Factors that Affect Boat Financing Terms

The financing terms for boat loans can vary depending on a number of factors, just like for other kinds of loans.

- Boat age: In general, better financing terms are associated with newer boats because lenders can more readily recover their costs in the event that the borrower defaults and the lender is forced to sell the boat. Older boat loans often have longer terms and higher interest rates. Usually, lenders won’t finance a boat that is more than 20 years old.

- Loan amount: How long you can finance something may depend in part on how much you need to borrow. In general, you can finance something for a longer period of time if you borrow more money.

- Boat type: Although loans for the majority of contemporary powerboats are handled similarly, loans for some boat types might have more particular conditions. These consist of sailboats, vessels with wooden hulls, racing or high performance vessels, and vessels that can be used as homes, like houseboats and yachts.

How Boat Loans Work

Many of the terms associated with other loans are also present in boat loans.

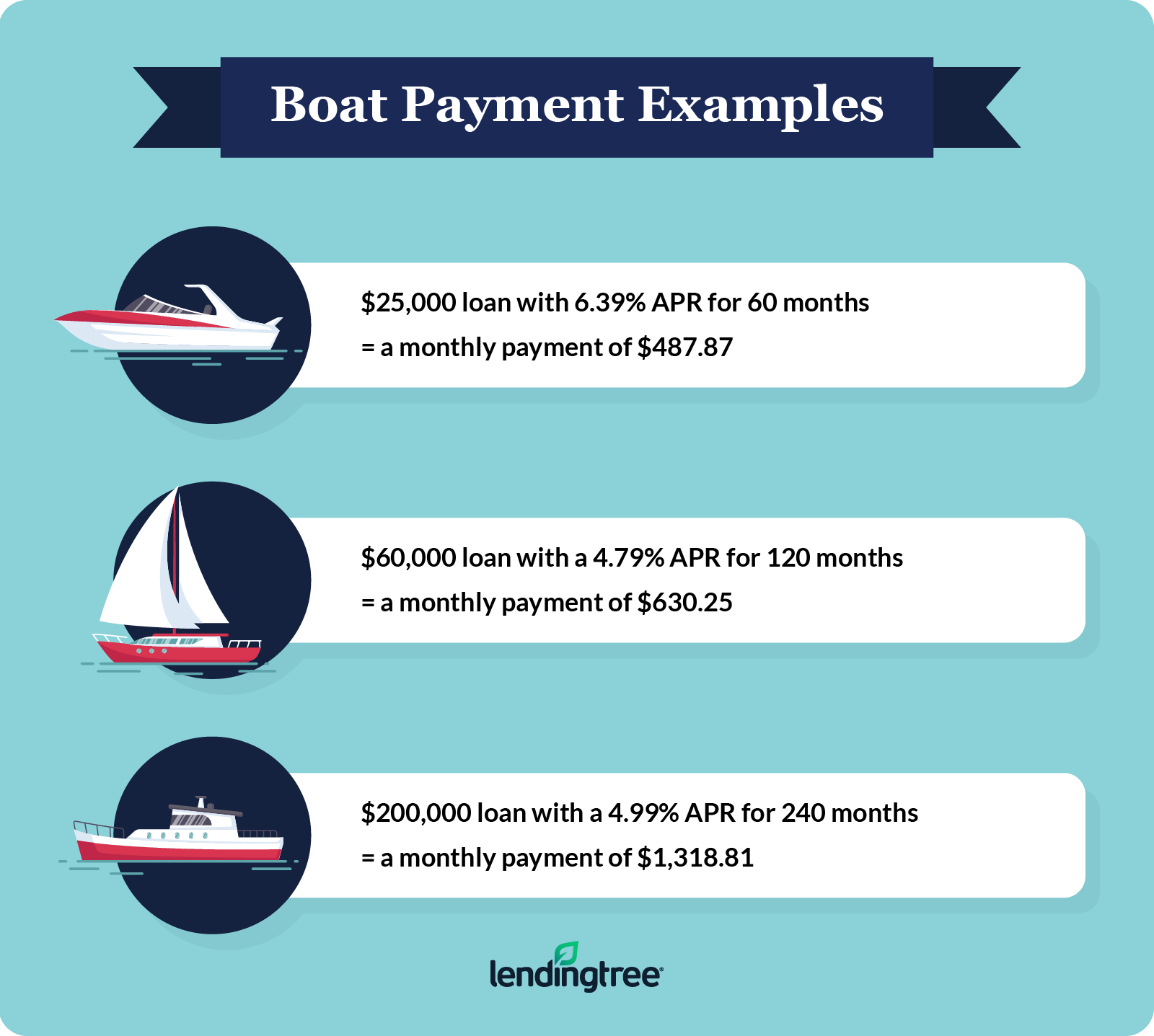

- APR range: For boat loans, interest rates normally begin at 6% to 7%, but this can vary depending on the lender, the amount of the down payment, and the borrower’s credit score and history.

- Amount range: Depending on the kind and age of the boat, boat loans can have a wide range of amounts. Lenders could finance anywhere from $5,000 to $5 million.

- Lenders have different requirements, but some common ones are a minimum credit score, income levels, and a loan-to-value ratio (the ratio of the loan amount to the boat’s market value).

- Boat requirements: Depending on the age of the boat, the lender may restrict the amount it will lend, if at all.

- Fees: These consist of closing costs, processing fees, application and origination fees. Lenders may also charge prepayment penalties if you wish to pay off the loan early and late fees for past-due payments.

Other Considerations

The loan terms may also be impacted by the loan type and interest rate.

The monthly loan payments for a boat loan with a fixed interest rate won’t change over the course of the loan. A boat loan with a variable interest rate may have regular rate changes, which could result in an increase or decrease in the monthly payment over the course of the loan.

