New year, new finances – achieve your goals with a loan

Obtaining a personal loan can assist you in making your goals come to pass. Simply provide a few details to receive customized rate quotes from several lenders. Loan amount.

Online loans for excellent credit

When applying for a personal loan online, everything is done online, including pre-qualification and signing. These loans are usually unsecured, and your eligibility is largely determined by your income, debt, and credit score. During the loan term, which is normally two to seven years, approved borrowers receive the loan funds in one lump sum and repay the loan in fixed monthly installments.

You can use online loans for almost anything, such as debt consolidation, home repairs, and emergencies. All types of borrowers can obtain loans, however those with lower credit scores may pay higher interest rates. Financial experts advise a lower annual percentage rate (below 3.6%) for a loan in order to make it more affordable for the borrower.

Certain online lenders provide features like co-borrower addition, flexible payment schedules, and the ability to refinance an existing personal loan. When looking for an online loan, take into account and contrast the loan features.

Pros and cons of online loans

Comparing the benefits and drawbacks of using an online lender vs a physical lender like a bank or credit union is a smart idea. While specific features may differ between lenders, the following features are typically associated with online loans:

Pros of online loans

- Convenience: The entire loan application process can be finished on your phone or, in certain situations, a computer. You can use mobile apps from the best online lenders to manage your loan during the repayment period.

- No-risk estimates: The majority of online lenders allow you to preview estimated rates and pre-qualify in a matter of minutes without affecting your credit score. (A hard credit check is required by all lenders prior to loan completion.) ).

- Easy and quick shopping: Because each online lender has a unique underwriting formula, rates may vary from one lender to the next. Through comparison websites, borrowers can apply once and receive loan offers from several lenders. Compared to banks or credit unions, which might only handle loans in person or require you to visit a branch to complete the application process, this is simpler.

- Debt relief: With certain online lenders, borrowers can choose to have the funds from a debt consolidation loan sent straight to their creditors, relieving them of the responsibility of repaying individual credit cards.

Cons of online loans

- More costly than credit unions and certain banks: Generally speaking, online lenders’ loans are more expensive than credit unions’. Additionally, banks that you already do business with might provide you with better rates than online lenders. Before taking out an online loan, compare rates offered by a number of lenders both online and offline.

- No face time: Most online lenders only service loans digitally. If you ever want to have a face-to-face conversation with a representative, this could be difficult.

- Smallest loans unavailable: Internet loans under $500 may be difficult to locate at rates lower than 2036% Many online lenders have loan minimums from $1,000 to $2,000. Certain credit unions might be able to offer smaller loans, with a $250 minimum.

- Predators lurk: Reputable online lenders compete alongside predatory online lenders. Reputable lenders typically have annual percentage rates (APRs) that peak at %2036%. They check your credit and ability to repay. Predatory lenders usually don’t check credit, but you have to pay for the additional risk by having an annual percentage rate that is significantly higher than 10%.

