Homeowners are searching for solutions due to the persistently high interest rates throughout the economy. Thankfully, the 5/1 adjustable-rate mortgage (ARM) provides a good balance between mortgage savings and flexibility. From the first day of the loan, your savings start to accumulate with a five-year fixed low interest rate. But because these are intricate loans, it’s best to fully understand them before using them. Yes, there are benefits to lower monthly payments and interest rates; these are perfect for refinancing or short-term ownership. However, after the initial period, there may be higher rates, so a 5/1 ARM might not be the best option for your financial circumstances.

How We Make Money

The businesses whose offers you see on this website pay us. Unless our mortgage, home equity, and other home lending products are specifically prohibited by law, this compensation may have an impact on how and where products appear on this website, including, for example, the order in which they may appear within the listing categories. However, this payment has no bearing on the content we post or the user reviews you see here. We don’t include the range of businesses or loan options that you might have.

Our goal at Bankrate is to assist you in making more informed financial decisions. Although we follow stringent guidelines, this post might mention goods from our partners. Heres an explanation for . Bankrate logo.

Bankrate was established in 1976 and has a long history of assisting consumers in making wise financial decisions. We’ve upheld this reputation for more than 40 years by assisting people in making sense of the financial decision-making process and providing them with confidence regarding their next course of action.

You can rely on Bankrate to prioritize your interests because we adhere to a rigorous editorial policy. All of the content we publish is objective, accurate, and reliable because it is written by highly qualified professionals and edited by subject matter experts.

In order to give you peace of mind when making decisions as a buyer and homeowner, our mortgage reporters and editors concentrate on the topics that matter most to consumers: the newest rates, the greatest lenders, navigating the homebuying process, refinancing your mortgage, and more. Bankrate logo.

You can rely on Bankrate to prioritize your interests because we adhere to a rigorous editorial policy. Our team of distinguished editors and reporters produces truthful and precise content to assist you in making wise financial decisions.

We value your trust. Our goal is to give readers reliable, unbiased information, and we have established editorial standards to make sure that happens. Our reporters and editors carefully verify the accuracy of the editorial content they produce, making sure you’re reading true information. We keep our editorial staff and advertisers apart with a firewall. No direct payment from our advertisers is given to our editorial staff.

The editorial staff at Bankrate writes for YOU, the reader. Providing you with the best guidance possible to enable you to make wise personal finance decisions is our aim. We adhere to stringent policies to guarantee that advertisers have no influence over our editorial content. Advertisers don’t pay our editorial staff directly, and we carefully fact-check all of our content to guarantee accuracy. Thus, you can be sure that the information you’re reading, whether it’s an article or a review, is reliable and reputable. Bankrate logo.

How we make money

You have money questions. Bankrate has answers. For more than 40 years, our professionals have assisted you in managing your finances. We always work to give customers the professional guidance and resources they need to be successful on their financial journey.

Because Bankrate adheres to strict editorial standards, you can rely on our content to be truthful and accurate. Our team of distinguished editors and reporters produces truthful and precise content to assist you in making wise financial decisions. Our editorial team produces factual, unbiased content that is unaffected by our sponsors.

By outlining our revenue streams, we are open and honest about how we are able to provide you with high-quality material, affordable prices, and practical tools.

Bankrate. com is an independent, advertising-supported publisher and comparison service. We receive payment when you click on specific links that we post on our website or when sponsored goods and services are displayed on it. Therefore, this compensation may affect the placement, order, and style of products within listing categories, with the exception of our mortgage, home equity, and other home lending products, where legal prohibitions apply. The way and location of products on this website can also be affected by other variables, like our own unique website policies and whether or not they are available in your area or within your own credit score range. Although we make an effort to present a variety of offers, Bankrate does not contain details about all financial or credit products or services.

This article was written in part using an internal natural language generation platform. Our editorial staff examined, verified, and revised the article.

- With a 5/1 ARM loan, borrowers receive a five-year initial fixed-rate period; following that, the interest rate is adjusted annually based on current market rates.

- Rate caps on adjustable-rate mortgages (ARMs) set a maximum interest rate after the initial fixed-rate period expires.

