Though you’re unsure of what to anticipate from a Credit Strong account, you might be interested in saving money and establishing credit. Developing credit can be challenging and perplexing, particularly if it’s difficult to get loans or credit cards approved. Fortunately, this post clarifies what it means to open a Credit Strong account and explains how Credit Strong simultaneously helps you increase your savings and establish credit.

6 Things to Know about Credit Builder Loans

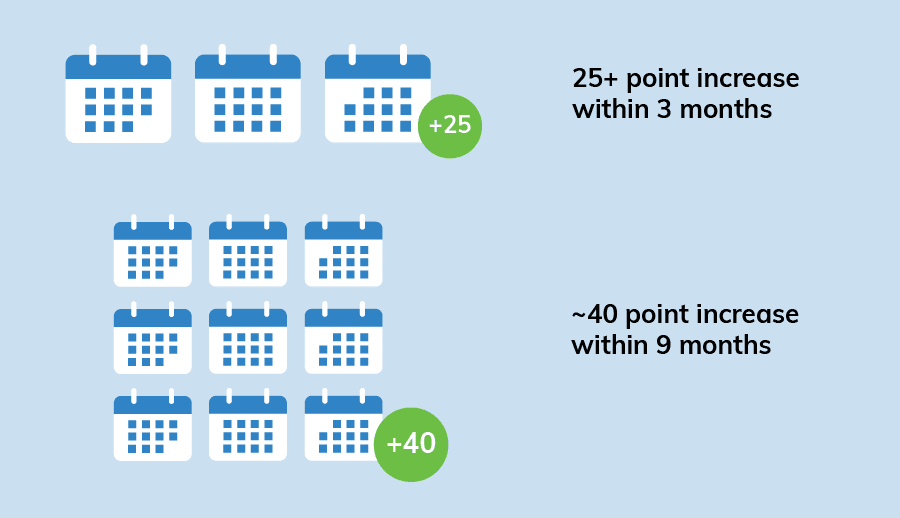

1. The average account holder increased their FICO® Score 8 by more than 25 points within three months of opening a Credit Strong credit builder account, according to our analysis of 50,000 Credit Strong® credit builder accounts. The average credit score improvement rose to nearly 40 points after nine months.

2. Credit Strong account holders nearly doubled that improvement, with their average credit score rising by nearly 70 points, by making all of their payments on time for a full year.

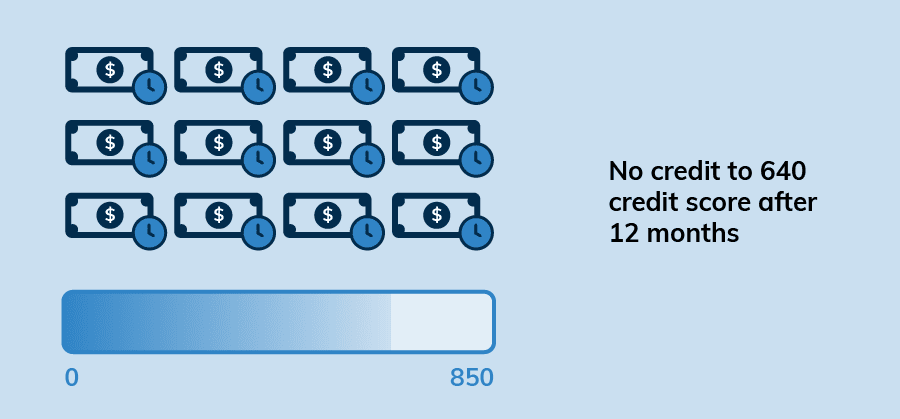

3. After a year, Credit Strong account holders who had no credit score when they opened their account (but made all of their loan payments on time) had an average score in the 630–650 range.

