How Does LendingTree Get Paid? LendingTree is compensated by companies on this site and this compensation may impact how and where offers appear on this site (such as the order). LendingTree does not include all lenders, savings products, or loan options available in the marketplace.

A home equity loan is a one-time payment that you can take out over a period of five to thirty years. This repayment schedule is comparable to other loan options that require you to repay the debt on a predetermined schedule, with interest, and use your home as collateral.

If you need to replace an old roof, grow a business, or consolidate high-interest debt, turning your home equity into spendable cash can be a wise decision. It’s crucial to first comprehend how repayment functions and if it fits into your overall financial strategy.

How long are home equity loans likely to last?

The typical duration of a home equity loan is five years, but depending on your lender, it can be extended to ten or thirty years. Your monthly payments will generally be more affordable the longer your loan term is. Conversely, a shorter loan term typically results in a higher monthly payment.

If making small payments is your main priority, you can take out a longer-term loan and repay it early—just make sure there isn’t a penalty for doing so. This tactic can give you some budget flexibility while saving you thousands of dollars in interest charges. When you can, you should pay extra toward the balance of your outstanding loans; however, in months when your finances are tight, you should only make the minimum payment.

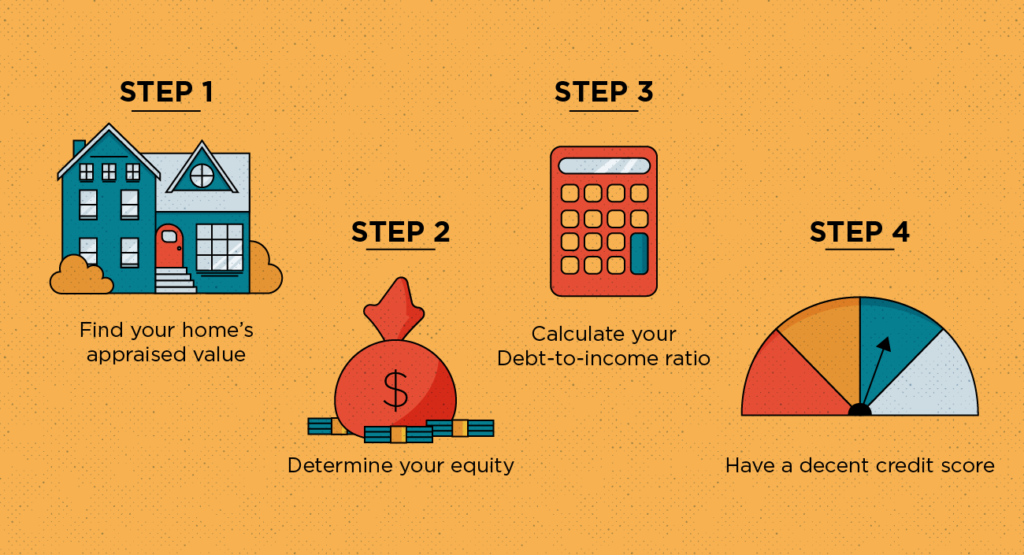

A home equity loan is a kind of second mortgage that lets you take out a loan against the equity in your house—that is, the difference between the value of your house and the amount of your mortgage that is still owed. The loan uses the house as collateral and is repaid in set monthly installments, just like a conventional first mortgage. A home equity loan will be repaid second in priority to a first mortgage in the event of a foreclosure. Generally, you will require a maximum of 85% loan-to-value (LTV) ratio in order to satisfy the requirements for home equity loans. The portion of the value of your home that is mortgage-financed is known as your LTV ratio. Nonetheless, some lenders provide high-LTV home equity loans if you require additional funding.

To get an idea of how much you might be able to obtain from a home equity loan, try our home equity loan calculator below:

Which home equity loan terms should you consider?