- If you want to sell your home or refinance before the initial fixed-rate period ends, a 5/1 ARM could be the best option for you.

The interest rate on an adjustable-rate mortgage (ARM) varies over time. An ARM usually starts you off paying a lower, fixed rate for a predetermined amount of time. When the fixed-rate period ends, your rate changes to reflect the market rate, which could be higher or lower. ARMs are frequently offered as 3/1, 5/1, 7/1, and 10/1 loans.

What is a 5/1 ARM?

A 5/1 ARM is one type of adjustable-rate mortgage. The terms “5/1” denote the frequency of rate changes and the duration of the fixed-rate period, respectively. The first five years of the mortgage’s fixed-rate period are represented by the “5”. After then, the interest rate will change by “1” times a year.

The 5/6 ARM, which adjusts every six months following the initial five-year period, is another popular type of mortgage.

How does a 5/1 ARM loan work?

As soon as the loan is closed, the clock on your 5/1 ARM begins to run. For example, your rate wouldn’t change again until July 2029 if you were to close your mortgage in July 2024.

Following this modification, the lender recalculates the interest on your loan based on the change in the interest rate, either upward or downward. Your loan will adjust once more after a year, and the cycle will continue until the loan’s term is over.

The most important thing to remember is that your monthly payment will increase if your rate does. The inverse is also true.

Because of the way ARMs are designed, they can have lower initial rates and later adjustments; however, rates cannot simply keep rising forever. On your closing documents, you’ll likely see the following:

- During the first fixed-rate period, the interest rate you will pay is known as the “teaser” or introduction rate.

- Adjustment intervals: These show how frequently the rate is subject to change. It can also be referred to as the reset date.

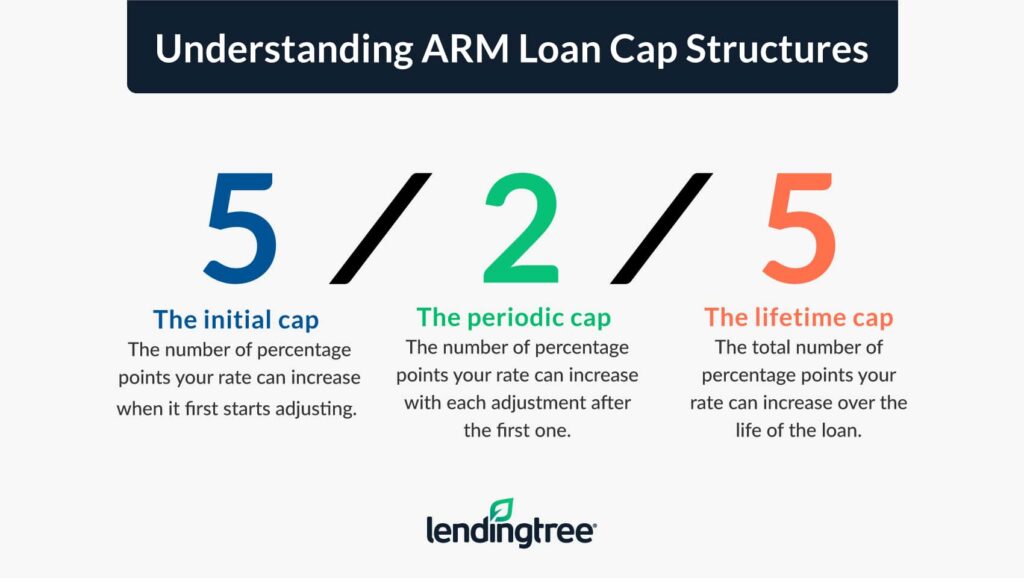

- The initial adjustment cap, which is typically 2 or 5 percent, sets the maximum rate rise at the first adjustment. In other words, the interest rate cannot rise by more than 2 or 5 percentage points above the initial rate.

- Periodic rate cap: Also known as the subsequent adjustment cap, the periodic rate cap sets the maximum change the rate can have between resets, usually at 2 percent.