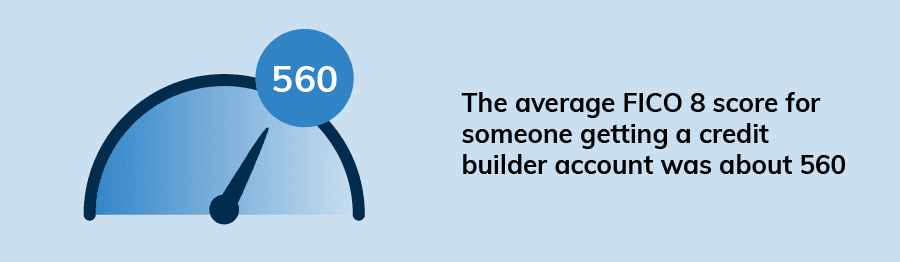

4. When applying for a credit builder account, the average FICO Score 8 was roughly 560.

5. A bit less than in 2010 in terms of credit builder account customers, initially having no credit score when they opened an account

6. According to a study by the CPB, a significant proportion of participants (93%) who opened a credit builder loan made at least one late payment, which could potentially harm their credit scores rather than improve them. Therefore, it is crucial to ensure that you have a budget in place for timely payments when obtaining a credit builder loan.

What Is a Credit Builder Loan?

Installment loans of this kind, known as credit builders, can assist borrowers with poor or no credit in building credit history. Customers may raise their credit scores if they handle their credit builder loans well. However, the outcome of a credit builder loan could be the opposite for people who pay their bills on time each month.

Unlike with a conventional personal loan, you typically won’t get the loan funds immediately when using this credit building product.

Every lender is different, but here’s how they generally work:

- You apply for an online lender, credit union, or financial institution to open a credit builder loan.

- Until you make your last payment, the lender retains the loan funds and may or may not pay you interest on the proceeds. For the length of your loan term, loan proceeds are typically kept in a savings account or certificate of deposit (CD).

- Although loan amounts can vary, they typically fall between $500 and $2,500 (and occasionally more).

- The financial institution may allocate a portion of each monthly payment toward interest and the remaining amount toward the principal amount of the loan.

- The lender will report your account and payment history to one or more of the three major credit bureaus as you repay the loan. This offers you the opportunity to establish a solid payment record on your credit report or reports.

- The lender releases the proceeds of your loan, plus interest on your savings (if applicable), less any loan interest or fees, as soon as you make the last monthly payment.

Keep in mind that the conditions for each lender’s credit-building loan program vary. So, the process described above isn’t universal.

Do credit builder loans work?

Your credit score won’t rise just because you opened a credit builder account. However, the chances are in your favor if you properly manage your new account.

Within the first three months of opening an account, the average credit builder loan account holder saw an increase in their FICO Score of more than 25 points, according to Credit Strong’s internal data set.

By the nine-month point, the average FICO Score improvement had increased by an astounding 40 points. %20(Note: The length of your credit history affects your FICO score as of 2015) ).

When it comes to financing, a 40-point variation in your FICO Score could be significant.

Based on current interest rates, the following is an example of how much you might save on a $300,000 30-year fixed mortgage if your FICO Score increased by 40 points, from 639 to 679:

- Reduce the annual percentage rate on your mortgage from approximately 4% to approximately 203 5%.

- Save $163 per month

- Reduce the total interest paid on the loan by $58,751 over its term.

*Estimated savings calculated using the myFICO Loan Savings Calculator.

The Bottom Line: A prudently handled credit builder loan could improve your credit If your credit does get better, you might find it simpler to get approved for financing and end up paying less in fees and interest.

The importance of on-time payments

Credit builder loans are a tool. Based on a number of variables, you, the account holder, decide whether and to what extent this particular kind of personal loan benefits you.

Your account payment history is one of the key factors that determines how a credit builder loan affects your credit score. The most significant factor influencing your credit score and accounts for 35% of your FICO score is your payment history.

According to our data, account holders who fulfilled all of their payments on schedule for a full year nearly doubled the aforementioned credit score improvement figures.

On average, they improved their FICO Scores by almost 70 points.

Recall that attempting to raise your credit score indicates your desire to persuade potential lenders that you pose a low credit risk. On-time payments are a must.

Remember that other than your credit builder loan account, other items on your credit reports can also affect your FICO Scores.

The lesson is that payment history is the most important component of credit score. If you make late payments on your credit builder loan or any other account, it could undermine your attempts to improve your credit.

Do credit builder loans work for people with no credit score?

Credit scores are frequently not required by lenders who offer credit builder loans in order to be approved.

Therefore, even if you have no credit score, you can probably still be eligible for a credit builder loan.

When we analyzed Credit Strong’s internal data set, we discovered that, generally speaking, customers who applied for loans without a credit score did well.

