How We Make Money

The businesses whose offers you see on this website pay us. Unless our mortgage, home equity, and other home lending products are specifically prohibited by law, this compensation may have an impact on how and where products appear on this website, including, for example, the order in which they may appear within the listing categories. However, this payment has no bearing on the content we post or the user reviews you see here. We don’t include the range of businesses or loan options that you might have.

Our goal at Bankrate is to assist you in making more informed financial decisions. Although we follow stringent guidelines, this post might mention goods from our partners. Heres an explanation for . Bankrate logo.

Bankrate was established in 1976 and has a long history of assisting consumers in making wise financial decisions. We’ve upheld this reputation for more than 40 years by assisting people in making sense of the financial decision-making process and providing them with confidence regarding their next course of action.

You can rely on Bankrate to prioritize your interests because we adhere to a rigorous editorial policy. All of the content we publish is objective, accurate, and reliable because it is written by highly qualified professionals and edited by subject matter experts.

Our banking reporters and editors concentrate on the topics that matter most to customers: the best banks, the most recent rates, various account kinds, money-saving advice, and more, so you can handle your money with confidence. Bankrate logo.

You can rely on Bankrate to prioritize your interests because we adhere to a rigorous editorial policy. Our team of distinguished editors and reporters produces truthful and precise content to assist you in making wise financial decisions.

We value your trust. Our goal is to give readers reliable, unbiased information, and we have established editorial standards to make sure that happens. Our reporters and editors carefully verify the accuracy of the editorial content they produce, making sure you’re reading true information. We keep our editorial staff and advertisers apart with a firewall. No direct payment from our advertisers is given to our editorial staff.

The editorial staff at Bankrate writes for YOU, the reader. Providing you with the best guidance possible to enable you to make wise personal finance decisions is our aim. We adhere to stringent policies to guarantee that advertisers have no influence over our editorial content. Advertisers don’t pay our editorial staff directly, and we carefully fact-check all of our content to guarantee accuracy. Thus, you can be sure that the information you’re reading, whether it’s an article or a review, is reliable and reputable. Bankrate logo.

How we make money

You have money questions. Bankrate has answers. For more than 40 years, our professionals have assisted you in managing your finances. We always work to give customers the professional guidance and resources they need to be successful on their financial journey.

Because Bankrate adheres to strict editorial standards, you can rely on our content to be truthful and accurate. Our team of distinguished editors and reporters produces truthful and precise content to assist you in making wise financial decisions. Our editorial team produces factual, unbiased content that is unaffected by our sponsors.

By outlining our revenue streams, we are open and honest about how we are able to provide you with high-quality material, affordable prices, and practical tools.

Bankrate. com is an independent, advertising-supported publisher and comparison service. We receive payment when you click on specific links that we post on our website or when sponsored goods and services are displayed on it. Therefore, this compensation may affect the placement, order, and style of products within listing categories, with the exception of our mortgage, home equity, and other home lending products, where legal prohibitions apply. The way and location of products on this website can also be affected by other variables, like our own unique website policies and whether or not they are available in your area or within your own credit score range. Although we make an effort to present a variety of offers, Bankrate does not contain details about all financial or credit products or services.

- Funding for limited liability company (LLC) small businesses is provided by LLC loans.

- LLC loans can be used for a variety of purposes, such as working capital, startup expenses, purchasing inventory or equipment, marketing and advertising, and even commercial real estate.

- If you sign a personal guarantee, your liability protections will be nullified, making you personally accountable if your company is unable to pay its debts.

Millions of small company owners choose the limited liability company (LLC) as their preferred business structure. It provides tax benefits and safeguards that reduce members’ potential legal liability. LLCs are also simple and affordable to register.

Looking for an LLC loan? Traditional banks, credit unions, and online lenders offer them; however, there are some steps you should take to ensure it’s the right loan option for you before applying. Additionally, you should exert every effort to guarantee your approval.

What you should know about LLC loans and how to apply for one is provided here.

Check your credit score

When deciding which loans to approve, some lenders take business credit reports and scores into account. They’re available through Dun & Bradstreet, Equifax and Experian. However, small business lenders may also consider your personal credit history and credit score to assess your suitability for a business loan and the interest rate you will pay.

