Manufactured home loans can be a smart choice for buyers

Obtaining a mortgage for a manufactured home differs slightly from obtaining a conventional mortgage for a stick-built house.

Although not all lenders provide these kinds of loans, you do have a respectable selection of choices. When considering financing a mobile home, government-backed loans such as FHA, USDA, and VA loans are available, and some manufactured homes can be acquired with traditional mortgages.

Your eligibility as a borrower, the age and kind of the home you’re purchasing, and whether or not your new residence is classified as “real property” or “personal property” will all determine the best manufactured home loan for your needs. ”.

In this article (Skip to…)

What is the difference between manufactured homes, mobile homes, and modular homes?

The terms manufactured, modular, and mobile are often used interchangeably when referring to these kinds of homes. However, each comes with its own unique characteristics and advantages.

The differences between these three types of housing should be taken into account as you consider your options, especially if you’re determining which manufactured home mortgage or other financing options are best for you.

Manufactured homes, formerly referred to as “mobile homes,” have significantly improved and evolved since their creation. These homes are factory-built and then transported to the site. The HUD (U. S. Since 1976, the Department of Housing and Urban Development has governed their building and safety requirements. Here are some key features:

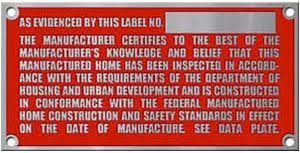

- Regulation: Manufactured homes were built after 1976. In contrast to their historical counterparts, modern manufactured homes adhere to strict HUD Code regulations. This code establishes requirements for design, construction, energy efficiency, and installation that are safety and quality-related.

- Construction: Manufactured homes are built on a non-removable steel chassis. Sections are transported to the site and then assembled. These houses can have a range of sizes and floor plans, and they are usually single-story buildings.

- Ownership: Manufactured homes can be owned on property that is either purchased with the home or that is leased (such as in a mobile home park).

- Affordability: Compared to traditional, site-built homes, manufactured homes typically provide a more affordable housing option.

Typically, manufactured homes constructed in compliance with HUD’s safety regulations bear a “HUD tag” on them.

However, even though the manufactured home you’re purchasing was constructed in accordance with HUD guidelines, it might not be eligible for a conventional mortgage. If the house can’t pass a few more requirements, you might require financing for a different kind of manufactured home. We explore these requirements in more detail below.

The term “mobile home,” which is sometimes used synonymously with “manufactured home,” generally refers to dwellings constructed prior to the implementation of the HUD Code in 1976. In order to establish new, stricter guidelines for the design and safety of these kinds of homes, the National Manufactured Housing Construction and Safety Standards Act was passed at this time.

Despite the frequent confusion between the terms, understanding the distinctions between these houses will enable you to distinguish between them.

- Regulation: Mobile homes were not held to the same stringent safety and construction standards as modern manufactured homes because they were built in factories prior to June 15, 1976. The longevity, security, and quality of these homes may be impacted by this lack of regulation.

- Construction: After first being placed, mobile homes can be moved because of their movable chassis. But for the most part, mobile homes remain in one place for the duration of their lives.

- Ownership: Mobile homes, like manufactured homes, can be situated on privately held or leased land.

- Affordability: Mobile homes are frequently a cost-effective housing option, but it’s vital to take into account the possible costs of energy efficiency and maintenance, which may be higher because there are no established building regulations.

Similar to manufactured and mobile homes, modular homes, also referred to as prefabricated homes, are constructed in factories. Nonetheless, there are variations in their design, construction, and regulations.

- Regulation: Depending on where the property is located, modular homes must adhere to local, state, or regional building codes. These requirements are usually the same as those for homes constructed on-site, resulting in similar quality and longevity.

- Construction: Although these houses are built in factories in sections, or modules, they are assembled on a permanent foundation on the construction site, just like a conventional house. Modular homes offer a great deal of design and layout customization and can have multiple stories.

- Ownership: For financing and property value purposes, modular homes are typically regarded as site-built homes. Usually, the land where they are positioned is owned, not leased.

- Investment Value: Modular homes tend to increase in value over time because, once finished, they are nearly identical to site-built homes, making them a wise long-term investment.

