What Is a Mortgage Preapproval?

A mortgage preapproval is a letter from a lender stating that you are qualified to purchase a home with a conditional mortgage loan, up to a certain amount. It typically details the kind of loan you are eligible for as well as the interest rate you will pay the lender once your complete mortgage application is submitted.

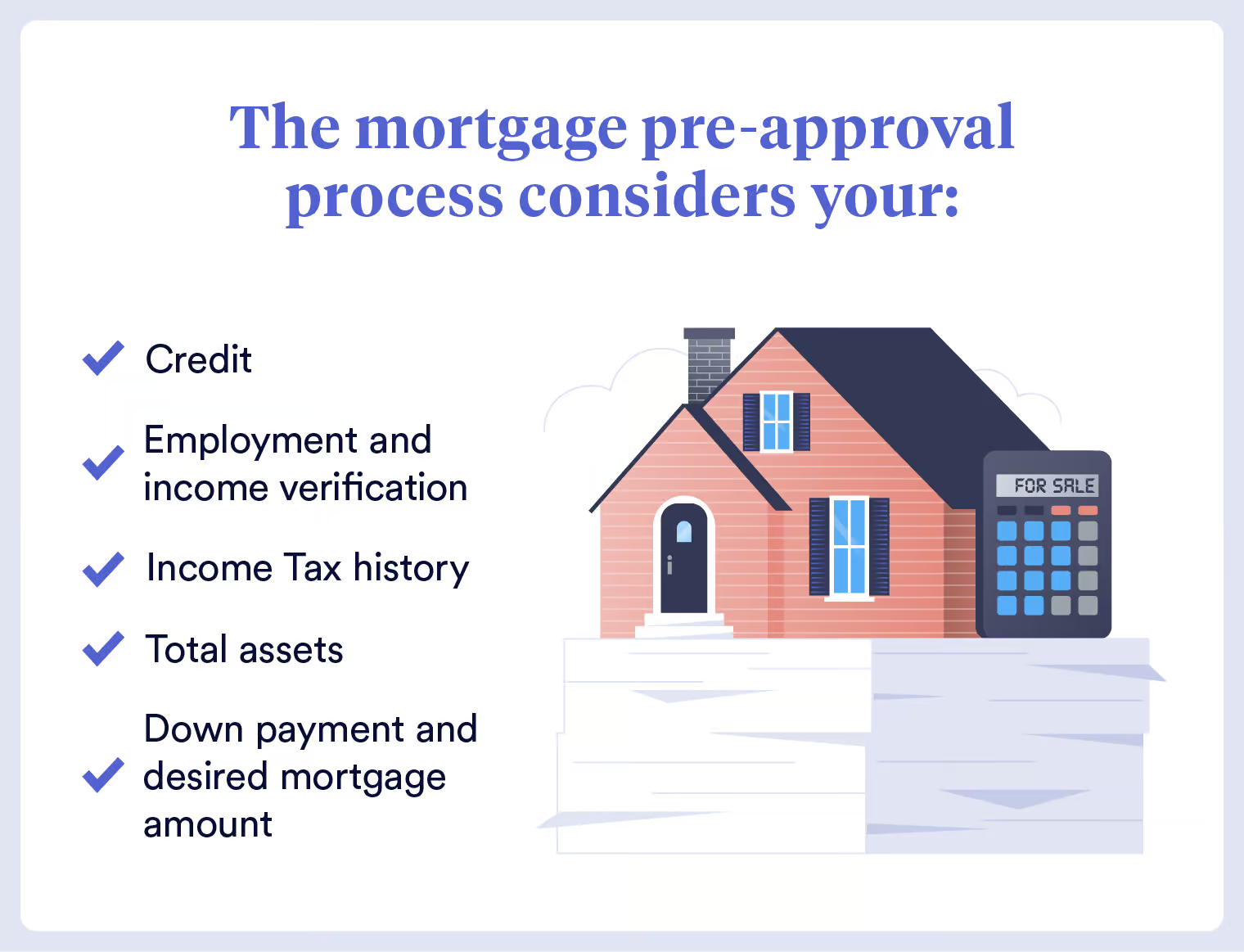

Applying for a mortgage and getting preapproved are nearly identical processes. Your lender will examine your credit report and credit score in addition to evaluating your income, assets, debt, and work history. Remember that preapproval should only be considered an initial document. This means that until they have verified the information about you and any other borrowers on the loan application, as well as the property you wish to buy, your lender will not fully approve your loan or finalize terms.

Because it attests to your ability to follow through on a purchase offer, a mortgage preapproval letter is valuable. When a seller is evaluating multiple comparable offers for a property, a bidder with preapproved financing may have an advantage over others who do not, as your ability to secure financing is more certain than that of rival bidders. This can be a significant advantage in competitive housing markets. Sellers in competitive real estate markets might only take offers from potential purchasers who have already received loan preapproval.

How Soon Should I Get Preapproved for a Mortgage?

Generally speaking, it’s best to obtain a preapproval letter before you start taking serious interest in houses. The preapproval can help you determine how much house you can afford and could provide you with an advantage over other buyers should multiple bids be made for the same property. If you’re not sure if you’re ready, a loan officer can perform a preliminary credit and financial review and advise you on any necessary actions before moving forward.

However, keep in mind that most preapprovals are only good for three months, so you don’t want to receive one too soon. The last thing you want is for your preapproval to end before you’ve discovered the house of your dreams. Get ready to purchase a home by investigating the area you wish to live in, hiring a real estate agent, and improving your credit score before applying for a mortgage preapproval.

