What Is Student Loan Deferment?

For a maximum of three years, qualified applicants may choose to stop making loan payments entirely or to reduce them with a student loan deferment.

Federally subsidized loans do not accrue interest during the deferment period because the interest payments are covered by the government. Interest does accrue on unsubsidized loans and is added to the total amount owed at the conclusion of the deferment period.

- Although a student loan deferment allows you to stop making payments for a maximum of three years, the loan remains outstanding.

- It is necessary for you to apply and be granted a deferment if you are not enrolled in school full-time.

- Federally subsidized loans do not accrue interest while they are being deferred.

- Unsubsidized loans do carry interest, which is added to your loan at the conclusion of the deferral period.

- Private student loan deferments differ from lender to lender and are not available from all lenders.

The following information does not refer to the special rules that were implemented in reaction to the COVID-19 pandemic; rather, it is based on the standard principles of student loan deferment.

Should You Defer Your Student Loan Payments?

The following are some questions you should ask yourself before pursuing student loan deferment:

- Do I have Perkins Loans or federally subsidized loans? Interest on Perkins Loans and federally subsidized loans does not accrue during the deferment period. If you don’t make interest payments on your unsubsidized federal or private loans during the deferment period, interest will probably continue to accrue.

- Is it feasible for me to make a smaller loan payment? If not, a deferment might give you some breathing room until you can start making payments again. Deferment is considered a temporary measure. A plan with income-driven repayment (IDR) may be more sensible if you require a longer-term lower payment.

- Will I soon be able to resume my student loan payments? If so, deferment could be a useful strategy to help you get through a brief financial snag. Deferment might not be the best choice if you don’t see a way to pay later on.

The COVID-19-related student loan relief measure ended in September 2023. Payments resumed in October 2023.

Qualifying for a Student Loan Deferment

It is not enough to just stop making student loan payments and put your loans into deferment. You must be eligible, which entails completing an application and coordinating with your lender or loan servicer.

Your loan servicer or lender will review your application, notify you if further information is required, and determine your eligibility. It’s crucial that you keep up your timely loan payments while you’re waiting for a decision. If you don’t, your credit score could suffer greatly and you could end up in default on your loan.

Federal Student Loan Deferment

Most federal student loan deferments require that you apply. There is just one kind that is automatic if you are enrolled at least half-time; it’s called in-school deferment. You must apply if you think you are eligible for a deferment under other circumstances.

To do that, go to the U.S. Department of Education’s Federal Student Aid Forms website, click on Loan Deferment and Forbearance, and retrieve an application for the type of deferment for which you believe you qualify.

Private Student Loan Deferment

You must get in direct contact with your lender in order to postpone a private student loan. If you are unemployed, in the military, or enrolled in school, many offer some kind of relief or deferment. Some also provide deferment for economic hardship.

Most of the time, any delay of a private loan entails accrued interest that is added at the end of the deferment period, just like with unsubsidized federal loans. By making interest payments as they come due, you can prevent this.

Another option to postpone repayments is through forbearance. As with deferment, it’s a temporary fix. If you anticipate that your financial difficulties will persist, an income-driven repayment (IDR) plan might be a better choice.

Types of Federal Student Loan Deferment

The following deferment types apply to federal student loans. As previously mentioned, some private lenders also provide payment relief; however, each lender has different requirements, rules, and types of relief.

In-School Student Deferment

The federal government only provides one automatic deferment, and that is now. It comes with a condition that you attend classes for at least half of the time.

Your loan payments will be suspended for six months following your graduation or withdrawal from school if you have an unsubsidized or subsidized direct federal Stafford student loan, or if you are a graduate or professional student with a direct PLUS or Federal Family Education Loan (FFEL) PLUS loan. Repayment of Parent Loan for Undergraduate Students (PLUS) loans must commence as soon as the borrowers graduate from college for all others.

Request that your loan servicer receive your enrollment details from your school’s admissions office if you don’t receive an automatic deferment.

In-School Parent Deferment

You are qualified for deferment if you are a parent who obtained a direct PLUS or FFEL PLUS loan and the student for whom you obtained the loan is enrolled at least half-time; however, you will need to make a request for it.

You will have the same six-month grace period as students during your deferment. For either kind of in-school deferment, there is no time restriction.

