What is a Mortgage Pre-Approval?

Pre-approval for a mortgage serves as a kind of rehearsal for the actual mortgage.

Pre-approval takes into account your financial circumstances, including assets, income, and credit score. ) to find out how big of a loan and what interest rate you qualify for. Additionally, you’ll get a housing payment estimate each month, which is helpful for budgeting.

Pre-approvals give buyers the knowledge they need to decide how much house they want to buy and tell them exactly how much they can afford.

Pre-approvals are also required for house hunting. Sellers and real estate agents don’t consider offers seriously unless they are accompanied by a mortgage pre-approval.

Learn more about how to get pre-approved for a mortgage.

How Long Do Mortgage Pre-Approvals Last?

Your financial situation may change over time, interest rates are subject to constant fluctuation, and credit scores are updated on a monthly basis. For better or worse, each of these factors may have an impact on your maximum purchase price.

When that ninety-day period is almost up and you still haven’t found a house, give your mortgage advisor a call and let them know you’d like your pre-approval updated.

They will review all the details once more and refresh your credit report once you give them some updated documentation. They will notify you if there are any changes, whether they are favorable or unfavorable. Additionally, you’ll receive a new pre-approval letter that is valid for ninety more days of house hunting.

How Do You Get a Mortgage Pre-Approval?

