What Is a Default?

Failure to make required interest or principal payments on a debt—whether it be a loan or a security—is referred to as default. Debt default is a possibility for people, companies, and even entire nations. Default risk is an important consideration for creditors.

- When a borrower ceases making the necessary payments on a debt, there is a default.

- Defaults can happen to unsecured debt like credit cards or student loans or to secured debt like mortgage loans secured by real estate.

- Defaults put debtors at risk of legal action and could prevent them from obtaining credit in the future.

:max_bytes(150000):strip_icc()/default2.asp-final-be203234104f4c9d979f7d3eee8f0e78.png)

Understanding a Default

Debt that is secured by assets, like a business loan backed by the assets of the company or a mortgage loan secured by a house, may default. If the borrower doesn’t make timely payments, the loan may go into default, putting the asset or collateral that was used to secure it in danger. A business would also be in default if it couldn’t make the required coupon payments on its bonds.

Credit card balances and other types of unsecured debt are also susceptible to default. A default lowers a borrower’s credit score and may make it more difficult for them to borrow money in the future.

Defaulting on Secured Debt vs. Unsecured Debt

When someone defaults on a debt, the lender or investors may file a lawsuit to recoup the money. The likelihood of their recovery will vary depending on whether the debt is secured or unsecured.

Secured Debt

If the borrower defaults on the mortgage, the bank may eventually foreclose on the home secured by the mortgage. If a borrower defaults on an auto loan, the lender may seize the car. These are examples of secured loans. When an asset is purchased using a secured loan, the lender is entitled to that specific asset.

In order to avoid forfeiture and to give themselves more time to negotiate a settlement with creditors, corporations that are in default on secured debt may file for bankruptcy protection.

Unsecured Debt

Additionally, unsecured debt, like credit card balances and medical bills, may go into default. Even though unsecured debt isn’t collateralized, the lender nevertheless has legal standing in the event of a default. Usually, credit card companies hold off on placing an account into default for a few months.

After six or more months without any payments being made toward the outstanding balance, the debt would be “charged off.” On a debt that has been charged off, the lender would close the account and write it off as a loss. After the debt has been charged off, the creditor may sell it to a collection agency, which will make contact with the borrower in an effort to collect.

When a collection agency purchases an unsecured debt that has been charged off, the borrower’s assets may be subject to a lien or judgment. A judgment lien is an order from a court that allows creditors to seize property belonging to a debtor in the event that the debtor breaches a contract.

