How We Make Money

The businesses whose offers you see on this website pay us. Unless our mortgage, home equity, and other home lending products are specifically prohibited by law, this compensation may have an impact on how and where products appear on this website, including, for example, the order in which they may appear within the listing categories. However, this payment has no bearing on the content we post or the user reviews you see here. We don’t include the range of businesses or loan options that you might have.

FAQ

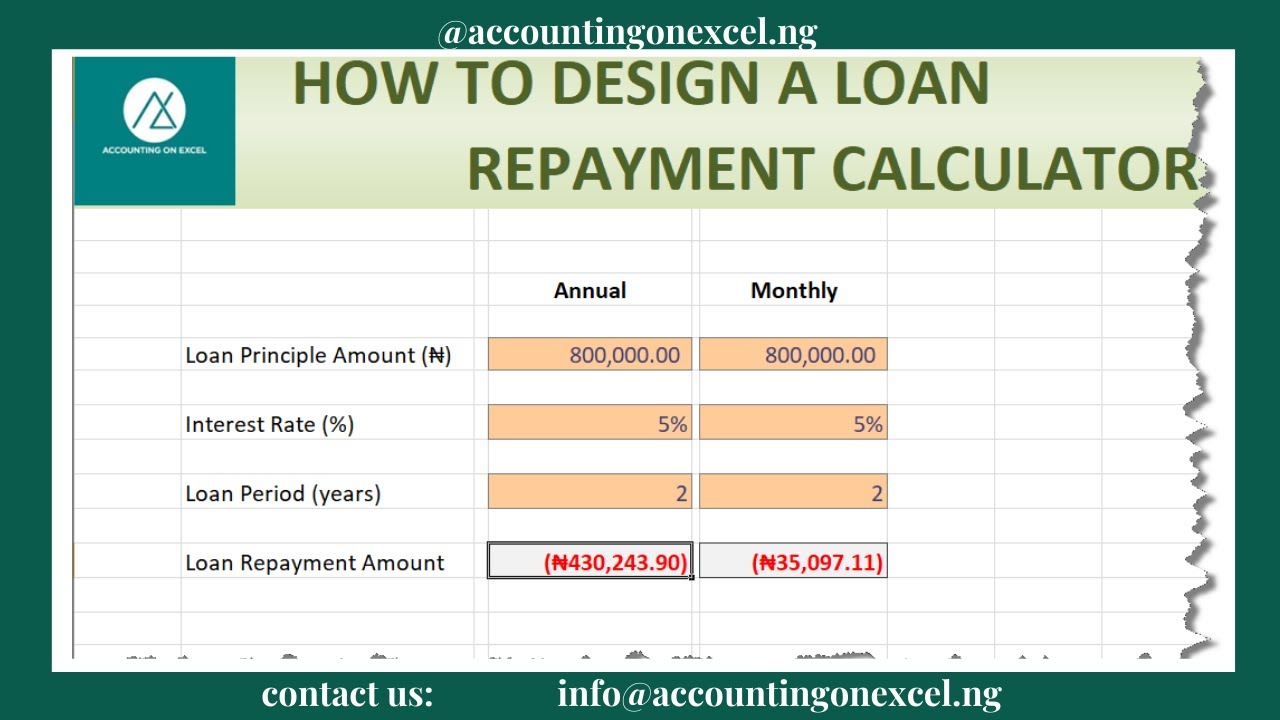

What is the formula for calculating loan repayments?

Therefore, you must divide your interest rate by 12 to get your monthly loan payment. Whatever figure you get, multiply it by your principal. A more straightforward approach is principal x (interest rate / 12) = monthly payment.

How do you calculate monthly loan payments?

The interest rate (i divided by 12), the number of monthly payments (n), the monthly payment (M), and the loan amount (P) are all included in the formula.

How do I calculate the total amount to repay a loan?

You will need to multiply the principal amount borrowed by one plus the interest rate in order to determine the total amount paid at the conclusion of the number of years you repay your loan. Next, increase that amount by the number of years. The equation looks like this: F = P(1 + i)^N.

What is the formula to calculate interest for loan repayment?

How to calculate simple interest. The following formula can be used to determine your total interest: principal loan amount x interest rate x loan term = interest.

Read More :

https://www.bankrate.com/loans/personal-loans/how-to-calculate-loan-payments/

https://www.bankrate.com/loans/loan-calculator/