After twelve months of making on-time payments, the average credit score for account holders who had no credit score when they first opened their account fell between 630 and 650.

On a FICO Score scale of 300-850, a score of 630-650 is considered fair. At this level, you still have more work to do to reach the “good” FICO Score threshold of 670.

However, a FICO Score of 630-650 is likely sufficient to help you qualify for certain types of financing, like a mortgage or auto loan, albeit probably not at the most competitive interest rate.

The Takeaway: If you don’t already have a credit score, a credit builder loan could help you get one.

Pro Tip: You can create a VantageScore® 3 if you don’t have any credit history. 0 (the score typically offered by free credit score providers) after only one or two months; however, you’ll need to have made payments for at least six months in order to obtain a FICO Score. The credit scores that lenders most frequently use to determine creditworthiness are FICO scores.

When do credit builder loans not work?

Naturally, a credit builder loan isn’t a panacea for all credit issues.

A credit builder loan may not always improve your credit in certain situations. Everything depends on how you handle the account (as well as the other things listed on your credit report).

Late payments often cause severe credit score damage. Sadly, not everyone who obtains a credit builder loan in order to establish credit makes timely payments.

The Consumer Financial Protection Bureau conducted a study on credit builder loans in July 2020. The agency examined 1,531 credit builder loan borrowers, over 60% of whom had an annual income of less than $30,000, who were members of a St. Louis area credit union.

According to the study, 339 percent of participants who opened a credit builder loan paid it back late at least once.

The lesson learned is that you should plan your finances before applying for a new credit builder loan. Receiving a credit builder loan and failing to make payments on time will lower your credit ratings.

The Average FICO 8 Score for Someone Opening a Credit Builder Account was Around 560

Since many lenders don’t require a minimum credit score to qualify for this type of account, people with no credit or a low credit score may be good candidates for credit builder loans.

The average FICO 8 score for someone opening a credit builder account was approximately 560, according to our analysis of more than 50,000 Credit Strong accounts.

FICO rates a score of 560 as “poor.”

Your bad credit indicates to potential lenders that you could be a risk. Because of this, you might find that some lenders are unwilling to give you a loan or create a credit card in your name.

The Bottom Line: If you want to establish credit but are having trouble getting approved for traditional financing because of credit issues, you might want to consider a credit builder loan. In addition, these loans may be desirable if you wish to establish credit without obtaining a credit card.

Nearly 10% of Credit Builder Account Customers Had No Score at the Time They Opened the Account

Applying for an account that could help someone establish credit can occasionally be intimidating for those who don’t have one.

According to the CFPB, around 45 million consumers have no credit score due to one of the following reasons:

- An individual who is “credit invisible” lacks a credit file with the major credit reporting agencies, and as a result, their credit score is zero.

- “Unscoreable” individuals possess a credit history from at least one credit bureau, but it is insufficient to be eligible for a credit score.

But we discovered that a significant portion of individuals in our data set didn’t let their lack of a credit score prevent them from submitting an application for a credit builder loan.

Approximately 10% of credit builder account holders did not have a score when they first opened an account. (That’s close to 5,000 people. ).

When these account holders first opened their accounts, their credit files were either thin or nonexistent, making it impossible to determine their credit score.

The Moral of the Story: Many people feel at ease taking out credit builder loans in order to begin establishing credit, even if they have no credit history or credit score.

Examples of People Who Used Credit Builder Loans

Let’s go back to a crucial aspect of our initial query: Are credit builder loans effective?

The answer is yes. When used properly, credit builder loans are effective instruments that have assisted many individuals in establishing credit.

Example #1: Customer who wants to get a mortgage to buy their first home.

In an effort to get their credit ready for a mortgage, many people look for credit builder loans.

An installment loan that is similar to a credit builder loan is a mortgage.

Before granting you such a large loan, lenders must ensure that you have the ability to repay your home loan.

Therefore, it makes sense that before approving you for a mortgage, lenders like to see that you’ve paid your installment loans on time.

Being able to make timely payments on other installment loans does not ensure that you will be approved for a home loan. However, it’s frequently a step in the right direction.

One customer who had opened a credit builder loan achieved his dream of buying a house.

Due to his poor credit, Joshua had to live in an apartment for 12 years before deciding he wanted a change. He was prepared to take care of his credit issues and buy a house.