The better one’s personal credit score, which runs from 300 to 850, Your credit score, in addition to your credit report, can reveal information about how you have handled debt in the past. Generally speaking, traditional lenders favor borrowers with good or excellent credit, usually with a score of 700 or higher, but you can find lenders who are more forgiving. For instance, with a score as low as 640, you might be eligible for an SBA loan.

If your credit score is lower, you can still get funding for your small business from alternative lenders like peer-to-peer websites or online lenders, but be prepared to pay high interest rates.

Your personal credit reports are available for free at AnnualCreditReport.com. com. Additionally, there are a few ways to obtain your credit score at no cost, such as by utilizing the FICO Open Access Program offered by a credit card issuer or another lender.

Choose the right type of LLC loan

There are several types of LLC loans to choose from. Prior to applying, take into account the credit score requirements and evaluate the advantages and disadvantages of each choice to decide which is best for your business.

| LLC loan type | Minimum credit score | Advantages | Disadvantages |

|---|---|---|---|

| Term loan | 550 |

|

|

| Business line of credit | 550 |

|

|

| SBA 7(a) loan | 660 |

|

|

| SBA microloan | 580 |

|

|

| SBA Community Advantage loan | 600 |

|

|

| Equipment financing | 500 |

|

|

| Invoice factoring | 500 |

|

|

| Merchant cash advance | N/A |

|

|

If your company defaults on a loan, limited liability companies provide legal protection against being held personally accountable. However, lenders circumvent this by requesting personal guarantees from the majority of business owners. Even your LLC status won’t shield you from a lender pursuing your personal assets after you sign a personal guarantee if you don’t pay back a business loan.

Calculate how much debt you can afford

You must tell the lender why you need the money and how much you want to borrow when you apply for an LLC loan. To determine a loan amount that won’t negatively impact your company’s cash flow, use a business loan calculator.

To calculate your monthly payment amount and the total interest you will pay over the loan term, you will enter the loan amount, repayment period, and annual percentage rate (or the interest and fees).

For instance, you would pay $304 over the course of a three-year, $10,000 small business loan with an annual percentage rate of 6%. 22 per month and $951. 90 in interest over the life of the loan.

Make sure to adjust the figures until a manageable monthly payment is found. In this manner, you’ll be prepared when looking for LLC loans. This calculator is another resource you can use to research lenders and funding options.

Upon determining the loan amount you can afford, the following course of action is to begin investigating lenders. Examine the offerings of online lenders, credit unions, and banks. When comparing your options, bear in mind the lending requirements, fees, interest rates, and terms of the business loan.

In addition, take into account the approval and funding schedules if you want the loan proceeds as soon as possible.

Calculating the numbers to get the best financing deal is equally important. If a lender charges a high origination fee, you might discover that they are not the cheapest option even though they are offering the lowest interest rate. Furthermore, if you intend to repay the loan early, a hidden prepayment penalty in the fine print may cause your borrowing expenses to skyrocket. Lightbulb Bankrate insight.

When you’re ready to locate an LLC loan, our reviews examine a number of leading LLC lenders, such as:

Gather necessary LLC loan documents

When you’re ready to apply, it’s advisable to compile the documentation needed for the business loan that the lender will need to see. Here’s a general idea of what you’ll need:

- Personal information. Names, addresses, resumes, sources of income, and phone numbers for the co-owners of the business as well as you

- Company information. Company’s name and address, tax ID or EIN number .

- Company financials. Two years’ worth of income tax returns, balance sheets, profit and loss statements, cash flow forecasts, and business bank account statements

- Legal documents. Articles of incorporation, business license, and, if necessary, evidence of business insurance

- Business plan. A report outlining your plans for the money and the financial boost it will give your business

Some lenders may request additional documents. If a secured loan is extended to you, you will additionally be required to furnish details regarding the collateral. To prevent processing delays, find out in advance what you’ll need from the lender. Lightbulb Bankrate insight.

A secured business loan is a type of financing where you have to pledge an asset to serve as collateral for the loan. If you are unable to make loan payments, this asset—also referred to as collateral—may be taken from you. Examples of collateral include real estate, business equipment and inventory. You may even be able to use outstanding invoices.

Apply for your LLC loan

Many lenders offer LLC loans. Applying online and uploading supporting files to an online dashboard for evaluation is possible with online lenders. It is likely that you will hear back within minutes, or even within a single business day.