The same loan programs that are available for conventional site-built homes can also be used to finance modular homes. This is one of the key advantages of modular homes. Most lenders treat them similarly because they are usually installed on a permanent foundation and, once completed, are often identical to homes built on sites.

How to qualify for a manufactured home mortgage loan

Like you would if you were purchasing a site-built home, you must meet the minimum credit score, income, and down payment requirements in order to be eligible for a mortgage loan for a manufactured home.

Additionally, the manufactured home must be mortgage-qualifying. In addition to abiding by HUD’s post-June 15, 1976, safety requirements, the house has to:

- Be “real property” and not “personal property”

- Have at least 400 square feet of living space

- Be situated on land you also own and permanently affixed to a foundation

I would like to take a closer look at these requirements before you begin applying for loans.

Real property versus personal property

“Real property” must include both land and items like houses, paved driveways, and in-ground swimming pools that are difficult or impossible to remove from the land. Anything that is transportable and useful elsewhere, like a car, a boat, or a real mobile home, is considered personal property.

How the current owner pays taxes will tell you whether an existing manufactured home is real or personal property.

If the residence is owned by the DMV, it is deemed personal property. Furthermore, a house on leased land is not going to be regarded as real property. If you’re purchasing a new house from a dealer, the house must be situated on either your own or newly purchased land.

To be eligible for a manufactured home loan, the house you’re purchasing needs to have 400 square feet or more of living space.

The majority of manufactured homes, particularly double-wides and modular homes, easily satisfy this condition.

However, some manufactured home loan programs call for additional space. For instance, the standard loan offered by Fannie Mae for manufactured homes necessitates that the house have a minimum of 600 square feet of living area.

Foundations and land requirements

Prefabricated houses can be delivered in sections and put together on location. Alternately, they could be constructed elsewhere and towed to their final location.

In either scenario, the house won’t be eligible for most government-backed loans or conventional loans until it is permanently affixed to a foundation.

Moreover, the house cannot be situated on property that someone else already owns and refuses to sell to you, nor in a mobile home park.

Manufactured home mortgage loans

You might be able to finance your manufactured home with a conventional home mortgage if it satisfies the requirements listed above. I believe that to be a government-backed mortgage program such as Fannie Mae, Freddie Mac, or others.

The loans function nearly in the same way as conventional “stick-built” home financing, but higher interest rates are to be expected.

Freddie Mac and Fannie Mae, two government-sponsored enterprises (GSEs), provide loan programs especially made for manufactured homes. These initiatives seek to increase access to home ownership by offering solutions for affordable housing.

With traditional Fannie Mae and Freddie Mac loans, you can put down as little as 3% of the total amount. For manufactured home loans, there are additional risk-based fees, which results in somewhat higher rates. Here’s what you can expect.

Freddie Mac: Manufactured Home Loans

The “Duty to Serve” plan of Freddie Mac includes a manufactured home loan program that offers more financing choices for manufactured homes. Key features of this program include:

- Loans for Real Property: The manufactured home must be permanently affixed to the borrower’s owned land in order to qualify as real property.

- MH Advantage: Manufactured homes that satisfy certain construction requirements, such as being built on a permanent chassis and measuring at least 400 square feet, are eligible for this mortgage program. Homes that meet the requirements for MH Advantage may be eligible for financing comparable to that of site-built homes, possibly with longer loan terms and smaller down payments.

Fannie Mae: MH Advantage and HomeReady

Fannie Mae offers two main programs:

- MH Advantage: Fannie Mae’s manufactured home financing program, which is akin to Freddie Mac’s program of the same name, offers financing for manufactured homes that meet specific requirements, like being at least 600 square feet and at least 12 feet wide. The benefits can include interest rates that are closer to those of site-built homes, down payments as low as 3%, and possibly longer loan terms.

- HomeReady: The goal of the HomeReady program is to assist low- to moderate-income homebuyers who have little money set aside for a down payment. It provides lower mortgage insurance premiums, lower interest rates, and other advantages to qualified borrowers for manufactured homes.

