Interest is what you pay to borrow money from a lender when you finance the purchase of a vehicle.

Your monthly loan payment includes interest, which can increase the amount you have to repay by thousands of dollars. It’s crucial to comprehend how auto loan interest is determined, what variables may have an impact on your rate, and how to pay as little interest as possible because of this.

How is interest calculated on a car loan?

There are two methods used by lenders to compute interest on auto loans: simple or precomputed. When you have a simple interest loan, the interest you pay is determined by the loan balance on the day that your auto payment is due. The amount of interest you pay each month changes. When you have a car loan with precomputed interest, the interest is computed based on your total loan amount at the beginning of the loan term. Every month, you pay the same amount of interest. Let’s take a closer look at each type of interest.

Simple interest car loans

The majority of auto loans have simple interest rates, which means that your monthly interest payment is determined by your loan balance on the due date. Your loan balance and the amount of interest you owe can go down if you pay more than the minimum amount due.

On a simple interest loan, interest is front-loaded and amortized. A portion of your monthly car payment with an amortized loan goes toward the principal—the amount you borrowed—and a portion goes toward interest. Because the loan is front-loaded, at the start of the loan term, a bigger amount of each car loan payment goes toward interest, and at the conclusion of the term, a larger amount goes toward the principal balance.

For instance, in the event that you have a $25,000 car loan with a 48-month term and a 4% interest rate, you will be required to pay an estimated $83% in interest and $481 in principal during the first month of the loan term. You will only have to pay an estimated $2 in interest by the last month, with $563 going toward the principal. To obtain an approximate amortization schedule, utilize an automobile loan calculator.

Precomputed interest is a feature of certain auto loans where the interest rate is determined in advance based on the loan amount. To calculate your monthly payment, that sum is added to the principal and divided by the total number of months in the loan term.

Unlike with a loan with simple interest, your payments are applied to both principal and interest simultaneously. You won’t save as much on interest as you would with a simple interest loan if you pay more than the minimum amount due, make additional payments, or pay off your loan balance early.

Interest rate vs. APR

The interest rate and the annual percentage rate, or APR, are the two ways that a financial institution can express the cost of borrowing money. The annual percentage rate that you pay for borrowing money is called an interest rate. APR reflects the interest rate plus any additional loan fees. It’s also expressed as a percentage. If the interest rate or annual percentage rate is higher, you will have to pay back the loan with more money until it is fully paid off.

All lenders must disclose the APR on a loan offer. The APRs, which show the entire cost of financing, should be considered when comparing loans. And ensure that you are comparing interest rates to APRs rather than APRs to one another.

What’s the average interest rate on a car loan?

The average rate for a 48-month new car loan was 5.5% in the first quarter of 2021, according to the Federal Reserve. 21%, and the mean interest rate on a new car loan for a period of 60 months was $204. 96%.

Your credit scores, the amount of your down payment, and the length of your loan term are just a few of the variables that could influence the interest rates you are offered. Your rate may differ from the average based on your financial circumstances.

Factors that can affect the interest rate on a car loan

Your interest rate is set by your lender following an assessment of your finances and credit. These are but a few of the variables that could influence the price that is given to you.

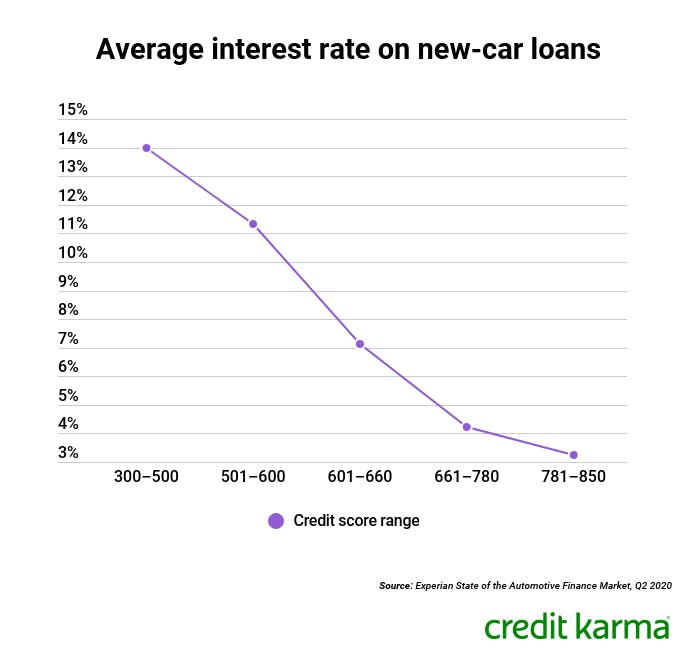

People with higher credit scores are generally more likely than those with lower scores to be eligible for lower rates. Experian’s State of the Automotive Finance Market report for the first quarter of 2020 found that the average interest rates on new car loans for those with the highest credit scores were almost 11 percentage points lower than for those with the lowest scores.

Auto loans are also provided by automakers’ finance companies, and they occasionally run special offers. A dealer may give you a 200 percent annual percentage rate (APR) offer if your credit is good.