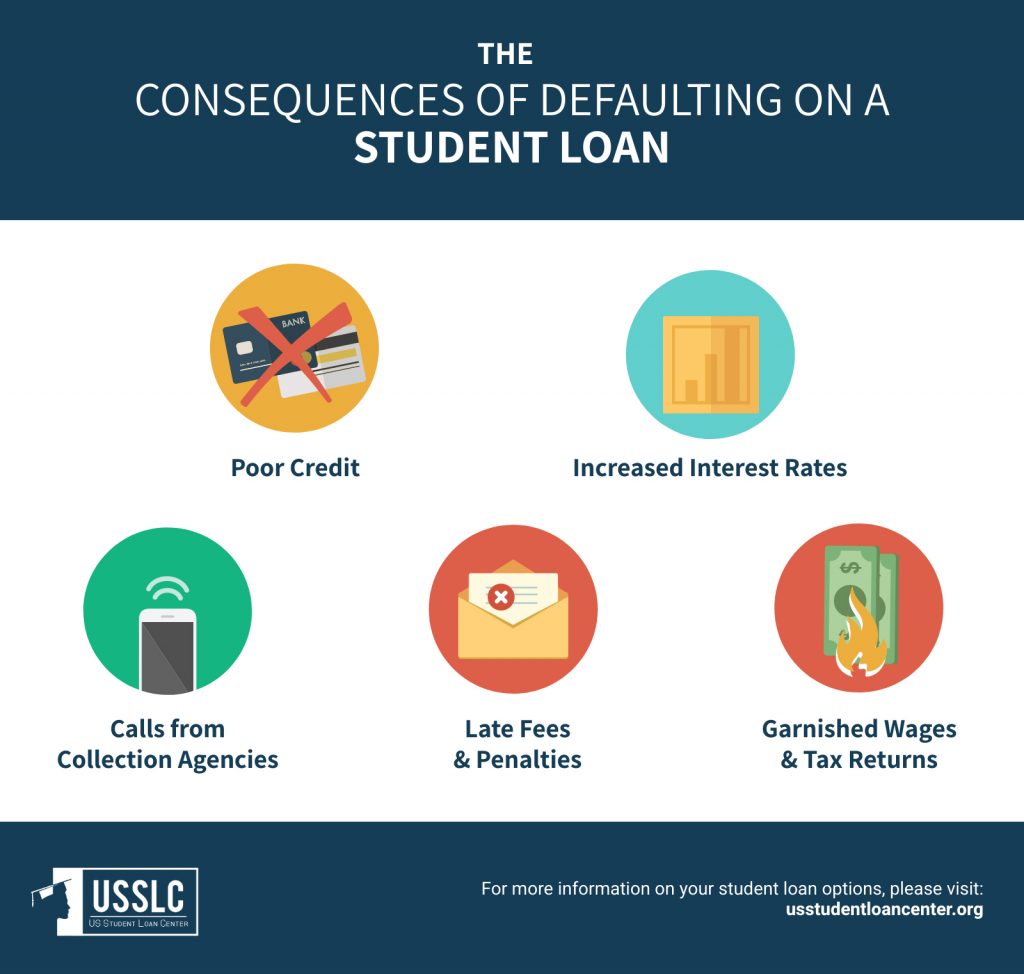

Defaulting on a Student Loan

Student loans are another type of unsecured debt. Similar to not paying off a credit card, defaulting on a student loan can negatively impact your credit score, credit rating, and future loan opportunities. Federal student loan defaulters may also have their wages garnished.

First You’re “Delinquent”

When a payment is 90 days past due on your loan, it becomes officially delinquent. Your credit score will decline as a result of it being reported to the three main credit bureaus. Riskier borrowers may only be charged a higher interest rate if their new credit applications are approved or denied.

A bad credit rating can follow you in other ways. Prospective employers and landlords frequently review applicants’ credit reports, particularly for positions requiring a security clearance.

Next, You’re “in Default”

If you don’t make your payments on time for at least 270 days, the loan will default. The percentage of federal student loan borrowers who have defaulted at least once is about one-third.

If borrowers do not enter into a loan rehabilitation agreement with the Default Resolution Group at the Department of Education’s Office of Federal Student Aid, they may eventually be subject to withholdings of tax refunds and other federal payments, as well as garnishments of up to 15% of their take-home pay.

If your federal student loans are in default, you can use loan consolidation or enroll in the federal student loan rehabilitation program.

Deferment or Forbearance

As soon as you suspect that you might struggle to make your payments, it’s a good idea to get in touch with your lender. The lender might be able to assist you in getting a loan payment deferment or forbearance, or they might be able to work with you on a more manageable repayment schedule.

Temporary Aid for Student Loan Borrowers

The Department of Education (DOE) suspended student loan payments and the accrual of interest on outstanding loans as a COVID-19 relief measure. In response to a federal court order that blocked the White House’s student loan forgiveness plan, the DOE then prolonged the suspension of federal student loan payments in November 2022.

Resuming student loan payments was planned to happen 60 days following the department’s approval to start the program or the conclusion of the legal dispute. Student loan interest charges then resumed on Sept. 1, 2023 and payments restarted in October 2023.

In April 2022, the DOE introduced the “Fresh Start” program, which assists defaulting borrowers in maintaining certain benefits while exiting default. The temporary program will last until September 2024 unless extended. Collections were halted, you were eligible to apply for federal student aid, and your credit report would now show your loan as “current” rather than “in collections.”

Sovereign Default

Sovereign default occurs when a country doesnt repay its debts. A court cannot normally force a nation that is in default to fulfill its obligations, unlike a debtor who is an individual or corporation. However, it also faces a number of additional dangers and issues. There could be a recession or a depreciation of the value of the currency. The defaulting nation might be barred from debt markets for an extended period of time.

A number of factors, such as political upheaval, poor economic management, or a banking crisis, can lead to sovereign default. Greece defaulted on a $1. Prior to receiving further debt relief from the European Union, the country paid the International Monetary Fund (IMF) 73 billion in 2015.

