FHA Loan Programs for 2024

The most recognized 3. 5% down payment mortgage in the country. Affordable payments w/good credit.

Choose a Loan Typelearn more

For loans made by lenders who have been approved by the Federal Housing Administration, or FHA, mortgage insurance is available. In the US and its territories, FHA insures these loans for single-family and multi-family properties. Since its founding in 1934, it has insured tens of millions of residential mortgages, making it the largest residential mortgage insurer in the world.

- FICO® score at least 580 = 3.5% down payment.

- FICO® score between 500 and 579 = 10% down payment.

- MIP (Mortgage Insurance Premium ) is required.

- Debt-to-Income Ratio < 43%.

- The home must be the borrowers primary residence.

- Borrower must have steady income and proof of employment.

A Federal Housing Administration-insured mortgage is known as an FHA loan. They let borrowers finance houses with as little as a three percent down payment. 5% and are especially popular with first-time homebuyers.

First-time homebuyers who might not have enough savings for a sizable down payment should consider FHA loans. It is possible for borrowers to be eligible for an FHA-backed mortgage even if they have experienced bankruptcy or foreclosure.

Applicants for FHA loans must meet the current 3 point low down payment requirement, which requires a minimum FICO® score of 580. 5%. In the event that your credit score falls below 20580, the required down payment is 2010. You can understand why having a clean credit history is crucial.

Remember that the FHA’s credit requirements go beyond your FICO® score; they also take into account the borrower’s payment history, past bankruptcies, foreclosures, and any unusual circumstances that prevent the applicant from paying on time. RELATED ARTICLES.

A number that indicates a potential borrower’s creditworthiness is called their FICO® score. Consumer credit files gathered from various credit bureaus are used by data analytics company FICO® to calculate credit scores.

Lenders examine your FICO® score in order to assess your likelihood of making mortgage payments on time. Your chances of obtaining a lower mortgage interest rate increase with a higher score.

SEE YOUR CREDIT SCORES From All 3 Bureaus

When approving your loan, your FHA lender will check your credit history. If you have a history of making your payments on time, you should be able to get an FHA loan. Items on the following list may have a negative impact on your eligibility for a loan:

- No Credit History Your lender must obtain a non-traditional merged credit report or create a credit history through other means if you do not have an established credit history or do not use traditional credit.

- Bankruptcy A borrower seeking an FHA-insured mortgage is not prohibited from filing for bankruptcy. In order to file for Chapter 7 bankruptcy, the borrower must have refinanced debt or decided not to take on new credit obligations after at least two years.

- Late Payments: It is advisable to apply for an FHA loan after you have made all of your required payments on schedule for a full year.

- Foreclosure Depending on the situation, a prior foreclosure may not always be a barrier to obtaining a new FHA home loan.

- Judgements, Collections, and Federal Debt Generally speaking, FHA loan regulations mandate that the lender ascertain that judgments are settled or paid off before or at closing.

- Easier to Qualify FHA provides mortgage programs with lower requirements. Because of this, most borrowers—even those with dubious credit histories and low credit scores—find it easier to qualify.

- Competitive Interest Rates: FHA loans provide homeowners with affordable monthly housing payments by offering low interest rates. When you weigh this advantage against the drawbacks of subprime mortgages, it’s quite substantial.

- Bankruptcy / Foreclosure You are not ineligible for an FHA loan if you have filed for bankruptcy or experienced a foreclosure within the last few years. Rebuilding credit and a stable payment history can assist in meeting FHA requirements.

- Credit History Determination A lender can evaluate your credit history in a variety of ways, and it goes beyond simply reviewing your credit card usage. Any kind of payment, including rent, utility bills, student loans, etc. should all reflect a general pattern of reliability.

