Understanding the 60-Day Rollover Rule Loophole

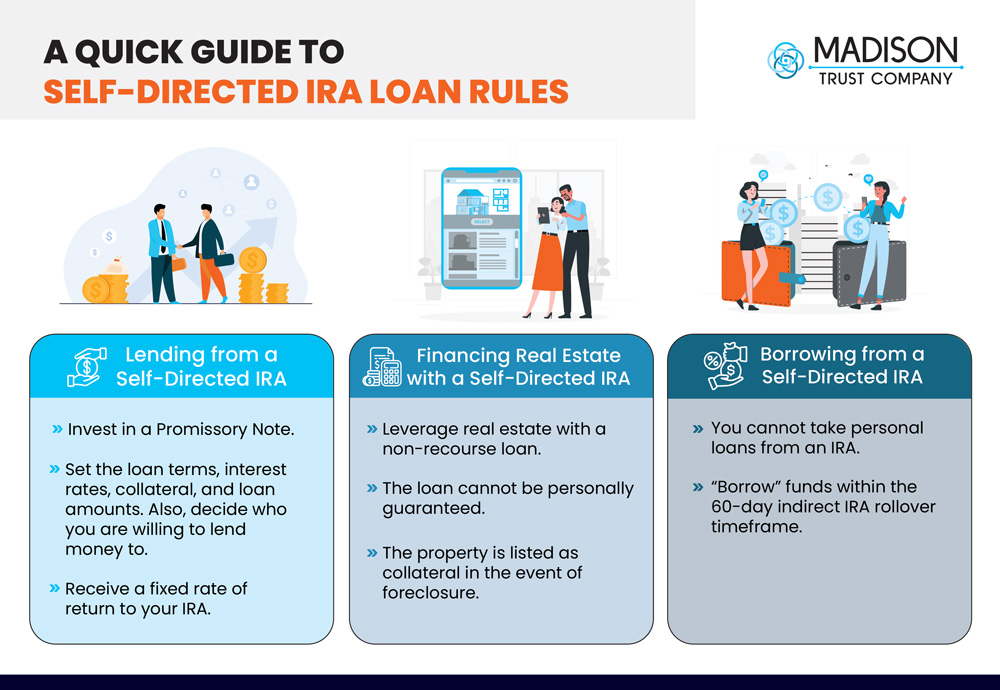

Qualified individual retirement accounts (IRAs), including self-directed IRAs, do not permit retirement savers to use their account as collateral against a personal loan, in contrast to 401(k) retirement accounts.

However, there is one significant exception to this rule: if the funds are needed for a brief period of time—60 days or less—then they are not restricted. The rollover rule, which is usually meant to make it easier to roll over one retirement account to another, has a loophole that you can take advantage of.

If you redeposit the money in an eligible retirement account within the next sixty days, the IRS permits you to withdraw funds from your IRA. This could be the same IRA or a new one.

For instance, you could take money out of your IRA and use it as a short-term loan to help pay for a child’s tuition this month if you need $4,000, but you won’t be paid again until the following month. You could then replace the money once you get paid.

If you do not comply with the letter’s 60%60-day rule, not only will the funds be subject to income tax, but if you are younger than 60%599%C2%BD, you will also be required to pay an early withdrawal penalty of 60%09.

You are not able to just take out another IRA rollover after 60 days have elapsed because you are only permitted one IRA rollover per 12-month period.

Additionally, the IRS has made this strategy more challenging since 2015, so if you have previously used this strategy, review these guidelines.

Alternatives to Borrowing Against Your IRA

What can you do if you are unable to borrow from your IRA? First of all, in an emergency, it is usually preferable to use assets that are not designated for retirement. However, if you must have the money now, consider the following choices:

Workplace retirement plans

Additionally, you may be able to take out a loan against the funds in workplace retirement plans, like a 401(k) Loans must be permitted by your plan (not all do), and borrowing entails a number of risks. If you are unable to repay the loan, you will not only have to take money out of your savings but also pay taxes and possibly penalties. Think about the consequences of changing jobs before making the complete repayment.

You may even be able to transfer money from an IRA into your 401(k), which would increase the amount of money you are eligible to borrow. Collaborate with your tax advisor, financial planner, and HR department to comprehend the benefits and drawbacks of this method.

Roth IRAs

By using the same trick, Roth IRAs might be able to give you the money you need, but once more, you’ll fall short of your retirement objectives. Because contributions to a Roth are made with after-tax money, you might be able to withdraw your contributions (but not your earnings) without incurring any tax obligations. A lot of regulations apply, so find out from your tax preparer if that’s an option for you.

Unsecured loans

It might be preferable to borrow money from somewhere else in order to safeguard your retirement savings and reduce tax issues. You might only need an unsecured loan, meaning you don’t have to put up any collateral. Peer-to-peer lending services, relatives, banks, and credit unions can all provide those loans. Article Sources: Investopedia mandates that authors cite original sources to bolster their claims. These consist of government data, original reporting, white papers, and conversations with professionals in the field. When appropriate, we also cite original research from other respectable publishers. You can read more about the guidelines we adhere to when creating impartial, truthful content in our

You consent to the use of cookies on your device to improve site navigation, track user activity, and support our marketing initiatives by selecting the option to “Accept All Cookies.”

FAQ

Can I use my IRA to get a loan?

IRAs do not allow account owners to borrow funds. Alternatively, they can reinvest the money back into the same IRA or withdraw it and roll it over to another eligible account or IRA. Withdrawing money from an IRA and reinvesting it within 60 days is the closest thing to taking out a loan from it.

Can you borrow against an IRA to buy a house?

The funds in the IRA can be used to buy property. This can apply to a house, an apartment complex, or business real estate. Additionally, you may lend money to a borrower secured by real estate. The primary requirement is that the self-directed IRA’s real estate cannot be used for personal purposes.

What retirement accounts can you borrow against?

Loans may be available through profit-sharing, money purchase, 401(k), 403(b), and 457(b) plans. Consult the Summary Plan Description or the plan sponsor to find out if a particular plan offers loans. Participant loans are not available in IRAs or IRA-based plans (SEP, SIMPLE IRA, and SARSEP plans).

Can you get a margin loan on an IRA?

The issue with margin in individual retirement accounts (IRAs) is that the tax laws that give IRAs their advantages prevent you from using the contents of your retirement account as security for a loan. Traditional margin accounts cannot be IRAs because the normal margin relationship is based on the use of investment assets as collateral.

Read More :

https://www.investopedia.com/ask/answers/102714/can-i-use-my-selfdirected-ira-take-out-loan.asp

https://www.thebalancemoney.com/ira-loan-options-315561