home is appraised. Before the appraisal, increase the value of your house by clearing out clutter, painting, and maintaining the landscaping. If the results of your appraisal are less than anticipated, though, you might not be able to borrow as much equity from your house as you’d like.

The lender determines your cash-out amount after receiving the results of your appraisal by:

- Subtracting your current loan balance from the final loan amount

- Subtracting refinance closing costs from your loan proceeds

4. Your previous loan is repaid, and you get the difference in cash back.

Your lender funds your loan once you sign your closing documents and go over your closing disclosure to verify the final numbers. Your new mortgage is secured by your house, your old mortgage is paid off, and you receive a wire transfer or check.

Cash-out refinance guidelines vary by loan type. Here are a few general guidelines for conventional, VA, and FHA cash-out refinance loans that you should quickly review:

| Conventional | FHA | VA | |

|---|---|---|---|

| Maximum LTV ratio | 80% | 80% | 90% |

| Minimum credit score | 620 | 500 | No minimum |

| Maximum DTI ratio | 45% to 50% | 43% to 50% | 41% |

Maximum 80% LTV ratio

The maximum 80% loan-to-value ratio is the accepted practice for both conventional and FHA mortgages. But, homeowners who meet the requirements can borrow up to 90% of their home’s E2%80%99 value through a VA cash-out refinance.

Minimum 620 credit score

Conventional cash-out refinance guidelines require a 620 score. Although many lenders set their own minimum score requirements at 620, the VA does not. The exception is FHA loans, for which applicants can be approved with as little as 500.

![]() Learn more about FHA cash-out refinances.

Learn more about FHA cash-out refinances.

Maximum 43% DTI ratio

Lenders calculate your debt-to-income ratio (DTI) by dividing your total monthly debt by your pretax income. They also prefer that borrowers stay below a 2.43% DTI ratio. Your chances of being approved may be improved if you have a high DTI ratio, a high credit score, and extra cash in the bank.

A cash-out refinance loan from FHA or VA is only available for use on your primary residence. If you’re willing to borrow less and pay higher interest rates, conventional loans let you borrow against the equity in a second home or investment property.

You’ll get the most cash out of a single-family home. For multifamily properties with two to four units, lenders have lower LTV ratio restrictions.

When borrowing equity from a condo or manufactured home, lenders may impose additional costs or higher interest rates. Some might even limit these property types’ cash-out LTV ratios.

There is a 12-month waiting period if you recently financed your house before you can complete an FHA cash-out refinance. Conventional cash-out refinances are likewise subject to the 12-month waiting period, with the following possible exceptions:

- You inherited the property or obtained it through a court order, such as a divorce or separation.

- The property was purchased with all cash

If you are eligible for a VA cash-out refinance, the waiting period is only 210 days, or roughly seven months.

The annual changes in FHA and conventional loan limits based on median home prices will affect your cash-out refinance loan. VA loans are exempt from loan limits, however lenders are free to set their own upper limits.

![]() The 2024 single-family home limit for conventional loans is $766,550 and for FHA loans is $498,257.

The 2024 single-family home limit for conventional loans is $766,550 and for FHA loans is $498,257.

How to get the best cash-out refinance rates

Rates for cash-out refinances are typically higher than those for standard refinances. Lenders pass on this risk to you by charging higher rates when you turn equity into debt, increasing the likelihood that you could lose your house to foreclosure.

To obtain the best rates, you can take the following actions, though:

Raise your credit score

Cash-out refinance rates are significantly influenced by your credit score. You can obtain the best rates on a traditional cash-out refinance with a score of at least 780. Even though FHA loans have lower minimum requirements, your credit score is still a factor in determining your FHA interest rate.

Prior to applying, pay off credit card debt in full, refrain from establishing new credit accounts, and make all of your payments on schedule. Making the extra effort could result in interest savings of thousands of dollars over the course of a 30-year loan term.

![]() Learn more about how to improve your credit score.

Learn more about how to improve your credit score.

Your loan-to-value ratio (LTV ratio), which measures how much you owe on your house, also affects your cash-out refinance rate. Your rate will increase with a higher LTV ratio.

Increasing your down payment is one method to reduce your LTV ratio and borrow less money. Obtaining a gift letter from a relative or requesting down payment assistance are just two of the numerous ways to increase the amount of the down payment.

![]() Learn more about borrowing money for a down payment.

Learn more about borrowing money for a down payment.

![]() Read more about finding how much you should put down on a house.

Read more about finding how much you should put down on a house.

Making the appropriate home improvements could raise the value of your house, reduce your loan-to-value ratio, and result in a lower cash-out refinance rate. Check Remodeling Magazine’s most recent Cost vs. Check out the Value Report to find out which enhancements offer the best value for your money.

Shop around for lender offers

Studies from LendingTree consistently demonstrate that compared to people who don’t shop, mortgage shoppers save a significant amount of money. Gather loan quotes from three to five different lenders, or use an online comparison tool to let them battle it out for your business.

![]() Read more about our best refinance lenders.

Read more about our best refinance lenders.

Cash-out refinance closing costs: How much you’ll pay

Generally speaking, refinancing closing costs range from 2% to 6% of the total loan amount, depending on the size of the loan. The origination, title, appraisal, and credit report fees associated with a purchase mortgage also apply to a cash-out refinance.

Remember that homeowners insurance and title fees are based on a percentage of the loan amount, as are origination fees. Thus, the amount you pay for these closing costs will increase with the amount you borrow.

