Can You Get Pre-Approved for a VA Loan?

It is true that both veterans and those presently serving in the armed forces can be pre-approved for a VA loan. Griffin Funding offers pre-approval for VA loans; to apply, either online or by phone, contact us. All you have to do to be pre-approved for a VA loan is send us your Certificate of Eligibility (COE) and a few basic details.

Why Get Pre-Approved for a VA Loan?

If you are looking to purchase a home and you qualify, it is highly recommended that you get pre-approved for a VA loan. The following are advantages of having a VA loan pre-approved:

- Be aware of your financial situation: It’s much simpler to enter the buyer’s market when you’ve been pre-approved for a VA loan and know exactly how much you can afford.

- Become a competitive buyer: People who are pre-approved for a government-backed VA loan are more likely to be recognized as competitive and qualified buyers. Finding the house of your dreams is made easier and more flexible when you have the option to make offers on properties.

- Know the terms of your loan: Having a clear understanding of your VA loan terms in advance will give you comfort and clarity. You will be guided through the terms that are most important for your VA loan during the pre-approval process.

- Streamline the closing process: Having your VA loan application pre-approved allows you to expedite the closing process after you’ve decided on a home to buy. This is a noteworthy benefit. Because VA loans are government-backed, they ensure that closing costs and other fees are minimized and the process proceeds as smoothly as possible during the home-buying process.

How to Get Pre-Approved for a VA Loan

It’s critical to comprehend the requirements in order to be pre-approved for VA loan opportunities before you start looking into and comparing VA loan rates. Applicants must meet at least one of the following requirements in order to be approved for a VA loan:

- A minimum of 181 days of active duty during peacetime must have been served by the individual.

- People have to have been on active duty during a war for at least ninety-nine days.

- spouses of veterans or active duty members killed while performing their duties If a spouse of a military member died as a result of another service-related disability or was killed in action (KIA), they may also be eligible for a loan backed by the VA.

- According to Title 32, veterans must have completed at least 90 days of active duty or at least six years of service in the National Guard or Reserves. At least thirty of the ninety days that are served have to be consecutive.

The mortgage lender you select will examine your debt load, active or retired military status, and current credit score during the pre-approval process. Although a flawless credit score is not a requirement for a VA loan, having a higher credit score will enable you to get better terms and interest rates.

VA Loan Pre-Approval vs. Pre-Qualification

Recognize the distinctions between pre-approval and pre-qualification before submitting your VA loan application. Pre-qualification and pre-approval for a VA loan are two different processes.

Lenders will review your credit scores from several credit reporting agencies and your current debt during the pre-qualification phase of applying for a VA loan. Along with your current income, you might also be asked for details about your personal assets. During the pre-qualification phase, this basic data will assist lenders in determining your debt-to-income ratio, or DTI. It is much simpler to calculate the loan amount you qualify for based on your current DTI and anticipated income after this is done.