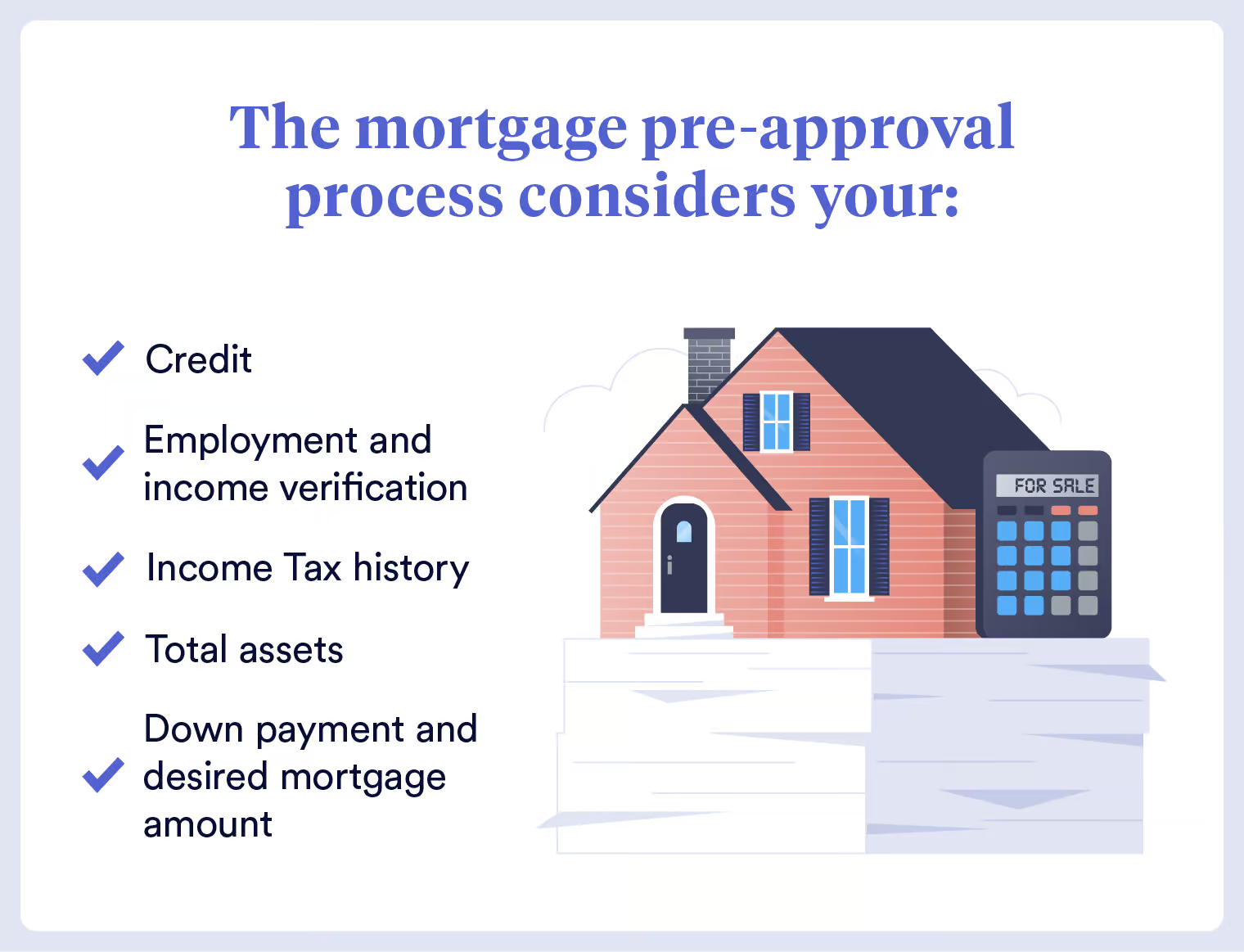

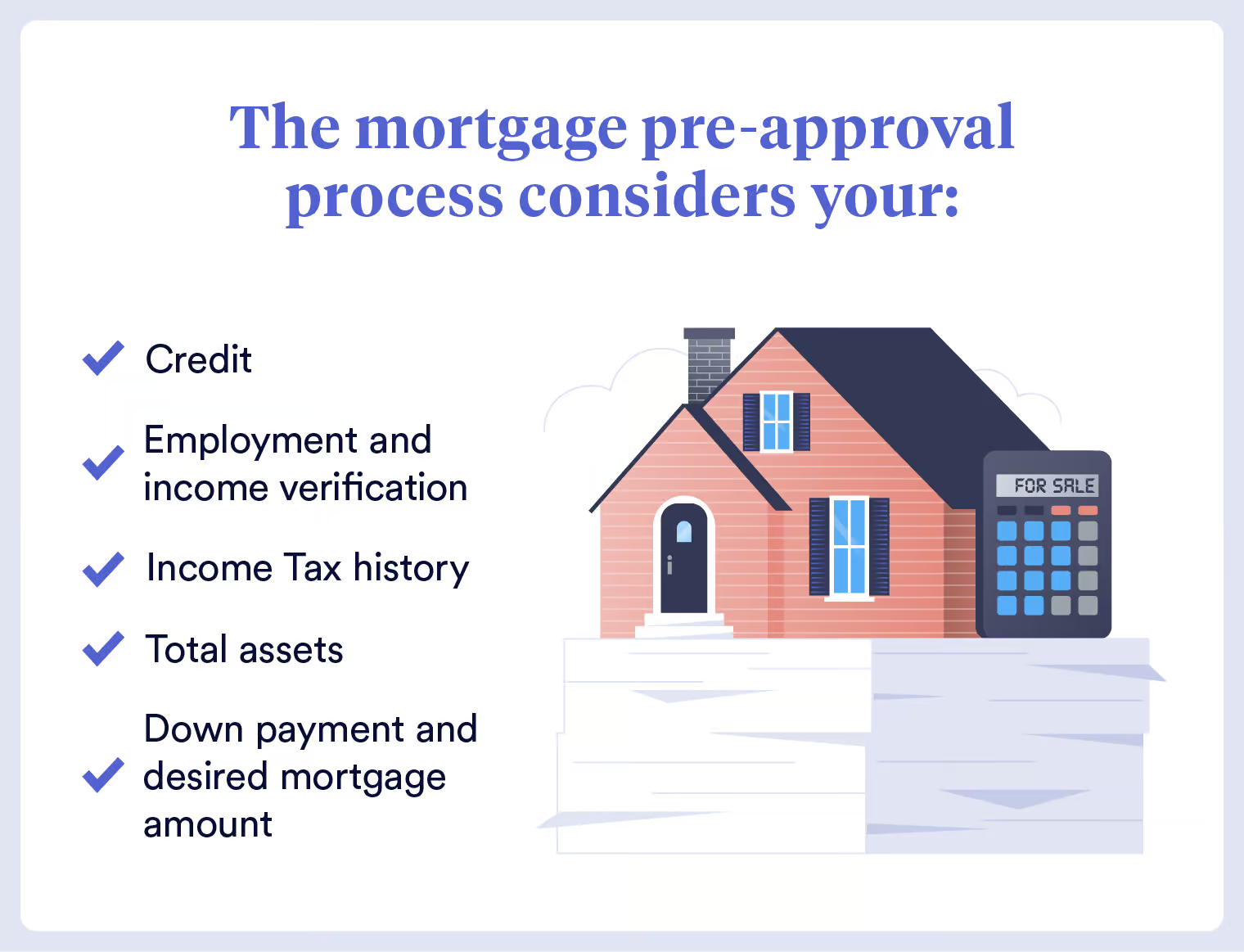

To get a pre-approval, the mortgage lender will look at:

- Credit

- Employment and income verification

- Income tax history

- Total assets

- Down payment and desired mortgage amount

Mortgage pre-approvals can be completed online, over the phone, or in person, depending on your preference, and only take a few minutes.