The best home equity loan term for you usually depends on how much you can afford to pay monthly. Your lender considers your debt-to-income (DTI) ratio — the percentage of your gross monthly income used to repay debt — when qualifying you for a loan. In most cases, your DTI ratio shouldn’t exceed 43%. For example, let’s compare the home equity loan rates and monthly payments on a $100,000 balance with 10-, 15-, 20- and 30-year repayment terms.

| 10-year home equity loan | 15-year home equity loan | 20-year home equity loan | 30-year home equity loan | |

|---|---|---|---|---|

| Interest rate* | 7.20% | 7.18% | 7.86% | 7.375% |

| Monthly payment | $1,171.42 | $908.92 | $827.75 | $690.68 |

| Total interest paid | $40,570.25 | $63,605.88 | $98,659.56 | $148,643.05 |

Longer terms leave more space in your budget>

To maintain a comfortable cash flow, it often makes sense to select a longer repayment term for a larger loan balance. A home equity loan with a 10-year term will cost you almost $1,200 per month in the example above. If that puts too much strain on your finances, you might want to think about a 15- or 20-year term.

Home equity loan terms vs. HELOC terms

The terms of a home equity line of credit (HELOC), which normally lasts five to thirty years, are similar to those of home equity loans. But a HELOC is a revolving credit line that you can access whenever you need it. Similar to a credit card, your payments will be determined by the amount you borrow as well as the interest that is applied to the outstanding balance.

The credit line can be used, paid back, and then used again as long as you have access to it. However, you will have to pay back your credit line in accordance with the terms of your loan after your HELOC draw period ends. This makes a HELOC a wise option if you intend to make numerous purchases over time or if you’re unsure of how much money you’ll need.

Should you consider a cash-out refinance instead?

Cash-out refinance repayment typically lasts 15 to 30 years. This is comparable to home equity loans and HELOCs with longer terms, but it might not be what you need if you need a five- or ten-year repayment period.

A cash-out refinance, like the other options we’ve covered so far, is a mortgage that enables you to access your home equity. But in this instance, you’ll receive the difference as a lump sum after taking out a new first mortgage for more than you owe on your existing loan.

Similar to a home equity loan or home equity line of credit, you can use the proceeds from your cash-out refinance for almost anything.

Frequently asked questions

A home equity loan normally takes two to four weeks from application to funding. This is a little quicker than the six to eight weeks it could take to get a cash-out refinance and comparable to how long it takes to get a HELOC.

In the event that your house is fully paid for, you will have zero equity.

The following are some drawbacks of a home equity loan:

- You’ll pay higher interest rates than for a HELOC

- You’ll pay closing costs

- It is required that you have at least 2015% equity built up in your home in order to qualify.

HELOCs are frequently the least expensive way to access home equity because they often have lower interest rates and you only pay interest on the money you withdraw, not the entire credit line amount. Nevertheless, in order to fully understand what’s best for you, you’ll need to run the numbers on your particular situation using actual loan offers you’ve received.

When mortgage rates rise, homeowners frequently choose equity loans; therefore, before you decide to borrow, make sure you know how a home equity loan operates.

Discover the information you need to know about borrowing against your home equity after bankruptcy and whether you can obtain a home equity loan following a negative credit event.

Closing costs for home equity loans usually vary from 2% to 5% of the loan amount; however, certain lenders may waive or reduce them completely.

FAQ

How much would a $50000 home equity loan cost per month?

Example of loan payment: for a $50,000 loan with 120 months at 8 40% interest rate, monthly payments would be $617. 26. Tax and insurance premium amounts are not included in the payment example.

What is the normal term for a home equity loan?

The majority of home equity loans have repayment terms of five to thirty years, though this can vary depending on the lender. You will receive more affordable monthly payments if the loan term is extended. That said, you’ll also pay far more in interest.

What is the downside of a home equity loan?

Drawbacks of Home Equity Loans: Higher Interest Rate Compared to a HELOC: Over the course of the loan, you may pay more interest since home equity loans typically have higher interest rates than home equity lines of credit. Your House Will Be Used As Collateral: Your credit score will suffer if you don’t make your monthly payments on time.

What happens to a home equity loan after 10 years?

Typically, a HELOC has a ten-year draw period. But, yours could be different. Following this date, the HELOC will switch from the draw period to the repayment period, during which you won’t be able to take any further withdrawals and your monthly payments—which will cover principal as well as interest—will be adjusted.

Read More :

https://www.lendingtree.com/home/home-equity/how-long-are-home-equity-loan-terms/

https://www.cbsnews.com/news/how-long-are-home-equity-loans/