Keep in mind that even though Fannie Mae and Freddie Mac are the ones who design these programs, you will normally collaborate with a bank or another lender to complete the loan application process. It’s crucial to do your research and evaluate several lenders and programs to determine which one best suits your requirements and financial circumstances.

There are two loan programs offered by the Federal Housing Administration (FHA) that are especially made for manufactured homes: the Title I program and the Title II program. Depending on whether the borrower intends to purchase a manufactured home in its entirety, in part, or neither, each offers distinct advantages.

Because the financing is insured by the FHA, borrowers with credit scores as low as 580 can get loans with three 5% down. You’d need to use the home as your primary residence.

FHA Title I loans

Loans made by authorized lenders to finance the purchase of a new or used manufactured home, a lot for a manufactured home, or both are guaranteed under the Title I program. It is also possible to refinance your current mortgage with this kind of loan. It is intended to assist people and families who might not otherwise be eligible for conventional financing. Here are your different options:

- Only the purchase of a manufactured home is eligible for this loan. It’s the kind of loan you would take out if you intended to rent a manufactured home community frequently. For a manufactured home or a single-section manufactured home and lot, the maximum loan term is 20 years.

- Lot-only: Loans for lots are also covered by the Title I program. This loan can be suitable if you’re buying land for your manufactured home. For a lot only, the maximum loan term is fifteen years.

- Combination loan: Under the Title I program, you can finance the purchase of a manufactured home as well as a lot to put it on with a combination loan. A loan on a manufactured home lot or a loan on a manufactured home and lot with multiple sections may have a maximum loan term of 25 years.

The land the manufactured home will be placed on does not need to be owned by the borrower in order to qualify for the Title I program. But the house has to be the borrower’s primary residence.

FHA Title II loans

When purchasing a manufactured home, be sure to review the FHA’s Title II program. This program resembles the FHA’s traditional mortgage for site-built homes.

While manufactured homes and lots are covered by the Title I program, homes that meet certain requirements and are categorized as real property are guaranteed mortgages under the Title II program. Here are its main features:

- Real property requirements: The manufactured home must be permanently fixed to a foundation on land that the borrower owns, comply with local and regional building codes, and HUD’s post-1976 safety regulations in order to be eligible for financing through the Title II program. Having a minimum floor area of 400 square feet is part of this.

- Title II loans are used to finance the purchase of both the house and the land it is situated on. The maximum loan term is 30 years.

- Equity and appreciation: Since these houses are regarded as real estate, there’s a greater chance that their value will increase over time, providing the homeowner with equity.

Additionally, the FHA can assist you in purchasing the land for your new manufactured home through a procedure similar to that of obtaining a construction loan.

Most private lenders offer loans backed by the FHA. Finding a lender that underwrites FHA Title II manufactured home loans may require some research, similar to what happened with Freddie and Fannie loans.

The U. S. Loans for veterans and active-duty military personnel are insured by the Department of Veterans Affairs.

The VA loan program includes financing for manufactured homes. Purchasers are required to make a 5% down payment, and the loan terms are shorter, ranging from 2020 to 2025 years, contingent upon the property.

The VA can assist qualified veterans in purchasing both manufactured homes and land.

VA loans are available from most private lenders and have some of the lowest fees and most competitive rates available.

If you’re a rural home buyer looking to finance a manufactured home or a home and lot, you might be qualified for a USDA Single Family Housing Guaranteed Loan (SFHGLP).

- Homebuyers with low incomes (those who make 80% or less of the area median income, or E2%80%99) are eligible to apply for loans directly from the USDA.

- Buyers with moderate incomes (earnings between 20115% and less of the area’s median, or E2%80%99s) are eligible for USDA Guaranteed Loans, which are provided by private lenders.

USDA Rural Housing loans require no down payment. As long as the manufactured home is brand-new, buyers can take advantage of this loan program. In addition, the house must be constructed in accordance with HUD’s post-1976 standards, have a permanent foundation, and have at least 400 square feet.

USDA manufactured home loans are only available to buyers who meet certain income requirements and can only be used in rural and suburban areas, similar to all USDA loans.

Options for mobile home loans

You won’t be able to use a conventional or government-backed mortgage program to finance the purchase of your manufactured home unless it meets the requirements for real estate.

