The products listed here, many or all of them, are from our partners, who pay us. This affects the products we write about as well as the location and arrangement of the products on a page. However, this does not influence our evaluations. Our opinions are our own. This is our revenue model and a list of our partners.

Hopefully, a thorough and well-written business plan will increase your chances of being granted a small business loan by convincing lenders that your venture is worthwhile. A business plan is one of the many documents that many lenders will request you submit with your loan application.

Writing a business plan for a loan should showcase your skills, support your need for funding, and demonstrate your ability to pay back the loan.

What Does a Successful Business Plan Include?

The following components of a solid business plan for a loan application are present:

It’s possible that a lot of lenders are still closely examining how your company will run during the COVID-19 pandemic. Lenders are primarily looking at two criteria:

- How the company will continue to make money in light of COVID-19’s effects and restrictions

- How a borrower will safely operate their business.

We recommend adding a “COVID-19” section to your business plan. It doesn’t have to be long, but it should explain how you intend to maintain a calm and safe workplace for your employees and clients. Place it in or after your Organization and Management section. The information to include is:

- Restricting occupancy

- Stocking up on cleaning supplies and hand sanitizer

- Wearing masks, gloves, or other safety gear

- Cleaning equipment: In a fitness center, for instance, cleaning equipment could occur once every hour.

To address concerns about revenue, include information such as:

- If your state has allowed your industry to reopen

- If you are unable to open a physical location, consider new or different ways to generate income.

If you want to start a franchise, be sure to ask your franchisor about the policies and procedures they have in place for their franchisees. Many franchises have started requiring their franchisees to implement safety measures.

Cover Page and Table of Contents

Make sure your business plan appears professional because it is a professional document submitted with your loan application. The name of your company and your contact details should appear on the cover page. Your logo ought to be on the cover if you have one.

A table of contents and page numbers in the business plan for a loan application will be helpful to lenders and you alike so they can locate specific sections quickly. If you are providing your plan electronically rather than in person, make sure the table of contents can be clicked to direct readers to the appropriate sections.

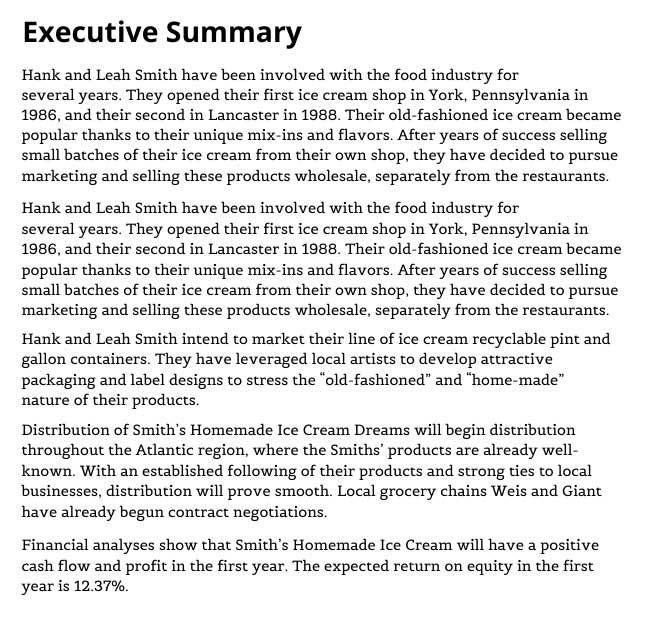

Business documents frequently start with executive summaries, which provide busy people with quick access to the most important information from a longer document. Important information shouldn’t require your reader to sift through a lengthy document.

Briefly summarize the entire business plan on a page. Tell us about the business, the product, and the motivation behind the launch. Mention your main rivals and the reasons your product will outperform them. Talk about the state of the economy in relation to your clients and merchandise, if appropriate.

Advice: Limited financial information should be included in the executive summary. You can include a financially significant or noteworthy result if you have one.

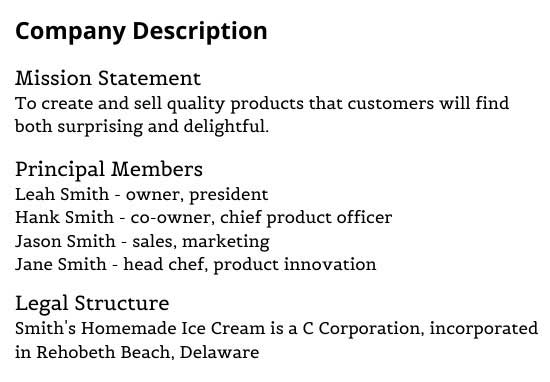

A mission statement, the company values, any strategic partners, and your corporate structure should all be included in the description of your business. It will be relatively short.

