Business Loan Terms by Type of Loan

The length of a typical business loan varies depending on the kind of loan you take out and your intended use of it. When you apply for a loan, you will negotiate a term; however, there is an average loan term and interest rate for each type of loan.

While there may be considerable variations between loans, the terms and conditions listed below are typical for that kind of loan.

Bank Loans

- Average loan term: Three to 10 years

- Maximum loan amount: $250,000 to $1 million

- Typical interest rate: 3% to 22%

- Time to apply: Two weeks to several months

- Minimum eligibility requirements: Generally, collateral or a minimum credit score of 640 are required. Occasionally, minimum revenue amounts and a minimum duration of business operation are also required.

Small Business Administration (SBA) Loans

- Average loan term: Up to 25 years

- Maximum loan amount: Up to $5 million

- Typical interest rate: Base rate, plus 2. 25% to 4. 75% for 7(a) loans (variable-rate loans); base rate plus 6. 00% to 8. 00% for fixed-rate loans.

- Application period: 30 to 90 days, based on the type of loan

- Minimum eligibility requirements: The company must be for-profit, operate in the US, have used other financing sources, and have a specific portion of its owners’ equity available for investment in order to be accepted. Furthermore required is a credit score of at least 640, ideally 680 or higher.

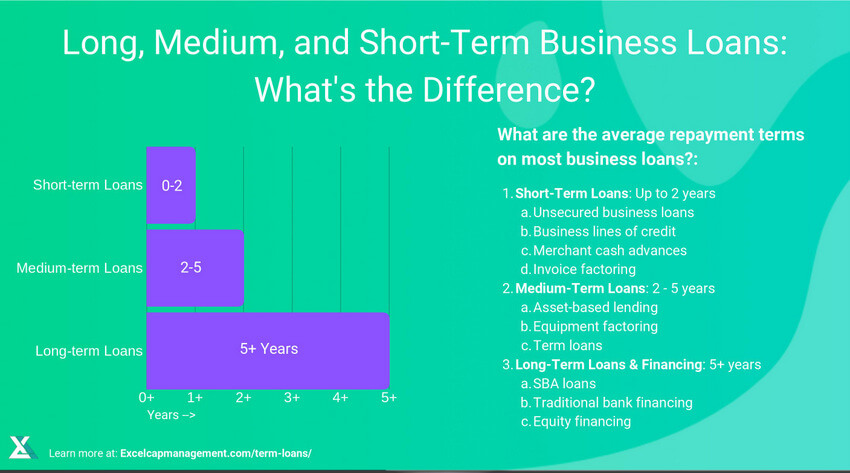

Term Loans

- The average loan term is three to 24 months for short-term loans, five years for mid-term loans, and ten years for long-term loans.

- Maximum loan amount: $5,000 to $1 million+

- Typical interest rate: 6% to 36%

- Time to apply: 24 hours to a few months

- Minimum qualifications: Dependent on the lending organization, but generally speaking, a credit score of 600, $8,000 in monthly revenue, and six months of business experience are required.

Business Lines of Credit (LOCs)

- Average loan term: Six months to five years

- Maximum loan amount: $1,000 to $250,000

- Typical interest rate: 10% to 99%

- Time to apply: A few days to two weeks

- Minimum eligibility requirements: Although some lenders may be more accommodating, a personal credit score of at least 680 is required. Minimum revenue thresholds vary from $10,000 per month to $250,000 annually, and there is a minimum time in business requirement of either six months or two years.

Microloans

- Average loan term: Up to six years for SBA microloans

- Maximum loan amount: Up to $50,000

- Typical interest rate: 6% to 9% for SBA microloans

- Time to apply: 30 to 90 days

- Minimum eligibility requirements: In addition to meeting all requirements set by the intermediary lender, applicants must also meet the SBA’s general eligibility requirements.

Merchant Cash Advance

- Average loan term: Three to 18 months

- Maximum loan amount: Up to $500,000

- Typical interest rate: Factor rate of 1.2 to 1.5

- Time to apply: As little as 24 hours

- $10,000 minimum monthly business deposits are required for eligibility, though this can vary based on the lender. Additionally, lenders evaluate revenue and income statements for a minimum of three months.