How are cash-out refinance costs paid?> You can pay cash-out refinance closing costs out of pocket, though most borrowers ask the lender to deduct the costs from their cash-back funds. Some companies offer

You might be acquainted with mortgage insurance if you made a down payment of less than the 20% required when purchasing your home. The good news is that you will only have to pay E2%80%99 for private mortgage insurance on a traditional cash-out refinance because the maximum 80% LTV ratio is the threshold that must be met in order to waive that requirement. Regardless of your LTV ratio, the bad news is that you will have to pay FHA mortgage insurance on an FHA cash-out refinance. And while mortgage insurance is not needed for VA loans, military homeowners typically have to pay a VA funding fee of 2. 30% to 3. 60% of their loan amount for a VA cash-out refinance.

Is a cash-out refinance a good idea?

If you meet the requirements, can afford a higher monthly mortgage payment, and would like to take advantage of lower interest rates compared to other loan options, a cash-out refinance might be a good option. However, you should weigh the advantages and disadvantages before determining whether a cash-out refinance is the best course of action.

The money you withdraw can be used for anything. You can use the equity in your home to pay off debt, buy real estate, or put money aside for other purposes.

The interest rate will be lower than with other financing options for you. Mortgages free up cash in your monthly budget because they often have lower interest rates than credit cards, personal loans, and home equity loans.

Your interest charges may be tax-deductible. When you file your taxes, you can write off the interest you paid if you used the money for home improvements.

You’ll need 20% equity to qualify. A cash-out refinance might not be feasible at this time if local home values have dropped or if you made a small down payment when you purchased your property.

You’ll lose some of the equity you’ve built. If you borrow against the equity in your house now, the profit on sale of your house will be less.

You’ll have a higher monthly mortgage payment. For as long as you own your home, a larger loan amount will typically result in a higher monthly mortgage payment.

If you choose a different kind of refinance, you might have to pay a higher rate. When compared to rate-and-term refinances, lenders usually charge higher rates for cash-out refinances. Borrowers with low credit scores should anticipate paying an even higher rate if they are using equity.

Cash-out refinance vs. HELOC

A credit card is similar to a home equity line of credit (HELOC). It is available for you to borrow against and repay as needed for the duration of your “draw period,” which is typically ten years. You only pay interest during the draw period, and many HELOC lenders allow you to pay only interest on the borrowed money. The repayment period begins after the HELOC draw period ends and typically lasts 20 years. You will make consistent payments to pay off the balance during this time.

One advantage of HELOCs is that most of the lenders will let you borrow up to 85% of the value of your house. Certain HELOC lenders will even lend up to 20100% of the total amount, or E2%80%94% more than the 80% cap on the majority of cash-out refinances.

![]() Think a home equity loan or HELOC is right for you? Try our home equity calculator to see how much money you could get.

Think a home equity loan or HELOC is right for you? Try our home equity calculator to see how much money you could get.

Which loan makes sense for me?>

If you have low credit scores, want the lowest monthly payment possible, or would rather have a consistent monthly payment that doesn’t change, then a cash-out refinance makes sense.

Cash-out refinance vs. home equity loan

A home equity loan, which is a loan secured by a portion of your home’s equity, is an additional option for tapping equity. All of the money will be given to you at once, and you’ll pay back the loan over time in equal installments. Terms often range from five to 30 years.

Home equity lenders, like HLOCs, have the ability to set LTV ratios as high as 20100%; however, most maintain the maximum at 85%.

Which loan makes sense for me?>

- More equity must be borrowed than cash-out refinance programs permit.

- You want to leave your current, low-interest-rate mortgage alone

- You don’t mind making two monthly mortgage payments

- You have a higher credit score

→ If you only want one monthly payment or your credit score prevents you from qualifying for a home equity loan, a cash-out refinance makes more sense.

Yes, if you qualify. But you’ll have to settle for a lower LTV ratio, and you should anticipate paying a higher interest rate. Lenders set a maximum limit of 2075 percent on the loan-to-value ratio for cash-out refis on investment properties, which implies that you will require at least 2025 percent equity after closing.

Yes, you might be able to withdraw equity from a second residence, but the rates and loan-to-value limitations will be the same as for cash-out refinances of investment properties.

The maximum LTV ratio of the loan program you have selected will determine how much money you can borrow. As an illustration, you can borrow up to 80% of the value of your home using a traditional cash-out refinance.

Yes, if you use the funds exclusively for home improvements. If you use cash-out refinance funds for any other purpose, you are not eligible for the tax break.

Compare a cash-out refinance vs. a home equity loan or line of credit to determine which option best suits your needs.

To find out how much you can cash out and what your new mortgage payment will be after refinancing, use our cash-out refinance calculator.

To cash out your home equity, you have three main options: a home equity line of credit (HELOC), a home equity loan, and a cash-out refinance.

FAQ

How does cash-out refinance work?

When you refinance with a cash-out, you take out a new mortgage that is larger than your old one, and the difference is paid to you in cash. When refinancing with cash out, you typically pay more points or a higher interest rate than when refinancing with a rate-and-term, where the mortgage amount remains the same.

What is the downside of a cash-out refinance?

Higher rates: Because there is more risk involved when increasing the size of your loan, cash-out refinancing loans typically have higher interest rates than conventional mortgages and rate-and-term refinances.

How is a cash-out refinance paid back?

With a cash-out refinance, you can refinance your mortgage and obtain a larger loan amount than what you currently owe. The difference is given to you in cash by the lender, less closing costs. The new loan is repaid over a period of time, typically 15 to 30 years.

What is the difference between cash out and no cash-out refinance?

Refinancings of loans can generally be divided into two groups: cash-out and no cash-out. When refinancing with a cash-out, the borrower increases the principal amount. The borrower refinances only the principal amount, or possibly less, in a no cash-out refinancing.

Read More :

https://www.lendingtree.com/home/refinance/cash-out/

https://www.rocketmortgage.com/learn/cash-out-refinance