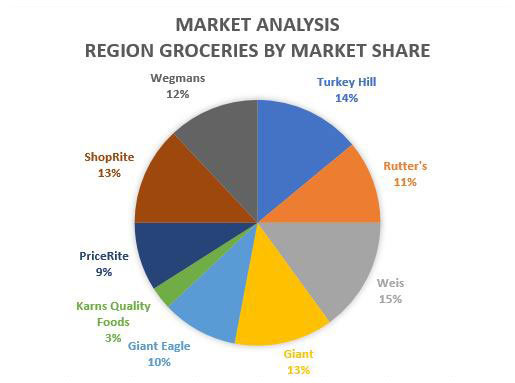

Following your explanation of your company’s operations and personnel to the lender, you should present a competitive analysis of your market. To be clear, a market analysis is not a comprehensive marketing strategy. That will come later. The characteristics of the market are the main focus of the market analysis, not a thorough strategy for how to corner it. Identify the existing gaps that your business will fill. A business plan’s market analysis should include:

- An industry overview and outlook

- Any differentiation in sector and niche

- Information on your target market

- The marketing plan for the business and how it will set it apart

Additionally, the market analysis ought to detail how external sources impact your business. If the industry is regulated, for instance, provide details about your familiarity with the regulation and your prior adherence to it (if your business is already operational). Are there any risks associated with price points changing? Will you need raw materials? If yes, how do you ensure you’ll have them at prices that support your financials?

What about your rivals? How do they set themselves apart? What is their approach to pricing?

Although your market analysis will contain information about your competitors, your target customers should really take center stage. Perhaps there are multiple customer types; in that case, you should include information about both customer segments. Where do they currently shop? Why? How old are they? What are their beliefs? What is their current average income? Demonstrating to potential investors that you are an expert at your ideal client breeds confidence in your ability to succeed.

Indicate in this section whether your business is conducting ongoing market research or research and development for innovative, competitive products and services. Do you conduct customer interviews as part of your research? How are you going to guarantee the validity of your findings?

The market analysis should be based on reputable sources. For example, when summarizing your rivals’ offerings, make it obvious to readers where the information originated.

Advice: A lot of business owners hire outside firms to conduct analyses. If you have, be sure to cite them. Make sure to cite any published research or surveys that you used to get your information.

Organization and Management

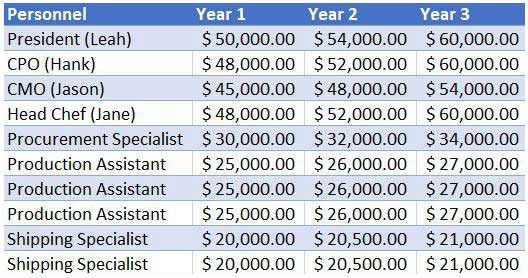

Your company’s management structure should be listed in detail in the organization and management section. An organizational chart, a description of the structure, and salary projections are common features of business plans.

Every management position should be described, along with the individual holding it, their duties, and their credentials. List your board of directors and any experience they have that is pertinent to the success of your company on a different page.

The business description section includes the firm’s principals, including the owner and co-owners. It is not required to include a separate organization and management section if your business is small and currently only consists of the principals.

Service or Product

It’s time to go into more detail about the goods or services your business offers. Business plans frequently itemize a company’s entire product line with the planned or current pricing structure. What do you sell, and who do you sell to? What is your exact business model? What need are you meeting for the client base?

Included in the service or product section should be the estimated lifecycle of your offering as well as any completed, ongoing, or planned research and development. Naturally, based on the nature of your business, this section will differ significantly. If relevant, a description of any patents, trademarks, or other intellectual property rights should be included.

See an example of a service and product section here.

Marketing and Sales

Three essential pieces of information are included in the marketing and sales section:

- How will customers find out about your products?

- What will your sales channels and methods be?

- What is your growth strategy?

If you intend for consumers to learn about your goods or services through educational channels such as trade shows, describe your strategy in detail. If you want to create a public relations campaign or run advertisements, be specific about what you will be doing. Will you use a targeted sales team to complete sales? Will management contact relevant potential customers or stores? Will you have an online presence? Are these efforts intended to appeal to particular demographics or types of customers? Which social media channels will you use and why?

If you have a growth strategy, outline it. If you intend to expand into new markets or target demographics, be sure to address it in this section.

See an example of a marketing and sales section here.