When you take out a secured loan, the lender uses your boat as collateral. This means that if you don’t make your payments as agreed upon, the lender has the right to take your boat back and sell it to cover the loan balance.

You won’t have to worry about losing your boat if you default on an unsecured loan. But because the lender is taking on more risk, unsecured loans might have higher interest rates and/or require a larger down payment.

Where to Find a Boat Loan

There are many lenders who offer boat loans, from your neighborhood bank to licensed marine brokers. Thus, just like other personal loan categories, boat loans are available online and through physical lenders.

Banks and Credit Unions

When looking for a boat loan, speak with a banking specialist at your present bank or credit union as many banks and credit unions offer boat loans. If you currently use a loan, you might be eligible for better terms, like lower interest rates.

Online Lenders

Online lenders often offer lower interest rates on loans, including boat loans, because they don’t have the same overhead as physical financial institutions. Compare the loan terms offered by several online lenders when looking for a boat loan.

Dealer Financing

Boat dealers may provide financing when you buy a boat, just like auto dealers do. However, when compared to other lenders like your bank or credit union, dealer financing might have higher interest rates or come with extra fees.

Boat Lender Options

| Boat Loan Lenders With Varying Loan Limits | ||||

|---|---|---|---|---|

| Lender | Starting Interest Rate | Minimum Credit Score Required | Loan Amount | Loan Terms |

| Lightstream | 7.49% w/autopay | None, but good credit recommended | $100,000 maximum | 24 to 144 months |

| BMO | 9.14% | 700 | $5 million maximum | 5 to 20 years |

| Southeast Financial | 7.49% | 550 | $10,000 to $4 million | Up to 20 years |

| Mountain America Credit Union | 8.99% | None | Unknown | Up to 15 years |

Alternatives to Boat Loans

A home equity loan or a personal loan are two additional financing options for buying a boat besides boat loans.

Home Equity Loans or Home Equity Lines of Credit

You might be able to use the equity in your house as collateral for a secured loan if you are the owner. A home equity loan is an installment loan that you pay back over time after receiving money in one lump amount.