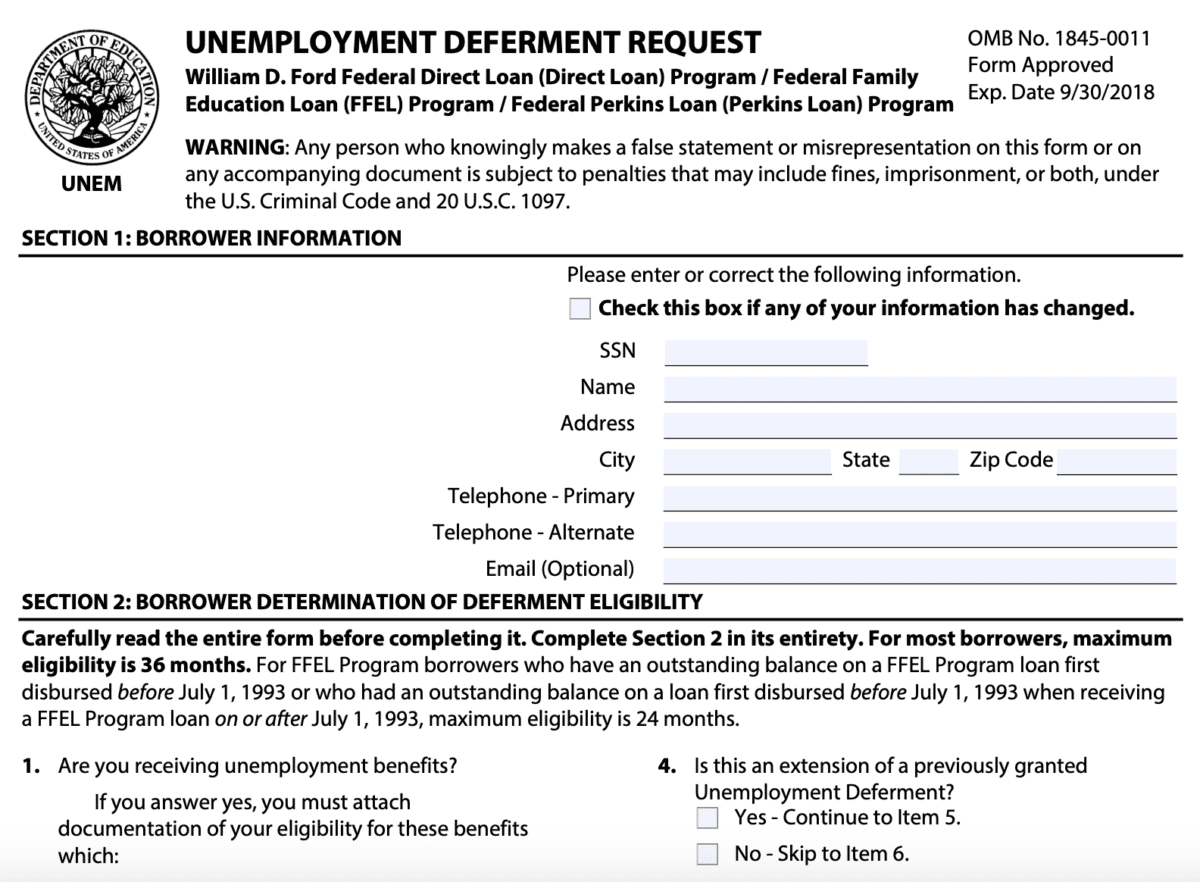

Unemployment Deferment

If you are unable to find full-time employment or become unemployed, you may request a deferment for a maximum of three years.

You must be seeking full-time employment by registering with an employment agency or be receiving unemployment benefits in order to be eligible. You must reapply for this deferment every six months.

Economic Hardship Deferment

If you receive state or federal assistance, such as through the Temporary Assistance for Needy Families (TANF) or Supplemental Nutrition Assistance Program (SNAP), you may be eligible for an economic hardship deferment for a maximum of three years. In the event that your monthly income falls below 50% of your state’s poverty guidelines, the same applies.

Peace Corps Deferment

If you are a Peace Corps volunteer, you may also be eligible for a deferment of up to three years. While serving in the Peace Corps entitles you to an economic hardship deferment, you are not obliged to reapply during this time.

Military Deferment

Student loan deferment may be available to you if you are serving on active duty in the military during a war, military operation, or national emergency. This may include a grace period of 13 months after the conclusion of your service or until you return to the classroom at least part-time.

Cancer Treatment Deferment

If you have cancer, you can ask for your student loan debt to be suspended both during your treatment and for six months after it ends.

Other Deferment Options

In the event that none of the aforementioned deferments apply to you, you might be eligible for one of the following:

- Deferment of graduate fellowship if you are enrolled in an authorized program

- Deferment of rehabilitation training, provided that you are enrolled in a recognized program for rehabilitation

- Deferment of Perkins Loan Forgiveness if you were granted a Perkins Loan and are actively seeking to have it canceled

- Additional or improved deferment options for FFEL or direct loans obtained prior to July 1, 1993 Contact your loan servicer for details.

How Student Loan Interest Is Calculated

The method used to compute interest on student loans differs slightly from that used to calculate interest on the majority of other loans. Interest on student loans is added to the balance on a daily basis, but it is not compounded. Instead, a portion of the principal as well as the interest for that month are included in your monthly payment.

Here’s an example of how it works:

- Loan total = $20,000

- Annual percentage rate (APR) = 7%

- Daily interest rate (APR divided by 365) = 0. 07 ÷ 365 = 0. 00019 or 0. 019%.

- Daily interest amount = $20,000 × 0 (balance times daily interest rate). 019% = $3. 80.

Your loan’s balance and daily interest amount decrease as you make payments on it. However, because the interest is not capitalized—that is, added to the loan—until the end of the deferment period, the daily interest amount on your loan stays the same until you start repaying it.