Longer-term loans may have higher interest rates from the lender. Additionally, if you choose a longer loan term, you run the risk of owing more than the value of your car because cars lose value quickly. While it might be alluring to select a longer term in order to lower your monthly loan payment, doing so could result in higher interest costs overall.

If you put down little or nothing at all, lenders may charge you higher interest rates. This higher interest rate is offered in return for the possibility that you will miss payments on your auto loan, leaving the lender in possession of a car that isn’t worth as much as you owe.

Rates for loans for new cars are typically lower than those for loans for used cars. For a used car loan, the average interest rate was 9. 65% in the first quarter of 2020, compared to 5. 61% of borrowers on new car loans, according to Experian E2%80%99’s report on the state of the automotive finance market

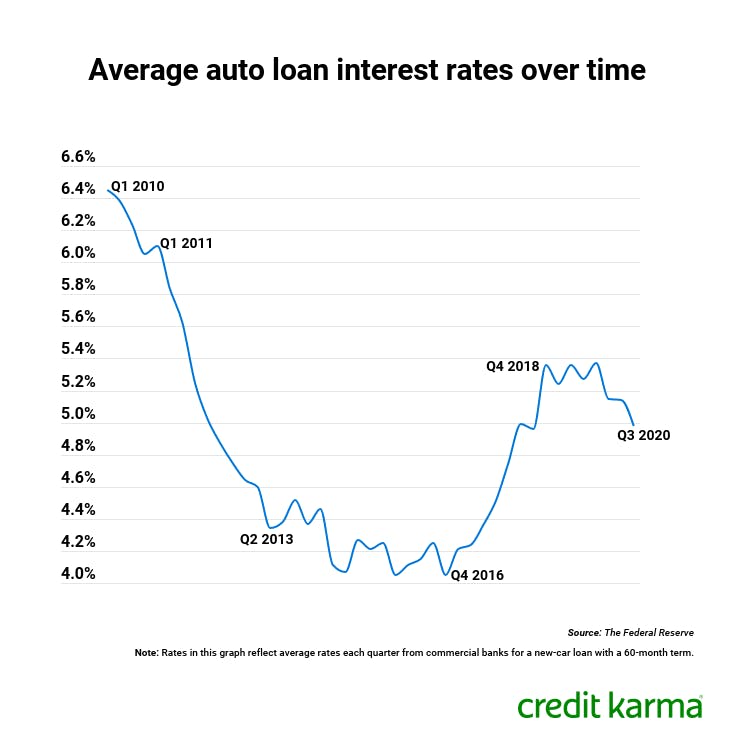

Interest rates aren’t static. They move up and down based on market conditions. Rates are typically lower during hard times, such as the financial crisis of 2007–2009, to entice borrowers to take out loans and businesses to make expansion-related investments. Rates are usually higher in a thriving economy to help contain inflation.

Be sure to check rates before you begin car shopping. Some lenders post their starting APRs on their websites.

How can I pay less interest on my car loan?

The amount you must repay may increase by thousands of dollars due to interest charges. However, if you must finance your car purchase, there are ways you might be able to lessen the financial impact.

- 0%%20APR%20financing%20%E2%80%94%20If you have exceptionally good credit and the auto manufacturer’s finance division offers special financing, you might be able to benefit from 200% APR financing for a set period of time.

- Early repayment — If you have a loan with simple interest, you can lower your interest costs by paying off the balance early or above the minimum amount due each month.

- Shorter loan term: In the long run, paying less interest overall is possible when you opt for a shorter repayment term. However, it will raise your monthly payments, so make sure you have the money.

- Refinance later – You might be able to obtain a lower rate by refinancing your auto loan if interest rates decrease or your credit improves after you obtain your car loan.

If you need a car loan to pay for the purchase of a vehicle, use online calculators to see how different interest rates might impact both the monthly payment and the overall cost of the loan.

Remember to shop around and contrast the loan offers you receive from different lenders. To ensure you compare offers and receive the best deal for you, make sure you understand all the terms of a car loan, keeping in mind that your interest rate is only one component of the total.

FAQ

How is auto loan interest calculated?

Your interest payment is determined by multiplying your outstanding principal balance by the daily interest rate, which is equal to your interest rate divided by 365. In essence, the amount of interest you pay depends on the remaining principal balance and the length of time you owe it.

What is 6 interest on a $30000 loan?

As an illustration, the interest on a $30,000, 36-month loan at 6% is $2,856. If the same loan ($30,000 at 206%) were repaid over 2072 months, the interest would be $5,797%. Naturally, even slight adjustments to your rate have an effect on the total amount of interest you pay.

Is interest on a car loan daily or monthly?

Car loan interest is typically computed daily using the principal amount. The daily interest is divided by 365 (or 366 in a leap year) to get the annual rate. In the event that you have a $10,000 balance at a 3% interest rate, for instance, the daily interest would be approximately $0. 82.

How does the APR work on a car loan?

The annual percentage rate (APR) of a loan includes both the interest rate that the lender charges and other costs related to the loan. These costs are known as “prepaid finance charges” and can differ significantly amongst lenders, so be aware of them.

Read More :

https://www.investopedia.com/articles/personal-finance/061615/how-interest-rates-work-car-loans.asp