- Lifetime cap: This is the highest percentage that the rate can fluctuate over the course of the loan; it varies depending on the lender but is typically 5 percent.

After the initial fixed-rate period expires, knowing the maximum amount your interest rate could increase can help you budget and plan for future payments. Alternatively, considering a fixed-rate loan could be a better choice if you believe you wouldn’t be able to afford larger payments.

Example of a 5/1 ARM loanLet’s say you take out a 5/1 ARM loan for $300,000 with a 7 percent interest rate. For the first five years of the 30-year loan, your rate would be locked in at 7 percent, making your monthly payment about $1,99 After five years, your interest rate is expected to change by 0.25 percent every year, making your new payment in the sixth year of your loan’s term about $2,041 per month (if rates go up). With a 12 percent lifetime cap on your loan, your maximum monthly payment would be $2,678 toward the end of your loan’s term — much higher than your initial monthly payment.

Our adjustable-rate mortgage calculator allows you to calculate your projected monthly payments and view potential changes over the course of the loan.

What index does the 5/1 ARM use?

Make sure to find out which index your lender uses, as it plays a significant role in determining the rate you pay. This information ought to be included in the documentation for your loan estimate from your lender. Your ARM rate rises in tandem with the yield on the particular index.

ARMs may also be linked to the Secured Overnight Financing Rate, or SOFR, or the 11th District Cost of Funds Index (COFI). The index rate plus a margin set by the lender determines your mortgage rate.

Pros and cons of a 5/1 ARM

It’s crucial to consider the benefits and drawbacks of a 5/1 ARM loan before applying:

Pros of a 5/1 ARM

- Cheaper to start: Compared to a 30-year fixed mortgage, the primary advantage of a 5/1 ARM is initially lower monthly payments.

- Greater home in a better neighborhood: The smaller payment may enable you to take out a larger mortgage and purchase a home that is larger or in a better neighborhood.

- Your rate may drop following the initial period: Should interest rates decline, your monthly payment will likewise likely drop following the initial period and possibly even during subsequent resets.

Cons of a 5/1 ARM

- could end up costing you much more: Exposure to higher rates after the fixed period expires is the main drawback of the 5/1 ARM. If rates have risen, your monthly payment will increase.

- Complexity: Compared to a fixed mortgage, an adjustable mortgage has more moving parts. Rate caps, indexes, resets—for the typical borrower, this can get rather technical

- Interest-only trap: With certain ARMs, you are only required to pay interest during the first period and not principal. That might help you stretch your money and make smaller payments, but your payments—principal included—will increase significantly after the set period. In addition to making your budget suffer, a decline in home values could put you in default on your loan.

Remember that not everyone is a good fit for a 5/1 ARM, despite its advantages.

According to Greg McBride, CFA, chief financial analyst at Bankrate, “the risk of future rate adjustments is always there, even though the differential between the initial rate on an ARM and that of a fixed rate mortgage isn’t always the same.” Sometimes the difference between the initial rate and the benefit is so small that the risk is not worth taking. If you don’t intend to stay in the house long enough to witness the first rate adjustment—for example, if you intend to move again within the next five years—an ARM may be appropriate. However, even if you choose this course, be cautious because if your original plan doesn’t work out, you might have to pay more when the rate starts to fluctuate. ”.

How 5/1 ARMS compare to other loans

Although 5/1 ARMs are widely used, there are numerous other mortgage options.

- 5/1 ARM vs. other ARMs: A 10/1 or 7/1 ARM, for example, functions similarly to a 5/1 ARM with the exception of the initial fixed-rate period’s duration and the interest rate. A 10/1 ARM has a fixed initial rate for the first ten years as opposed to the first five, and a 7/1 ARM has an initial rate that changes after the first seven years. Given that 10/1 and 7/1 ARMs have longer initial fixed-rate periods than 5/1 ARMs, rates on these loans are probably going to be a little bit higher.

- 5/1 ARM vs. fixed-rate mortgage: Compared to a 30-year fixed-rate loan, the initial fixed rate on a 5/1 ARM is frequently significantly lower. That translates to a lower monthly payment, at least initially. Of course, the drawback is uncertainty. Your ARM rate and monthly payment may increase after five years. You can more easily budget for the payments when you have a fixed-rate loan because you will know exactly how much you will pay over the course of the loan.

