5 Common Personal Loan Requirements

For personal loans, most lenders have comparable requirements, though each lender may have different qualifications. For instance, your credit score may be taken into consideration by two lenders, but one may demand a higher credit score than the other. Here are some other common requirements they might consider:

- Credit score and history

- Income

- Debt-to-income ratio

- Collateral

- Origination fee

Credit Score and History

One of the most crucial elements a lender takes into account when assessing a loan application is the applicant’s credit score. Credit scores, which vary from 300 to 850, are determined by a number of factors, including length of credit history, amount of outstanding debt, and payment history. Some lenders will lend to applicants who have no credit history at all, but many require applicants to have a minimum score of about 600 to be eligible.

In order to make sure borrowers have the resources to pay back a new loan, lenders place income requirements on them. Minimum income requirements vary by lender. For instance, Avant’s minimum annual income requirement is only $20,000, whereas SoFi’s minimum salary requirement is $45,000. However, if your lender withholds information about minimum income requirements, don’t be shocked. Many don’t.

Pay stubs, recent tax returns, monthly bank statements, and signed letters from employers are examples of evidence of income; self-employed applicants may submit bank deposits or tax returns.

The percentage of a borrower’s gross monthly income that goes toward her monthly debt service is known as her debt-to-income ratio, or DTI. DTI is a tool used by lenders to estimate a potential borrower’s capacity to repay both new and existing debt. It is therefore ideal for a DTI to be less than 2036%, however some lenders will accept a highly qualified applicant with a ratio as high as 200%.

When you apply for a secured personal loan, your lender will ask you to provide collateral, or valuable assets. When it comes to loans for houses or cars, the collateral usually has something to do with the loan’s main objective. However, other valuable assets, such as cash accounts, investment accounts, real estate, and collectibles like coins or precious metals, can also be used as collateral for secured personal loans.

In the event that you miss payments or default on your loan, the lender may take back the collateral in order to recover the outstanding balance.

Many lenders demand borrowers to pay personal loan origination fees in order to cover the costs of processing applications, conducting credit checks, and closing even though these fees are not part of the qualification process. The application fee and loan amount are among the factors that determine the fees, which typically vary from 1% to 8% of the total loan amount. Origination fees can be collected in cash at closing by certain lenders, financed as part of the loan amount, or deducted from the total amount disbursed at closing by other lenders.

4 Personal Loan Documents Your Lender May Require

When it comes time to submit an official personal loan application, your lender will ask for several documents to verify your identity, residency, and employment. These are the most typical paperwork that lenders need when you apply for a personal loan.

To start the lending process, lenders require potential borrowers to fill out and submit a loan application. Since every lender has a unique application, the particular specifications might change. However, generally speaking, you’ll need to supply your name, your desired loan amount, and the reason for the loan.

A loan application’s format might differ depending on the lender. While many online lenders allow you to apply entirely online, some might require you to speak with them over the phone before they can make a decision. Additionally, a lot of physical banks and financial institutions demand that applicants submit a paper application in person.

Proof of Identity

In order to demonstrate that they are at least eighteen years old and citizens of the United States, the majority of lenders demand that applicants submit at least two types of official identification. This precaution also reduces the threat of identity theft. Acceptable forms of government-issued identification often include:

- Driver’s license

- Other state-issued ID

- Passport

- Certificate of citizenship

- Birth certificate

- Military ID

Employer and Income Verification

Lenders want to know that you can afford to repay both the new loan and your existing obligations. Lenders normally require potential borrowers to provide proof of their employment history and current income as part of the application process in order to accomplish this. Common forms of income verification for traditional employment include:

- Paystubs

- returns

- W-2s and 1099s

- Bank statements

- Employer contact information

Instead, self-employed potential borrowers must rely on income tax returns, 1099 forms, and bank statements.

Proof of Address

The majority of lenders want to know that you have a stable living arrangement in addition to verification of employment. Giving proof of your address could entail presenting documents such as a current utility bill, a copy of your lease or other rental agreement, your voter registration card, or evidence of your residence, rental, or auto insurance that includes your address.

How to Qualify for a Personal Loan

There is no set method for being eligible for a personal loan because each applicant’s circumstances are distinct and varied. Nonetheless, there are guidelines and suggestions that can help you increase the likelihood that you will be approved for a personal loan.

To ascertain your eligibility, the majority of personal loan lenders look at your income, DTI ratio, credit history, and credit score. Although each lender has different minimal requirements for each of these elements, our suggestions include:

- Minimum credit score of 670. Sustaining a minimum credit score of 670 will enhance your likelihood of being approved. However, we advise a minimum score of 720 if you wish to get the best terms.

- Consistent and steady monthly income. Lenders’ minimum income requirements can differ significantly, with some having no requirements at all. To prove that you can afford your monthly payments, you must, however, have a minimum of one continuous and steady source of income.