Fitch, a leading provider of credit ratings, downgraded the U. S. credit rating from AAA to AA+ on Aug. 1, 2023. It mentioned the federal government’s propensity for last-minute talks over the nation’s debt ceiling and predicted “fiscal deterioration” over the next three years. The U. S. According to the Budget Committee, this is only the second time in the history of the country that a credit rating agency has taken this step.

Defaulting on a Futures Contract

When one party breaches a futures contract, the other party is in default and cannot perform as agreed. Generally speaking, default occurs when one party fails to pay the other party by the deadline in this instance.

A legal agreement for a future transaction involving a specific commodity or asset is called a futures contract. Under the terms of the agreement, one party will purchase at a given time and price, and the other will sell at the agreed-upon milestones. If one party doesn’t pay, they might be subject to lawsuits and collection actions.

What Happens When You Default on a Loan?

The following outcomes are possible when a borrower defaults on a loan:

- Reduced credit score—a number that indicates how creditworthy a borrower is—and unfavorable comments on their credit report

- Reduced likelihood of obtaining credit in the future

- Higher interest rates on any new debt

- garnishment of wages, which is a legal procedure that directs a third party to take money out of a borrower’s paycheck or bank account in addition to other fines

The credit bureau Experian states that a default will remain on your credit reports and affect your credit score for seven years.

A Real World Example

Puerto Rico failed to make bond payments totaling $58 million in 2015, paying only $628,000. Hurricane Maria’s damage in 2017 subsequently made the island’s debt and economic problems worse.

In the biggest bankruptcy in U.S. history, Puerto Rico revealed intentions to reduce its debt to about $86 billion from $129 billion in 2019. S. history. The bankruptcy filing was permitted by a law passed by Congress in 2016. A financial board was also established by the Puerto Rico Oversight, Management, and Economic Stability Act (PROMESA) to supervise the territory’s public finances.

A U. S. As part of the bankruptcy process, a judge approved a restructuring plan in early 2022 that reduced Puerto Rico’s $70 billion public debt to $37 billion.

What Happens When You Default on a Payment?

When you miss payments on a loan, your account is eventually forwarded to a debt collection company, which attempts to recoup your unpaid balance. Any payment default will lower your credit score, make it more difficult for you to borrow money in the future, result in fees, and possibly lead to the seizure of your personal belongings.

How Long Does a Default Stay on Your Credit Report?

Defaults stay on your credit report for seven years. If it can be demonstrated that a default was made in error, it may be removed sooner. Your credit score should improve after the default is removed.

What Is an Example of a Default?

A missed payment, or several missed payments, on borrowed money constitutes a default. Not making your monthly mortgage payment or credit card bill payment is an example of a default.

The Bottom Line

Failure to make required principal or interest payments on a debt is referred to as default. Individuals, businesses, and countries can default on debt obligations. In addition to having an impact on a person’s credit rating and ability to obtain future loans, nonpayment of a mortgage, student loan, or personal loan may result in the seizure of assets or income.

Companies may go into default if they don’t make bond coupon payments. Sovereign default occurs when a country doesnt repay its debts. Article Sources: Investopedia mandates that authors cite original sources to bolster their claims. These consist of government data, original reporting, white papers, and conversations with professionals in the field. When appropriate, we also cite original research from other respectable publishers. You can read more about the guidelines we adhere to when creating impartial, truthful content in our

FAQ

What are the consequences of defaulting on a loan?

-Your credit score will be damaged. -You’ll pay significantly higher interest rates and might have trouble getting approved for credit cards, auto loans, or mortgages. -You might experience trouble obtaining a cell phone plan, auto or home owner’s insurance, or utility registration.

What 3 things can happen if you default on debt?

Any payment default will lower your credit score, make it more difficult for you to borrow money in the future, result in fees, and possibly lead to the seizure of your personal belongings.

What happens if your loans go into default?

When a secured personal loan defaults, the collateral asset will typically be seized by the lender. In the case of secured business loans, lenders will typically seize inventory or revenue in the event of a default. When unsecured personal loans are not repaid, wage garnishment is frequently the outcome.

What happens if you can’t pay back a loan?

Your creditor will be aware that you are unable to repay the loan once you default. After that, they might go into collections mode and either assign you to a team of internal collectors or sell your debt to a third-party debt collector.

Read More :

https://www.investopedia.com/terms/d/default2.asp

https://money.usnews.com/loans/articles/what-happens-if-you-default-on-a-loan