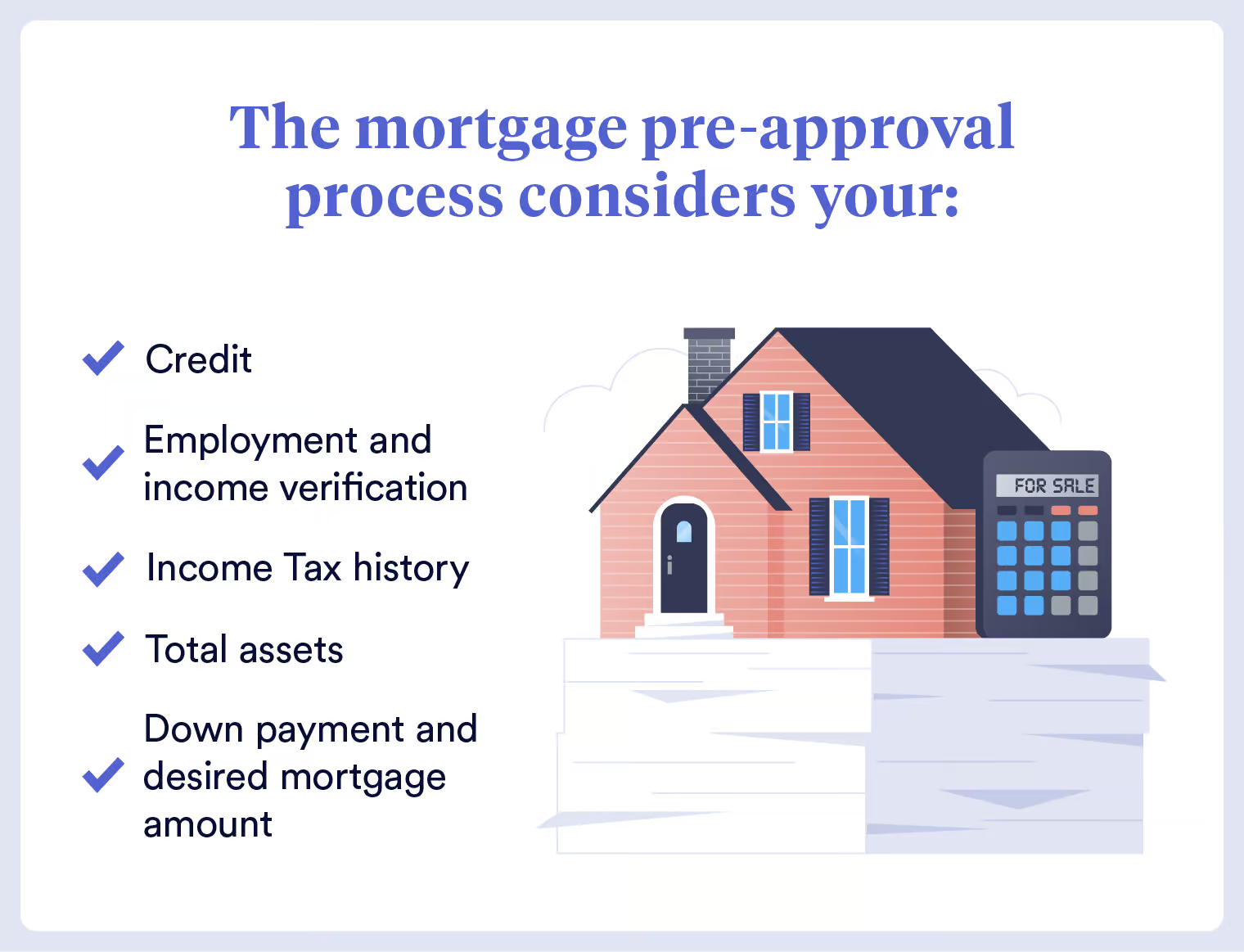

Following the completion of the pre-qualification procedure, you can proceed to getting pre-approved for a VA loan. The following will be part of the VA loan pre-approval process:

- Credit check: After you move through the VA loan pre-approval process, another credit check will be carried out. This will support the verification of both your total debt-to-income ratio, or DTI, and your current debt. Remember that when applying for a VA loan, your credit score matters less than it does for a conventional mortgage loan.

- Statement of Service: To demonstrate that you are currently serving in the military, you will also need to submit a statement of service. Only those who are presently on active duty are covered by this. In order to verify their eligibility for a VA loan, veterans might be required to submit previous documentation of their military service, such as their COE.

Documents Needed to Get VA Loan Pre-Approval

If you are considering applying for a VA loan, bear in mind that in order to complete the process, you will need to provide a number of documents. For those who are veterans or currently serving in the military, lenders will need the following paperwork:

- Identification: A driver’s license or Social Security card or number, among other forms of identification, will be required of you.

- The VA will provide you with a Certificate of Eligibility (COE) if you satisfy the minimal service requirements and are eligible for VA loan benefits.

- Verification of employment: Those applying for a VA loan must attest to their current employment. This could include current pay stubs and W-2s from previous years to confirm income.

- Asset verification: When completing the pre-approval procedure for a VA loan, bank statements, evidence of assets, and even retirement accounts may be taken into consideration.

How Long Does It Take to Get Pre-Approved for a VA Loan?

While searching for a new residence for you and your family, being aware of the VA loan timeline can help you keep your peace of mind. It’s crucial to keep in mind that each VA loan has different requirements when attempting to get pre-approved. Nonetheless, the VA loan pre-approval procedure typically doesn’t take any longer than that of a conventional mortgage loan.

If you have all the necessary paperwork, the VA loan pre-approval procedure can proceed swiftly. At Griffin Funding, we frequently offer pre-approval for VA loans in less than a week. Following your pre-approval, your pre-approval letter will be valid for 60 to 90 days, giving you a specific window of time to look for a house and make a decision.

Check with Griffin Funding to see if you are eligible for a VA loan. Apply Today.

Get VA Loan Pre-Approval Through Griffin Funding

Griffin Funding can assist you whether this is your first VA loan application or you are interested in learning more about the pre-approval procedure. Griffin Funding is available to help you if you’re considering refinancing or to walk you through the process of getting pre-approved for a VA loan for your first residence. Get in contact with the Griffin Funding team to begin the pre-approval process for a VA loan!

FAQ

Does a VA home loan pre approval affect credit score?

Lenders obtain your current credit scores by performing what is called a “hard inquiry” with your consent. Your credit score may be negatively impacted by a hard credit inquiry, but usually only by a few, if any, points.

How long are pre approved loans good for?

A preapproval letter, which is an offer (not a commitment) to lend you a certain amount for a period of 90 days, will be given to you if you are preapproved.

Can a VA loan be denied after pre approval?

Calling your loan officer is the first step to take when learning that your VA loan was rejected following preapproval, regardless of whether it was denied by Veterans United or another lender. They ought to be able to provide a detailed explanation for your denial as well as suggestions on how to strengthen your future home-buying prospects.

How long is a VA loan offer good for?

Does a veteran’s home loan entitlement expire? No. Home loan entitlement is generally good until used. But military personnel’s eligibility is only available while they are on active duty.

Read More :

https://www.valoansforvets.com/how-long-does-it-take-to-get-va-loan-approval/