Inventory Financing

- Average loan term: Up to one year

- Maximum loan amount: 20% to 65% of the inventory cost

- Typical interest rate: 0% to 80%

- Time to apply: 24 hours to a few months

- Minimum qualifying requirements include the sale of goods and materials, a minimum of six months to a year of operation, the possibility that certain lenders will demand minimum inventory levels, and the presence of a solid and dependable inventory management system within the company.

Equipment Financing

- The equipment’s usable life (typically two to seven years) determines the average loan term.

- Maximum loan amount: Up to 100% of the equipment cost

- Typical interest rate: 4% to 5%, up to 30%

- Time to apply: 24 hours to a few weeks

- Minimum eligibility requirements: A credit score of at least 600. Operating history requirements may also need to be met.

Invoice Factoring

- Average loan term: 30 to 90 days

- Maximum loan amount: Up to 100% of each invoice amount

- Average interest rate: 3% processing fee plus a factoring fee ranging from 1% to 2% of the invoice amount

- Time to apply: As little as 24 hours

- Minimum eligibility requirements: Variable. A financial statement’s line items, such as accounts receivable, are evaluated. Reviewing bank statements and unpaid invoices is also necessary. The assessment of the clients’ creditworthiness will also be conducted in order to ascertain the total risk level.

How to Choose the Right Business Loan Term

Depending on what you need the loan for, you can choose the right loan type and term for your company. Generally speaking, you should try to accept the shortest loan that is practical for your company. This will lower your interest payments and help you pay off debt more quickly. Having said that, you should also be reasonable about how soon you can pay back the loan. Failure to make payments on time may result in fines or, in the worst situation, your lender taking possession of your collateral.

So, before requesting any type of funding, it is crucial to have a workable business plan in place. You have a better chance of getting approved for a loan and being able to repay it if you can demonstrate with reasonableness that the money you borrow will increase the profitability of your company.

What Is a Loan Maturity Date?

A debt’s maturity date indicates when it must be fully repaid. This is the date that a business loan should terminate if payments are made on schedule.

Is There a Penalty for Paying Off My Loan Early?

It depends on the business loan you take out. If you intend to repay your loan early, make sure you won’t be penalized by carefully reading your terms and conditions.

Why Do Businesses Use Short-Term Loans?

Among other things, businesses can use short-term loans to close a cash flow gap.

What Is the Longest Term You Can Get on a Business Loan?

One can work out a repayment schedule that lasts for at least 25 years. When taking out a loan with such a long duration, proceed with caution because you will be paying interest, which can add up to a large sum over time.

What Is the Maximum Amount for a Small Business Loan?

With an SBA loan, you can borrow up to $5 million, but the maximum amount you can borrow will depend on how big your company is and how confident your lender is in it.

The Bottom Line

The typical duration of a business loan varies based on the loan type and the intended use by the borrowing company. The duration of a loan can be anything from a few months to over 25 years. Prior to choosing your loan term, it’s critical to clearly define your loan needs. Article Sources: Investopedia mandates that authors cite original sources to bolster their claims. These consist of government data, original reporting, white papers, and conversations with professionals in the field. When appropriate, we also cite original research from other respectable publishers. You can read more about the guidelines we adhere to when creating impartial, truthful content in our

FAQ

What is the average term of a business loan?

Repayment terms can last up to 72 months, or six years, but they typically last 40 months, or slightly over three years. SBA 504 loans: These loans are intended to support large fixed assets that scale your company’s growth and generate employment. Typically, business loans have terms of ten or twenty years.

Can you get a 20 year business loan?

Some long-term business loans, such as certain types of U. S. Loans from the Small Business Administration (SBA) have up to 25-year payback terms. Although loan amounts differ, they are usually greater than those for short-term business loans.

What is the maximum length of a business loan?

Long-term business loans offer financing with repayment periods that range from three to ten years, and up to 25 years in certain situations. How much do you need?.

What is the term for a typical business loan?

Loans from the Small Business Administration (SBA): Typical loan period: up to 25 years Maximum loan amount: Up to $5 million. Typical interest rate: Base rate, plus 2. 25% to 4. 75% for 7(a) loans (variable-rate loans); base rate plus 6. 00% to 8. 00% for fixed-rate loans. Application period: 30 to 90 days, based on the type of loan

Read More :

https://www.investopedia.com/what-is-the-average-business-loan-term-7550255

https://www.nerdwallet.com/article/small-business/small-business-loan-terms