Your house is used as collateral for a home equity line of credit (HELOC), but instead of receiving a lump sum payment, you get a credit line that functions much like a credit card. You only have to pay interest on the money you borrow, so you can use as much of the credit line as you need. You can borrow money again once you pay it back.

Because home equity loans and home equity lines of credit are secured by collateral, which reduces the risk for lenders, they can offer a larger amount of money at a lower interest rate. But, you run the risk of losing your home to foreclosure if you are unable to repay these loans.

Personal Loans

You might be eligible for an unsecured personal loan to buy a boat if your credit is good. Your credit score and financial details, such as your income, are taken into consideration when approving personal loans. But they are not backed by collateral. Although personal loans have higher interest rates than secured boat loans, there are several uses for them.

You get a one-time payment with a personal loan that you can use for your bills. The loan is then repaid over a predetermined period of time. Personal loans typically have terms of two to five years. The maximum amount most lenders offer is between $30,000 and $50,000, but some might offer up to $100,000.

How Old Can a Boat Be to Get Financing?

Generally speaking, lenders won’t fund boat loans for vessels older than 20 years. You might need to apply for an unsecured personal loan that can be used for a variety of things, including purchasing a boat, if you want to buy an older boat.

What Credit Score Do I Need to Get a Boat Loan?

Lender requirements for credit scores vary, with some having as low as 550. Your likelihood of paying more interest increases with a lower credit score.

What Is the Average Interest Rate on a Boat Loan?

Interest rates vary depending on several factors, but they usually begin between 6% and 7%. Your local bank or credit union is a good place to start, though this varies by lender.

What Time of the Year Are Boats the Cheapest?

Fall is typically the slowest time of year to purchase a boat, so you might be able to find a fantastic offer, including favorable loan terms. When a local boat show is held or newer boat models are introduced, you might be able to score a good deal on a boat.

Do Boats Hold Their Value?

Boat values decrease with age, just like the values of other kinds of vehicles, so the older the boat, the less it is worth. Boats do not usually appreciate in value as other assets, like houses, do.

The Bottom Line

Generally speaking, boat loans have terms of 10 to 20 years, depending on the loan amount, boat age, and boat type. Many lenders offer boat loans, including banks, credit unions, and unions, online lenders, the boat dealer, and marine brokers. Your financial situation and the length of the boat loan will determine the best option. Article Sources: Investopedia mandates that authors cite original sources to bolster their claims. These consist of government data, original reporting, white papers, and conversations with professionals in the field. When appropriate, we also cite original research from other respectable publishers. You can read more about the guidelines we adhere to when creating impartial, truthful content in our

You consent to the use of cookies on your device to improve site navigation, track user activity, and support our marketing initiatives by selecting the option to “Accept All Cookies.”

FAQ

How long can you finance a $100 K boat?

The loan repayment terms are contingent upon the vessel’s year, credit profile, and the amount financed. These days, marine lenders only offer terms up to 20 years, which are usually associated with financed amounts greater than $100,000.

What are typical boat financing terms?

What is the typical duration of a boat loan? While terms for secured loans (which use the boat as collateral) from IFG’s recreational finance banks typically reach up to 20 years (240 months), unsecured boat loans (which do not use the boat as collateral) from general banks typically range between two and seven years.

How long do most people finance boats?

Boat financing terms generally range between 10 to 15 years. For refinancing and new or used boat loans, Mountain America provides flexible financing options. Some people may prefer a longer term with lower payments, while others may select a shorter financing term with a higher payment.

Why are boat loans longer?

A boat can be financed for up to 15 years by many lenders. Because many new boats cost significantly more than cars, a long term loan is frequently required. This helps to keep your monthly payments manageable. An important drawback of a long loan term is to take it into consideration.

Read More :

https://www.macu.com/loans/vehicle-loans/boat

https://www.investopedia.com/how-long-are-boat-loans-7975687