When Should You Apply for Pre-Approval?

Prior to looking for a house, you ought to be pre-approved for a mortgage. By doing this, you’ll be able to plan your purchase more efficiently and be prepared to make a serious offer as soon as you find a house that you love.

Among the most important details you’ll receive with your pre-approval are payment estimates, interest rates, down payment amounts, and loan sizes. To create a budget and decide how much house you want to buy, all of this is necessary.

It’s crucial to recognize the distinction between pre-qualifications and pre-approvals, which some lenders or websites may offer.

What’s the Difference Between Pre-Approval vs Pre-Qualification?

The lender can ensure that you will be approved for a particular loan amount and interest rate with a pre-approval, which is a thorough review of your financial history.

Pre-qualifications are an estimate of the amount of a mortgage based on your credit history and basic income, but they are not guaranteed.

While pre-approvals make it easier to submit an offer on a property and streamline the mortgage process after it is accepted, pre-qualifications may seem more practical.

With a mortgage pre-approval in hand, you can budget sensibly and make an offer as soon as you find a property because you have concrete evidence that you can obtain the mortgage you need to purchase a home.

If your house search is taking longer than expected, get in touch with your mortgage expert to renew your pre-approval since mortgages expire after 90 days.

Get Pre-approved! When are you buying? We know timelines change, but this helps us provide you the best service.

Pre-approvals for mortgages are typically valid for ninety days, and they can be easily renewed at any moment. The mortgage pre-approval is your first big step towards homeownership. Additionally, obtaining preapproval early on in the procedure streamlines the remainder of the process. Sellers of real estate won’t consider you seriously unless you can prove your qualifications. And as valuable as your […].

Subscribe to our Newsletter

Be a better buyer. Get your subscription today to avoid missing out on first-time buyer programs, fresh market trends, and exclusive insights.

Ready to get started?

Mortgages for first-time home buyers. Member FDIC. Equal Housing Lender.

NMLS 423065 Type {{ rate. loanType }} 30-Year APR {{ formatRate(rate. apr) }} {{ rate. points > 0 ? Points : Refund }} {{ formatPoints(rate. points) }} Rate {{ formatRate(rate. rate) }}.

NMLS 423065 Type {{ rate. loanType }} 30-Year Rate {{ formatRate(rate. rate) }} APR {{ formatRate(rate. apr) }} {{ rate. points > 0 ? Points : Refund }} {{ formatPoints(rate. points) }}.

Mortgage Rate Assumptions

The mortgage rates displayed on this page are accurate as of and are based on assumptions about you, your house, and your location. Mortgage bond market activity determines how quickly mortgage rates fluctuate.

The mortgage rates displayed on this page are accurate as of {{ formatDate(rates[0]) and are based on assumptions about you, your house, and your location. createdAt) }}. Mortgage bond market activity determines how quickly mortgage rates fluctuate.

Legal Disclosures

Unless you are a first-time buyer buying a single-family home to be your primary residence in any state other than New York, Hawaii, or Alaska, and you have a credit score of {{ rates, your actual mortgage rate, APR, points, and monthly payment are unlikely to match the table above. length ? rates[0]. You have a fico score of 760 or above, you are using a 30-year fixed-rate mortgage, you are making the minimum down payment needed for the loan type, and your household income is low to moderate in comparison to the area.

The information offered is only meant to be used as a source of information; it is not a guarantee of a mortgage rate or an approval of a mortgage loan. A mortgage rate quote that differs from what is displayed above could be given to you. You will often be able to choose between receiving a rebate in exchange for higher mortgage rates or paying discount points for a lower rate.

{{ rate. loanType }}. The {{ formatRate(rate. rate) }} mortgage rate ({{ formatRate(rate. APR) is predicated on data obtained on {{ formatDate(rate). createdAt) }}. This rate requires {{ formatPoints(rate. points) }} discount points at closing, which costs {{ formatPoints(rate. points) }}% of the starting principal balance. Assuming a loan size of {{ formatDollars(rate. loanAmount) }}, the following terms apply to the monthly mortgage payment: {{ formatDollars(rate monthlyPayment) }} for 360 months, plus taxes and insurance premiums. {{ rate. Lender }} does not guarantee accuracy and only provides this information for estimating purposes. Your mortgage rate, APR, loan size, and fees may vary.