- DTI ratio less than 36%. Although a highly qualified applicant may be approved by some lenders with a ratio as high as 2050 percent, it is best to aim for a DTI that is less than 2036 percent to increase your chances of qualifying.

Since every lender has different minimum requirements, it is best to prequalify whenever feasible and find out from the lender what requirements you must meet. This will guarantee that you apply for loans only based on your unique financial circumstances.

How To Prequalify for a Personal Loan

You can view the interest rates and terms you might be eligible for when you apply for a personal loan by first becoming prequalified. However, until you submit a formal application, these cannot be guaranteed.

The lender usually only performs a soft credit check during prequalification, which has no effect on your credit score. However, they will perform a hard credit check after you submit the entire application, which will momentarily and slightly lower your score.

Although your prequalification offer is subject to change until you submit an official application, it’s a useful tool for comparing possible loans from different lenders to determine which one would be best for you.

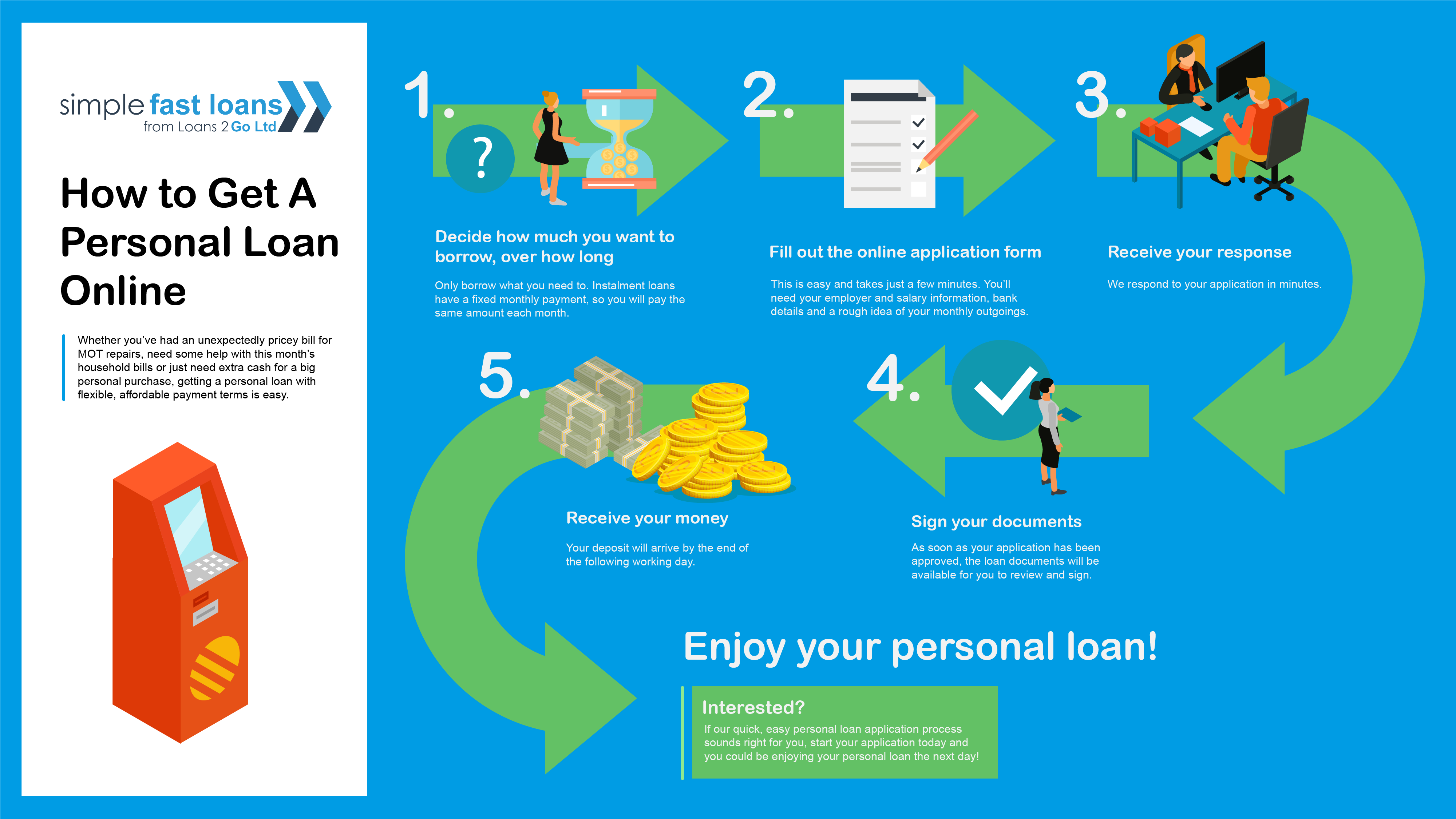

How to Get a Personal Loan

Applications for personal loans are frequently completed online, and decisions can be made as soon as the same day. Still, there are a few things you ought to do prior to even starting the application process. When you’re ready to submit an application for a personal loan, think about taking these actions first:

- Check your credit score

- Take action to raise your score by examining errors and making debt repayments.