RELATED ARTICLES

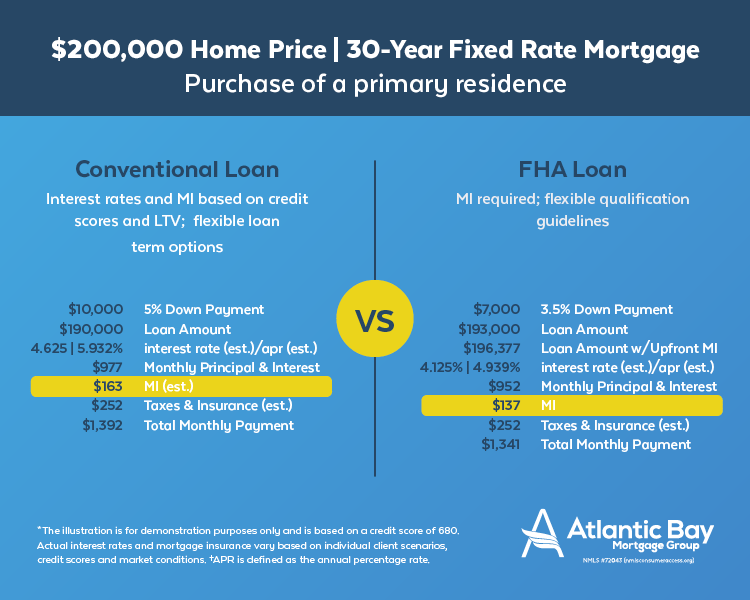

Undecided borrowers frequently select FHA loans over conventional loans after learning about some of its features. These advantages include lower down payment requirements, better interest rate offerings, and special refinance opportunities.

- Requirements for Down Payment: FHA loans can be obtained with as little as three 5% down, conventional loans usually require a 20% down payment. The only sources of funding allowed by FHA are your savings account, cash saved at home, investments you have withdrawn, gift funds, etc.

- Conventional loans typically require the borrower to carry Private Mortgage Insurance in the event that the borrower fails to provide the required minimum down payment of 2020 percent. Unlike other mortgages, FHA mortgages have two requirements: an annual mortgage insurance premium (MIP) and an upfront premium.

Programs for down payment assistance lower the cost of the mortgage application process for qualified candidates who want to buy a house but require financial support to do so. Typically, financial assistance comes in the form of grants that are not repaid, loans that are forgiven, or low-interest loans. Homebuyer education courses may be required.

Generally speaking, the property being bought needs to be the applicant’s primary residence and need to be in a certain city, county, or state. It might also have to fit within a program’s upper limits on purchase prices. Income restrictions may be applicable and will resemble this (the figures may not match the requirements of your program):

- 1 person household: $39,050

- 2 person household: $44,600

- 3 person household: $50,200

- 4 person household: $55,750

- 5 person household: $60,250

- 6 person household: $64,700

- 7 person household: $69,150

- 8 person household: $73,600

All income received by household members (18 years of age or older) who will be residing in the home, regardless of whether they are mortgage holders, is typically referred to as household income. RELATED ARTICLES.

Homebuyers who want to use an FHA loan might require assistance with the down payment. In this way, FHA loan regulations control not only the source of funds but also who is permitted to give such gifts. If you receive a financial gift in connection with your home loan transaction, be ready to substantiate it with documentation. Gifts may be provided by:

- Borrowers family member

- Borrowers employer or labor union

- a close friend whose interest in the borrower is well-defined and documented

- A charitable organization.

- A public organization or governmental agency that runs a program to help low- and moderate-income families or first-time homebuyers become homeowners

The maximum loan amounts that the FHA will insure for various regions of the nation have been determined. These are collectively known as the FHA lending limits. These loan limits are calculated and updated annually. They are affected by the location and kind of house, such as a duplex or single-family home. Some buyers opt to buy properties in counties with higher lending limits, or they might search for properties that are within the boundaries of the neighborhood they want to live in.

| LOW COST AREA | |||

| 2024 FHA Limits | |||

| Single | Duplex | Tri-plex | Four-plex |

|---|---|---|---|

| $420,680 | $538,650 | $651,050 | $809,150 |

| HIGH COST AREA | |||

| 2024 FHA Limits | |||

| Single | Duplex | Tri-plex | Four-plex |

|---|---|---|---|

| $970,800 | $1,243,050 | $1,502,475 | $1,867,275 |

Each local FHA office determines the precise costs and amounts that are deemed reasonable and customary, even though FHA requirements specify which closing costs are permissible to be charged to the borrower.