That’s OK, though. These properties can still be financed; however, mortgages are not an option.

If you are unable to obtain conventional mortgage financing for your mobile home, you have a few alternative loan options.

FHA Title I loans

The FHA’s Title II loan for manufactured homes that meet real estate requirements was previously discussed. Title I loans for personal property, or houses that aren’t considered real estate, are also available from the FHA.

You’d need to put 5% down. Although annual percentage rates for home loans will be higher than those for conventional loans, they should be less than those for personal loans.

There are maximum loan amounts depending on whether you’re financing the purchase of a home, the purchase of land for the home site, or both. The interest rate is fixed for the duration of the loan.

Current FHA Title I loan limits:

- Manufactured home: $69,678

- Manufactured home lot: $23,226

- Manufactured home and lot: $92,904

There are also maximum loan terms:

- 20 years for a single-wide house and lot or a manufactured home

- 15 years for a manufactured home lot loan

- A loan for a multi-wide manufactured home and lot with a 25-year term

Both buying and refinancing a manufactured home are possible with an FHA Title I loan.

You’ll need to inquire online or through referrals to find lenders who provide FHA Title I financing, as not all of them offer this program.

An alternative to consider when financing a mobile home is a chattel loan. Because the home is used as collateral, this loan is similar to an auto loan.

If you don’t intend to purchase the home site, which is frequently the case in a mobile home community, you might be eligible for a chattel loan.

And you’d need at least 5% down to get financing. Chattel loans are less risky than personal loans because the value of the home acts as security, and they can also have more favorable interest rates.

Rates will still be higher than those of a conventional fixed-rate mortgage, though, by a few percentage points. That often translates into higher monthly payments due to the shorter loan term of a chattel loan.

Use existing home equity

If you already own a house, you can use the equity to purchase a manufactured home that you can use as a vacation home or rental.

The portion of your home’s value that you have paid off is called equity. You would have $150,000 in equity if your house is worth $300,000 but you only owe $15,000.

You can borrow against your equity by getting:

- A cash-out refinance replaces your current mortgage with a larger one, allowing you to keep the extra money you receive. If you want to cash out for a large purchase and need a new primary mortgage, it’s a good option.

- Using a home equity loan or line of credit, you could add a second mortgage while maintaining your primary mortgage. While home equity lines of credit (HELOCs) allow you to borrow from your equity as needed, home equity loans offer a lump sum of money.

Interest rates are reasonable because your home’s value acts as security for these loans, especially if you have good credit and enough equity to meet your lender’s loan-to-value requirements.

However, these loans also place a lien on your house, so if you don’t make the payments, you risk losing it.

Consider personal loans if your manufactured home is still mobile or unfinancingable for any other reason.

The fact that personal loans require no property approval at all is what makes them so appealing.

The loan is based on you, not the property. Based on your credit history and debt-to-income ratio, you may still be approved even if the mobile home is too old or in poor condition for financing.

This kind of financing is also fast. You can have the money to assist with the purchase of a home in less than a week.

However, there’s a catch: The annual percentage rates for personal loans will be significantly higher than those for secured loans, such as mortgages or chattel loans. If your credit is not stable, your rate might even be higher than your credit card rate.

Additionally, some lenders charge origination fees that range from 6% to 7%, which is higher than the average mortgage loan amount and closing costs.

Manufactured and mobile home mortgage rates

The mortgage rates for manufactured homes can vary and occasionally be higher than those for conventional home loans. However, you shouldn’t let that scare you because understanding how these rates operate will actually enable you to negotiate a better price.

The terms of the loan, the size and condition of the home, and your credit score are some of the variables that affect manufactured home mortgage rates. For those purchasing their first home, some lenders may also provide promotional rates, which is a wonderful benefit if you’re new to this.

Look into both fixed-rate and adjustable-rate mortgages while you’re shopping around. If your interest rate is fixed, it will remain constant for the duration of the loan. Conversely, adjustable-rate mortgage loans may change over time, which may work to your advantage or disadvantage based on the state of the market.

Don’t forget to compare lenders and get multiple quotes. Rates can differ dramatically between lenders, and over time, a small variation in the percentage can result in significant cost savings.

