The products listed here, many or all of them, are from our partners, who pay us. This affects the products we write about as well as the location and arrangement of the products on a page. However, this does not influence our evaluations. Our opinions are our own. This is our revenue model and a list of our partners.

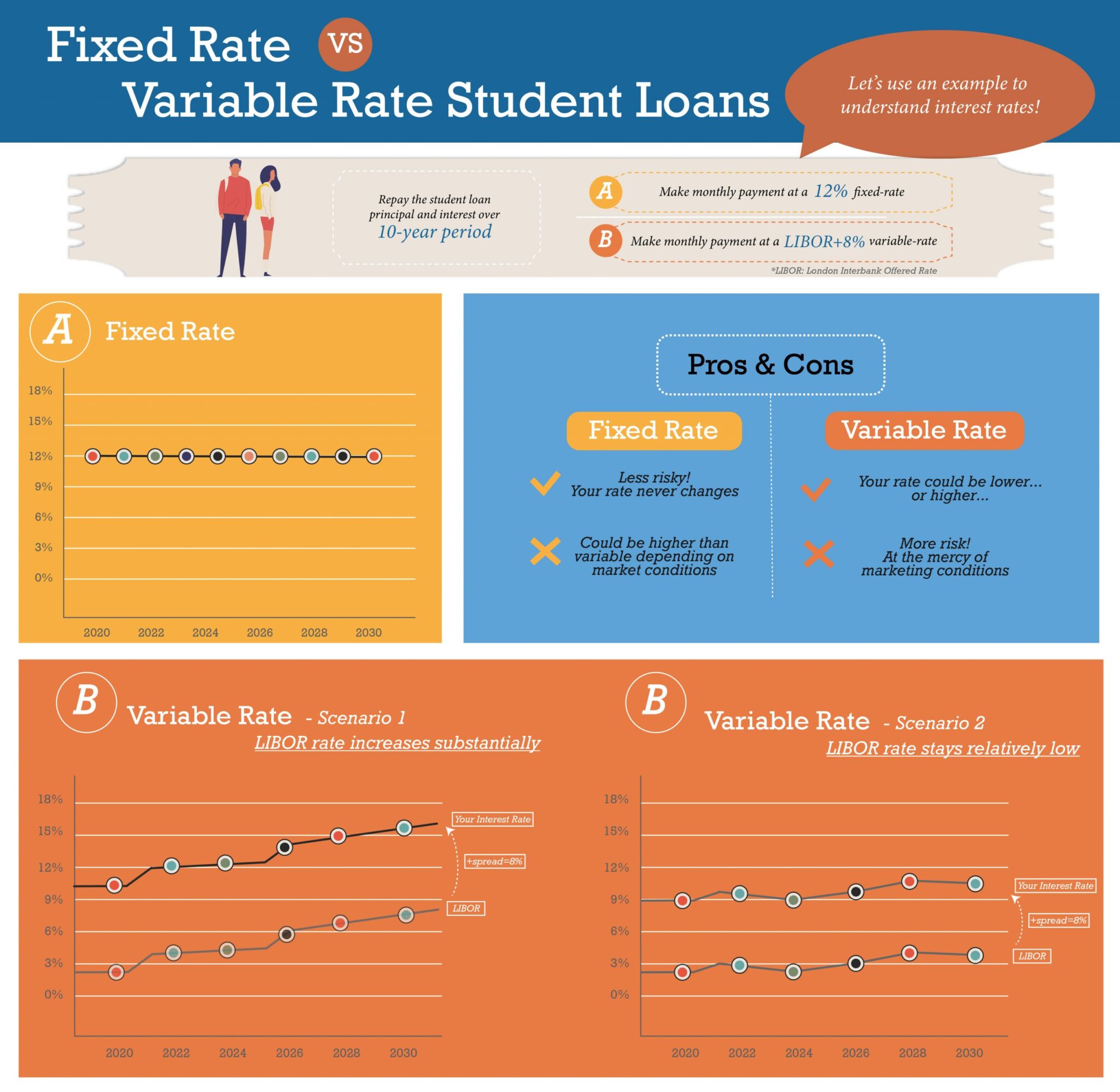

In general, fixed student loan interest rates are preferable to variable rates. This is due to the fact that variable rates are subject to monthly or quarterly changes based on the state of the economy, whereas fixed rates are always the same.

Student loan interest rates are rising. Why do they usually follow the Federal Reserve’s recent hikes in the federal funds rate in an effort to fight inflation? The federal funds rate is predicted by economists to peak in 2023 before beginning to decline.