However, if you have to apply for the loan in person, a traditional lender may not respond for a few days to a few weeks. The waiting period is often even longer for SBA loans.

The lender will prepare documents for you to review and sign once it has granted approval. Funds will be released to you upon processing of the loan documentation. Depending on the loan product and lender you choose, the funding schedule varies.

What happens if your LLC loan is denied?

Should your application be rejected, your options might not be completely closed. To increase your chances of approval going forward, start by getting in touch with the lender to find out why your application was turned down.

You may have to look at different types of loans. Given your poor credit history, you might be a good candidate for a business loan with higher interest rates. Also, consider alternative lenders. Peer-to-peer and online lenders typically have looser eligibility requirements. Consider using a crowdfunding platform, which allows you to raise small amounts of money through donations or investments in your business.

If all else fails and your credit history is one of the reasons you were turned down for financing, it would be wise to dedicate some time to repairing it.

Pros and cons of LLC loans

Like most financial products, LLC loans have advantages and disadvantages that should be taken into account before moving forward.

- Flexible funds

- Low interest rates

- Chance to build business credit

- May have to sign personal guarantee

- Can be expensive if you have fair or bad credit

- Limited disclosure requirements

Alternatives to LLC loans

If an LLC doesn’t seem like the best option for your company, take a look at these other options for LLC loans:

- Business grants. This is an unrestricted source of funding that is free. Additionally, businesses that fit into a particular category—such as women- or minority-owned enterprises—can apply for business grants.

- Personal loans. They’re easily accessible compared to traditional business loans. However, the costs of borrowing might be higher, and some lenders have rules that forbid using the money for expenses related to the business.

- Business credit cards. They function similarly to conventional credit cards and let you use the money you pay off with them again, up to the credit limit. Seek out solutions that provide promotional interest-free periods and incentive schemes.

- Home equity loans. To help finance your LLC, you can take out a loan against the equity in your house. Remember that it functions as a second mortgage, so missing loan payments could result in the loss of your house.

- Loans from friends and family. Another choice to consider is obtaining a low-interest or interest-free loan from a friend or relative. To make sure everyone is on the same page, get the agreement in writing. To keep the relationship intact, it’s equally critical to only accept terms that benefit the financial health of your business.

A good place to start if you’re an LLC small business owner in need of funding is with an LLC loan. Depending on your credit history and the state of your company overall, you might have no issues being accepted. Plan ahead, though, if you’re just starting out or have a bad credit history.

The above steps will help you find the best LLC loan for you: check your credit, make sure you know what kind of loan is best for you, determine how much you can afford, and compare lenders. By following these guidelines, you can streamline the application process and make sure you’ve taken all the necessary steps to be granted the loan you desire.

- Not necessarily. In the event that you are a sole proprietor, you may also qualify for a business loan. However, since the majority of conventional banks and credit unions are frequently reluctant to lend to sole proprietors, your options may be restricted to online and private lenders.

- Obtaining a business loan through an LLC can frequently be simple if you meet the requirements of the lender and have good credit. However, it could be difficult for startups and companies with low income to get approved, particularly when dealing with traditional banks and credit unions. It might be necessary for you to look for financing from a different lender, which might have more stringent terms for repayment and higher interest rates.

- It depends on the type of LLC loan you select. Certain LLC business loans are installment loans that have a lump sum payout and a predetermined repayment period. Other options include revolving credit lines, which function similarly to credit cards and are utilized as needed.

- Yes, it can be easier to get an LLC loan. Some lenders won’t lend to sole proprietors. According to a recent study published in the Journal of Marketing Research, incorporating your company as a legal entity may lessen lender bias and facilitate financing access.

FAQ

Can I make a loan to my single member LLC?