How to apply for manufactured home loans

Although the process of getting a manufactured home mortgage is similar to that of getting a traditional mortgage, it has some unique aspects of its own.

It’s crucial to remember that the requirements for eligibility and the application process vary based on the kind of loan you’re applying for: chattel, conventional, FHA, or VA.

- Research your mortgage options. You might discover that one sort of loan is a better fit for your needs than another depending on your financial status, credit score, and the characteristics of the manufactured home (such as its age and whether it is permanently attached to a piece of property).

- Decide whether you’re buying land. Those who want to rent a plot for their home will have fewer loan options available to them than those who plan to purchase the land on which their home will be built. Your mobile home is less likely to be moved if you own the land and have removed the axle and wheels. This may make more lenders willing to finance you.

- Assemble your application materials. This usually consists of a credit report, a list of your assets and liabilities, employment verification, and proof of income. If you are applying for a loan through the VA or FHA, you will need to provide additional documentation.

- Get rate quotes from several lenders. Different lenders may offer drastically different terms and rates, even for the same kind of loan. So you should look around for the best deal. But bear in mind that every lender will obtain your credit report, and an excessive number of hard inquiries may have a negative effect on your credit score. Try to complete all of your rate shopping in a condensed amount of time, usually 14 to 45 days, to lessen this.

Finally, submit your application and watch for the lender’s response. They will take into account your creditworthiness, the manufactured home’s value, and your intended down payment before approving your loan.

Tips for getting a manufactured home mortgage

Getting a mortgage can be a scary prospect, especially if you want to finance a manufactured home. Still, there are ways to improve your chances of getting approved and get the best terms on your loan.

Improve your credit score

Your first goal should be to raise your credit score. Your credit score has a significant impact on both your ability to obtain a mortgage and the amount of interest you will pay. If you pay off your debt, pay off your bills on time, and review your credit report for errors, you can gradually raise your credit score.

Shop around for the best rates

Next, compare your loan options carefully. Just like you would when purchasing a car or a piece of furniture, shop around to make sure you’re getting the best deal. Lenders may differ in terms of interest rates, fees, and loan terms. Be sure to consider these factors when choosing a choice.

Assess the condition of your home

Consider the manufactured home you wish to finance in terms of its age and condition. Lenders usually have strict rules about these things. Refinancing is more likely to be granted for a reasonably priced, well-maintained home.

For instance, if you want to purchase a 20-year-old, dilapidated manufactured home, some lenders might reject your loan application. However, if you find a lender who is willing to work with you and specializes in financing older homes, they might ask for a larger down payment or charge higher interest rates.

It’s crucial to consider each of these factors before selecting a loan option.

Finally, be truthful and provide lenders with all the data they require. Inaccurate or missing information could cause your application to be rejected or be delayed.

Pros and cons of manufactured home mortgages

Although manufactured home mortgages can simplify the process of becoming a homeowner, it is crucial to weigh the advantages and disadvantages of this option before making a decision.

Pros of manufactured home loans

One advantage is that manufactured homes are typically less expensive than conventional stick-built homes, which can enable people who might not otherwise be able to afford it to become homeowners.

The fact that there are several loan options available, including ones made especially for manufactured homes, is another benefit. Compared to traditional mortgages, these loans frequently feature more lenient credit requirements and competitive interest rates.

Additionally, manufactured home mortgages allow for flexibility in the location of the home. Financing options are available regardless of whether you own the land where the home will be built or decide to rent a lot in a manufactured home community.

Cons of manufactured home loans

On the other hand, there are some downsides to consider. One significant disadvantage is that, in contrast to traditional homes, which usually increase in value over time, manufactured homes can lose value. This may make it more difficult to accumulate equity or sell the house at a higher price later on.

Furthermore, manufactured homes may be subject to stricter credit requirements and higher interest rates from lenders who view them as riskier than conventional homes.

Lastly, the locations of manufactured homes can occasionally be restricted by zoning laws and homeowners’ association regulations, which may limit your options.

Many people discover that the advantages of owning a manufactured home, such as affordability and flexibility, outweigh the disadvantages even with these possible drawbacks. But before making a choice, it’s important to take your unique situation and long-term objectives into account.