Pick fixed if you’re not sure which rate to use; it’s the safer option even in a high-rate environment. In order to benefit from possibly declining rates in 2023, think about implementing a variable rate. Please keep in mind that interest rate forecasts are only that—predictions. It’s not always easy to predict when interest rates will drop and how much they will drop.

How We Make Money

The businesses whose offers you see on this website pay us. Unless our mortgage, home equity, and other home lending products are specifically prohibited by law, this compensation may have an impact on how and where products appear on this website, including, for example, the order in which they may appear within the listing categories. However, this payment has no bearing on the content we post or the user reviews you see here. We don’t include the range of businesses or loan options that you might have.

Our goal at Bankrate is to assist you in making more informed financial decisions. Although we follow stringent guidelines, this post might mention goods from our partners. Heres an explanation for . Bankrate logo.

Bankrate was established in 1976 and has a long history of assisting consumers in making wise financial decisions. We’ve upheld this reputation for more than 40 years by assisting people in making sense of the financial decision-making process and providing them with confidence regarding their next course of action.

You can rely on Bankrate to prioritize your interests because we adhere to a rigorous editorial policy. All of the content we publish is objective, accurate, and reliable because it is written by highly qualified professionals and edited by subject matter experts.

So that you can feel secure when investing your money, our loans reporters and editors concentrate on the topics that matter most to consumers: the various loan options, the greatest rates, the best lenders, how to pay off debt, and more. Bankrate logo.

You can rely on Bankrate to prioritize your interests because we adhere to a rigorous editorial policy. Our team of distinguished editors and reporters produces truthful and precise content to assist you in making wise financial decisions.

We value your trust. Our goal is to give readers reliable, unbiased information, and we have established editorial standards to make sure that happens. Our reporters and editors carefully verify the accuracy of the editorial content they produce, making sure you’re reading true information. We keep our editorial staff and advertisers apart with a firewall. No direct payment from our advertisers is given to our editorial staff.

The editorial staff at Bankrate writes for YOU, the reader. Providing you with the best guidance possible to enable you to make wise personal finance decisions is our aim. We adhere to stringent policies to guarantee that advertisers have no influence over our editorial content. Advertisers don’t pay our editorial staff directly, and we carefully fact-check all of our content to guarantee accuracy. Thus, you can be sure that the information you’re reading, whether it’s an article or a review, is reliable and reputable. Bankrate logo.

How we make money

You have money questions. Bankrate has answers. For more than 40 years, our professionals have assisted you in managing your finances. We always work to give customers the professional guidance and resources they need to be successful on their financial journey.

Because Bankrate adheres to strict editorial standards, you can rely on our content to be truthful and accurate. Our team of distinguished editors and reporters produces truthful and precise content to assist you in making wise financial decisions. Our editorial team produces factual, unbiased content that is unaffected by our sponsors.

By outlining our revenue streams, we are open and honest about how we are able to provide you with high-quality material, affordable prices, and practical tools.

Bankrate. com is an independent, advertising-supported publisher and comparison service. We receive payment when you click on specific links that we post on our website or when sponsored goods and services are displayed on it. Therefore, this compensation may affect the placement, order, and style of products within listing categories, with the exception of our mortgage, home equity, and other home lending products, where legal prohibitions apply. The way and location of products on this website can also be affected by other variables, like our own unique website policies and whether or not they are available in your area or within your own credit score range. Although we make an effort to present a variety of offers, Bankrate does not contain details about all financial or credit products or services.

Depending on a number of variables, such as whether you’re taking out a federal or private student loan, you may want to consider fixed-rate or variable-rate financing.

With a fixed-rate loan, your monthly payments are predictable because the interest rate stays the same for the duration of the loan. In contrast, the interest rate on variable-rate student loans varies according to the state of the market.

For many students, fixed-rate loans are typically the safest option because it’s difficult to predict which way interest rates will go. But knowing the advantages and disadvantages of each choice can assist you in choosing one that best suits your needs and financial constraints.

Key differences between fixed and variable student loans

Whether the interest rate can fluctuate is the primary distinction between student loans that are fixed and variable.

Your rate, however, can also have an impact on other areas, such as your budget, the amount you pay back on your student loans, and how much you have to pay back in relation to your future income.

| Fixed-rate student loans | Variable-rate student loans | |

|---|---|---|

| Benefits | Interest rate will never change

Monthly payments are consistent You’ll know how much interest you’ll pay |

Typically lower starting ratesBenefit from market changes (in some cases)Lower monthly payments if interest rates are low |

| Drawbacks | Generally higher starting rates

No benefit if interest rates drop |

Rate can rise over time

Monthly payment can change |

As you pay off your debt, your monthly student loan payments will be predictable because fixed rates are fixed for the duration of the loan. A fixed interest rate can only be altered by refinancing the loan.

