What to do now

Look at:

- The loan amount.

- The interest rate. When contemplating an adjustable rate mortgage (ARM), consider the worst-case situation in the event that interest rates increase.

- The monthly principal and interest payment.

- The monthly mortgage insurance payment (if any).

- Your entire monthly expenses, which include principal and interest, homeowners’ insurance (often included in escrow), property taxes, mortgage insurance, and, if relevant, home owners association dues

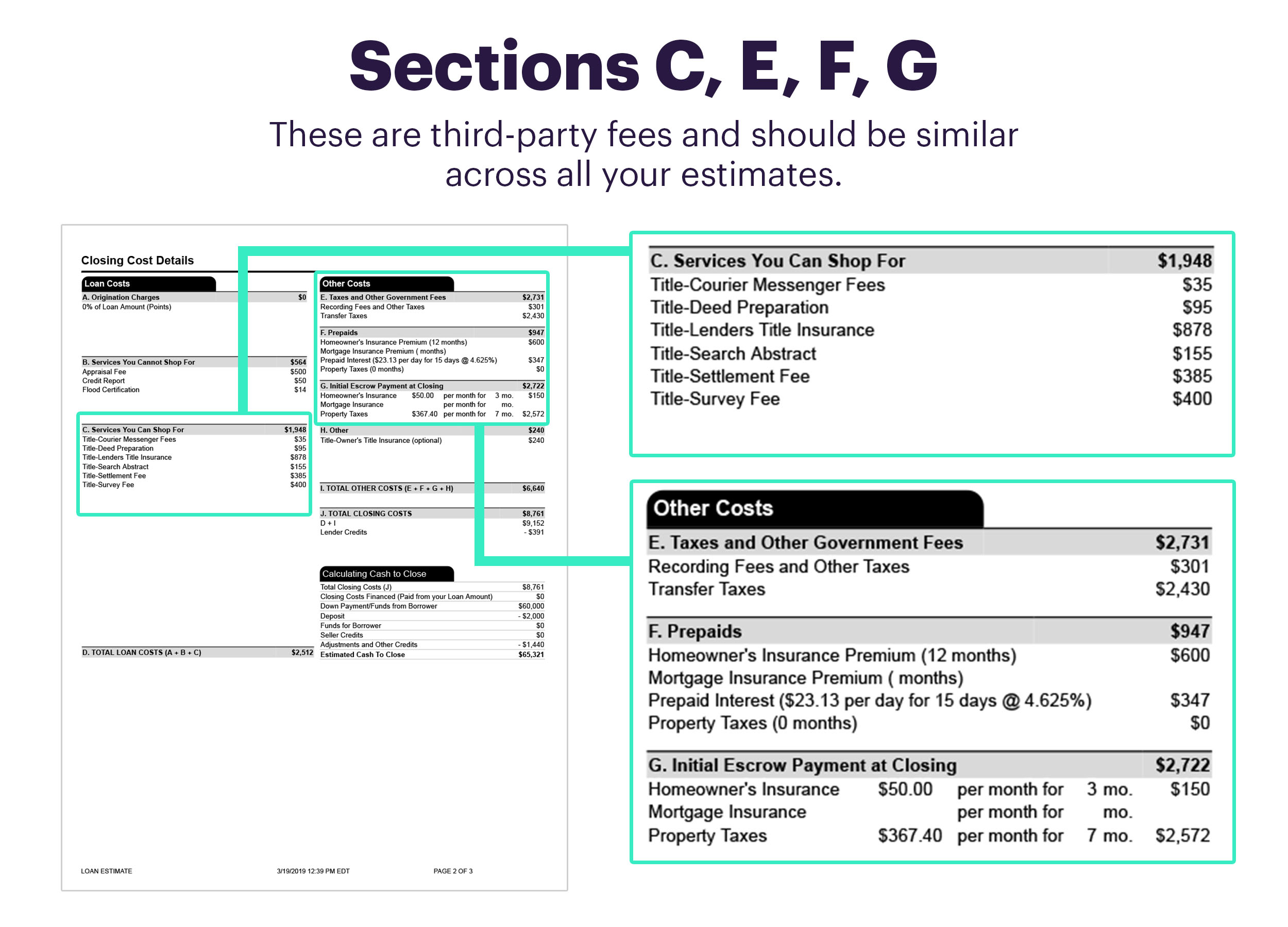

- The initial loan costs (found in Section D, Total Loan Costs, on page 2)

- The lender credits (found in Section J, Total Closing Costs, on page 2)

- The amount of cash you’ll need to bring to closing.