FAQ: Manufactured home mortgage loans

It can be difficult to purchase a mobile home with no down payment, but some programs might make it possible. For instance, VA loans are available to qualifying surviving spouses, veterans, and service members and frequently have no down payment requirements. Also, USDA loans—which are intended for homebuyers in rural and suburban areas—may be available with no down payment. Certain requirements must be met in order to be eligible for these programs, and availability may vary.

It can be challenging to obtain a conventional loan for a mobile home. The majority of traditional lenders demand that the house be real property, not personal property, and that it be situated on a permanent foundation. If manufactured homes satisfy specific requirements, some lenders, such as those who offer Fannie Mae’s MH Advantage program, may offer conventional loans for them.

Yes, a lot of credit unions and banks finance mobile homes situated on land. These are usually considered real property loans. Certain VA loans and FHA Title II loans are examples of government-backed loan programs that permit financing of mobile homes and the land they are situated on.

Financing is available from Rocket Mortgage for manufactured homes constructed on permanent foundations. Nevertheless, true mobile homes—those built prior to June 15, 1976—and manufactured homes without a permanent foundation are not eligible for financing from Rocket Mortgage.

Yes, you can get a mortgage on a manufactured home. There are numerous choices, such as certain conventional loans, VA loans, and FHA loans. Typically, the house must fulfill certain criteria, like being on a permanent foundation and being considered real estate.

Under certain circumstances, it is possible to obtain a reverse mortgage on a manufactured home. The house needs to be built after June 1976, be on a permanent foundation, be taxed as real estate, and satisfy the FHA’s property eligibility requirements. You must also own the land the home is on. The FHA’s Home Equity Conversion Mortgage (HECM) program is the reverse mortgage program that is most frequently utilized for this purpose. Before making decisions on intricate financial matters such as reverse mortgages, it is advisable to seek advice from a qualified professional.

Indeed, just like a car dealer, a dealer of manufactured homes may provide financing. However, you should do your own home financing research. With a longer loan term or a lower interest rate, the FHA Title I program may be able to provide lower monthly payments.

You are required to obtain mortgage insurance in the event that you secure a conventional mortgage with a down payment less than a 20% down payment or an FHA or USDA-backed loan. In the event that you default on the loan, this coverage safeguards the lender. Your monthly payments and upfront expenses will increase due to mortgage insurance premiums. These premiums could save you money because they also lower your interest rate.

What are today’s manufactured home loan rates?

As mortgage rates begin to return to historical norms, individuals are realizing that their payments will exceed what was usual in 2020 and 2021.

Some prospective homeowners are considering manufactured homes as a cost-effective option. Targeting properties that qualify for a conventional mortgage is a smart move when looking for the best manufactured home mortgage rates.

You should also compare offers from at least three different lenders to make sure you’re choosing the most prudent course of action financially.

Types of Home Loans

FAQ

Is it harder to get a mortgage for a mobile home?

However, compared to buying a traditional home, financing the purchase of a mobile or manufactured home might involve more digging. This is because, because of their lower cost and declining value, the majority of mortgage lenders do not provide financing for these kinds of properties. Still, there are some options available.

What is a method for financing manufactured homes?

ConventionalGovernment-backedLoan typeFannie MaeFHAMinimum down payment3% to 5%3. 5% Maximum loan amount based on lender requirements: Home only: $69,678%; Lot only: $23,226%; Both: $92,904; Loan type: fixed and adjustable rates;

What is the loan term for a mobile home?

Federal Government grants or loans are not available for Title I manufactured home loans. For the duration of the loan, which is typically 20 years, the interest rate, which is negotiated between the borrower and the lender, must remain fixed.

What are top banks that do loans on manufactured housing?

CompanyStarting Interest RateMinimum Credit ScoreManufacturedHome. What is the best loan for good credit? 21st Mortgage Corporation is the best for bad credit? NeeLend is the best for low down payments? Vanderbilt Mortgage and Finance is the best for manufacturer’s financing?

Read More :

https://www.rocketmortgage.com/learn/mobile-home-loans

https://themortgagereports.com/21473/manufactured-home-mortgage-loan