However, in a competitive market, waiting too long to receive a preapproval could put you at a disadvantage. For instance, while you’re waiting for the lender to review your preapproval application, another buyer might find the ideal home and take it. Therefore, your best bet might be to obtain a preapproval before you start actively looking at properties.

How to Get Preapproved for a Mortgage

Preapproval is a fairly simple process, and you can typically submit your application online.

Follow these steps to obtain a mortgage preapproval letter:

Check Your Credit

Before your lender does, it’s a good idea to review your credit report and score to find and address any issues that might be negatively impacting your credit. Recall that you are able to challenge any information found on your credit report. Removing information that has been fraudulently obtained or inaccurately reported by a creditor, for example, may improve your credit score.

You can access your credit reports for free at AnnualCreditReport. com. Additionally, Experian offers free credit reports and credit scores at any time.

To be eligible for a mortgage, you typically need a credit score of at least 620. Better interest rates and increased chances of loan approval are associated with higher scores. Calculating your debt-to-income ratio (DTI), which compares the total amount of your monthly debt obligations to your gross monthly income, is also a smart idea while you’re at it. It is one of the metrics that lenders use to determine whether you can afford a new mortgage payment. While some lenders prefer ratios below 2036%, the majority of lenders require your DTI to be below 2043%.

Gather Your Financial Information

Getting your financial records together, such as those pertaining to your job, income, and assets, can facilitate the application process. Documents lenders typically require include the following:

- Personal information: A valid driver’s license, passport, or other identity document must be presented. You dont need to be a U. S. citizen to apply for a mortgage. If you can provide proof of your residency status, you can apply for a mortgage as a foreign national.

- Information about your income: Be ready to provide your last two years’ worth of annual tax returns, account statements, and recent pay stubs.

- Information about your assets and debts: Account statements displaying your savings, investments, real estate, and other assets must be given to your lender. On the other hand, your lender will request to view the balances of your existing loans, credit cards, and other debt. In the end, lenders want to know that you have the resources necessary to make the mortgage down payment and to assist you in making loan payments in the event that your employment or income changes.

Choose Your Lender

To learn about the various loan options, the Consumer Financial Protection Bureau (CFPB) advises comparing at least three mortgage lenders. Finding a loan with the best interest rate and fees can help you save thousands of dollars over the course of the loan by getting preapproval from a number of lenders.

You might have to pay more up front to compare lenders, but if you find a lower rate that saves you a lot of money over time, it might be worth it. When you’re prepared to start putting in buy offers, you’ll apply for preapproval to the lender or lenders of your choosing. There might be a few hundred dollar fee, but if you end up getting your mortgage from that lender, you can usually get that back as a credit.

Receive Your Preapproval

Preapproval decisions can be made in as little as one day after you submit all necessary paperwork, but they usually take one or two extra days. Attach a copy of your preapproval letter to each offer letter you submit as soon as you obtain one.

Does a Mortgage Preapproval Affect Your Credit Score?

Your credit score may be impacted when your lender checks your credit when you apply for a preapproval. A hard inquiry is a record that this credit check creates on your credit report. Hard inquiries can result in a small, usually only a few point, decline in credit scores.

A score reduction related to a hard inquiry usually lasts only a few months, provided you pay your bills on time. After a year, the inquiry will not be used to determine your credit score, and after two years, it will be completely removed from your credit report.

Thankfully, you won’t see a drop in your credit score each time you apply for preapprovals from several lenders quickly. Regardless of the number of lenders that process your preapproval, you will only be penalized once (or not at all) because the numerous inquiries are made in a brief amount of time and are related to a single mortgage loan.

When making an offer on a house, having a mortgage preapproval letter can give you an advantage over the competition. But, as most approvals are only valid for ninety days, it makes sense to obtain your preapproval letter only when you’re prepared to look for a property and submit an offer.

If you’re trying to improve your credit before being preapproved, you might want to think about using Experian Boost®ç to expedite the process at no cost. This feature, which gives you credit for bills you already pay, such as rent, utilities, and streaming services, can, as its name implies, help you improve your credit.

Learn what it takes to achieve a good credit score. Check your free Experian FICO® Score now to see what’s boosting and depressing your score.

No credit card required

Learn what it takes to achieve a good credit score.

FAQ

How long does loan approval last?

While most preapprovals are valid for 90 days, some lenders only grant 60 or 30 days. It’s best to obtain a mortgage preapproval right before you start looking for a real home.

Does loan approval expire?

Depending on the bank and the reason for the loan (i.e., Owner-occupied or investment property), there may be variations in the expiration dates of finance pre-approvals. The majority of pre-approvals, also known as letters of offer or LOOs, expire in 60 to 90 days, and that time can fly by.

How long is a personal loan approval good for?

Usually, loan approvals are valid for 60 days following the application date. Rates differ depending on the product: rates for fixed-rate loans, like personal and auto loans, are valid for 60 days following the application date.

How long is a preapproval valid for?

In summary, most mortgage preapproval letters are valid for a period of 60 to 90 days. The amount you are approved to borrow, your interest rate, and other terms and conditions will be listed in your mortgage preapproval.

Read More :

https://www.experian.com/blogs/ask-experian/how-long-does-a-mortgage-preapproval-last/

https://www.rocketmortgage.com/learn/how-long-does-a-mortgage-preapproval-last