- Decide how much you want to borrow

- Use lender prequalification to shop around for competitive rates

- Submit a formal loan application

What To Do If You’re Denied For a Personal Loan?

There are several reasons why a lender might reject your application for a personal loan. It’s possible that your DTI is too high or that your credit score is too low. It’s also possible that, depending on your income, employment stability, and other outstanding debts, the bank determined that you couldn’t repay the higher loan amount you requested.

If your application for a personal loan is rejected by a lender, you can try these few things to increase your chances of getting approved for another loan in the future:

- Ask for the specific reason your application was rejected

- Review your loan application for mistakes or inaccuracies

- Reduce your current outstanding debts to raise your credit score.

- Check for mistakes on your credit report

- Increase your income

- Compare lender requirements

- Apply for a smaller loan amount

- Consider using a co-signer

Compare Personal Loan Rates From Top Lenders

Depending on your qualifications, the loan you’re applying for, the lender, and the state of the economy, getting a personal loan may be simple or challenging. Obtaining a personal loan can be simple if your income and credit score are high. If you’re applying for a larger loan or have poor income or credit, it could be more difficult to get approved.

What can be used as collateral for a personal loan?

Lenders only require collateral for secured personal loans. Generally, you can use the following assets as collateral when applying for a secured loan:

- Cash in a savings or certificate of deposit (CD) account

- Car

- Boat

- Home

- Stocks

- Bonds

- Insurance policy

- Jewelry

- Fine art

- Antiques

- Collectibles

- Precious metals

- Future paychecks

How long does it take to get a personal loan?

The turnaround times for personal loans differ among online lenders, conventional banks, and credit unions. The quickest lenders are usually those found online, where some offer funding and approvals as soon as the same or next day. On the other hand, funding from traditional banks and credit unions could take up to seven days.

Can you get a personal loan without income proof?

Your income is not only a critical component of the lender’s qualification process, but it is also critical to your capacity to repay the loan. To verify your ability to fulfill repayment obligations, the majority of lenders demand proof of income. It’s best to refrain from taking on more debt if you don’t have a job or another source of income and can’t afford to take out a personal loan.

What disqualifies you from getting a personal loan?

The most frequent reasons for personal loan denials are related to your income, credit history, and credit score. Applicants for personal loans with bad, damaged, or no credit often have trouble getting approved. That being said, having excellent credit does not guarantee that you will be approved for a personal loan. Lenders typically won’t take on the risk if your income doesn’t demonstrate that you can afford monthly payments.

Can you get a personal loan without collateral?

Since most personal loans are unsecured, collateral is not required by the lender. However, you might not be eligible for an unsecured personal loan if your income or credit are low. If so, you might try applying for a collateral-required secured personal loan. Remember that this implies that if you don’t make your payments on time, the lender may take your property. Helping You.

Find out which lending platforms are rated highest by Forbes Advisor, as well as useful advice on how to choose the best loan depending on your credit score. Regards Please see our.

Please rate this article. Email: Please enter a working email address. Comments: We would love to hear from you. Please enter your thoughts. Send feedback to the editorial team. Something went wrong. Thank you for your feedback! Invalid email address Please try again later. Find The Best Personal Loan.

Next Up In Personal Loans

Kiah Treece is a small business owner and licensed attorney with expertise in financing and real estate. Her goal is to help people and business owners take charge of their finances by demystifying debt. lorem Is it really your intention to put your decisions on hold? The Forbes Advisor editorial staff is impartial and independent. We receive compensation from the businesses that advertise on the Forbes Advisor website in order to support our reporting efforts and keep this content available to readers for free. This compensation comes from two main sources.

FAQ

What disqualifies you from getting a personal loan?

A lender may reject an application for a personal loan for a variety of reasons, including a high debt-to-income ratio or a low credit score. Alternatively, it’s possible that you asked for a larger loan than what the lender believes you can responsibly manage given your income and other commitments.

Is it hard to get accepted for a personal loan?

In addition to the economic factors influencing the lending industry, it can generally be challenging to be approved for unsecured personal loans. To be approved, a lot of lenders and financial institutions need at least a stable income, a good credit rating, and a clean credit report.

Do I need proof of income for a personal loan?

Along with identification, most lenders will also want to see proof of income. Dec. 14, 2023, at 12:15 p. m. Your application for a personal loan is evaluated to determine if you meet the requirements, which include having a good credit score, a favorable debt-to-income ratio, and more.

Read More :

https://www.bankrate.com/loans/personal-loans/documents-required-for-personal-loan/

https://www.forbes.com/advisor/personal-loans/personal-loan-requirements/