|

Online loans pros |

Online loans cons |

|---|---|

|

|

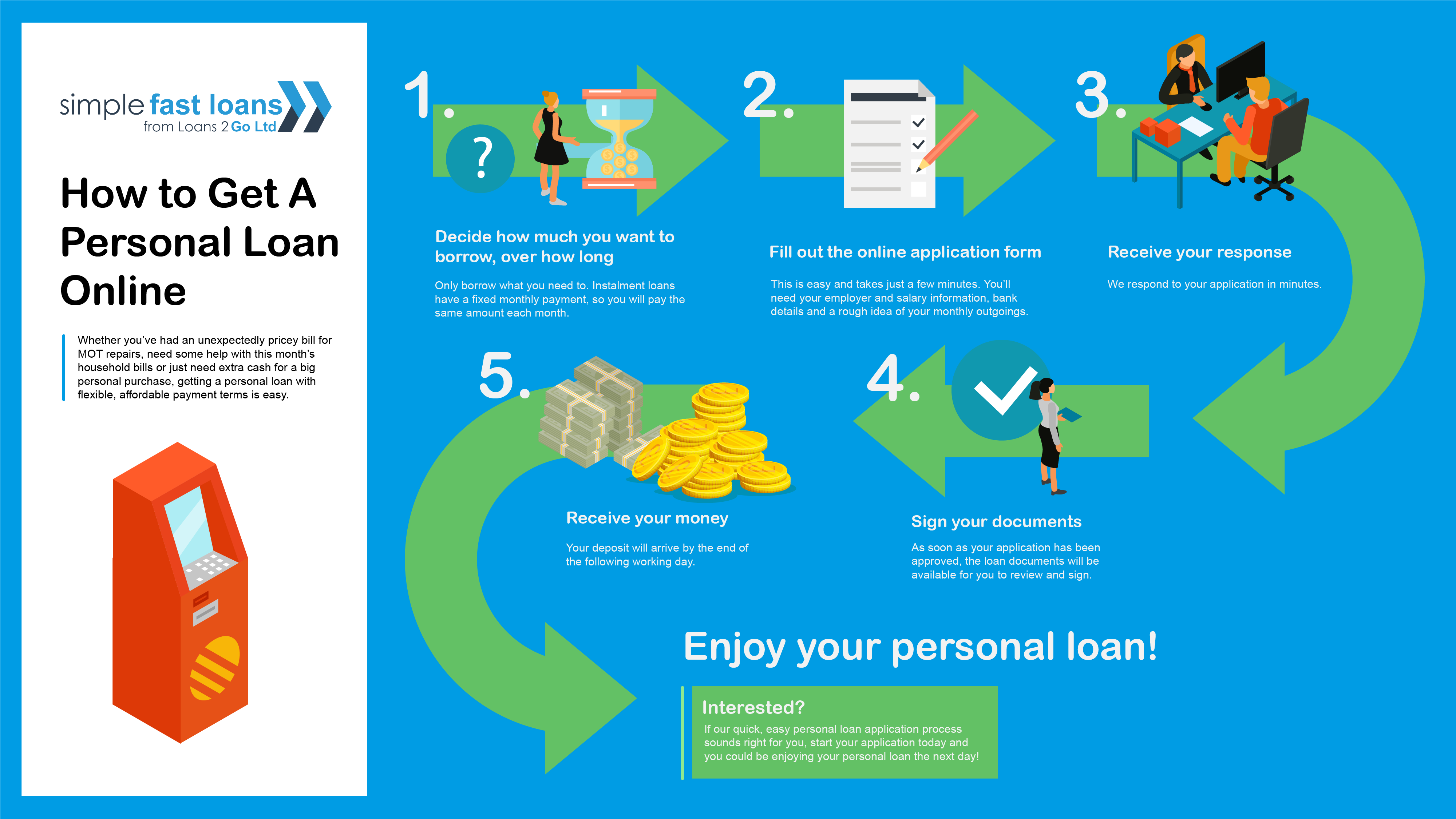

How to apply for a personal loan online

- Check your credit score. Your free credit report is available at AnnualCreditReport.com or NerdWallet. com. By doing this, you can identify and correct any mistakes before applying.

- Calculate your loan payments. To calculate the monthly payments for personal loans with varying interest rates and loan terms, use a personal loan calculator. Although a longer term will result in lower monthly payments, the total interest cost will be higher.

- Pre-qualify. To find the best interest rate, compare offers from several online lenders and check rates. A soft credit check is part of the pre-qualification process, and it has no bearing on your credit score.

- Select a lender and loan option. Select an online loan that best suits your needs in terms of rate, monthly payment, loan amount, and term.

- Collect loan documents. Upload the necessary files, which could include a W-2 or pay stub as proof of income and a form of identification.

- Complete the application and submit. After reading and comprehending the loan’s fine print, submit the application. Depending on the lender, you might get your loan in a day or two after it is approved.

Can I get a loan with bad credit?

When compared to borrowers with good or excellent credit (scores above 689), those with bad credit (scores of 629 or lower) may be eligible for a rate at the top of the lender’s range or be approved for a smaller amount.

When evaluating an applicant, some online lenders who provide loans to people with poor credit don’t just consider their credit score. In order to increase their chances of approval, they might take into account things like cash flow, employment history, and educational background.

Borrowers with poor credit can improve their online loan application in a few ways:

- Joint loan. To increase your eligibility, obtain a lower interest rate, or obtain a larger loan amount, include a co-borrower or co-signer on your loan application. This person bears the cost of the loan as well as any penalties if you are unable to repay it.

- Secured loan. Collateral, such as your car or a savings account, must be put up for a secured loan in order to help guarantee the loan. But if you don’t pay back the loan, you could lose the collateral.

- Build your credit. You can take action to improve your credit before applying for a loan if you don’t need it right away.

No-credit-check and online payday loans

Credit checks are not necessary for payday loans or no-credit-check loans, which can appear like simple solutions for urgent financial needs. Nevertheless, with triple-digit interest rates, both of these loan kinds have the potential to be costly and predatory.