- Lenders origination fee.

- Deposit verification fees.

- Attorneys fees.

- The appraisal fee and any inspection fees.

- Lenders origination fee.

- Cost of title insurance and title examination.

- Document preparation (by a third party).

- Property survey.

- Credit reports (actual costs).

- Transfer stamps, recording fees, and taxes.

- Test and certification fees.

- Home inspection fees up to $200.

You will have items on your checklist as the buyer and borrower that are necessary for your lender, the seller, and even the title company. Before the title is transferred to you, the closing checklist includes all the costs that must be paid, the documentation that must be given, and the disclosures that must be signed.

- Identification All parties at the closing should have valid ID.

- Title Insurance Policy: In order to ensure that the property is free of prior claims or liens, you must purchase title insurance.

- Homeowners Insurance Policy: In order to protect your property in the event of damage, you must obtain homeowner’s insurance before closing on the house.

- Closing Funds: All agreed-upon funds must be brought, either electronically or as a cashier’s check.

RELATED ARTICLES

Mortgage insurance is necessary for FHA-insured loans in order to shield lenders from losses resulting from home mortgage defaults. The majority of FHA loans issued today will require MIP for either 11 years or the duration of the mortgage, depending on the specifics of your loan.

MIP Rates for FHA Loans Over 15 Years

Your annual mortgage insurance premium will be the following if you take out a standard 30-year mortgage or anything longer than 15 years:

| Base Loan Amount | LTV | Annual MIP |

|---|---|---|

| ≤ $625,500 | ≤ 95% | 80 bps (0.80%) |

| ≤ $625,500 | > 95% | 85 bps (0.85%) |

| >$625,500 | ≤ 95% | 100 bps (1.00%) |

| > $625,500 | > 95% | 105 bps (1.05%) |

To prevent homebuyers from purchasing a property they cannot afford, FHA guidelines mandate that borrowers and/or their spouse must meet specified debt-to-income ratio requirements.

These ratios are employed to determine whether or not the prospective borrower is in a position to support the costs that are frequently associated with home ownership. RELATED ARTICLES.

Many FHA Loan programs and other initiatives are available to help you with the cost of your first home purchase if you’re thinking about doing so.

- people and spouses who haven’t owned a primary residence in the previous three years

- Parents who are single and have only jointly owned a property with their former spouse

- People who have only owned with a spouse and are displaced homemakers

- People who have only ever owned their primary residence that isn’t permanently attached to a foundation in compliance with the relevant regulations

- People who have solely possessed real estate that does not adhere to state, municipal, or model building codes and that would require significant investment to bring into compliance before building a permanent structure

First-time homebuyers most frequently use the FHA Loan, and there are many excellent reasons for this.

FHA. The website com is privately owned and unaffiliated with the U S. government. Remember, the FHA does not make home loans. They guarantee the FHA loans that we can help you obtain. FHA. com is a private corporation and does not make loans.

Purchase or refinance your home with an FHA loan. One can be purchased for as little as three 5%. Examine our frequently asked questions for prospective homeowners to gain insight into the specifics of this government-backed loan scheme.

FAQ

How hard is it to get approved for FHA loan?

Applicants for an FHA loan must meet the following requirements in order to be eligible: a credit score of at least 500. Borrowers who make a down payment of 10% of the total amount due may be eligible for an FHA loan if their credit score is as low as 500. A minimum down payment of three can be made by those with scores of 580 or higher. 5%. Check your credit score to see where you stand.

What disqualifies you from an FHA loan?

Three main things can prevent you from being approved for an FHA loan: having too much debt compared to your income, having bad credit, or not having enough money for the required down payment, monthly mortgage payments, or closing costs.

What is the minimum income for a FHA loan?

No, FHA loans don’t have a set minimum income requirement. Lenders, however, will evaluate your income in light of your monthly debt obligations. Your debt-to-income ratio (DTI) will be examined to see if you are able to make your mortgage payments.

Read More :

https://www.rocketmortgage.com/learn/fha-loans

https://www.fha.com/fha_loan_requirements