Although owning a home can be costly, you can save thousands of dollars over the course of your loan if you choose the appropriate mortgage.

Because borrowers have so many options, they might overlook government-backed programs like the USDA loan. USDA loans can offer mortgage assistance to help you become a homeowner while spending less money because they are guaranteed by the US Department of Agriculture’s (USDA) Rural Development Guaranteed Housing Loan program.

In rural towns that qualify, there is no down payment required for a USDA loan. Let’s talk about USDA loans and their benefits and drawbacks so you can decide if this loan is the best fit for you and your family.

No Cash Reserves Required

Borrowers with credit problems or high debt-to-income ratios may need to have cash reserves for other loan types, such as conventional and FHA loans. This means that after buying the property, you would have to demonstrate that you have enough cash on hand to pay for at least one month’s worth of expenses. But with USDA loans, cash reserves arent required.

Should you choose to pay off your loan early, certain loan types will charge you a fee. This fee assists the lender in recovering some of the interest income they would have otherwise lost if you were to pay off your loan early. But with USDA loans, there’s no penalty.

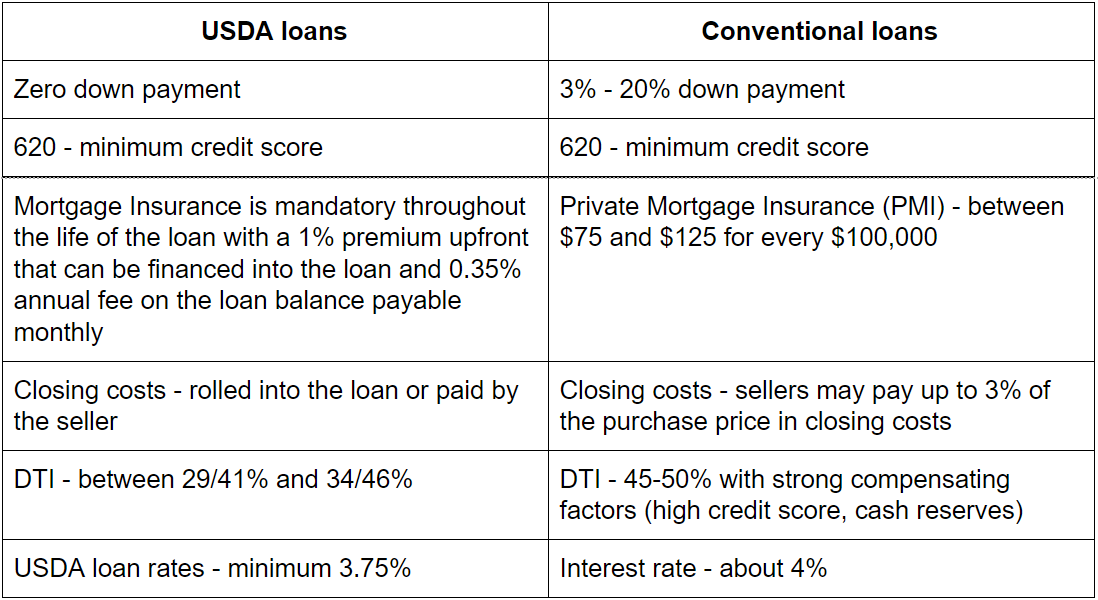

If the borrower has a lower credit score, loans with low down payment requirements, like the conventional loan, may have higher interest rates. However, once more, because lenders bear less risk when your loan is backed by the government, they are able to maintain low USDA interest rates. Reduced monthly payments and less money spent on interest over the course of the loan are the results of lower interest rates.

Closing Costs Can Be Rolled Into the Loan

Many buyers discover to their surprise that closing costs typically amount to between 3% and 5% of the purchase price of the home. That would be $7,500 to $12,500 on a $250,000 house, which is a lot of money to just have lying around. However, if you apply for a USDA loan, you can include this expense in your loan and avoid having to pay it upfront. You may occasionally be able to get the seller to cover your closing costs in certain market circumstances, which would completely relieve you of this expense.

Note: Some lenders might only offer to roll closing costs into the loan if the appraisal results are higher than the purchase price.