The financial analysis section is key for lenders. Financial projections for the next three to five years must be included in the financial analysis. Naturally, the longer the forecasts for the future are out, the harder it is to make a firm prediction. Making a three-year forecast for your business plan and having a five-year forecast available for the investors to request is one way to address this issue.

Advice: If you already own a business, you should also include historical data for the previous three to five years (or, if shorter, for the entire duration the business has been in operation).

The financial projections must include:

They might also contain sales projections, profit and loss statements, and financial indicators specific to your sector. More specific information, like the cost of sales or the cost per product (or service), may be requested by lenders.

The projections must be provided by the month, quarter, and year. Prospective investors are interested in seeing the short- and long-term financials. Why? Because it can be dangerous for businesses to fall short of their monthly and quarterly projections. They may fail quickly if, for example, they are lagging behind in sales or profit.

However, if sales are significantly higher than anticipated, it may be difficult for the business to maintain production and other initiatives. Lenders always want a clear picture of what’s likely to happen in order to offset the risk.

See an example of a financial analysis section here.

Need funding? We can get your dream off the ground.

A break-even analysis computes and examines a company’s margin of safety based on revenue and related expenses.

Learn how to calculate break-even analysis in Excel here.

3 Projected Profit and Loss

Likewise referred to as a P

Advice: Most accounting programs, such as Peachtree or QuickBooks, can produce a P

4 Cash Flow Forecast

An estimate of the amount of money that will enter and leave your company over a given period of time is recorded in a cash flow forecast (usually 12 months) The forecast includes your projected income and expenses.

Learn more about how to model your cash flow forecast here.

Advice: You can estimate and predict your future cash flow by using accounting software to examine your historical cash flow.

5 Projected Balance Sheet

Another term for a projected balance sheet is a “pro forma” balance sheet. Account balances for a company’s equity, liabilities, and other expenses and income are listed.

Learn more about how to create a pro forma balance sheet here.

Learn how to create a company balance sheet and download a template here.

In a business plan, ratios are used to evaluate and examine a company’s performance. In this instance, projected ratios are another useful tool that banks can use to assess the potential of your company and act as a guide for your planning.

Common Business Ratios (and Their Formulas)

It’s time to submit your funding request! Make sure to include a detailed list of the reasons you require business financing, the amount you are requesting (both current and prospective for the next five years), and the purposes for which you intend to use the funds.

Advice: Explain how funding will help your business (and its strategic plan) succeed overall. Will it permit calculated R

Here’s one way you can structure your funding request:

- Your current funding needs.

- Any future funding requirements over the next five years.

- How you intend to use the funds you receive.

- Any strategic future financial plans.

Appropriate appendix materials include:

- Principals’ resumes

- Tax returns

- Relevant real estate documents

- Documents detailing the legal structure of your business

- Processing flowchart

- Letters of intent to purchase from buyers

- Advertisement and marketing materials

- Relevant training certificates

- Sales forecast

- Other financial forecasts

- Personnel plan

- Profit and loss statement

- Balance sheet

The Easier Way to Get a Business Loan

It can be intimidating to handle the business loan application process alone. Because of this, a lot of present and prospective small business owners collaborate with organizations like Guidant Financial, which can help you every step of the way.

The following are some benefits of working with a consulting firm such as Guidant:

- Simplified Application Process. We shop a single application to multiple lenders, saving you time from having to fill out separate loan applications for each bank.

- Improved Loan Terms: Applying to multiple lenders at once frequently results in receiving loan offers, giving you greater flexibility to choose the terms and conditions.

- Faster Approvals: Your application is sent directly to banks that are most likely to approve your loan because of the extensive network of lenders we have cultivated relationships with.

Guidant supports you throughout the entire loan application process. Additionally, we make sure you’re matched with lenders who offer the best loan rates and the highest likelihood of approval thanks to our thorough analysis of loan packages. Call us at 888. 472. 4455 or pre-qualify in under five minutes.

FAQ

Do you need a business plan to get a loan?

Regardless of the lender, the answer to the question “does one need a business plan in order to obtain a loan?” should be “yes.” This is because all it takes to write a business plan for a loan is to state clearly how much money you need, why you need it, and for what purpose.

How do I write a business plan for a cash loan?

Typical sections include the management team, executive summary, business overview, products and services, market analysis, marketing and sales plan, and operational plan. Financial statements and a funding request should be included with your loan application.

Read More :

https://www.guidantfinancial.com/blog/how-to-write-a-business-plan-for-a-loan/%3Fnab%3D0

https://www.nerdwallet.com/article/small-business/business-plan-for-a-loan