The Cost of Deferment

Deferment can be expensive if you have unsubsidized federal student loans or private loans. This is due to the fact that, in contrast to subsidized loans, interest on these loans is capitalized—that is, added to the outstanding balance—at the conclusion of the deferment period. This raises the total amount you will pay back over the course of the loan as well as the amount you owe when you start repaying it.

Let’s say you obtain a $20,000 student loan and pay it back over the course of 2010 years at an interest rate of 7% annually. The amounts you would pay under each of the following four scenarios are displayed in the table below:

- Paid as agreed

- Subsidized with 36 months of interest-free deferment

- Unsubsidized with a 36-month deferment but paying interest during deferment

- unsubsidized, deferred for 36 months, and interest-free during that time

| Payments on a 10-Year $20,000 Student Loan* | |||||

|---|---|---|---|---|---|

| Monthly Payment | Years 1–3 | Years 4–10 | Years 11–13 | Interest | Total |

| (1) Paid as agreed | $232 | $232 | $0 | $7,840 | $27,840 |

| (2) Subsidized | $0 | $232 | $232 | $7,840 | $27,840 |

| (3) Unsubsidized/interest paid | $116 | $232 | $232 | $12,016 | $32,016 |

| (4) Unsubsidized/no interest paid | $0 | $281 | $281 | $9,559 | $33,720 |

The above table shows that if an unsubsidized loan is placed on three-year deferment and no interest is paid during this time (scenario 4), the amount owed will be higher ($24,161 vs. $20,000) when repayment begins. Your total loan repayment over the course of the loan will increase by nearly $6,000 due to the additional interest and the nearly $50 increase in monthly payments.

Alternatives to Deferment

There are two alternatives to student loan deferment that you may want to think about, depending on your situation:

Forbearance

If you’re not eligible for deferment, you might be able to use forbearance. The primary distinction between forbearance and deferment is that, in the former case, interest is always charged and added to your loan at the conclusion of the deferment period unless you choose to pay it as it becomes due. (The above scenarios 3 and 4 show what occurs to any loan that is placed in forbearance.) ).

Income-Driven Repayment (IDR)

An income-driven repayment (IDR) plan can be the best option for you if you anticipate that your financial issues will persist for longer than three years. Your monthly payments under these plans are determined by your family size and income.

IDR plans provide loan forgiveness if your loan isn’t paid off after 20 to 25 years, and they even offer payments as low as $0. If your payments are insufficient to cover accrued interest, many income-driven plans waive interest for a maximum of three years. Since IDRs lengthen the loan term, you will probably pay more interest overall over the course of the loan than you would if you chose deferment.

A significant warning: IDRs can only be used to settle federal student loans. This is a significant argument against combining private and federal loans into a single, consolidated loan. If you do this, the federal loan portion of your combined debt will no longer be eligible for IDR.

How Long Is a Student Loan Deferment?

You can stop making loan payments for up to three years if you qualify for student loan deferment.

What Should I Do If I Don’t Know When I Can Start Paying Again?

If you’re uncertain about when you’ll be able to pay back your student loans, you might want to think about enrolling in an income-based repayment (IBR) plan. Deferment and forbearance are just temporary solutions.

Are There Any Fees for Deferments or Forbearance?

While there are no costs involved in deferring or forbearing your student loans, you will typically be charged interest. Deferment can be expensive if you have unsubsidized federal student loans or private loans.

The Bottom Line

If you have Perkins Loans or federally subsidized loans, student loan deferment makes the most sense because no interest is charged on these loans. If you are not eligible for a deferment, you should only consider forbearance. Remember that deferment and forbearance are for short-term financial difficulty.

If you are repaying federal student loan debt and your financial difficulties are expected to last longer than three years, income-driven repayment (IDR) is a preferable choice.

In all situations, if you are having problems paying your student loans, be sure to get in touch with your loan servicer right away. Article Sources: Investopedia mandates that authors cite original sources to bolster their claims. These consist of government data, original reporting, white papers, and conversations with professionals in the field. When appropriate, we also cite original research from other respectable publishers. You can read more about the guidelines we adhere to when creating impartial, truthful content in our

FAQ

How do you qualify for loan deferment?

ESTABLISHING THE MAXIMUM MONTHLY GROSS INCOME To be eligible for an economic hardship deferment, the borrower’s monthly gross income cannot exceed the higher of two amounts: either the monthly gross income of a minimum wage earner or the monthly gross income of a family of two at 100% of the poverty line.

Is loan deferment a good idea?

Deferring your student loans is usually a better option if you qualify for it. If you have subsidized loans or Perkins Loans, you may be able to freeze payments for a longer period of time than you would in forbearance, and interest will not be charged. However, apply for forbearance if you’re having financial difficulties and there isn’t a deferment available.

Read More :

https://studentaid.gov/manage-loans/lower-payments/get-temporary-relief/deferment

https://studentaid.gov/help-center/answers/article/how-can-i-apply-for-loan-deferment