Find the Best Student Loans for You

Different repayment plans are available for federal loans, and they can be changed if circumstances change. Federal student loans have a 10-year repayment term as standard, but they also have graduated, extended, and income-driven repayment options. Federal loans also offer some forgiveness programs.

In contrast, income-driven repayment terms and loan forgiveness are typically not available for private loans, which are typically for ten years.

Private loans are the last choice for borrowers looking to finance their education because they provide limited options for repayment. In the end, private loans might be required, but federal student loan options should be looked into after scholarship and grant opportunities.

The Student Loan Ranger advises against ever attempting to evade student loan repayment. If you are having difficulties making payments, it’s critical to stay in touch with loan servicers and let them know about your circumstances. If you default on your student loans, the consequences could still be felt for up to 30 or 40 years.

Student Loan Ranger helps prospective and current students and recent graduates make sense of borrowing options, student debt and loan repayment. The blog is currently authored by Education Finance Council, a national trade association representing nonprofit and state-based higher education finance organizations; GreenPath Financial Wellness, a national nonprofit organization that provides financial counseling and education to empower people to lead financially healthy lives; and The Institute for College Access & Success, an independent nonprofit organization that conducts research, analysis and advocacy on making higher education more available, affordable and equitable. Previous blog contributors include the Financial Counseling Association of America, National Foundation for Credit Counseling and American Student Assistance.

College Admissions: Get a Step Ahead!

Get updates from U. S. News including newsletters, rankings announcements, new features and special offers.

Sign up to receive the latest updates from U. S News You acknowledge and agree to our terms and conditions by clicking submit.

You May Also Like

FAQ

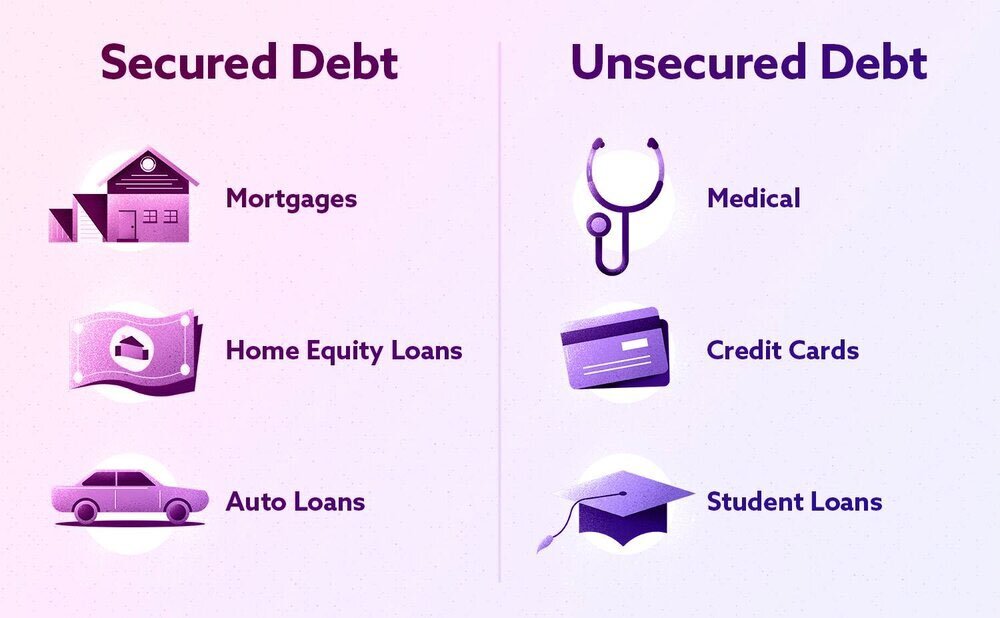

Is a student a secured loan?

The majority of student loans, including those from Discover Student Loans, are unsecured. Small personal loans, such as those offered by Discover Personal Loans, are typically unsecured as well. You will probably be given an interest rate on an unsecured loan from the government that was decided upon at that time by Congress.

What type of debt is a student loan considered?

Loan type: Although student loans have more flexible payment terms than other loans, they are still unsecured installment debts. Interest rates: Interest rates on student loans vary.

How do you know if a loan is secured or unsecured?

The main difference between the two comes down to collateral. A borrower’s asset, such as a vehicle, home, or cash deposit, serves as collateral to support a debt. Secured debts require collateral. Unsecured debts don’t.

Do student loans have collateral?

Unsecured debt, like federal student loans, doesn’t require collateral. But that doesn’t mean that defaulting on the loan won’t have any repercussions.

Read More :

https://www.usnews.com/education/blogs/student-loan-ranger/articles/2018-12-26/how-student-loan-debt-is-different-from-other-types-of-debt