Fixed rates offer stability because the payment won’t fluctuate, even though they are usually higher than the lowest advertised variable rates. You will be fully aware of the monthly payment and total interest amount.

Because variable interest rates are dependent on the state of the market, changes in your interest rate could result in an increase or decrease in your student loan payment. Usually, lenders attach the variable rate on the loan to a fixed margin plus a benchmark rate, such as the prime rate or the Secured Overnight Financing Rate (SOFR) index.

Your interest rate and monthly payment may increase over time, even though you may begin with a lower payment than you would with a fixed-rate loan.

When to choose a fixed-rate student loan

Fixed interest rates are advantageous for borrowers who lack the flexibility to adjust their loan balance in response to changes in interest rates. Interest rates on all new federal student loans are fixed, and private lenders usually offer fixed rates as well.

In the following situations, selecting a fixed-rate student loan can make sense:

- Due to your low income, you must make constant payments on your student loans.

- You wish to lock in a low rate because you live in a low-interest rate environment.

- You’re going to experience changes in the market and have selected a lengthy repayment period.

When to choose a variable-rate student loan

If you meet the requirements to receive the lowest rates possible, variable-rate student loans are a wise choice. Federal student loans do not have variable interest rates, although private student loans frequently do.

In the following situations, obtaining a variable rate loan makes sense:

- Your goal is to pay off your student loans early to avoid interest rates going up too much.

- Your budget allows for some wiggle room in case interest rates rise.

- To be eligible for the best rates and terms, your credit must be good or excellent.

What to do before choosing an interest rate

Before deciding on an interest rate, there are a few things to take into account:

- Think about the type of loan: If you are obtaining federal student loans, the only option available to you is a fixed interest rate. In contrast, most private lenders offer both.

- Consider how long it will take to pay off the loan: If you intend to pay back the loan after you graduate from college, that is a long period of time for your interest rate to change if it is a variable rate. When you take into account your entire repayment period, that timeline becomes even longer. However, a shorter repayment term works better with variable rates than a longer one if you’re a parent or student planning to begin making payments right away.

- Examine the state of the market: It’s hard to predict with precision how much more expensive one form of interest rate would be for you than another. However, consider the state of the economy right now and whether interest rates are rising or falling. For instance, variable interest rates are likely to follow suit as the Federal Reserve continues to raise interest rates in an effort to fight inflation.

- Inquire about variable terms: Inquire with the lender about the frequency of rate changes and the existence of a maximum rate cap if you’re thinking about taking out a variable-rate loan.

- Consider your risk tolerance: If you choose a variable-rate loan, you are the one who is assuming the risk of rising interest rates. On the other hand, with a fixed rate, the risk is assumed by the lender. Consider whether you would prefer the security of a fixed rate or the flexibility of short-term interest rate fluctuations.

Spend some time considering each of these aspects and how they might affect you in the event that you decide between a fixed-rate and variable-rate student loan. And keep in mind that if you decide later on that another option is better for you, you can change your mind and refinance your loans.

If you would rather have a longer repayment period and consistent monthly payments for the duration of the loan, a fixed-rate student loan might be your best bet. Additionally, it’s your only choice if you’ve exhausted all federal loan options first, as many experts advise.

A variable-rate loan might be a better option for you if you want to pay off your debt more quickly and need a private student loan to cover any gaps in your finances. To get the best deal, compare rates and terms from as many lenders as you can, regardless of the option you select.

FAQ

Is student loans a fixed or variable expense?

Loan payments for fixed expenses include those for student loans and auto loans. Insurance premiums, such as for car insurance and homeowners insurance. Property taxes. Internet and cable bills.

Are student loans fixed or variable in 2023?

An office of the Department of Education, Federal Student Aid, states that the fixed rates for loans disbursed between July 1, 2023, and July 1, 2024 are: 5 50% for direct undergraduate loans that are both subsidized and unsubsidized. 7. 05% for Direct unsubsidized loans for graduate or professional students.

How do you tell if a loan is fixed or variable?

If you have fixed-rate financing, your loan’s interest rate won’t fluctuate over time. With variable-rate financing, the prime rate or another rate known as an “index” will determine how much your loan will interest you. ”.

Which loans are variable rate?

The federal fund rate or London Interbank Offered Rate (LIBOR) are examples of benchmark or reference rates that are used to set the variable interest rate. The lender also sets the margin or spread. Variable rate credit cards and variable mortgage rates are two instances of variable rate loans.

Read More :

https://www.bankrate.com/loans/student-loans/fixed-variable-student-loan/

https://www.nerdwallet.com/article/loans/student-loans/fixed-variable-student-loan