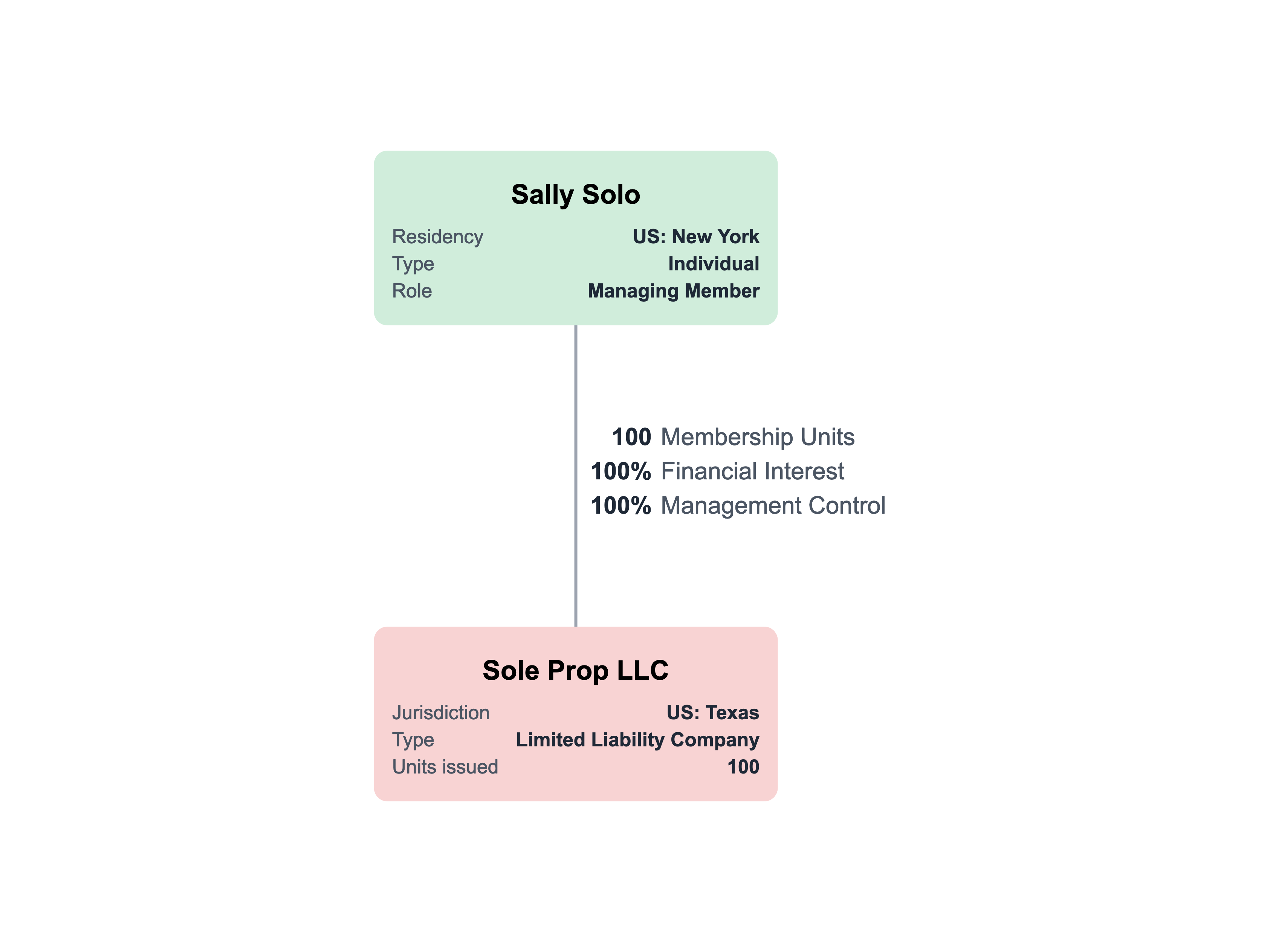

By default, state laws permit members to make personal loans to single member LLCs and make financial loans to their own LLCs; however, an appropriately adopted operating agreement by the members can forbid or place restrictions on these types of transactions.

Is it easier to get a loan with an LLC?

Obtaining a business loan through an LLC can frequently be simple if you meet the requirements of the lender and have good credit. However, it could be difficult for startups and companies with low income to get approved, particularly when dealing with traditional banks and credit unions.

Will a bank give a loan to a new LLC?

Lenders such as banks, credit unions, and online lenders provide LLC loans, just like they do for other kinds of business loans. Although they can have different structures, small business loans and the best LLC loans generally have many of the same advantages.

Does an LLC have a credit score?

These scores are typically maintained by business credit bureaus. Your LLC’s credit score is determined by its payment history, credit history, and financial behavior, which includes how it handles debt and other financial commitments.

Read More :

https://www.bankrate.com/loans/small-business/how-to-get-an-llc-loan/

https://www.thetaxadviser.com/issues/2018/oct/loans-members-llcs.html