Take a look back at your budget

Are you comfortable that you can afford the upfront costs as well as the total amount of payments each month? How do these figures compare with your budget?

Calculate your five-year cost of borrowing

Before moving or refinancing, most borrowers hold onto their mortgages for an average of five years. Calculating the total amount you will pay in interest and fees over a five-year period is a useful way to compare loan offers, even though your situation may be different.

- Find the line that reads “In 5 years” in the Comparisons section on page 3 of the Loan Estimate. The first figure displays the total amount of money you will have to pay over a five-year period, including principal. The amount of principal you will have paid off after five years is indicated by the second number.

- After five years, you can calculate the total amount of interest and fees you will have paid by subtracting the second number from the first one. This is your five-year cost of borrowing.

- Remember that the five-year cost of an adjustable rate mortgage (ARM) is based on the assumption that interest rates will remain constant. An increase in interest rates will result in a higher actual cost of borrowing.

Compare the Annual Percentage Rate (APR)

The APR takes into account both interest and loan fees. It displays which loan has lower total cost over the course of the loan.

Subscribe to receive the most recent financial advice and updates directly in your inbox.

Know when you are comparing apples-to-apples and when you’re comparing apples-to-oranges

An adjustable-rate mortgage (ARM) is not the same as a fixed-rate mortgage, for instance.

When were your Loan Estimates issued?

Since interest rates can fluctuate on a daily basis, if two lenders offer different rates, it could be because of shifts in the market on the days the Loan Estimates were released.

Do all your Loan Estimates treat homeowners insurance and property taxes the same way (included in your monthly payment as escrow, or paid separately)?

You’ll need to make changes if they don’t in order to guarantee that your monthly payments overall are comparable.

Do all your Loan Estimates use similar numbers for estimated taxes and insurance?

It doesn’t necessarily follow that a loan is a better deal if one Loan Estimate has noticeably lower taxes and insurance. Lenders don’t control your taxes and insurance. To assist you in determining which set of figures is more realistic, ask your real estate agent.

Do your Loan Estimates list condo or homeowners’ association (HOA) dues?

You typically pay condo or HOA dues separately from your mortgage payment each month if your new home has them. In the event that the lender is missing this information, HOA dues might not show up on your loan estimate. In the event that certain amounts are included on your loan estimate by one lender but not by another, you will need to adjust the figures so that the comparison is accurate.

For additional information about the figures and facts we cite, see our sources page.

Mortgage regulations that apply to the majority of mortgages are reflected in the process and forms outlined on this page.

FAQ

What should you compare when comparing loans?

Examine the Annual Percentage Rate (APR) comparison. The APR includes both loan fees and interest. It displays which loan has lower total cost over the course of the loan.

How accurate are mortgage loan estimates?

Loan estimates are generally pretty accurate. Final loan costs are required by law to be no more than 2010% of the amount displayed on the LE. However, since mortgage rates fluctuate frequently, you should attempt to obtain loan estimates from multiple lenders on the same day to ensure that the comparisons you see are accurate.

Should you compare your loan estimate to the closing disclosure?

It displays the total amount you will have to pay if you proceed with the loan and closing. Advice: To ensure that all of the important terms of your loan are as promised, compare your Loan Estimate from the same lender with your Closing Disclosure in order to keep your lender honest.

How many loan estimates should I get?

Obtaining at least three Loan Estimates from three different lenders is a great way to compare rates and terms of different mortgage lenders, even though it may be tempting to work with just one.

Read More :

https://www.consumerfinance.gov/owning-a-home/compare/compare-loan-estimates/

https://www.bankrate.com/mortgages/how-to-compare-loan-estimates/