Estás ingresando al nuevo sitio web de U.S. Bank en español.

Many loans seem self-explanatory based on their titles. For example, it’s evident that an auto loan will facilitate your purchase of a car. Or that a student loan goes to fund education. Mortgages fund homes, company loans fund commercial endeavors, and so forth.

In contrast, the term “personal loan” doesn’t provide much information about how this kind of funding can assist you in achieving your objectives. In actuality, you can use the proceeds from a personal loan for almost anything you want. Furthermore, you can typically receive the loan funds in your account in less than a week if the lender is satisfied with the information you provided about your income.

If you want to investigate this option, start by asking yourself the following questions:

How do I know if a personal loan is right for me?

In some circumstances, applying for a personal loan makes the most sense. For instance:

- It might be the most affordable credit option available to you: Be sure to look into all of your options before applying for any type of loan. Would a balance transfer or credit card with a zero percent annual percentage rate, for instance, be a more cost-effective or sustainable option? (Of course, you would need to pay off the balance by the time the zero percent rate expires.) ).

- You intend to take on a project that might yield a return on your investment: home remodeling is a common use for this kind of financing. Since home equity loans and lines of credit (HELOCs) can also be excellent choices for financing a home remodel, be sure to speak with your banker to determine which option is best for you.

- You are comfortable making the monthly payments. Look into ways to increase your income, reduce unnecessary spending, or do both in order to help you reach your repayment goals. In general, your interest rate on a personal loan will be lower (to a point) the higher your credit score.

Learn more about Personal Loans through U. S. Bank, apply in three simple steps by using our calculator to estimate your monthly payment.

When should I consider alternatives to a personal loan?

In every one of the subsequent scenarios, selecting an alternative form of funding could be more advantageous for you:

- Medical costs: Find out about financing options provided by your doctor’s office before taking out a personal loan.

- Big-ticket, discretionary spending: If you’re thinking about making a nice-to-have purchase, hold off on making it until you have enough money saved up. If there’s a true urgency (e. g. , a major appliance breakdown), a credit card with no interest could be a good substitute.

- Debt consolidation: A personal loan may be a useful tool in this process. But if your credit score is already low, you may be hit with a high interest rate on a personal loan. That increased rate may put you at risk for even higher monthly payments. A balance transfer to a credit card with a zero percent annual percentage rate is one option to rapidly pay off debt without accruing more.

- Paying for a car: In certain situations, auto loans have cheaper interest rates than personal loans. That’s mostly because the car itself serves as collateral.