Joshua’s entire plan for improving his credit included a credit builder loan.

First, Joshua checked his three credit reports. Then, he disputed the inaccurate information on his reports.

Joshua didn’t have any open accounts at the time to help establish good credit. He therefore opened a secured credit card and a credit builder loan.

He always made sure to pay off his new credit card balance in full by the due date. Most significantly, he consistently paid both of his new bills on schedule.

Joshua tracked his progress using a credit monitoring service. The changes he wanted to see didn’t happen over night. However, following nine months of diligent work, Joshua’s credit scores were high enough to be eligible for a mortgage.

Although this is merely an example, credit builder loans help actual people fulfill their dream of owning a home. Here’s an actual quote from a Credit Strong customer:

“You guys helped me buy a house. I had a 394 when I started. 18 months later I have a 725!”.

Example #2: Customer who wants to get a car loan to buy a car.

Along with mortgages and credit builder loans, auto loans are another kind of installment loan.

Installment loans require you to borrow a certain amount of money and pay it back over a predetermined period of time. The lender will typically also charge you a fixed interest rate.

Your credit may improve if you pay back a credit builder loan from a lender that reports to the three credit bureaus on time.

This may increase a lender’s assessment of your credit risk.

You have a higher chance of being approved for other loans—with lower interest rates—if you have better credit than you had when you first opened and closed your credit builder account.

Here’s another fictitious instance of someone qualifying for an auto loan with the aid of a credit builder loan.

Amanda needed a new, reliable vehicle. It was difficult for her and her spouse to share a car because they both had outside jobs. But she was having trouble locating reasonably priced auto financing because of her bad credit scores.

She decided to improve her circumstances as a result.

Amanda’s credit reports lacked diversity and she had multiple credit cards that were fully charged. She didn’t have any open (or closed) installment accounts.

The first step Amanda took was to reduce her spending. As a result, she was able to begin reducing her credit utilization rate, which is a crucial component of credit score.

Next, Amber opened a credit builder loan account. She made the monthly payments on her new credit builder loan in addition to working to pay off credit cards. And she always paid on time.

Six months later, Amber’s credit was in better shape. She went to her neighborhood credit union, applied for an auto loan, got a good interest rate, and purchased a car that brought her great joy.

The scenario above is just an example. Real people do use credit builder loans to fulfill their dream of purchasing a car. Here’s an actual quote from a Credit Strong customer:

“Thank you Credit Strong! I was able to get approved for a brand-new car because of you. ”.

Building credit from the ground up can be a challenge. Additionally, attempting to repair bad credit may not be simple.

Should you find yourself in any of these circumstances, you might be able to benefit from a credit builder loan.

It’s crucial to conduct your own research before selecting a credit builder program.

Certain lenders demand that you access your bank account and make a one-time payment. This obstacle may make it more challenging for you to afford a program that builds credit.

Your credit builder account may not be reported by other lenders to all major credit bureaus. Therefore, even if you handle your account perfectly, you won’t receive full credit for your excellent payment history.

However, if you choose the correct credit builder loan and make your payments on schedule, you may be able to increase your savings and get a good credit score at the same time.

Testimonial Disclaimer: Individual results may vary. Individuals’ past performance and unique experiences do not guarantee the same outcomes for others in the future. Testimonials might not accurately represent the experiences of all people, and some people might perform worse than those who have received positive feedback.

FAQ

How much money does credit strong give you?

With Credit Strong, you can open a credit account with up to $2,000 and save more than $1,000 in just 13 months.

Is Credit Strong a personal loan?

What is a Credit Strong account? It’s a combination of an FDIC-insured savings account and a secured consumer installment loan. You accumulate savings and credit history over the course of your Credit Strong account.

Do you get the money back from credit strong?

A lock is put on the commercial savings account to secure the loan during the term of the loan, meaning that the funds inside are not accessible for withdrawal. When the loan matures, that is, when it is closed and paid off, the lock is taken out and you can access the money in the savings account.

Can I pay off my credit strong loan early?

Yes. Paying off your CreditStrong account loan early does not incur any prepayment or early withdrawal penalties.

Read More :

https://www.creditstrong.com/credit-builder-loan/

https://www.creditstrong.com/what-to-expect-from-your-credit-strong-account/