Of course, when weighing the benefits and drawbacks of USDA loans, we can’t simply overlook the possible drawbacks. It’s critical that you receive a thorough explanation of all of your mortgage options as a prospective homeowner. As promised, the following are some potential issues with USDA loans.

USDA loans aren’t appropriate for those looking to purchase a home in the middle of a large city. Urban properties fall outside of the qualifying geographic areas. But a lot of towns are included in the USDA’s property eligibility map, particularly if they have fewer than 35,000 residents.

The USDA home loan program aims to assist low- to moderate-income homebuyers in finding properties. Because of this, there is an income cap, which effectively means that you can earn too much money to be eligible for a USDA loan. For homes with 1-4 members, income is limited to $110,650. For homes with 5-8 members, the income limit is $146,050.

USDA Upfront Guarantee Fee

An up-front guarantee fee is required for USDA loans in order to process the loan. This fee equals 1% of the loan amount. You have the option to roll over this fee into your loan and pay it off gradually through your monthly mortgage payments, as opposed to paying it all at once at closing.

USDA Annual Guarantee Fees

You will be required to pay ongoing USDA program fees in addition to your upfront guarantee fee. As of 2021, these fees equal . 35% of the loan amount. You have the option to pay this amount in monthly installments along with your mortgage payments rather than in one lump sum each year.

The good news is that, provided the property is used as your primary residence, you can use USDA loans for a variety of property types, including single-family homes, newly constructed homes, condos, and manufactured homes. The bad news is that the following cannot be financed with a USDA loan:

- Vacation homes

- Multi-family housing, such as apartments, duplexes, or triplexes, even if you live in one of the units as your primary residence

- Investment properties

- Non-residential real estate

Note: Paddio currently does not offer financing for manufactured homes.

When you apply for a USDA loan, lenders must verify a lot of information, so the underwriting process may take longer than it would with a conventional home loan. This could not be the best choice for you if you’re anxious to close on a house.

USDA Loan Frequently Asked Questions

For the appropriate buyer, without a doubt! If you’re searching for a house in a qualifying area, have a low to moderate income, and would prefer a 20% down payment, an FHA loan might be worthwhile.

What is the Downside to USDA Loans?

The potential problems with USDA loans are:

- Geographic restrictions on where you can buy

- Income thresholds that must be met in order to be eligible

- Restrictions on the type of property you can buy

- Program-specific fees

- Longer loan processing times (compared to conventional loan)

Do USDA Loan Require a Down Payment?

Nope! The majority of buyers won’t have to make a down payment of any kind, though some with incomes above the acceptable income limit may be obliged to do so.

Find a USDA Lender

Knowing the benefits and drawbacks of the USDA loan will put you one step closer to obtaining the funding required to purchase a property. Are you prepared to move forward? Find the ideal lender for you. Written by:

Tyler completes the team with her bachelor’s degree in marketing with a focus on professional sales and her knowledge of FHA, conventional, and USDA home loans.

FAQ

Are USDA loans worth it?

The absence of a down payment requirement is the primary advantage of a USDA home loan. This can be an excellent program for those who are flexible with where they live and are on a tight budget. The limitations on where you can purchase or how much money your family can make are the main drawbacks.

Which is better FHA or USDA?

For those with lower incomes who wish to purchase in rural areas, USDA loans are the best option. When a borrower has little saved for a down payment and their credit score is too low to qualify for a conventional mortgage with a low interest rate, FHA loans are frequently the best option.

Does USDA annual fee ever go away?

If the annual fee is not paid by the deadline, USDA may charge the lender a late fee. For a purchase and refinance transaction, there might be differences in the annual fee and/or upfront guarantee fee that apply. When 80% of the loan to value (LTV) is reached, the annual fee will no longer be collected.

Why is a conventional loan better than a USDA?

When purchasing a home in an eligible rural or suburban area, with no down payment, or with limited income, USDA loans are typically a better option. For borrowers who want flexibility in where they can make purchases and have good credit and steady income, conventional loans can be excellent choices.

Read More :

https://www.paddio.com/learn/usda-loans-pros-and-cons/