When to consider a 5/1 ARM loan

A 5/1 ARM could be a suitable option for you if you’re looking for a mortgage in the following circumstances:

- You plan to refinance or sell soon. You won’t ever have to deal with a rate adjustment if you don’t intend to keep the loan for longer than five years. Nonetheless, you must have a clear strategy for paying off the loan, whether it involves refinancing or moving. Remember that you will need to be able to qualify for a refinance and pay closing costs if you wish to do so.

- You expect your income to increase over time. You may be able to bear a possible payment increase if you anticipate earning more money in five years. This could be the case if you work as a lawyer, a doctor, or in another profession that is similar and has a high earning potential, such as someone who is about to graduate from medical school.

- Your budget supports the maximum payment. An increase in the rate and payment might not have a significant impact on your budget if you’re financially secure. This significantly reduces the risk of rate changes, but it also means you might have less money left over for other financial objectives, such as investing or retirement savings.

- When you take out a 5/1 ARM, there’s a possibility that after the initial fixed-rate period expires, your interest rate and payment will go up. You can budget for the increase in your payment or get advice from a housing counseling organization recognized by the U S. Department of Housing and Urban Development (HUD). If you can find a lower interest rate and intend to remain in the house long enough to recoup your closing costs, you can also refinance your ARM loan into a fixed-rate mortgage.

- A minimum credit score is needed for ARM loans, however the exact amount varies depending on the kind of ARM. A minimum credit score of 620 is needed for conventional ARMs, but a minimum credit score of 580 is needed for FHA ARMs. VA ARMs don’t have a minimum credit score requirement, but they do have an upper limit of 41% on the debt-to-income ratio. Furthermore, your debt-to-income ratio needs to be no higher than 43% (some lenders may only accept up to 50%). Conventional ARMs require a minimum down payment of 5%, whereas FHA ARMs only require a minimum of 3%. 5 percent. VA ARMs do not require a down payment.

- A high credit score is something you can ensure you have before applying for a loan. Lenders usually offer the best mortgage rates to borrowers with excellent credit scores. Additionally, a larger down payment can help you obtain a lower mortgage rate by lowering your loan-to-value ratio (LTV). It’s not always a wise decision to pay mortgage points in order to obtain the best initial interest rate on a 5/1 ARM, despite what you might believe. “Usually, it takes five to six years for the lower monthly payments to offset the initial cost of the points,” notes McBride. If you intend to move within the next five years, taking out a 5/1 ARM makes sense. However, it would take longer to recover the points if you paid points to further lower the rate. This is more appropriate for 10-year ARMs or fixed-rate mortgages if you have the money to pay points and you intend to keep the loan for a long enough period of time to recover the costs. ” .

FAQ

Is it a good idea to have a 5 1 ARM?

A 5/1 ARM could be a good option for you if you’re looking for a mortgage in the following circumstances: You intend to sell or refinance soon. You won’t ever have to deal with a rate adjustment if you intend to keep the loan for longer than five years.

How long does it take to pay off a 5 1 ARM?

Generally, 5/1 ARM loans have an overall term of either 15 or 30 years. For the first five years of the loan, the interest rate is set, and for the remaining five years, it changes annually. Use the calculator below to see what your monthly payment would be at a given interest rate.

What is the current interest rate for a 5 1 ARM?

|

Product

|

Interest Rate

|

APR

|

|

5/1 ARM

|

6.13%

|

7.27%

|

|

7/1 ARM

|

6.25%

|

7.20%

|

|

10/1 ARM

|

6.95%

|

7.72%

|

Does a 5 1 ARM require a down payment?

In order to be eligible for a 5/1 Adjustable-Rate Mortgage, you must contribute a minimum of five percent of the loan amount as down payment.

Read More :

https://www.bankrate.com/mortgages/what-is-a-5-1-arm/

https://www.quickenloans.com/learn/5-1-arm