Term 30 Years APR {{ formatRate(rate. apr) }} {{ rate. points > 0 ? Points : Refund }} {{ formatPoints(rate. points) }} Rate {{ formatRate(rate. rate) }}.

Rate {{ formatRate(rate. rate) }} Term 30 Years APR {{ formatRate(rate. apr) }} {{ rate. points > 0 ? Points : Refund }} {{ formatPoints(rate. points) }}.

Mortgage Rate Assumptions

The Homebuyer. The com mortgage rates that are displayed on this page are predicated on certain assumptions about you, your house, and the state in which you intend to buy The rate displayed is correct as of, but keep in mind that mortgage rates can fluctuate at any time depending on activity in the mortgage bond market.

The Homebuyer. The com mortgage rates that are displayed on this page are predicated on certain assumptions about you, your house, and the state in which you intend to buy The rate shown is accurate as of {{ formatDate(rates[0]. createdAt) }}, but keep in mind that mortgage rates can fluctuate at any time depending on activity in the mortgage bond market.

It’s possible that our assumptions about mortgage rates are different from those of the other mortgage lenders in the comparison table. Unless you fit the description below, your actual mortgage rate, APR, points, and monthly payment are unlikely to match the table above:

You are a first-time buyer in any state other than New York, Hawaii, or Alaska who is buying a single-family home to use as your primary residence. You have a credit score of {{ rates. length ? rates[0]. fico : 760 }} or higher. You are using a 30-year conventional fixed-rate mortgage with a twenty percent down payment. You earn a low-to-moderate household income relative to your area.

The information offered is only meant to be used as a source of information; it is not a guarantee of a mortgage rate or an approval of a mortgage loan.

Legal Disclosures

{{ rate. lender }}. The {{ formatRate(rate. rate) }} mortgage rate ({{ formatRate(rate. apr) }} APR) shown above for {{ rate. lender}} is predicated on data obtained on {{ formatDate(rate)} from the lender’s website. createdAt) }}. According to its website, {{ rate. At the published rate of the lender, buyers of real estate must pay {{ formatPoints(rate). points) }} points at closing, totaling {{ formatDollars(rate. cost) }}, on an example {{ formatDollars(rate. loanAmount) }} 30-year fixed-rate conventional mortgage. Its mortgage rate is predicated on the buyer of the property making an {{ formatDollars(rate downPayment) }} downpayment or larger and purchase a single-family residence. Additionally, its mortgage rate is predicated on the home buyer having a credit score of {{ rate. fico }} or higher. With the aforementioned terms, the monthly mortgage payment is {{ formatDollars(rate). monthlyPayment) }} for 360 months, plus taxes and insurance premiums. {{ rate. Lender }} does not guarantee accuracy and only provides this information for estimating purposes. Your mortgage rate, APR, loan size, and fees may vary.

FAQ

Can a mortgage pre-approval expire?

Obtaining a mortgage preapproval is a smart idea before you begin your home search. This can assist you in shopping within a comfortable price range and demonstrate to sellers that you are a serious buyer. However, a mortgage preapproval doesn’t last forever. Additionally, it may expire if your search for a home takes a long time.

How many months is a pre-approval good for?

In summary, most mortgage preapproval letters are valid for a period of 60 to 90 days. The amount you are approved to borrow, your interest rate, and other terms and conditions will be listed in your mortgage preapproval. Generally speaking, borrowers shouldn’t get preapproved until they’re prepared to look for a house actively.

What happens if I don’t use my pre-approval?

Your letter of approval will expire and you will need to be reapproved if you are unable to find a home within the preapproval period. You have the option to seek reapproval from a new lender or stick with your current one.

How many times can you get preapproved for a mortgage?

Preapproval for a home loan is available as often as necessary. Every mortgage preapproval letter comes with an expiration date. You’ll also need a new preapproval if the current one expires in order to keep looking at homes and submitting offers.

Read More :

https://www.rocketmortgage.com/learn/how-long-does-a-mortgage-preapproval-last

https://www.bankofamerica.com/mortgage/learn/mortgage-prequalification/