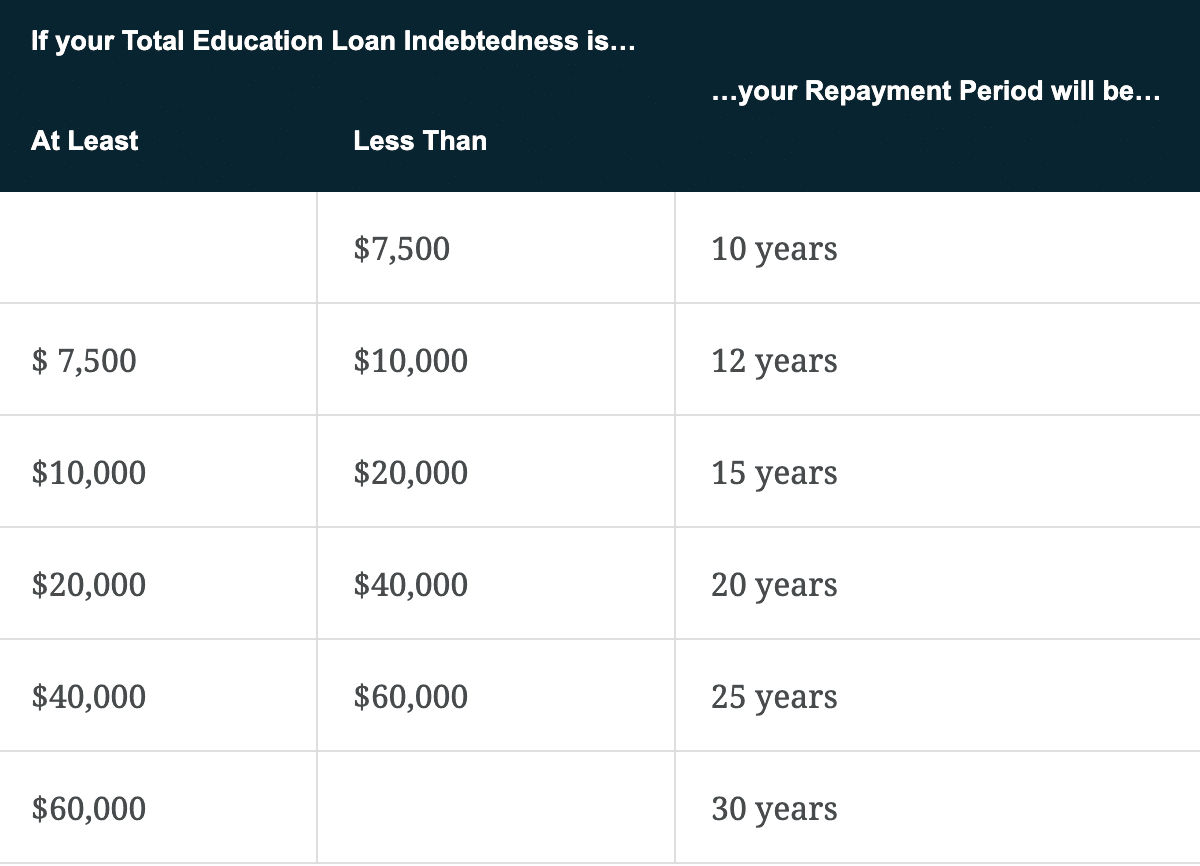

- Tuition for college: Your best bet for funding your education is still student loans. In contrast to personal loans, rates are usually lower, and you are not obliged to make your first payment until after you have finished your coursework.

- Emergency costs: Establish a practice of saving money for unforeseen events so you can respond to them without going into debt.

How much can I borrow and how do I receive the money? >

|If the loan is approved, the principal is paid to you all at once. A lot of things determine how much you can borrow, including your credit score. Typically, the loan amount falls within the range of $1,000 to $25,000. However, certain banks provide their clients with larger loan amounts. Make sure you can comfortably make the monthly payments when deciding how much to borrow.

How do I receive the money and what will my payments look like?

A personal loan is an installment loan. In other words, until the full amount is paid off, you owe a set amount each month. The majority of personal loans have a 12- to 60-month repayment schedule. A loan’s term is the length of time it will take to pay off the entire balance, assuming all payments are made on schedule.

Personal loans come in two different durations: one to five years and up to thirty years. In any case, you will have to pay off the principal (the upfront amount you are given) by the end of your term. You’ll also need to factor in monthly interest.

Based on the loan amount required and your expected or actual financial situation, you should think about:

- Is it better for me to take out a longer loan term in order to pay less each month?

- Alternatively, should I choose a shorter term to reduce the total amount of interest I pay on the loan?

- If I decide to repay my loan before the term ends, will there be a penalty?

How much interest should I expect to pay?

Many (though not all) personal loans are unsecured. With an unsecured loan, the borrower is not required to pledge collateral to cover the full amount borrowed, such as a house or vehicle.

Additionally, an unsecured loan means that, unlike a secured loan, the lender cannot seize your belongings in the event that you default on it. Lenders frequently charge higher interest rates to offset this risk.

Personal loan providers typically impose an annual percentage rate (APR) of 7–17 percent, depending on a number of variables. These may comprise the credit score of the applicant, funding and operational expenses, profit margins, and risk premiums.

According to Federal Reserve data, the average APR on a 24-month personal loan at a commercial bank was 10.63 percent in 2022. But, the rates can be even higher (above 17 percent) if you have poor credit.

Check your credit score now; many banks provide their clients with this free of charge. Should you take out a secured personal loan instead of paying off debt in order to improve your credit score and rate? Loan collateral can include certificates of deposit (CDs), savings account money, and personal property.

Will applying for a personal loan hurt my credit?

Potential lenders will review your credit history when you apply for loans in order to decide whether or not to grant you credit. This kind of credit check is frequently regarded as a hard inquiry, which can lower your score temporarily.

If your credit is good, this might not be a huge concern. However, you should speak with your lender if you’re worried about your credit status and request loan applications that only use a soft inquiry, which has no bearing on your score.

Which type of lender should I choose?

Do some comparison shopping. Prior to applying, it’s advisable to consider your options and compare rates and fees offered by different lenders.

Investigate a personal loan if you’re searching for fixed rates and a loan without collateral, and start moving toward your financial objectives right now.

Learn about U.S. Bank

FAQ

Do you have to pay back loans immediately?

Lenders typically have set repayment periods available. Which one you qualify for is determined by your financial circumstances and the loan amount. If there are no prepayment penalties assessed by your lender, you can pay off your loan more quickly.

How long can you go without paying on a loan?

It’s unclear when your loan will move from “behind in payments” to defaulted because it depends on the terms of your loan and the laws in your state. While some lenders may call it quits after 30 days, others may give you 90 days or more before declaring a default.

Do you have to pay a loan back straight away?

Although they may charge you an early repayment charge (ERC), loan providers are required to permit you to repay a personal loan early and in full. Although early repayment penalties differ, generally speaking you will be required to pay one to two months’ worth of interest.

Do you have to pay back a loan every month?

When your loan’s interest-only period expires, you’ll have to pay back the entire amount you borrowed. After the interest-only period expires, interest-only loans typically become amortizing loans that require monthly principal and interest payments.

Read More :

https://www.usbank.com/financialiq/manage-your-household/personal-finance/personal-loans-first-timers-guide.html

https://www.cnbc.com/select/loan-term-length/