If you don’t have excellent credit, online payday loans are a quick way to obtain loans for amounts less than $1,000. On the due date, payday lenders normally take repayments straight out of your bank account. These loans have annual percentage rates that are nearly 400%, which can quickly cause borrowers to owe more in interest than they did when they first took out the loan.

Credit checks are not required for loans under a few thousand dollars, and repayment terms range from a few weeks to several months. Lenders typically charge exorbitant interest rates for these loans because they don’t verify your credit score during the application process.

Payday loans and no credit check loans should only be taken into consideration as a last resort after all other options for less expensive loans have been exhausted.

Through its review process, NerdWallet assesses and ranks personal loan offerings from over 35 financial institutions and tech firms. To verify product details, we gather more than 50 data points from each lender and cross-reference them with corporate websites, earnings reports, and other publicly available documents. We might also follow up with business representatives and go through the pre-qualification process of a lender. Every year, NerdWallet writers and editors perform a thorough fact check and update. In addition, they provide updates as needed throughout the year.

Lenders that provide customer-friendly features, such as soft credit checks for pre-qualification, competitive interest rates without any fees, transparent rates and terms, flexible payment options, quick funding times, reachable customer support, payment reporting to credit bureaus, and financial education, receive points from us based on our star ratings. The lenders who engage in practices that could make a loan difficult to repay on time are penalized less in our ratings. These practices include charging high annual percentage rates (above 2036%), underwriting that fails to adequately assess the consumers’ E2%80%99% ability to repay, and lack of credit-building assistance. Regulatory actions submitted by organizations such as the Consumer Financial Protection Bureau are also taken into account. We evaluate each of these factors to determine which matters most to customers and how much they influence their experiences.

NerdWallet does not receive compensation for our star ratings. Learn more about our editorial policies and personal loan rating methods.

NerdWallet’s Best Online Loans of February 2024

- SoFi Personal Loan: Best for Online loans overall

- Discover® Personal Loans: Best for Online loans for excellent credit

- Best Egg: Best for Online loans for good credit

- Happy Money: Best for Online loans for credit card consolidation

- Upstart: Best for Online loans for fair credit

- Upgrade: Best for Online loans for bad credit

- LendingPoint: Best for Online loans for same-day funding

- LendingClub: Best for Online loans for joint loans

- LightStream: Best for Online loans with no fees

- Are loans made online safe? Depending on the lender, yes or no. It’s usually advised to conduct due diligence and select reliable lenders. Even with poor credit, online personal loans offer more affordable interest rates and flexible repayment schedules for small loans. After submitting an application, many people can fund a loan for as little as $1,000 in one business day.

- What is the best online loan? The best online loan facilitates the achievement of financial objectives, such as debt consolidation or large-scale expense coverage, without putting you under financial strain. Generally, interest rates and terms are determined by your income and credit history. Various lenders provide features that might be significant to you, such as flexible payment options or access to credit reports.

- Can I get an online loan with a co-signer? You can increase your chances of approval by adding someone to your loan application who may have a higher credit score or income. Co-sign loans are offered by some online lenders.

Annie Millerbernd is a personal loans writer. Her writing has been published in USA Today and The Associated Press. Read more about the author.

Ronita Choudhuri-Wade is a personal loans expert at NerdWallet. Among other publications, Ronita’s work has appeared in the LA Times, MarketWatch, Nasdaq, and Washington Post. Ronita has also appeared on “Mornings With Maria Bartiromo”. She is based in Tulsa, Oklahoma. Read more about the author.

FAQ

What is the easiest loan to get online?

Payday loans, installment loans, and loans from lenders who focus on subprime borrowers are usually the easiest online loans to obtain with bad credit. These loans have lower requirements or frequently don’t require a credit check, but they have expensive fees and interest rates.

How can I get a loan easily online?

You can apply for a personal loan online after contacting a bank or financial institution directly through its website to confirm your eligibility, interest rate, and amount of principal and interest due. If your loan application is accepted, the money will be transferred right away to your bank account.

How to borrow $500 quickly?

A payday loan, a credit card cash advance, or a loan app are some additional ways you can obtain a $500 loan in addition to some personal loans. In an emergency, a small loan like a payday loan might be helpful, but the interest rates will probably be higher.

Read More :

https://www.nerdwallet.com/best/loans/personal-loans/online-loans

https://www.cnbc.com/select/personal-loan-online-applications/